Summary:

- PENN Entertainment’s recent financials were disappointing, with a decline in gaming revenues and a rise in expenses.

- The company’s balance sheet shows stable long-term debt levels and a drop in financing obligations, but a decrease in shareholder equity.

- PENN’s cash flow statement reflects a significant drop in operating cash flow and free cash flow, causing share prices to come under pressure.

- The Company’s capital expenditures are likely to help turn earnings late next year, with strong free cash flow projected for 2026.

EricVega

A couple of weeks ago, PENN Entertainment (NASDAQ:PENN) reported fourth quarter earnings that disappointed investors. The gaming and entertainment company saw its shares fall in response, and the selloff intensified last week to new 52-week lows. Based on the company’s recent financials along with projections for the next two years, I believe there is a good opportunity to enter a long position in Penn by selling $15 put options.

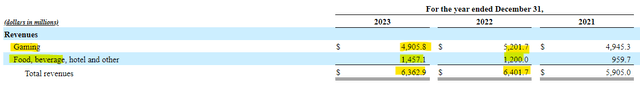

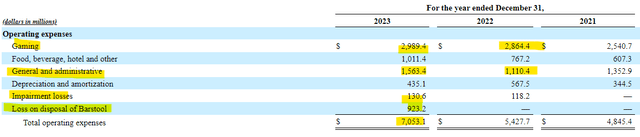

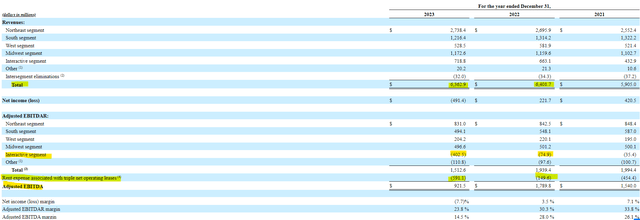

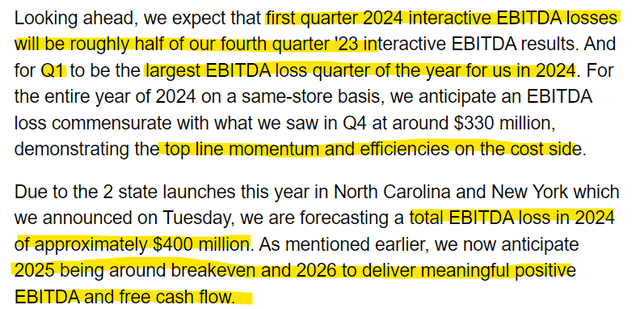

PENN Entertainment’s full year 2023 earnings were disappointing. The company saw a surge in food, beverage, and hotel revenue to help offset the decline in gaming revenues, but expenses rose sharply across all segments. Even without the write-off of Barstool, expenses still rose by $700 million. This brought adjusted EBITDA down to $921 million, compared to nearly $1.8 billion a year ago.

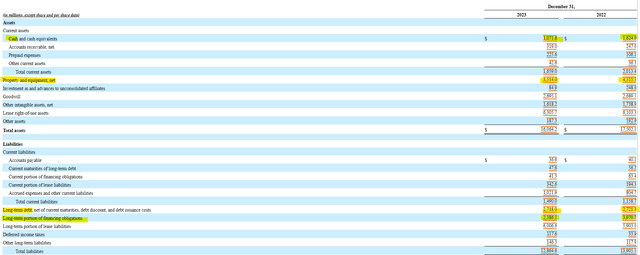

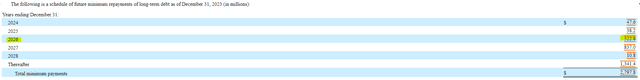

PENN Entertainment’s balance sheet consists of $1 billion in cash and approximately $3.5 billion in hard property assets. The drop in property assets is related to a lease modification signed at the beginning of the year. A majority of the assets are considered intangible, making shareholder equity a tough comparable to market capitalization. During 2023, Penn saw its long-term debt levels remain stable at $2.7 billion and had a drop in its financing obligations of over $1.5 billion in association with the lease modification. The lease modification did end up contributing positively to shareholder equity, but the Barstool write-off led to equity dropping to close to $3.2 billion.

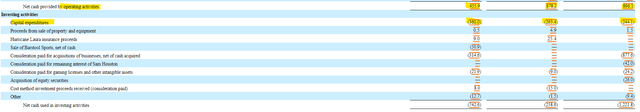

The headwinds facing PENN Entertainment are best exemplified by examining the cash flow statement. After two consecutive years of over $800 million in operating cash flows and more than $600 million in free cash flow per year, PENN Entertainment’s operating cash flow fell to $456 million and free cash flow dropped to less than $100 million in 2023. The earnings and free cash flow drop have caused the shares to come under pressure.

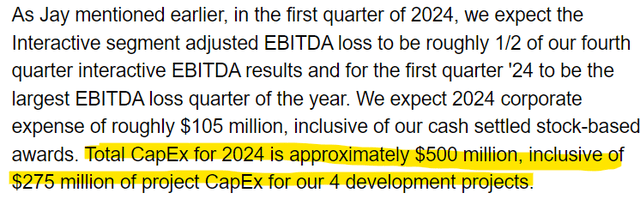

Looking ahead to 2024, PENN Entertainment is likely going to see free cash flow of around $0. This is due, in part, to their guidance of $500 in capital expenditures as they gear up to have their first March Madness on ESPN Bet and work on four other brick and mortar projects. With the near-term outlook being so challenging, why should investors consider taking a position in the company’s shares now?

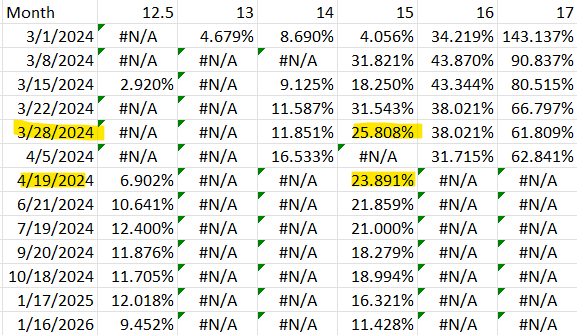

The current drop in share price has allowed options prices to rise on discounted shares. For example, at a $15 strike price, cash secured put investors can see annualized returns north of 20% with no earnings reports between now and expiration. I prefer grabbing the March 28th expiration, as data from March Madness will likely be unavailable by then.

Yahoo Finance

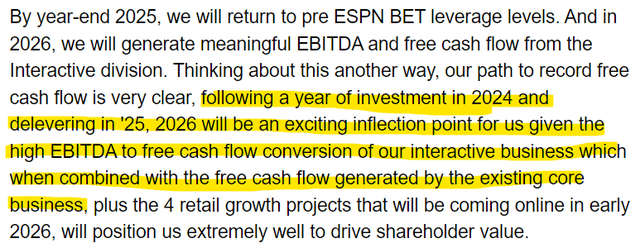

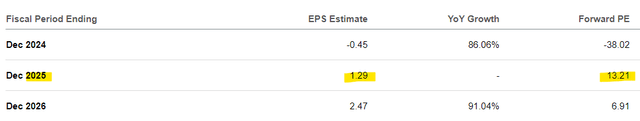

In addition to the options market, management is pointing to a path of strong earnings by late 2025 and for full year 2026. Analysts are also on board for a strong rebound starting next year. As it currently stands, shares are trading at 13 times next year’s earnings, but that multiple is reduced to nearly 11.5 times when considering the strike price of the options contracts. A 2026 turnaround to profitability and free cash flow generation will be timed perfectly as the company faces its next major debt maturity that year. Between now and then, if the company needs to burn cash, it can lean into its $1 billion of cash on hand.

Earnings Transcript Earning Transcript Seeking Alpha SEC 10-K

PENN Entertainment’s turnaround is going to rely on its execution of ESPN Bet, along with the timely delivery (and on budget) of its brick-and-mortar projects. The company’s prospects of expansion seem bright, despite the toll it is taking on current earnings. If I am assigned at $15 per share, I believe that will mark a great entry point for Penn shares. If not, I’ll earn a good income stream from selling put options.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PENN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.