Summary:

- PENN Entertainment’s sports betting venture ESPN Bet shows strong growth potential with expansion into New York and increased sporting events, despite being undervalued compared to peers.

- ESPN Bet’s smaller addressable population, lower initial hold, and early market entry contribute to its current undervaluation, but these issues are being addressed.

- PENN Entertainment’s regional casino business, despite high debt, remains robust, providing a solid foundation for ESPN Bet’s growth and overall company valuation.

- Catalysts like the New York launch and NFL season could drive significant user growth, making PENN a buy with the potential for substantial upside.

JasonDoiy/E+ via Getty Images

PENN Entertainment, Inc. (NASDAQ:PENN), the operator of regional casinos and online sports betting site ESPN Bet, is currently very cheap compared to peers in its industry. Especially, growth at ESPN Bet could lead to outperformance, with several key growth drivers coalescing in the third quarter.

Investors might be overlooking PENN Entertainment’s potential, particularly as its new ESPN Bet platform is primed to leverage ESPN’s expansive media reach and unique brand loyalty. Despite the shadow cast by the previous Barstool Sports venture, PENN’s current partnership with ESPN is strategically stronger, targeting an already engaged sports audience nationwide. As regulatory environments continue to evolve favourably and PENN rolls out more aggressive marketing campaigns for the coming NFL season, the company is well-positioned to capture significant market share and demonstrate its ability to generate consistent revenue growth. Additionally, PENN Entertainment’s regional casino operations, with over 35 locations across the US, will provide a further robust source of revenue for the company.

ESPN Bet Has Strong Growth Potential

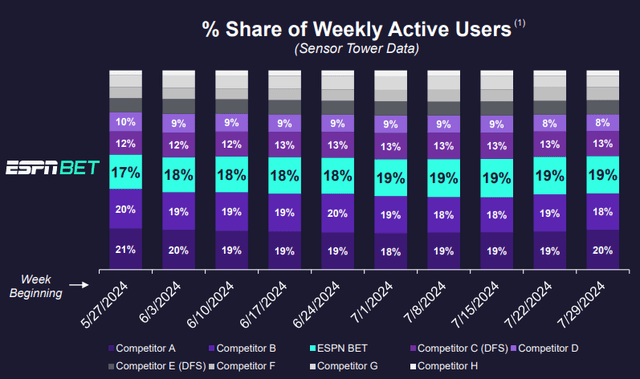

ESPN Bet is still in its early innings for PENN, having first forged the partnership with The Walt Disney Company’s (DIS) ESPN about a year ago, launching it in mid-November 2023, and scaling it up to being live in 18 states currently. PENN was able to instantly see success, with their database of registered users growing by 80% and monthly active users up over 130% since the launch of the partnership. Furthermore, in the states where they have gone live, PENN has been able to gain a very strong market share position as shown in their latest investor handout.

ESPN Bet Market Share (Penn Entertainment Investor Relations)

Okay, they have a Top 3 market share position and strong growth, but why aren’t they valued like DraftKings Inc. (DKNG) and Flutter Entertainment plc (FLUT), their two big competitors in the sports betting and iGaming space?

There are three main reasons for this, which I, however, believe will be alleviated over the coming years:

1. Currently, Smaller Addressable Population

With the 18 states ESPN Bet is online in, it lags behind its two competitors, with DraftKings and Fanduel both active in 26. This means that with its current lineup, ESPN Bet is only available to 40% of the US population, leaving room for expansion.

At the time of writing this article the launch of ESPN Bet in New York is imminent, with a spokesperson of the company recently saying they are looking to launch within the next few weeks, as they are currently waiting for a last legal check from the state. PENN originally gained access to the state after buying the license from their now-closed competitor WynnBet. With this launch, PENN can make massive progress in reaching more people. Due to housing 6% of the US population, the New York launch would allow ESPN Bet to make a quick jump from 40% to 46% of the US population having access to their product, marking a huge 15% increase from one day to the next. With ESPN reporting over 10 million monthly average visitors from the state of New York, ESPN Bet’s advertising work has practically already been taken care of, and they can quickly gain new users.

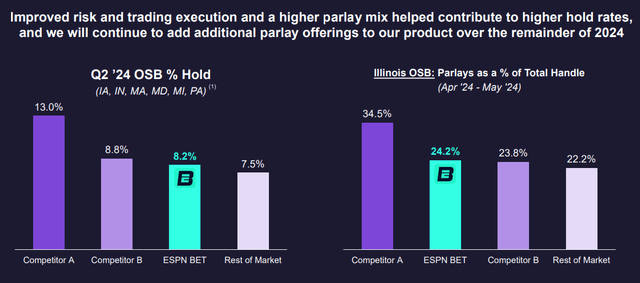

2. Lower Hold

Hold in the sports betting and iGaming space is defined as the amount of money the operator on average wins from a bet placed, this KPI varies between operators based on what types of bets they encourage their users to make, with bets such as parlays being more profitable for the provider. Initially, ESPN Bet did not have as much of a focus on parlays in their mobile sportsbook offering, leading to a lacklustre hold compared to their rivals. this issue has, however, been identified by management over the last quarters and a greater focus has been placed on raising their hold. Their efforts have visibly paid off with a rise in hold to about 8.2% in Q2, and an increase in parlays.

However, I still see room for improvement and I believe that management is still hungry to improve their mobile offering, to catch up to their major competitors as shown in their latest quarterly presentation.

ESPN Bet’s hold still below peers (PENN Entertainment Investor Relations)

In their latest quarterly call management announced a strong lineup of improvements coming to the ESPN Bet app, such as a specialised parlay lounge and a refreshed home screen, which, I believe, should do an amazing job in increasing the % of parleys played, thereby increasing ESPN Bet’s hold.

3. Still Early Innings for ESPN Bet

Due to being on the market for a rather short time compared to their large competitors which have had several years to grow, the market is still discounting ESPN Bet more than its peers. Comparing the monthly active paying users of both DraftKings and ESPN Bet clearly shows that being newer on the market ESPN Bet is still in earlier growth stages, with only about 0.5 million average monthly active users in Q2 compared to DraftKings 3.1 million.

However, I believe this is nothing to worry about given the stage the company is at, and they will rapidly gain new users for several reasons.

- Expansion into New York.

- ESPN Bet is better set up to capitalise on the coming NFL season, one of the most important events for sports betting companies, than last year.

- ESPN serves as a perfect marketing engine, with essentially every sports enthusiast in the US familiar with the brand.

- Improvements to the ESPN Bet app for the upcoming season.

Financials

Given the fact that PENN still makes most of its money in the regional casino business their balance sheet is not as clean as I would usually like it to be.

The company has about $11.2 billion of long-term debt originating from their regional casino business. While this number at first looks a bit scary, I am really not worried about it. It’s very common practice in the casino business to be quite leveraged, this stems from the fact that building a hotel and casino in the first place is highly capital intensive with large upfront costs. Therefore, financing has to be obtained. Once the casino is in operation it is highly cash flow generating and pays off the debt over time. All the debt and credit facilities the company is currently drawing are longer dated, with the majority of debt expiring past 2028, giving the company a long runway to pay off their debt or refinance at cheaper rates.

Additionally, the company has another $877 million in cash, as well as a current ratio of 1.03, giving them ample flexibility in their short-term operational expenses.

Peer-Based Valuation

To value PENN Entertainment I would like to compare them to their direct competitors and industry peers, for this, I split the valuation into two distinct parts: the regional casino business and ESPN Bet. For each I construct a revenue multiple we can then use to value PENN Entertainment.

All following tables are created by the author and numbers are based on data provided by investor relations programs.

Regional Casino

For the cleanest comparisons within the industry, I have chosen casino operators which mostly operate in the US and only run regionals. The list of companies which fulfill these criteria are Boyd Gaming Corporation (BYD), Monarch Casino & Resort, Inc. (MCRI), Full House Resorts, Inc. (FLL), and Century Casinos, Inc. (CNTY).

For the casino side of the business we need to take debt into account since these operators face very different levels of leverage, so the enterprise value (EV) to TTM Revenue multiple will be calculated. For the sake of a simpler analysis, I ascribe all of PENN’s cash and debt to the casino business.

| Numbers in $ Millions, except Multiple | Boyd Gaming | Monarch Casino & Resort | Full House Resorts | Century Casinos |

| Ticker | BYD | MCRI | FLL | CNTY |

| TTM Revenue | 3 785 | 510 | 274 | 587 |

| Enterprise Value | 8 968 | 1 405 | 659 | 972 |

| Revenue Multiple | 2.37 | 2.75 | 2.41 | 1.66 |

From this, we can take lower, base, and upper revenue multiples we can apply to PENN, with 1.66, 2.30, and 2.75 respectively.

| Numbers in $ Millions, except Multiple | Lower | Base | Upper |

| Casino Multiple | 1,66 | 2,3 | 2,75 |

| TTM Casino Revenue | 5 623 | 5 623 | 5 623 |

| Casino Enterprise Value | 9 334 | 12 932 | 15 463 |

| Casino Value | -1 198 | 2 399 | 4 930 |

From the EV we then subtract the net debt position the company is currently in, receiving the valuation an equity investor might give to just the casino business given the industry averages. This highlights the leverage the casino business has and also shows that at a revenue multiple that is average for the industry, the market completely forgets the existence of ESPN Bet.

ESPN Bet

Finding direct comparisons in this region was a bit harder, as many companies in the iGaming space operate internationally, however, I was able to find 3 companies that came closest: DraftKings Inc. (DKNG), Super Group (SGHC) Limited (SGHC), and Rush Street Interactive, Inc. (RSI). Since ESPN Bet has only been fully operational for two quarters I have chosen to create the revenue multiple using the revenue over the first 6 months of 2024, this also creates a fairer playing field as all providers will have experienced the same sporting events during this period. Additionally, this time around debt does not play a big role so we will be looking at the market cap instead of enterprise value.

| Numbers in $ Millions, except Multiple | DraftKings | Super Group | Rush Street Interactive |

| Ticker | DKNG | SGHC | RSI |

| Last 6 Months Revenue | 2 279 | 793 | 437 |

| Market Cap | 16 751 | 1 730 | 2 113 |

| Revenue Multiple | 7.35 | 2.18 | 4.84 |

Applying these multiples to the last 6 months of ESPN Bet revenue we get the following valuations for PENN’s digital gaming business.

| Numbers in $ Millions, except Multiple | Lower | Mid | Upper |

| IGaming Multiple | 2,18 | 4,79 | 7,35 |

| ESPN Bet Revenue Last 6 Months | 440 | 440 | 440 |

| ESPN Bet Value | 959 | 2 107 | 3 234 |

Bringing It All Together

Adding up the separate valuations, we get the below table:

| Numbers in $ Millions, per Share values | Lower | Mid | Upper |

| Casino Value | -1 198 | 2 399 | 4 930 |

| ESPN Bet Value | 959 | 2 107 | 3 234 |

| Total Value | -239 | 4 507 | 8 164 |

| Price Per Share | (-1.57) | 29.65 | 53.71 |

| Upside in % to the current price of $18.62 | (-108%) | 59% | 188% |

Seeing from our analysis, for the base valuation of just the casino business we can basically get the whole of ESPN Bet for free, giving us a 60% upside to the current stock price.

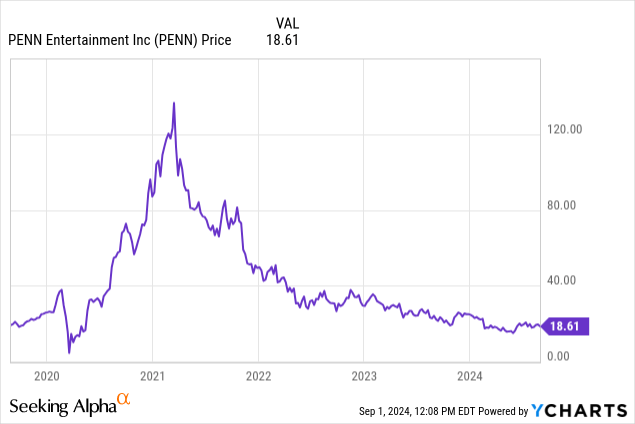

I think investors are overly cautious in pricing the ESPN Bet segment of PENN Entertainment, possibly due to the volatile stock reactions following PENN’s acquisition and subsequent sale of Barstool Sports, which have left lingering concerns about the company’s strategic direction and market stability.

Catalysts & Risks

I believe the coming quarter brings several catalysts which could, once the third quarterly earnings report is released, lead investors to finally re-value the ESPN Bet side of the business, giving investors significant upside. The main ones are: the launch in New York bringing in an injection of new users and the start of the NFL season with ESPN marketing getting wider attention, the two of which combined will in my estimation lead to above market user and revenue growth rates in the 3rd quarter.

Risks, however, include: against my expectations lacklustre user growth in the coming quarter, weakness in the brick and mortar casino business, and a general economic downturn leading to less gaming spend.

Conclusion

In conclusion, in comparison to its peers PENN Entertainment is currently quite undervalued and could soon deliver good results to investors. As long as the casino business of PENN holds up, ESPN Bet will continue to provide strong growth to the company. Therefore, I rate the company as a buy and look forward to the coming quarter. If run correctly and growth persists in ESPN Bet, a return to prices seen in mid-2021 is realistic for the company in the long run.

For investors interested in creating a long/short portfolio, a setup worth investigating would be shorting some of the more expensive regionals as well as online competitors of PENN, while buying PENN’s stock. This portfolio would insulate investors from an economic downturn, due to the gains from the shorts cancelling out PENN’s losses, while still gaining on ESPN Bet growing faster than their competitors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.