Summary:

- PENN Entertainment, Inc.’s solid casino business is not the main driver of upside, but rather its foray into sports betting and digital gaming.

- The company’s digital ventures, including the Barstool Sportsbook and ESPNBet, have resulted in significant losses and revenue softness.

- Despite the challenges, Penn’s foundational brick and mortar casino business remains strong, and the stock may be undervalued.

Seth Love

Above: Though sports betting will be a fringe producer of revenue for Penn, it, not its solid casino business, will tell the tale of an upside ahead.

Readers of this space know that I have been a big fan of the shares of PENN Entertainment, Inc. (NASDAQ:PENN) aka Penn going back about four years on Seeking Alpha. My reasoning from the beginning was significantly based on my career experience working with executives who had migrated to Penn from companies we both worked at over time. I liked the fact that most key people were ground rooted gaming people. They were not recruits from banking, hotel, entertainment or tech operations, but had spent the bulk of their careers working up the casino ladder from entry level.

Though I had not worked with Penn CEO Jay Snowden directly, I did with other people who worked both for him and with me. They came away from that association with positive grades for him. As noted, he was one of those top executives who had begun his career at the front desk at Harrah’s, moved steadily up, and after his graduation from Harvard, went on to Caesars Palace and Atlantic City. He became Penn CEO in 2017, and since has led the company through its strongest era of growth.

With an A grade for management, I then commenced regular coverage of Penn from the time it had emerged as a spinoff from its Gaming & Leisure (GLPI) REIT racino origins. My buy and strong buy guidance since has sprung from my contention that Penn has created by acquisition and/or merger a national presence, with 40 properties in a 20-state diverse geography, welded its customer base of 26m holders. It has now begun a move to what it calls is a “touchless” system of customer service. It enhances customer experience and saves labor costs.

In brief, that system enables patrons to glide through their visits without costly, time-wasting interaction with various services, waiting on long lines at check in. It also works through movements on the casino floor, dining outlets, shows and other amenities. Meanwhile, the strong customer service ethos with contact that counts to build loyalty remains in place. Penn has 26m loyalty card members. Post covid, the older slot play demo has returned in strong numbers. That initial burst has since cooled somewhat, but the basic marketing system remains strongly in place.

By any measure, this proved a business model well adapted to maximize earnings and build market share in the bare-knuckled daily battle in casino markets, where competitors are always in dense clusters due to the limits imposed by legalization. Penn cash flow has been strong. Its financials solid, its operating margins as good as can be expected in a business with a historic DNA of waste. For those reasons, my price target (“PT”) has been —- bullish based on solid earnings growth forecasts post covid.

However, from the entry of the company into sports betting and digital gaming through its first Barstool deal, I began to have reservations. My initial interpretation of that foray with Dave Portnoy was I had misgivings about the value of the 55m Barstool stoolies migrating to real money wagering. But I liked that management focused on getting profitable first. I liked the fact that the company was not as addicted to the insane revenue chase with giveaways.

Barstool Sportsbook had achieved a mid to low-single digit market share of sports betting during its most aggressive rollout. It was rapidly moving to become the first among 14 competitors to turn profitable. Seeing that vertical as a slow and steady caboose to the Penn locomotive made great sense to me, and, in turn, could be seen as a plus for the stock by investors. Even a small share of the market could generate accretive earnings over time—if management kept promotional costs in check, letting competitors do the heavy lifting spend.

What’s Changed: Penn’s costly love affair with sports betting and digital has pivoted the company in the wrong direction.

First, a quick glance of the just concluded 2023 FY results shows that digital losses and some revenue softness in some of Penn’s brick and mortar casinos produced a concerning y/y dive in net income, 2022$221m, 2023 ($490m), But the primary culprits in the earnings collapse were the devastating loss on its Barstool venture, which over time has lost $800m, plus the start-up costs of its ESPNBet venture with Disney (DIS). (More on this below).

Adjusted group EBITDAR: 2022: $1.,9b , 2023: $1,5b

Revenue by segment: 2023 2022

Northeast $2.7b $2.6b

South 1.2b 1.3b

West 528m 581m

Midwest 1.7b 1.1b

Interactive 718m 6.4b

Totals $6.3b $ 6.4b

Adj. EBITDAR: $1.5b $1.9b

Net income ($490) $221M

Loss per share: $3.22.

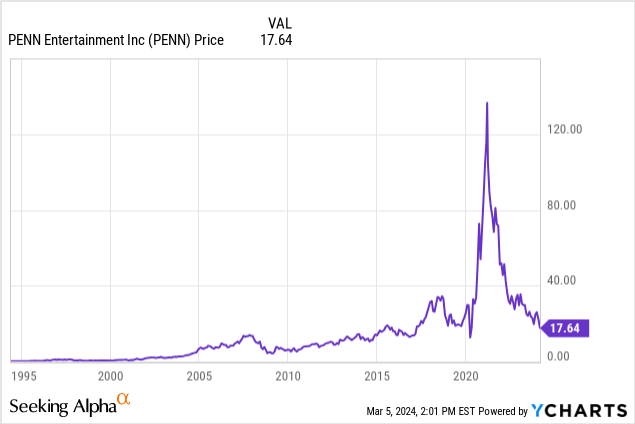

Last month’s earnings release triggered a 13% hit to the stock:

Pre-earnings release: $23.39

Post earning release, price at writing: $17.74

Analyst PT since last July $36. My PT $60 (last May).

Mea culpa: My strongly bullish outlook on PENN stock began five years ago, began when I saw savvy policy decisions from management resulting in sales and profit growth. As noted above, my conviction was that these sustaining positive results were flowing from a well thought out business model, executed over time. Penn was clearly positioned for exponential growth. This led to my conclusion that the market had yet to see this, and for that reason, the stock was vastly undervalued.

This was just at the pre-covid cusp. Then came the scourge.

I’ll take a mulligan on that massive headwind nobody saw coming. I turned out to be wrong in believing Penn would stay the course of disciplined marketing spend. I was wrong. The Barstool deal was yet to come.

Then, amidst the covid nuclear winter for brick and mortar casinos, Penn announced its first deal with Barstool Sports with an initial 38% equity buy-in. Mr. Market greeted the news as welcome. It reflected Penn’s grasp of what was coming: Either be ready for digital gaming, or prepare for obsolescence.

At that time, I challenged assumptions about how valuable Barstool’s 55m stoolies would be in real money sports betting. Despite my reservations, I remained bullish about the fortress brick and mortar business of Penn, which I said, would bounce back quickly in any post covid recovery.

Then, as Barstool Sportsbook rolled out, it became apparent that despite stoolie nation and Penn’s own strong database, that the venture at best was scratching out a low single-digit market share. That was alright, I thought, because Penn was on the record as believing in profit before sales growth. It was first to begin cutting promotion spend. It was on its way to profitability as a nice adjunct to its regular business. A bonus was the exposure its brick and mortar casinos gained by meaningful crossover business from millennial bettors onto their live casino floors.

Then, the ever-restive Barstool CEO, Dave Portnoy, began to bristle at the constant intrusion of gaming regulators and policies, erupting over some of his statements. He wanted out. Penn was equally unhappy. So by last year, Penn cut a deal that gave Portnoy back his company for $1.

The deal rattled shareholders because, between its initial buy plus the sunk cost it, resulted in an $800m loss for Penn. While the deal included Penn’s right to receive 50% of any proceeds if Portnoy ever opted to sell Barstool, I saw that as unrealistic. Dave was on the record saying he was never going to sell. At least for the foreseeable future, the deal was a massive dead loss for Penn.

Penn then quickly pivoted by striking a deal with Disney to create ESPNBet, a full service sports betting site with presumably the heft to swooping and make a run at building a double-digit market share. The deal is fundamentally a marketing spend of $1.5b over ten years to gain visibility throughout the ESPN ecosphere. It is one of those deals that looks like a shiny gold piece on the surface: ESPN’s massive sports audience and branding is the biggest in the sector. But just like the Barstool venture, below the surface it’s a tough crust of bread. The simple reason is that the assumption that ESPN viewers and subscribers could be switched from existing sites in great numbers from the get-go was at best naïve.

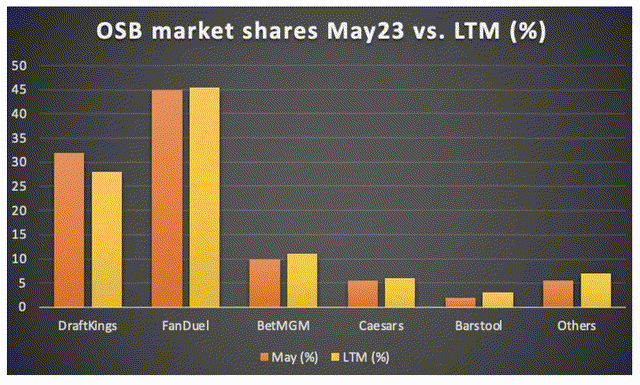

Above: Since this estimate, the dominance of the two leaders is at 70+%.

As I have pointed out in several articles in the sector, poaching market share from the two leaders, i.e., DraftKings and FanDuel, has a ton of wishful thinking in its assumptions. Jointly, the two sports betting giants control over 73% of the entire sports betting market. Both have a deep enough resource base to combat any aggressive marketing ESPNBet can launch.

Initial downloads of the site at 1 million sound encouraging, but in the end it’s in what states ESPNBet can get skins, and what specifically they offer bettors to wean them away from the leaders as well as the tier two sites like BetMGM and Caesars (CZR).

In time, ESPNBet could become a tier three site generating enough revenue to be accretive to Penn earnings, but for Disney, the deal is at best a piffle. Their participation is evidence of their long slumber in getting ESPN into sports betting. They should have moved four years ago. The Penn deal is a fig leaf to holders who have been agitated over their failure to either sell ESPN, or advocate really getting deep into the gaming process. Disney purists have long resisted a move into direct operations of a gambling business. And the company has paid the price.

When it’s all over and the fat lady is singing, Penn will have spent $2.3b in creating and nurturing a digital gaming business. It has acquired other small digital gaming tech companies as a resource for in-house development. The hope is that, in time, ESPNBet will achieve a market share that will translate to a bottom line that justifies Penn’s sunk costs since 2020.

Meanwhile, there is little in the company’s 2023 results to bring smiles to holders or Mr. Market in general. I see this digital foray as a string of bad decisions by management. It is evidence of a management clearly mesmerized by the promise of digital gaming in all its forms.

This is not to imply that digital gaming has no place in the future of the sector. It clearly does. And Penn’s moves are totally valid in theory. But it is clear that if first mover positioning in an exploding sector gives ballast to early entrants like DKNG and Flutter Entertainment (FLUT), one must believe that it’s also true that late movers, no matter their escutcheons, arrive with very high mountains to climb through very thin air.

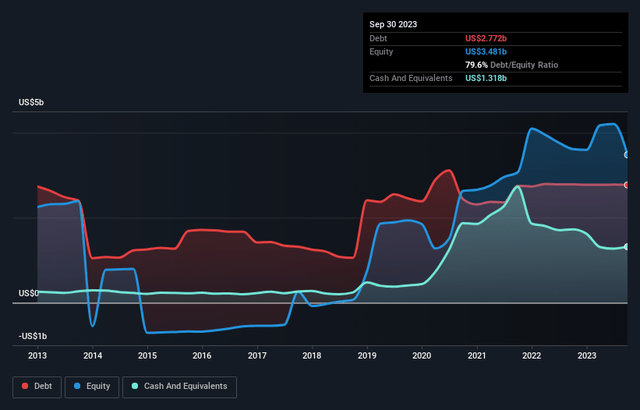

Above: Financially Penn is stable and will continue to be so but its bad pivots in digital will haunt the stock a while. Yet, trading below book, it could be a valid buy with a good margin of safety. BetESPN results ahead will count.

Conclusion

In digital so far, Penn has dealt itself a losing hand. Yet, its foundational brick and mortar casino business is, on the whole, strong, well operated and holding its own – despite periodic dips related to macros events.

What I see ahead is a long battle to establish ESPNBet that will continue to cost Penn resources without profit. The eventual outcome is unknown. But it could have a decent outcome nonetheless, with a viable presence and credible returns.

The stock has taken a big enough hit to suggest it would not be a terrible move now to buy, given the fact that the company is now trading below book value. Its asset base is strong, it could well be a target downstream for a major acquisition. Possible suitors I see are plenty given its current trade.

You could plop a very generous premium atop $17 and still have a solid case for holders and would be holders to keep the stock. But I also think we need to give the BetESPN launch at least another quarter or so to perform in the real world before we wave bye bye to the stock.

The downside risk at $17 provides quite a margin of safety. The financials and debt profile are positive. I have turned bearish on my original PT for certain. Yet, I see little risk with holding on a bit longer to see if Mr. Market sentiment might change. If Penn produces any glimmer of light on ESPNBet and its resumed sales growth in casinos, the stock could be poised for a nice move from its current low.

I can see the shares moving back up to the mid $20s by midyear, but nowhere near my own demonstrably wrong call last summer at $60. Or, for that matter, even the analyst consensus at $36. PENN Entertainment, Inc. is a “proceed with a blinking yellow light” situation from here to midyear.

Let’s look first at Penn’s Q4 2023 results for telltale signs that have moved me to see where my assumptions went wrong and what appears to be coming—at least on an interim basis.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.