Summary:

- PENN Entertainment is a speculative buy due to recent improvements in price action, short-term bullish momentum, and institutional accumulation.

- PENN’s price action has shifted from a long-term downtrend to a horizontal range, recapturing its 30-week EMA, indicating potential bullish behavior.

- Short-term momentum is bullish, while long-term momentum is bearish but could turn positive soon; volume patterns show institutional buying.

- Relative strength has been positive since mid-May; if PENN surpasses $21.50, consider adding to the position.

Michael Blann/DigitalVision via Getty Images

With the recent 50 basis points cut in the fed funds interest rate by the Federal Reserve on the 18th of September, stocks in the consumer discretionary sector of the economy should benefit. PENN Entertainment, Inc. (NASDAQ:PENN) operates in the casinos and gaming industry of the consumer discretionary sector, and it looks like a speculative buy to me using my technical analysis methodology. In this article, I will outline my investment thesis by outlining the price action, momentum, volume, and relative strength of PENN using a weekly price chart.

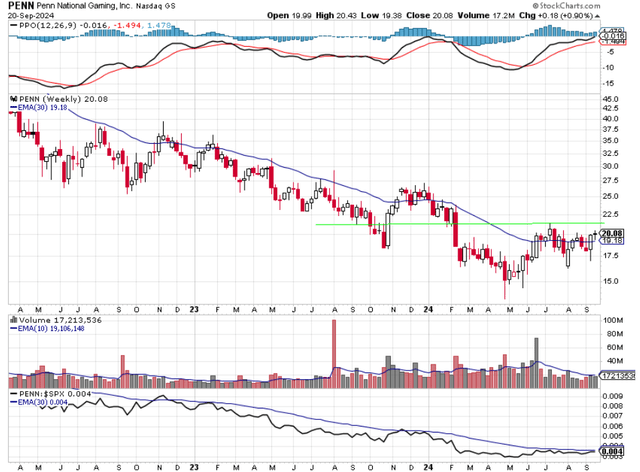

Chart 1 – PENN Weekly with Momentum, Volume, and Relative Strength

Chart 1 shows PENN on a weekly basis. This is my preferred time frame to analyze stocks and indices because it removes the day-to-day price fluctuations. A weekly price chart and the 30-week exponential moving average (“EMA”) combine to show a medium to long-term picture of price action. PENN has been in retreat for the better part of three years. When you see a stock price go from the upper left-hand side of the chart to the lower right-hand side of the chart, you know that is a downtrend. The price action of PENN has been mostly bearish.

What I want to see in the price action of a stock is bullish behavior. This would be a stock that is trading above an upward sloping 30-week EMA. If a stock has that going for it, then I consider it to be bullish. Notice how using that one metric would have kept investors out of PENN for most of the decline on the chart. Rarely has PENN traded above an upward sloping 30-week EMA since March 2023.

Recent price action has changed from that steady bearish decline. I’m encouraged by what I see in the price action. After making its bottom in April 2024 at $13.50 PENN rallied. It rallied all the way to $21.37 in July, before it gave back some of those gains by falling to a low of $16.28 in August. From there it rallied again and is back above its 30-week EMA. That is a good place to be. I am also encouraged that the 30-week EMA is flattening out. This flattening out is due to the fact that a stock has to consolidate or trade in a horizontal range after a long decline before the stock can start a new long-term advance. This horizontal range has been in effect since February 2024. If PENN can trade above the horizontal green line in the chart, that should be enough to cause the 30-week EMA to go from flat to having an upward slope, which is bullish. Because PENN is still trading in the horizontal range and has yet to trade above an upward sloping 30-week EMA for any length of time, I see PENN as a speculative buy, based on this price action. If PENN can clear the green trendline on Chart 1 then, you can add to your position.

Momentum is another factor I consider when purchasing stock. I want to buy stocks that have both short-term and long-term bullish momentum. I use the Percentage Price Oscillator (“PPO”) to determine momentum. PPO is easy to understand. When the black PPO line is trading above the red signal line, that is an indication of short-term bullish momentum. If the black PPO line is trading below the red signal line, then there is short-term bearish momentum. Right now, PENN has short-term bullish momentum. Long term bullish momentum is when the black PPO line has a reading above zero. This means that the line is above the centerline of the chart. When the black PPO line is trading below zero, then there is long term bearish momentum. I say long term because you can see that the black PPO line doesn’t often cross above and below the zero level, whereas the black PPO line often crosses above or below the red signal line, causing a short-term change in momentum. Now, PENN has long term bearish momentum as its reading is -0.016, and it looks like that reading could go above zero soon, adding to the speculative buy investment thesis.

Volume is the next factor I consider when buying a stock. I want to own stocks that institutional money managers are buying. They buy millions of dollars’ worth of shares and leave footprints we can see. They show up as the black volume bars in the volume pane of Chart 1. The black volume bars show the number of shares purchased when the stock advanced for the week. When we see the spikes in the black bars, that means that money managers were accumulating shares in PENN, pushing up the share price. When we see red volume spikes, that means that institutions were selling shares as they fell. The only reason money managers would buy a stock is because they think it is undervalued. Notice the black volume bars for the last two weeks are higher than the two most recent red volume bars. That is the type of volume picture I want to see as I want to own stocks that money managers are buying, and the volume footprint of PENN shows that money managers have been accumulating shares of PENN over the past four or five months.

Relative strength is a way to determine if the stock is outperforming another asset. In this case, I want to own stocks that are outperforming the SP 500 index. The way to beat the index is to own shares that are outperforming the index. The relative strength chart is easy to understand. When the black line is rising, that means that PENN is outperforming the index. When the black line is falling, then PENN is underperforming the index. Since mid-May of this year, PENN has been outperforming the major index slightly. That is a good sign. It is also fair to say that there is more work to be done regarding PENN’s outperformance. I want to see PENN’s relative strength line cross above its 30-week EMA and have more of an upward slope. That is another reason why PENN is a speculative buy at this point.

In summary, PENN is in an industry that should benefit from an interest rate cut, as that should put more money into the pockets of consumers who go to casinos. The price action of PENN has been terrible for most of the last three years. Recently, things have improved, and PENN is now in the midst of a horizontal range and has recently recaptured its 30-week EMA. I want to see PENN overtake the $21.50 level. PENN has bullish short-term momentum, while the long-term momentum is bearish and could soon become bullish. The volume pattern shows accumulation by money managers. Relative strength has been positive since mid-May, but not overwhelming. All of these factors make PENN a speculative buy now, meaning an investor could start a small position in PENN. I would consider adding to this position if PENN trades above the $21.50 level.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PENN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.