Summary:

- PENN Entertainment’s land-based casinos had a turbulent performance in Q3, but the performance should stabilize going forward after weather disruptions and hotel remodeling efforts.

- The company’s online efforts with ESPN Bet continue to strain earnings without significant market share gains, causing weaker future expectations.

- The weak online performance expectations are already priced into the PENN stock.

EricVega

PENN Entertainment, Inc. (NASDAQ:PENN) operates 43 regional land-based casinos throughout the United States with casinos throughout the Northeast, South, West, and Midwest. In addition, the company is actively trying to penetrate the rapidly growing online gambling market with the ESPN Bet brand among others, but the online segment remains a small and unprofitable part of PENN.

After better online gaming enthusiasm from the market throughout 2020 and 2021, PENN’s negative online earnings and poor ability to capture market share have crashed the stock. Given the current turbulent earnings profile, PENN doesn’t pay out dividends either.

Ten Year Stock Chart (Seeking Alpha)

PENN’s Land-Based Casino Earnings Were Turbulent in Q3, But Should Stabilize

PENN’s Q3 results came in slightly below expectations, as the revenues of $1.64 billion missed Wall Street’s expectations by a relatively small -$16.1 million margin and the adjusted EPS of -$0.25 missed by a -$0.03 margin.

Underneath, PENN’s land-based casinos had a weak performance in the quarter as revenues declined -1.9% year-on-year to $1.40 billion. While earnings in Northeast and Midwest were relatively stable, declining moderately amid challenging consumer confidence, especially the South segment contributed towards a total $96.7 million year-on-year decline in land-based adjusted EBITDAR into $348.4 million. In the South segment, weather disruptions and PENN’s hotel remodeling efforts caused the large turbulence, and a stronger underlying Northeast volume performance was mitigated by a weaker-than-normal hold — the Q3 land-based casino performance had several temporary weakening factors.

As such, I believe that the turbulent Q3 performance isn’t suggestive of a continued weak performance, as the operating environment included transitory effects in the quarter. PENN gave a $1.36-1.38 billion retail sales guidance for Q4 in the Q3 earnings call, suggesting a stagnant year-on-year performance from Q4/2023 with stable trends already seen in October. The hotel remodeling investments should also start to yield results in 2025, pointing towards a better outlook after the Q3 turbulence.

Over the long term, the land-based casino performance has also grown quite stably. Revenues rose from $2.59 billion in 2014 into $5.66 billion in land-based revenues in 2023 — despite the short-term turbulence, PENN’s regional casino performance has been quite good over the long term.

The Online Segment Continues to Strain PENN

Contrary to quite stable land-based operations, PENN’s online ventures have caused severe issues with a multi-faceted story. After operating the Barstool Sportsbook, the company rebranded its flagship sportsbook into ESPN Bet in a major deal with ESPN in 2023. The deal included an initial 10-year term worth roughly $1.5 billion, and was told by PENN to add up to $1 billion in annual AEBITDA potential to PENN’s Interactive segment over the long term.

While PENN is trying to capture significant market share of the rapidly growing US sportsbook and iGaming markets, the company’s efforts haven’t created significant market penetration. In a May report, ESPN Bet was only estimated to hold around a 2.8% market share of US online sports betting, and PENN’s iGaming brands only hold around 2.2% of the total market. PENN has clearly lost to first-movers like DraftKings (DKNG) and Flutter Entertainment’s (FLUT) FanDuel brand, despite the power of the ESPN sports brand.

PENN’s Interactive segment contributed $244.6 million of revenues in Q3, growing 25% year-on-year against DraftKings’ 39% Q3 growth, Flutter Entertainment’s 51% Q3 US growth, and Rush Street Interactive’s (RSI) 37% Q3 growth that I recently wrote on. PENN still doesn’t seem to be growing its market share and remains a small player in the online gambling industry. The company launched in New York in late September, but the new market potential doesn’t look likely to boost ESPN Bet’s market share very notably.

On top of weak growth so far, the Interactive segment has strained PENN’s earnings by a wide margin. In Q3, the segment had AEBITDA of -$90.9 million, still being far from profitability while showing unsatisfying market share trends. The online efforts have even pushed PENN’s total operating income slightly negative from the past twelve months from an average of 16.8% in the 2014-2023 period – the payments to ESPN clearly haven’t created sufficient brand value in return.

PENN is still focusing on investing in the online segment to turn away from a moderate growth outlook in land-based operations, but the company’s weak success so far has made the growth investments unattractive. Unless ESPN Bet starts achieving clear market share expansion, the segment looks to weaken PENN’s total earnings for several years, clearly causing distress for the whole company.

PENN’s Valuation Accounts for a Weak Online Performance

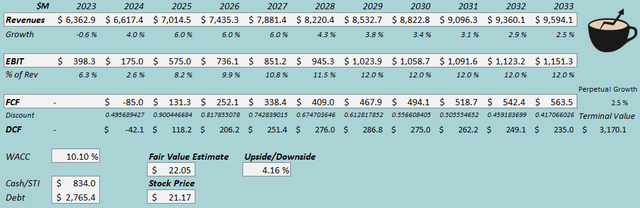

I built a discounted cash flow [DCF] model to estimate a fair value for the PENN stock.

In the DCF model, I estimate the Interactive segment and PENN’s land-based projects to create elevated growth in upcoming years at a moderate level, contributing towards a 4.2% revenue CAGR from 2023 to 2033 and a 2.5% perpetual growth afterward. The estimated growth accounts for quite a stable land-based performance, and a relatively slow total impact from online growth, given PENN’s struggles in capturing significant market share.

The Interactive segment looks to strain PENN’s margin level as well. Although I estimate a better operating environment and the Interactive growth to contribute towards margin expansion, I estimate the EBIT margin to only stay at a 12.0% level compared to the better 16.8% long-term level.

The cash flow outlook is moderately good but is weakened as I estimate interest expenses towards leases in the free cash flow estimates, being around $71.9 million in Q3 alone.

DCF Model (Author’s Calculation)

The estimates put PENN’s fair value at $22.05, 4% above the stock price at the time of writing – with a weak stock performance after 2021, I now believe the stock to be valued fairly in a base scenario. ESPN Bet’s future may still affect the valuation very much, though, making the investment volatile despite my estimate of a fair valuation in a base scenario. The valuation is further leveraged by PENN’s high debt and weak real estate holdings, as the company leases nearly all of its land-based casinos.

CAPM

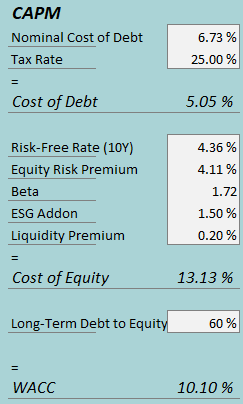

The DCF model uses a weighted average cost of capital of 10.10%. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q3, PENN had $46.5 million in interest expenses related to traditional debt, making the company’s interest rate 6.73% with the current amount of interest-bearing debt. I estimate quite a high 60% long-term debt-to-equity ratio.

To estimate the cost of equity, I use the 10-year bond yield of 4.36% as the risk-free rate. The equity risk premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, updated in July. Seeking Alpha estimates PENN’s beta at 1.72. With an ESG add-on of 1.5% and a liquidity premium of 0.2%, the cost of equity stands at 13.13% and the WACC at 10.10%.

Takeaway

PENN Entertainment, Inc.’s land-based casinos had a turbulent performance in Q3, but with several passing effects behind the performance, the land-based operations have a more stable growth outlook ahead, as is already suggested for Q4. On the other hand, the Interactive segment looks to continue straining earnings, as PENN’s 2023 deal with ESPN hasn’t been leveraged for notable market share penetration in the flagship online sportsbook. The valuation already fairly accounts for quite a weak continued performance in the online segment, and as such, I initiate PENN Entertainment at a Hold rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.