Summary:

- A flip flopping of strategy is a concern for any investor that develops a thesis based on what management says.

- PENN Entertainment is a perfect example of management committed to one strategy and then abandoning it to go into the opposite direction.

- Whether the pivot is right or not may not matter; if you don’t agree with management’s change in strategy, you shouldn’t be in the stock.

svetikd

Most investors know there’s not only one way to invest. Some investors are looking for a bargain, while others may be focused on growth. Still others want a story that they can believe in and a strategy that makes sense to them. No matter how you prefer to invest, I believe you must have faith in the management of the company you’re investing in if this is truly an investment and not a trade or speculation. A company can have a great business model, but management’s impact on that business model will determine whether the business is ultimately as successful as it can be. This is my main issue with PENN Entertainment (PENN); I have no faith in management. It’s not that CEO Jay Snowden and his team have been purposefully deceitful or have done anything illegal. They’ve lost my faith because they completely changed their strategy in the last six months after laying out a unique vision for their industry. Everyone has a right to change their mind, but I don’t have to stick along for the ride. I’d avoid PENN and look elsewhere.

Background

Ever since the initial acquisition of Barstool Sports was executed back in 2020, PENN (NASDAQ: PENN) CEO Jay Snowden talked about how PENN’s strategy was different than the DraftKings (DKNG) and Fanduels of the world. While these upstarts that didn’t have physical casinos were locked in a land grab for market share, helped in part by the site’s daily fantasy users, PENN believed that they could use Barstool to “significantly reduce customer acquisition spend.” What does that mean? Essentially, PENN didn’t believe they would need to spend nearly as much money on commercials, bonus bets and other marketing activities. PENN was clear that they were operating in a different manner, something that Dave Portnoy, founder of Barstool Sports, often spoke about. They used the Barstool acquisition as their marketing arm rather than incur customer acquisition costs that would make them unprofitable.

For a while it seemed like this strategy might work as the stock price soared to well over $100 a share in 2021 before falling sharply over the last couple of years.

PENN 5 year chart (Seeking Alpha)

As they struggled to keep up with the competition, management then claimed that the primary missing piece was their own proprietary in-house tech stack so they could better target their customer. If you look at what they did with the acquisition of theScore in Ontario, the results were remarkable and that was supposedly driven by the proprietary platform. Once they migrated Barstool sportsbook app, which by all accounts was somewhat clunky, to the new proprietary tech stack, management believed that operations would improve significantly. And to prove that this was such a big deal, they decided to actively refrain from driving customer acquisition until this happened, as they didn’t believe the user experience was good enough.

The big migration was to occur in the dead part of the sports calendar, the MLB All Star break in 2023. That short period of time has a dearth of sports activity as there’s no baseball and playoffs for basketball and hockey had just ended. And it goes without saying that there’s still a full two months until the main event for all sports betting, football. That two months would allow PENN to work out the kinks with their new systems and be ready to attack the market in the fall. Shareholders, myself included at the time, were very excited as they had been very patient with the acquisitions and integrations and the stock price had languished for years. This was finally the time for PENN to shine, I believed. The migration occurred as planned in July and shareholders were hopeful that this was the catalyst that they had been waiting for. It was time for all our patience to pay off.

Weeks later, in early August, the unthinkable happened. I checked my phone and saw a tweet from Dave Portnoy saying he had bought back Barstool Sports. What? Yes, it was true. PENN had sold back Barstool to its founder for $1 (plus half of any future sale price) and entered into a 10- year deal with ESPN (part of The Walt Disney Company (NYSE: DIS)) to launch ESPNbet.

What happened to all the talk about not paying for marketing, driving it organically through people that worked at the company like Dave Portnoy or Big Cat? How do you just have one strategy so well-articulated and then completely change gears to a strategy that looks a lot like your competitors? Rather than tweak your vision, PENN went completely in the other direction.

But wait, there’s more. Now it comes out that Barstool only has to wait until the end of the football season to partner with another gaming company. It’s very surprising that Barstool would only have a six month non-compete and PENN would allow its former marketing arm to hawk a competitor. To me that makes little sense.

Valuation

This article isn’t focused on valuation, but as any investor knows, you can’t write a story on a company without considering it. The greatest company in the world can still be too expensive at a certain price. A poor company may be the perfect investment at the right price (the old Ben Graham cigar butt). This is where PENN might have started to pique the interest of the cash flow investor as the market cap of the company continues to fall (now approximately $2.7b) and PENN’s TTM free cash flows through Q3 2023 were $377 million, which is a relatively attractive multiple on cash flows. It’s difficult to value PENN on earnings as there’s been some big losses due to the Barstool sale.

Given that everything’s changed with strategy however, it’s almost a fool’s errand to try to project what those cash flows will be in the future, so I don’t believe you can value this company off of cash flows and have any conviction that you’re right. In their Q4 conference call, the only projection that management gave was that for the Interactive segment, free cash flows and EBITDA are going to be breakeven in 2025 and then be “meaningful” in 2026 and beyond. That’s hardly enough to really value a business on.

Moreover, when asked about the open share repurchase plan that the company has authorized by the Board, CFO Felicia Hendrix had this to say:

“But look, as Jay and I talked about in our prepared remarks, this is a year of investment as we focused on growing and building out ESPN BET. So you probably won’t see share repurchases in 2024.”

PENN isn’t buying the stock despite having the authorization to do so. That says a lot to me.

Risks

I always try to consider where I could be wrong in any investment thesis. For starters, drumroll….the new strategy could work. ESPN could be even more powerful than I give them credit for and they could steal market share from the two market leaders. Perhaps ESPN’s personalities with huge followings can do for PENN what Barstool could not?

Or maybe PENN has a lot more value with the new tech stack and they’re able to target and retain customers as they had promised. Additionally, now that they don’t have the controversy that Barstool used to bring, they can be a player in all eligible markets. The recent acquisition of Wynn’s New York mobile sports betting license is a perfect example of the difference between a partnership with ESPN and Barstool.

Finally, the stock is down and down big. While that alone doesn’t mean much, cash flows don’t have to be that robust to justify this valuation, even though we know that’s at least two years out. But based on what the company has said recently, this is all speculation, we just don’t know what cash flows will look like at this point.

Looking at the 10-K

PENN recently filed its 2023 10-K and there are a few items that caught my eye.

PENN doesn’t typically report cash flows in its earnings releases, which makes the 10-Q or 10-K filing an important read for any investor. Comparing the year-to-date operating cash flow at the end of Q4 of $455.9 million against Q3’s year-to-date operating cash flow of $540.7 million allows an investor to calculate the quarterly operating cash flow. Obviously, that’s a negative number, which is the first time PENN has had negative OCF in a quarter since 2020.

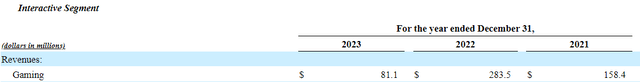

There’s also major drop in gaming revenues for the Interactive segment due to much higher promotional expenses associated with the ESPN partnership. Gaming revenues are reported on a net basis, with promotional customer acquisition spend reducing net revenues.

Interactive segment revenues (PENN 12/31/23 10-K)

It’s definitely early in the PENN/ESPN partnership, but to me the initial results are concerning and are supportive of my belief to no longer be in this stock.

Conclusion

Initially the market loved the ESPN deal. The stock rallied on the news initially, but months later it has settled into a trading range at a lower level despite the stock market nearly all-time highs once again. This story is long from over, but I’m not betting that this strategy ends up being a winner in the end.

At the end of the day, if you can’t trust the management of the company to do what they say they’re going to do, you shouldn’t be in the stock. As an investor, it is not your job to make the day-to-day operational decisions. All you can do is evaluate what management says they plan to do, and decide if you think that makes sense. Anyone that was in the stock and had done their due diligence should have been on board with the previous plan if they were paying attention, otherwise why be in the stock?

The old strategy was focused on profitability and avoided an expensive marketing blitz in a field of crowded competitors. The new strategy is jumping right into that crowded field after giving DraftKings and FanDuel a massive head start. To me, the assumption made by management appears to be that the ESPN name will be powerful enough to make up the head start that its competitors have enjoyed.

Who knows, this strategy may work. Maybe the power of ESPN is enough to drive PENN past its rivals that currently have massive market share leads. But that’s not what I signed up for. And as such, I sold my position shortly after this all went down in the summer.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I owned PENN Entertainment but sold it in August 2023.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.