Summary:

- PENN has unfortunately underperformed expectations with the stock declining by -32%, well behind the wider market at +20% since the launch of ESPN Bet.

- It is apparent by now that the management’s expectations for ESPN Bet has not played out, as losses also widen and market share gains disappoint.

- The US OSB market size is estimated to reach $40B by 2030, implying that the market may very well be big enough to accommodate multiple players, PENN included.

- However, as the management lowers their FY2024 profit guidance, the stock continually charts new lows, and short interest grows, it may be better to downgrade PENN to a Hold for now.

pictafolio

We previously covered PENN Entertainment (NASDAQ:NASDAQ:PENN) in November 2023, discussing why we had concurred with the management’s conclusion in which the stock was inherently undervalued compared to historical means and peers, offering interested investors with the opportunistic chance to dollar cost average.

Combined with the ESPN Bet’s excellent prospects and supposed cross-selling across its existing iCasino offerings, we had rated the stock as a speculative Buy then.

Since then, PENN has unfortunately underperformed expectations with the stock declining by -32%, well behind the wider market at +20%. It is apparent by now that the management’s expectations for ESPN Bet has not played out, as losses also widen and balance sheet deteriorates.

As the management lowers their FY2024 profit guidance, the stock continually charts new lows, and short interest grows, it may be better to downgrade PENN to a Hold for now.

PENN’s Investment Thesis Remains Speculative Until A Floor Has Materialized

For now, PENN has reported a double miss FQ1’24 earnings call, with total revenues of $1.6B (+14.2% QoQ/ -4.1% YoY) and adj EPS of -$0.76 (+67.9% QoQ/ -1,366.6% YoY).

Much of the top line headwinds are attributed to the extreme weather conditions across its physical portfolios in January and early February 2024, affecting its Retail Segment revenues to $1.39B (+1.4% QoQ/ -2.7% YoY).

For now, this is well balanced by the nascent Interactive Segment revenues of $207.7M (+559.3% QoQ), thanks to the robust engagement reported in ESPN Bet.

Nonetheless, it is also apparent that PENN’s forward path remains troubled, due to ESPN Bet’s massive cash burn at adj EBITDAR of -$196M (+41.2% QoQ), implying eyewatering adj EBITDAR margins of -94.3% in the latest quarter (+965.3 points QoQ).

This development well negates the Retail Segment’s growing EBITDAR of $452.2M (-5.1% QoQ/ -4.2% YoY) and decent adj EBITDAR margins of 32.5% (-2.2 points QoQ/ -1.2 YoY).

For now, based on PENN’s growing net debt of -$1.86B (compared to -$1.69B in FQ4’23, -$1.46B in FQ1’23, and $1.94B in FQ4’19) and the deteriorating annualized adj EBITDA of $1.02B (+127.7% QoQ/ -46.2% YoY) in FQ1’24, it appears that its net-debt-to-EBITDA ratio remains somewhat reasonable at 1.82x. This is compared to 1.11x in FQ4’23, 0.76x in FQ1’23, and 1.21x in FQ4’19.

For context, DraftKings (DKNG) reported a net-debt-to-EBITDA ratio of 0.66x, with the owner of FanDuel, Flutter Entertainment plc (FLUT) at 2.07x by the latest quarter.

At the same time, only $330M of PENN’s long-term debts will be due in 2026, implying its ability to reasonably finance its transition away from Barstool Sports while investing in ESPN Bet as its next growth opportunity.

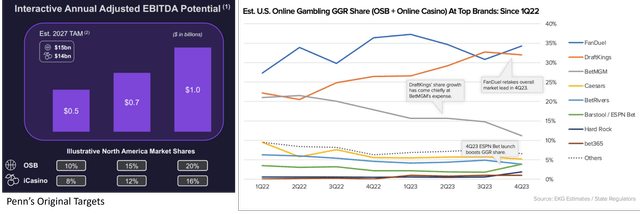

ESPN Bet’s Aggressive Market Share & Profitability Goals By 2027

PENN

On the one hand, it cannot be denied that ESPN Bet has recorded a deteriorating Online Sports Betting [OSB] market share from 8.1% in November 2023, down to 2.5% in January 2024 while temporarily recovering to 3.7% by March 2024.

While there remains plenty of time to 2027, it is apparent that early signs are not promising, with it remaining to be seen if ESPN Bet may eventually achieve the management’s aggressive goals of 20% in OSB market share and $1B in adj EBITDA.

This is especially since it has been estimated that PENN requires an OSB market share of 8% to at least break even, according to Bank of America gaming analyst Shaun Kelley.

On the other hand, we believe that it may be more prudent to give PENN more time, especially since ESPN Bet is only launched in November 14, 2023, with it unlikely to dislodge the two market leaders, FanDuel, currently with Q4’23 market share of 35% and DraftKings at 32%, with Q1’24 data yet available.

At the same time, the US OSB market size is estimated to reach $40B by 2030, implying that the market may very well be big enough to accommodate multiple players, especially one as well funded as PENN, with ESPN Bet also only launched in 17 states.

Before then, PENN investors may expect more pain indeed, based on the management’s lowered FY2024 Interactive Segment revenue guidance of $1.04B and adj EBITDA losses of $500M at the midpoint, compared to the original guidance of $1.34B and $400M.

It is apparent from these numbers that ESPN Bet may continue being a drag on its bottom line in the near-term, with slower market share gains and uncertain ESPN Bet monetization.

So, Is PENN Stock A Buy, Sell, or Hold?

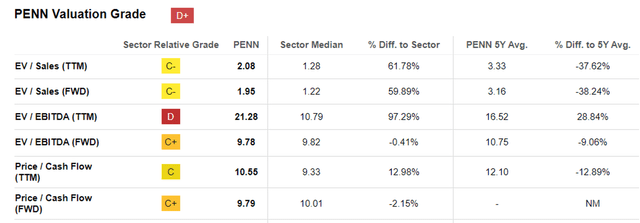

PENN Valuations

Seeking Alpha

As a result, we can understand why the market has temporarily discounted PENN’s valuations, with FWD EV/ EBITDA of 9.78x and FWD Price/ Cash Flow of 9.79x, compared to its peers, DKNG at 43.37x/ 42.36x and FLUT at 17.42x/ 23.49x.

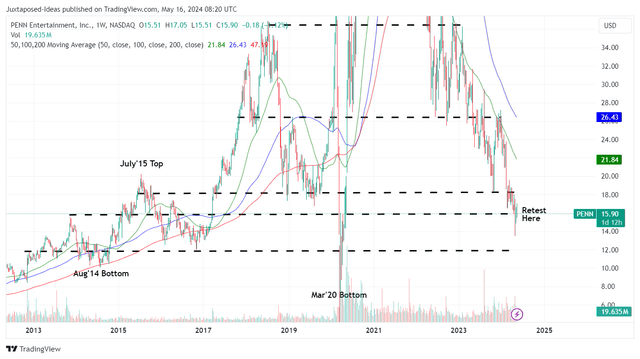

PENN 11Y Stock Price

Trading View

The same pessimism can also be observed in PENN’s drastic decline thus far, with it trading well below its 50/ 100/ 200 day moving averages while underperforming the wider market.

With impacted annualized EBITDAR profitability of $1.02B in FQ1’24 and the latest share count of 151.9M, we are looking at an estimated adj EBITDAR per share of $6.74. Combined with the discounted FWD EV/ EBITDA valuation of 9.78x, it is apparent that the stock is trading below our estimated fair values of $65.90.

Readers must also note that PENN remains highly profitable in the Retail segment, with the management already guiding the segment’s FY2024 adj EBITDAR of $1.94B at the midpoint, well balancing Interactive segment’s lack of profitability and the projected annual interest expense of $470M.

As a result, we are cautiously confident about PENN’s ability in reversing the pessimistic sentiments thus far, as the management slowly executes its OSB plan.

Nonetheless, it will be foolish to not mention its elevated short interest of 19.7% at the time of writing, implying that the stock is only suitable for those with higher risk appetite and long investing trajectory.

Combined with the stock’s lower highs and lower lows, interested investors may be better off observing its movement for a little longer before adding once a floor has materialized.

Downgrade to Hold (Neutral) here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.