Summary:

- PayPal’s management is expanding its offerings and bringing innovation to existing services, leading to improved customer experiences.

- Despite stagnation in the number of active users, all key business metrics grew in Q1, indicating a focus on high-quality growth over growth at all costs.

- The stock is dirt cheap because the business’ fair value is twice as high as the current market cap, according to my discounted cash flow analysis.

serg3d

Investment thesis

My previous bullish thesis about PayPal (NASDAQ:PYPL) aged well as the stock outperformed the broader market since February with an 8.5% rally. The company’s turnaround continues, and I see several positive developments. PayPal’s management expands its set of offerings together with bringing innovation to existing services, which leads to the improved experiences for customers. The fact that all key business metrics grew in Q1 despite stagnation in number of active users, evidence that the company is now seeking for high-quality growth instead of growth at all costs, which is a more sustainable approach for shareholder value creation. Apart from investing in improving the experience for profitable customers, the management is also committed to stringent cost control. Last but not least, the stock is extremely undervalued. All in all, I reiterate my “Strong Buy” rating for PYPL.

Recent developments

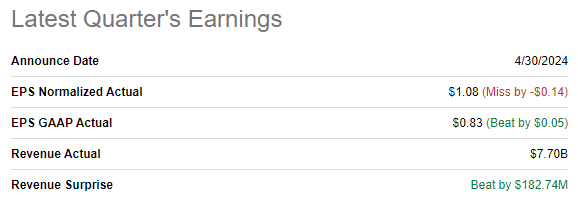

The latest quarterly earnings were released on April 30, when the company topped revenue and EPS consensus estimates. Revenue grew by 9.4% YoY, demonstrating growth acceleration for the fourth consecutive quarter. The operating margin followed the topline and expanded YoY from 16.5% to almost 18%.

Seeking Alpha

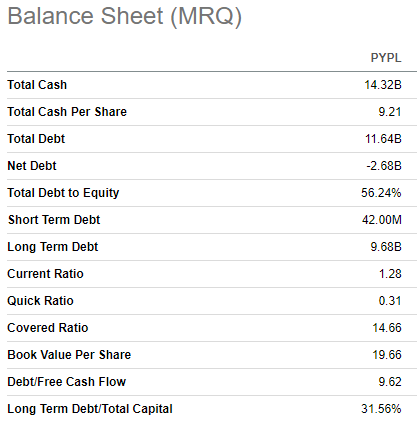

As a result of a strong revenue and operating margin performance, PYPL generated $2.1 billion in levered free cash flow [FCF]. This is three times higher compared to Q1 2023 and allowed PYPL to improve its financial position. The net cash [cash balance is greater than total debt] improved from $2.2 billion at the end of the previous quarter to $2.7 billion as of March 31, 2024. Improving the balance sheet is a bullish sign because it increases the company’s financial flexibility to fuel further growth.

Seeking Alpha

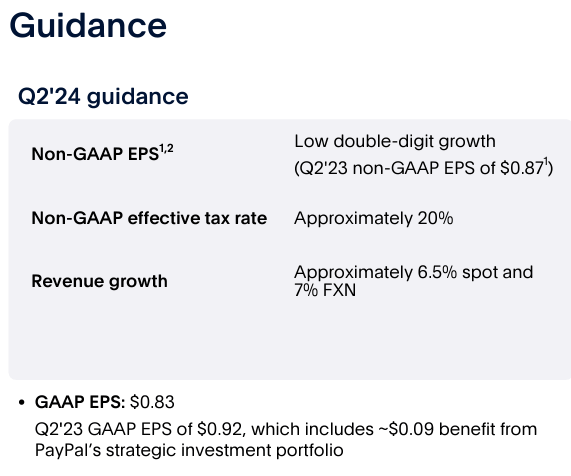

The upcoming earnings release is scheduled for August 2. Quarterly revenue is expected by consensus to be $7.8 billion, 7% higher compared to Q2 2023. The management expects non-GAAP EPS to demonstrate low double-digit YoY growth.

PYPL’s latest earnings presentation

I generally trust the management’s and consensus positive outlook, and there are several reasons for that. In the current environment of intensifying competition in the industry, it is crucial to sustain the commitment to innovation. Moreover, innovation was the major reason why PayPal disrupted the industry in the early 2000s.

Apart from introducing new AI-powered features which allowed to improve checkout speed and makes incentives for customers to come back to their merchants, the company also invested in a generative AI startup Rasa. This underscores PayPal’s commitment to continue leveraging advanced AI technologies to enhance customer interactions and operational efficiency.

Beyond AI-powered capabilities, PayPal also continues expanding its set of offerings. For example, in March the company introduced a complete suite of payment solutions for small and medium businesses [SMBs] across more than 20 geographies in North America and Europe. The move is strategically sound considering that there are 33 million SMBs in the U.S.

PayPal also continues steady expansion into crypto assets. The company is joining forces with cryptocurrency company MoonPay to offer its more than 426 million users access to over 100 digital assets. This is another evidence of PayPal’s commitment to innovate and improve experience for its vast customer base.

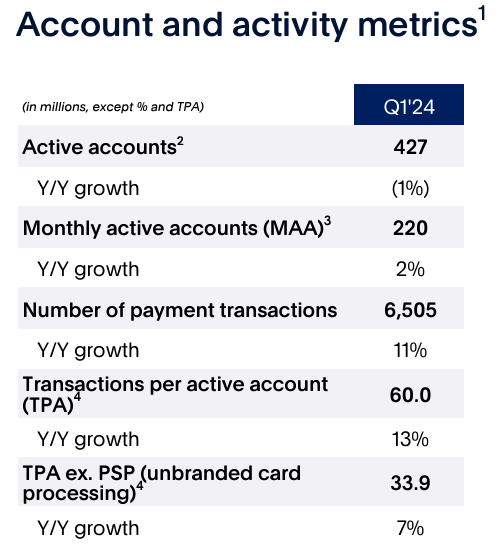

Offering more payment options and products is crucial because the number of payment transactions drives the total payment volume [TPV]. This has a direct impact on PayPal’s financial performance as the company charges commissions on transactions and the greater TPV means revenue growth for PYPL. In Q1, the number of payment transactions grew by 11% YoY and the TPV grew by 14% YoY, meaning that the average transaction amount also expanded. Notably, TPV grew despite a 1% decline in active accounts, signaling that the company prioritizes high-quality growth over growth at all costs, which is always a more sustainable strategy, in my opinion.

PYPL’s latest quarterly earnings

Apart from promising initiatives which will likely help to drive revenue growth, the management also does not forget that there is the second part of the profitability equation. I have already calculated the significant effect of this year’s 9% layoff in my previous thesis. But PayPal is not willing to stop only on layoffs to drive cost efficiency. During the latest earnings call, the management reiterated its commitment to seeking new cost efficiencies that will further drive to expand profitability. The fact that non-transaction related expenses dropped by 2% YoY in Q1, despite revenue growth, evidence that management’s commitment to cost-cutting is not just words.

Valuation update

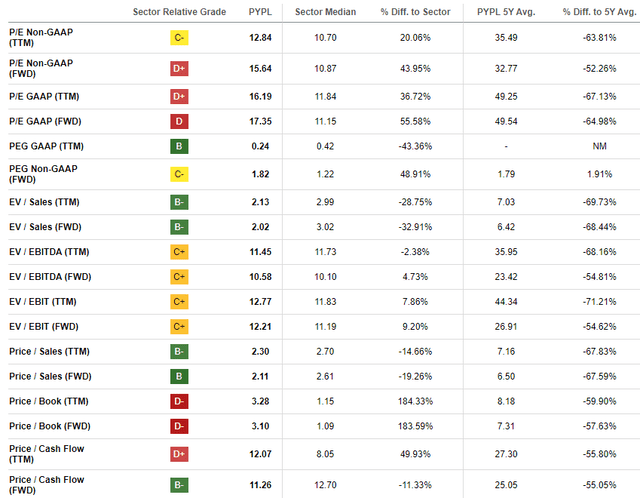

The stock price increased by 2.8% over the last 12 months, substantially lagging behind the broader U.S. market. PYPL delivered a 5.5% YTD return, also slower than the S&P 500. The stock is undervalued from the valuation ratios perspective. Most of the current valuation ratios are more than two times lower compared to the company’s historical averages.

I am not comparing PayPal’s valuation ratios to the sector median because the company has an unmatched profitability, and I believe that stocks of companies with stellar profitability deserve premium compared to the sector. Moreover, the sector PayPal represents is “Financials”, a mature industry where leading banks demonstrating modest revenue and EPS growth rates. PayPal is not a bank, which makes comparing the company’s multiples to the sector median slightly irrelevant.

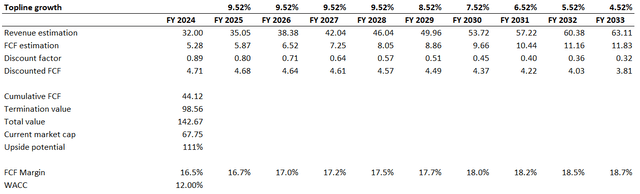

Looking only at valuation ratios is never enough for me. Therefore, I proceed with the discounted cash flow [DCF] simulation with a 12% WACC recommended by Gurufocus. I rely on consensus estimates for my base year revenue assumption. I incorporate a 9.52% revenue CAGR for 2025-2028, which is the growth rate for the digital payments industry projected by Statista. For years beyond 2028 I project a steady 100 basis points yearly growth deceleration. I use a 16.5% TTM FCF ex-SBC margin for FY 2024 and project a modest 25 basis points yearly expansion of the metric. I expect the FCF margin expansion to be modest due to the intense competition in the digital payments industry.

The stock is significantly undervalued. My calculations suggest that the business’s fair value is almost $143 billion, more than twice as high as the current market cap.

Risks to consider

Interest rates significantly affect PYPL both as a stock and as a business. The uncertainty around the Fed’s monetary policy makes it more difficult for the management to make informed decisions because interest rates have a direct impact on consumer spending and borrowing behavior.

From the stock market perspective, the uncertainty regarding Federal funds rates weighs on investors’ confidence. Moreover, higher interest rates lead to higher discount rates, which is an adverse factor for growth stocks like PYPL.

The competition in digital payments is intense, which is a significant risk even for such a large player like PayPal. In recent years several technological giants like Apple (AAPL), Amazon (AMZN), and Google (GOOG) entered the market. There are also other younger emerging players like Block (SQ) and Coinbase (COIN) that also overlap with PayPal in some services. PayPal’s pioneering status in the industry gives it a competitive edge, but with such formidable rivals joining the game, there is a risk of losing the market share.

Bottom line

To conclude, PYPL is still a “Strong Buy”. The company demonstrates topline strength coupled with the management’s financial discipline, which ultimately leads to profitability expansion and balance sheet improvements. It appears that PayPal moves ahead of the management’s turnaround plan and the valuation is still very attractive.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.