Summary:

- PENN’s recent 13% stock crash reflects the market unease over higher-than-expected Q4 losses and doubts about the $400 million investment in ESPN Bet, showcasing investor skepticism.

- Penn’s retail segment though is underappreciated with 43 properties and estimated cumulative free cash flow of ~$1.7 billion over three years.

- Despite ESPN Bet uncertainties, I believe PENN stock is trading at over a 100% discount to the intrinsic value of its retail segment.

Editor’s note: Seeking Alpha is proud to welcome David Papson as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

BrianAJackson

Company Overview and the Pitch

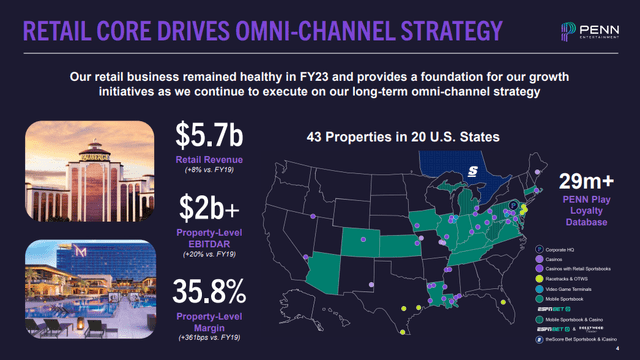

Founded in 1972 and headquartered in Pennsylvania, PENN Entertainment (NASDAQ:PENN) is a consumer entertainment company with two operating segments, the Retail and Interactive business segments. The retail business boasts a portfolio of 43 operated casinos and racetracks located throughout the country, with notable clusters in the northeast, the mid-west and down south, specifically in Louisiana. While the interactive business is a burgeoning digital iGaming platform that recently got a major boost from a licensing deal with Disney’s ESPN to form ESPN BET, a digital sportsbook with the aim of taking on the likes of FanDuel and DraftKings. In a market that seems obsessed with top-line growth, for investors and Wall Street, there is acute focus on Penn’s Interactive segment to be an engine of growth and although it is not the company’s first foray into digital sports betting, there are high expectations behind ESPN BET.

Unfortunately, for PENN shareholders, on last week’s fourth-quarter earnings conference call, it has become abundantly clear that the reality is that developing a sportsbook app to take on well-established and well-liked rivals in the space requires a good deal of capital investment and patience irrespective of the reputation of your licensing partner. Needless to say, the market did not take well to that message – the stock is off more than 20% since their earnings release.

However, I believe that the recent downswing in shares is an awesome buying opportunity, but not for the reason you may think. For me, the value of PENN is being lost in the myopic interest in digital growth and the success of ESPN BET. The true value of PENN lies in the Retail segment’s portfolio of brick-and-mortar regional casinos and racetracks that have a strong and long track record of profitability and free cash flow generation. For now, the value proposition of the Retail segment is being obscured as the profits from the segment are being used to get ESPN BET launched and prepared for battle with rivals. However, in 2025, when the entire Interactive segment is slated to breakeven on an EBITDA basis, I am of the view that the newly unencumbered cash flows of the Retail business should be returned to shareholders and PENN’s hidden value will be revealed.

Source: Penn Q4 Earnings Deck

The Market’s Q4 Takeaways

Last week, PENN reported earnings and gave an update on the recent launch of ESPN BET – the response was a violent 13% crash in the stock price that has continued into this week. It seems that the market balked at the higher-than-expected Q4 loss (-$1.75 per share) and took no solace in the idea that this year, management expects those losses to continue with a big bet on ESPN BET. For context, inclusive of the expected North Carolina and New York state ESPN BET launches, the Interactive business is expected to lose between $380 million and $420 million in EBITDA, a much higher sum than analysts had anticipated. In response to these forecasts, the harsh stock price movement is clearly an open rebellion against management’s capital allocation strategy to invest big on the growth of PENN’s digital platforms. For a management team led by CEO, Jay Snowden, that has already demonstrated weakness in this area as evidenced by the Bar Stool Sports debacle, the market’s skeptical stance seems to be warranted.

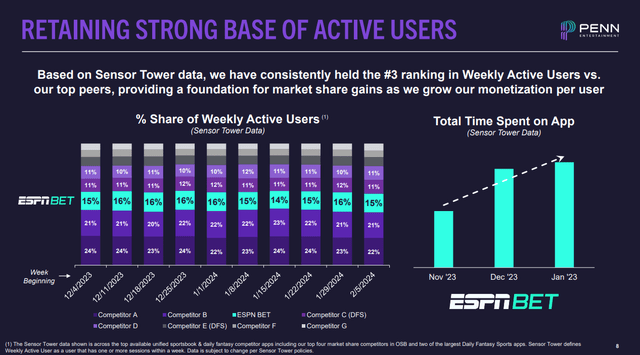

Additionally, analysts were quick to highlight ESPN BET market share concerns as they questioned management’s assertion that they are #3 in terms of market share in their states of operation. In their earnings deck, management boasted that it is #3 in terms of app screen time in its respective markets, but acknowledged analyst concerns that it is not yet receiving a commensurate market position in terms of the all-important cash handle, a market measure of total bets wagered.

At the time of this writing, with the stock price down more than -20%, the market is reasonably questioning if good money being generated by PENN’s retail business is being thrown after bad with respect to ESPN BET and the rest of the Interactive segment.

Source: Penn Q4 Earnings Deck

ESPN BET, What Went Right

We are the only company in the industry that has a fully integrated sports media and sports betting platform along with an omnichannel base of assets with which to drive cross-play and synergies as the database continues to grow at a rapid pace.

– CEO, Jay Snowden (Q4 2023 Conference Call)

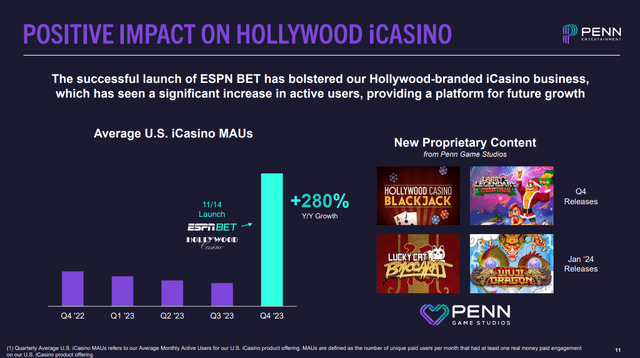

While the recent plunge in PENN’s stock price reflects market unease over the higher-than-anticipated losses in the Q4 report and the projected 2024 losses for the Interactive segment, we must frame the investment in the venture and future success of ESPN BET in terms of a broader omnichannel strategy. To achieve its omnichannel vision, the firm’s principal objective is to funnel customers onto the PENN Play platform via the ESPN BET app. A cogent strategy, with a straightforward objective; more customers on the ESPN app will lead to more traffic at Penn-branded physical casinos and iCasinos.

With over 1 million first-time depositors within the initial two months of the app’s launch, we can say comfortably that the company is executing on this front. Thus far, nascent digital indications are encouraging, with PENN reporting a surge of +280% iCasino monthly active users (MAUs). On the physical retail front, management was light on detail but did note that 43% of ESPN BET sign-ups originated within 50 miles of one of the company’s 43 properties, highlighting the potential for future cross-selling ESPN BET to brick-and-mortar casino initiatives that are currently in the pipeline.

Source: Penn Q4 Earnings Deck

To get the omnichannel strategy on its feet, it is imperative that the ESPN BET mousetrap must improve and at minimum match their rivals in terms of functionality. The aforementioned disconnect between market share in terms of time spent on the app and cash handle is clearly being driven by the app’s UI deficiencies. To that end, on the Q4 call, management committed to moving their app development team’s focus from state launches to product enhancements, specifically calling out, parlay offerings, player pops, live betting, in-game betting and further integration into the ESPN media platform (i.e., fantasy sports) as top of mind. These improvements in theory should help draw a broader audience and decrease attrition rates.

As I think about the future of ESPN BET, I think the market has been quick to pass judgment on a management team that admittedly has a checkered past in terms of capital allocation. But if given proper nourishment, the ESPN BET app has the potential to be a star in the $83 billion global sports betting market that is expected to grow +10% per year for the foreseeable future, according to Grand View Research. But my assertion is that my investment thesis on PENN does not rely upon the ESPN Bet app being a smash hit. In fact, if the interactive business just breaks even as it is expected to do in 2025, I believe that the stock is trading at a >100% discount to its intrinsic value.

Company Valuation, ESPN BET Doesn’t Matter

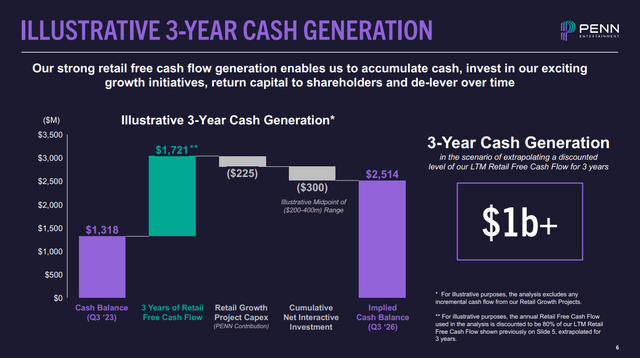

Putting aside the Interactive segment, let’s double-click on the company’s forgotten retail business. An underappreciated roster of 43 properties and 4 in development in Illinois, Nevada, and Ohio, the retail business is the cash bull that no one is talking about! During Q3, management gave us some direct insight about how they are thinking about the free cash flow generation of the Retail business for the next three years. By their estimate, they believe under conservative assumptions their cumulative FCF will be ~$1.7 billion before growth CapEx (namely, construction of their four properties in development) and ~$1.5 billion in total. At a current market cap of less than $2.6 billion, the firm expects to generate more than +55% of its value in cash by Q3-2026 – And that’s the Jackpot! If at minimum the ESPN BET app turns out to be a breakeven venture with some cross-selling opportunities, there is still a core asset generating massive cash flows in relation to the total value of the business.

Source: Penn Q3-2023 Earnings Deck

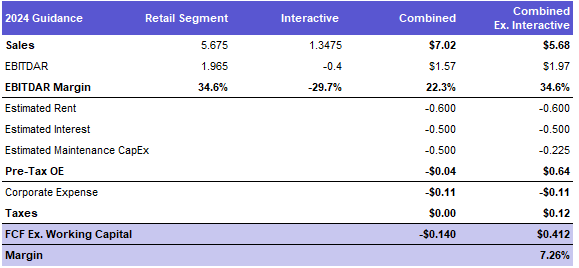

With some linear extrapolation from the Q3 guidance, we can infer that management believes that the Retail business generates ~$500 million FCF in a normal year. Additionally, using management’s 2024 guidance, I expect Retail FCF before working capital to be ~$400 million for 2024 (see below). Somewhere in the middle of these two figures is likely the right answer, so at a $450 million run-rate, the company is trading at a price-to-FCF of less than 6x. Assuming a terminal growth rate of ~3% for the regional casino business, 150% operating leverage and a 11.5% cost of equity, a more appropriate multiple is closer to 14x FCF or a market cap of $6.3 billion.

Further, if we want to be really conservative and close the loop on the ESPN BET investment, we may assume that the $400 million slated for app development and state launches this year is not recouped and the future return on investment is $0. In that case, the after-tax costs for this year will amount to $316 million (assuming a 21% normal tax-rate) and our final valuation assessment is a $6 billion market cap. Although I believe that the upside to PENN is enormous, in light of the ESPN distraction, it may take time for the company to realize this value. However, in 2025 when the interactive business becomes self-sufficient, I expect large share repurchases to be the catalyst for significant shareholder value creation.

Management Guidance & Author Estimates

Risks

The most obvious risk to this valuation is that the Interactive Segment does not manage to achieve breakeven profitability. In that scenario, it is plausible that management will continue to funnel Retail segment profits to keep the Interactive business afloat and shun share repurchases. To some degree, management did attempt to de-risk this potentiality by asserting that they would still expect to be profitable given their current iGaming market share.

And to your question, if we were to be at 7% a couple of years out, could we be profitable? The answer to that is yes.

– CEO, Jay Snowden (Q4 2023 Conference Call)

Lastly, there are no balance sheet concerns with PENN today. As evidenced by $1 billion in cash on the balance sheet and no major debt maturities until 2026, PENN has ample ability to meet its obligations. However, for this particular year, as the company expects to invest big in its digital platforms, if a recession were to dent the Retail business’s ability to generate the capital earmarked for ESPN BET, then we may have to be mindful of potential cash burn. Generally, regional casino operations fare better than your typical cyclical business in an economic downturn. Check out the Q3 earnings deck (slide 18) for management’s thoughts on this, but any cash burn could result in a delay of future share repurchases and value creation for shareholders.

Bottom Line

Trading at over a 100% discount to the intrinsic value to its Retail segment, PENN is certainly worth a bet. Add in what is essentially a call option on the future success of ESPN BET and PENN trading at under $18 per share is like getting pocket aces on the deal. Of course, there is no guarantee that the person sitting next to you does not get a flush on the flop, but at least you are off to a heck of a strong start!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PENN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is expressly the opinion of David Papson and does not reflect the opinion of CDT Capital Management ("CDT"). The stocks discussed in this article could be holdings of CDT and its affiliates.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.