Summary:

- PENN Entertainment’s partnership with ESPN aims to revitalize its online sports betting division, but the $1.5 billion deal and high debt pose significant risks.

- The sale of Barstool Sports for $1, after a $551 million investment, resulted in an $850 million writedown, adding to PENN’s financial strain.

- Despite ESPNBet gaining market traction, PENN’s Q3 2024 EPS is projected at -$0.26, and the company faces a daunting $10.5 billion net debt load.

- While the ESPN deal offers long-term growth potential, PENN’s current financial instability and high costs make the stock a hold for now.

felixmizioznikov

Co-Authored By Noah Cox and Brock Heilig

Investment Thesis

In August of 2023, PENN Entertainment (NASDAQ:PENN), formerly PENN National Gaming, announced that it entered into an Online Sports Betting (OSB) agreement with ESPN (part of Disney (DIS)). This agreement was largely agreed upon to help PENN revitalize its online betting and gambling division. The deal is a 10-year agreement worth roughly $150 million per year.

PENN has agreed to make $1.5 billion in cash payments to ESPN paid over the initial ten-year term and grant ESPN approximately $500 million of warrants to purchase approximately 31.8 million PENN common shares that will vest ratably over 10 years, in exchange for media, marketing services, brand and other rights provided by ESPN –Press release from August 2023.

Now that PENN Entertainment has dipped its proverbial foot into the nationwide trend of legalized sports betting (and away from its Barstool Sports approach on it), it appears management believes this is the key to growth for their betting franchise and casino business going forward.

The biggest issue for PENN though, is that the company as a whole is now losing money.

As a part of this deal, the company took a major writedown when it was forced to sell Barstool Sports back to its original founder, Dave Portnoy, for $1 after paying roughly $551 million for full control of it. This was needed in order to secure the deal with ESPN.

This has left PENN with a lot of debt, which is a big problem. Because of this, I think shares are currently a hold. There is plenty of potential for success with the new online sports betting route, but I’m not convinced that the unit economics makes sense yet.

Background

In February 2020, PENN Entertainment first partnered with Barstool Sports, acquiring a 36% stake in the company, which cost $163 million. After partnering with PENN, Barstool saw a major increase in its online reach as the platform expanded from just content production to online gambling as well.

In the first three years after PENN Entertainment and Barstool Sports began their partnership, Barstool Sports experienced powerful growth. Barstool (at this point a full subsidiary of PENN) saw audience growth of 194%, ad sales jumped by 160%, the company had 128 billion video views across different social media channels, and the partnership sold over 5 million units of apparel and direct to consumer merchandise.

Because of this success from 2020 to early 2023, PENN Entertainment acquired the remaining interest in Barstool Sports in 2023 for $388 million.

Despite this strong performance, the actual Barstool Sports’ online gambling site was likely not nearly as effective as PENN Entertainment had hoped. When ESPN approached the casino giant, I believe they felt like they could not refuse.

Despite having bought the rest of Barstool for $388 million in February of 2023, by August of the same year, PENN Entertainment sold Barstool Sports back to Dave Portnoy for $1.

PENN sold 100% of the outstanding shares of Barstool Sports to David Portnoy in exchange for a nominal cash consideration ($1.00) and certain non-compete and other restrictive covenants… the 10-Q filing read.

Barstool Sports is now its own independent entity yet again, and PENN Entertainment has since partnered with ESPN to form ESPNBet, another sportsbook. In all, between the ESPN deal ($1.5 billion) and the Barstool Sports deal ($551 million) PENN Entertainment is now in for over $2 billion to try to break into the online sports betting market.

When PENN Entertainment shed Barstool sports, they took an $850 million charge off.

In essence, it’s a lot of costs for just now getting momentum on a deal with ESPN.

ESPN Deal Shows Strong Traction

While PENN paid effectively $1.5 billion for the rights to this deal over 10 years, their deal with ESPN to form ESPNBet is already showing great traction against its competitors. As noted by PENN’s management, ESPNBet is up to 19% market share, which is up by 2% from May to July.

…ESPN and PENN share a common vision… we want to make ESPN BET America’s sportsbook. Sports betting is a key pillar of ESPN’s future growth, because sports betting content and connectivity drive user engagement… we are both deeply committed to making ESPN BET a top name with sports betting over the coming years. We don’t just want to compete here, we want to win…

-Chief Technology Officer Aaron LaBerge on the Q2 Earnings Call.

ESPN is the logical partner, and this was a smart partnership for PENN Entertainment to get involved with. Barstool Sports was denied gambling licenses, but ESPN, one of the leading brands in all of sports, has had no trouble getting its sportsbook up and running.

ESPN is also more professional than Barstool Sports when it comes to the type of content it publishes, which should attract more customers.

A key issue here, as I alluded to earlier, is that the deal with ESPN is very favorable towards ESPN and away from PENN Entertainment. Basically, ESPN is set to get (basically) guaranteed $1.5 billion in payments over 10 years. PENN Entertainment assumes most of the logistical risks just like they did with Barstool.

I think PENN Entertainment could struggle to make money because of this. According to the earnings presentation, their ESPNBet app currently has 465,000 active monthly users. This may sound like a lot, but the company had 196,000 active monthly users before the ESPNBet announcement. So, right now, they are paying effectively $150 million a year for an additional 269,000 users. That’s $557.62 per additional user per year. This feels way too high.

Overall Losses Are Concerning

PENN Entertainment’s earnings estimate data shows the company’s Q3 2024 EPS is expected to come in at -$0.26, making their forward P/E negative.

Pair this with the gross profit margins on the brick and mortar side of 34% to 35% as mentioned in the earnings call, and it’s clear that, after adding in the cost of ESPN, PENN Entertainment is currently losing money on the ESPN deal. The legacy business continues to produce solid cash flow. ESPN is currently not helping.

Financials

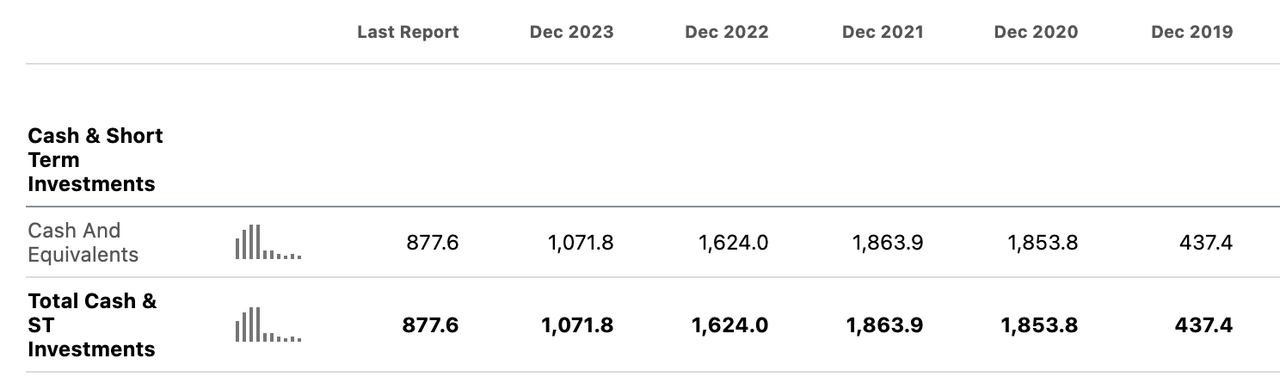

PENN’s balance sheet shows the company’s cash balance stood at $877.6 million as of the end of Q2, which is the lowest the company has reported since December 2019.

PENN Cash Balance (Seeking Alpha)

This is out of balance with their net debt load which, according to the balance sheet, is more than $10.5 billion, and has more than doubled in the last 10 years (I am counting the net that Seeking Alpha displays at the bottom of the balance sheet page). This includes capital leases.

One of the biggest problems this company faces is that it is very capital intensive to build physical casinos. It’s clear they are able to generate a strong 34-35% gross margin here, but the purpose of the ESPN deal is so they can expand into a new market and get access to returns that are less capital intensive. The $1.5 billion cost of their deal is a fairly large overhang.

Don’t get me wrong, the deal was needed and in the long run I think it’s going to be a smart move, I just think the company is paying a lot for this upfront (on top of carrying a large debt load).

For now, since I believe the stock is a hold, I am not sure what the fair value of shares are.

To be clear, I think shares are expensive, but I do not know how expensive. The company’s forward EV/Sales is higher than the sector median (2.01 vs. 1.28). Their forward EV/EBIT is also high because of their debt load (67.63 vs. 14.82).

As I outline below, the company is supposed to see incredible EPS growth over the next 10 years. If these results prove to be true then the company is clearly undervalued.

But I’m not sure what the odds are at this point that these estimates will play out.

Bull Thesis

The move to ESPN from Barstool Sports was an overall good decision from PENN Entertainment. If they execute on it right, this could set the company on a real track toward strong EPS growth and success.

Looking forward, analysts estimate that PENN Entertainment could report profit per share earnings of just under a dollar, $0.93, in 2025 and over two dollars per share, $2.12, in 2026.

In fact, by 2032, one estimate shows that EPS could reach a high of $27.85/share, although that is the estimate of just one analyst, not multiple analysts. This would go a long way towards lowering the forward P/E multiple. But these are also bold assumptions.

The company is losing money right now, and basically the future of PENN is largely based on a strong ramp of their ESPN deal. With fall sports like football starting up, this provides a big opportunity for PENN Entertainment to kickstart its growth.

Overall, the trend is going in the right direction for sports betting. According to data from GeoComply:

The first week of the season saw a 73% year-over-year increase in the number of transactions, with unique users up 39%.

With ESPNBet holding almost 20% of the market share, growth should be strong for them too.

But my question is (and why I am at a hold rating): is this growth strong enough to counter the $150 million per year fees to ESPN and the over $10 billion net debt load on the balance sheet? I am not sure at this point.

Conclusion

I think PENN Entertainment showcases a lot of promise for the future, but there’s a lot that needs to go well (almost perfect execution) in order for this to happen. The company clearly is headed in the right direction in its partnership with ESPN. Moving on from Barstool and signing with ESPN was one of the better moves PENN Entertainment could have made. It was incredibly costly, but it was probably worth it.

In the long run, though, I think the $10.5 billion in debt is going to be a large overhang. For now, I think shares are a hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.