Summary:

- PepsiCo’s strategic focus on expanding its snack segment has proven beneficial, with higher margins compared to beverages.

- The company has faced challenges with its pricing strategy, as evidenced by recent declines in volume despite price increases.

- Questions remain about its working capital management and the impact on future cash flows and profitability.

lcva2/iStock Editorial via Getty Images

It’s been almost a year since I published my first article on Seeking Alpha about PepsiCo, Inc. (NASDAQ:PEP). My thesis is better explained in that article, and I believe many of the things I anticipated have become reality. From the price-volume relationship to the valuation discussed in that article. Today, almost a year later, it’s time to report on the latest events that have happened for Pepsi and how some of them might affect another company I’ve also written articles about, Celsius Holdings, Inc. (CELH).

Key Points Of The Thesis

This section will be a brief summary of the key points of the Pepsi thesis.

The snack segment has become more significant in the company’s product portfolio. This is partly positive, as Pepsi has a more dominant position in this category, and the segment has higher margins than beverages (24% EBIT compared to 9.35% for Pepsi North America). If this trend continues, Pepsi should be able to keep increasing its margins over time.

This type of company is not typically cyclical on the demand side, but it can suffer more on the cost side, as they are exposed to fluctuations in raw materials such as aluminum and oil. Sometimes, when it seems more expensive based on the PE multiple, it is actually cheaper based on other multiples, like EV/Sales. The same happens to Monster and Celsius.

Pepsi has a great management team, well-aligned with shareholders, and generally makes good capital allocation decisions to mitigate potential future growth challenges for the company, although there are some aspects to review here that I will discuss later.

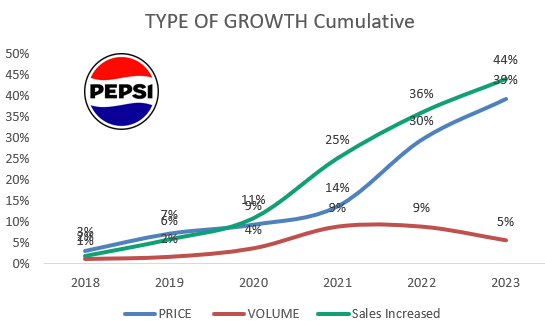

In consumer staple companies, it’s crucial to be cautious with the price/volume relationship. When brand power can’t sustain a high price, the value proposition breaks down, and volumes suffer. Pepsi has been experiencing this for several quarters. In fact, in the most recent quarter, prices rose by 5% while volumes fell by 3%. I predicted this a year ago. I believe Pepsi should return to the path of price increases between 2%-4% to try to increase volumes by 1%-2% annually, thereby continuing to gain some market share. If we take a cumulative view of these effects over the past few years, we can see where the company’s sales growth has come from.

Source: Author’s Representation

2024 Q2 Earnings

In this section, I will share my notes from Pepsi’s Q2 conference call and attempt to draw some conclusions and second-level thoughts regarding Celsius as well.

They provided guidance for the year of +4% in sales and +8% in EPS. They also mentioned that they have experienced supply issues with Quaker, but these should be resolved by Q4, and that the international segment is growing faster overall.

One thing I didn’t like that might be affecting Celsius: “Gatorade, for example, has been gaining share. This year, year-to-date meaningfully is accelerating. That’s a core part of our portfolio and a very profitable part of our portfolio. So that’s one data point. We’ve been investing in Gatorade. Not so much on, as you were saying, promos and discount, but more on innovation, execution and branding. And that’s paying back. The same with Propel. So all that functional hydration space, I think it’s a focus for us. It’s always been a focus, but now I think that part of the portfolio is working well.” Ramon Laguarta, Pepsi’s CEO.

Although they are not completely substitutable goods and cannot be categorized together, there could be some temporary cannibalization now that energy drinks are becoming less favorable among the general public. I keep stressing that a key part of Celsius’ thesis is to launch products without (or with less) caffeine. However, this would create significant conflicts of interest with Pepsi. Increased involvement by the giant in Celsius could alleviate these tensions. If the stock drops to around $40, we might see some movement. It’s worth noting that their stake was acquired at $25 per share.

These are merely speculations, but Pepsi is having trouble growing by volume, and Celsius is the fastest-growing energy drink brand in the market. I believe that increasing Pepsi’s stake in Celsius would alleviate tensions between them and align their goals more closely. It seems like a win-win for both parties.

The good news is that Pepsi is still seeing a boom in zero-calorie drinks, a segment where Celsius has clear advantages. Ultimately, I think it combines the best aspects of Pepsi’s products: the hydration and sports benefits of Gatorade and the caffeine activation of Pepsi-Cola. That’s why I always say that Celsius serves higher purposes and is not purely discretionary. This often makes a difference in the food and beverage sector. Recurrence and durability in demand tend to be higher for companies that serve higher purposes rather than merely discretionary ones.

They remain very focused on the growth of Frito-Lay and not as much on margins (although it’s worth noting that it has higher margins than the beverage segment), stating that they will grow at 4-5%. This is slightly above the category average to continue gaining market share.

I love the question posed by Kaumil Gajrawala: “Do you believe that the prices at Frito are too high given the increases over recent years?” Direct and to the point, and completely in line with what I said about it a year ago.

The response was as follows: “but some parts of the portfolio need value adjustments, some parts of the portfolio don’t. Some parts of the portfolio need to be — for particular consumers we need some new entry price points and probably some new promotional kind of mechanics that don’t spec for the consumer to invest so much cash in a purchase of salty, so there’s adjustments that we have to make to — for certain consumers some parts of the portfolio.” Ramon Laguarta, Pepsi’s CEO.

To me, the answer is yes; they have overstepped with the prices. When your brand power cannot sustain the “Quality/Brand-Price” relationship, the value proposition breaks down, and volumes suffer.

But they made an interesting comment about how they plan to increase volumes in the food segment: “Now that our cost are kind of normalizing, our input costs, and we’ve all been going at productivity, in our case, this has been a very, very strategic focus for us. Now how do we deploy those resources against what are the best levers to reignite growth? And again, it will not be a blanket approach. It will be a segmented approach.

In our case, it will be very rational. It will be based on data. I think we have a lot of data, and we have great segmentation. And I think we can execute with — again, with precision so that we don’t destroy value, but we create value for the category as we increase the net revenue of the category.” Ramon Laguarta, Pepsi’s CEO.

They also don’t believe that GLP-1 is having too much of an impact on their sales. It was an interesting question, one I’ve often wondered about myself, with well-argued opinions on both sides. This time, they provided an answer.

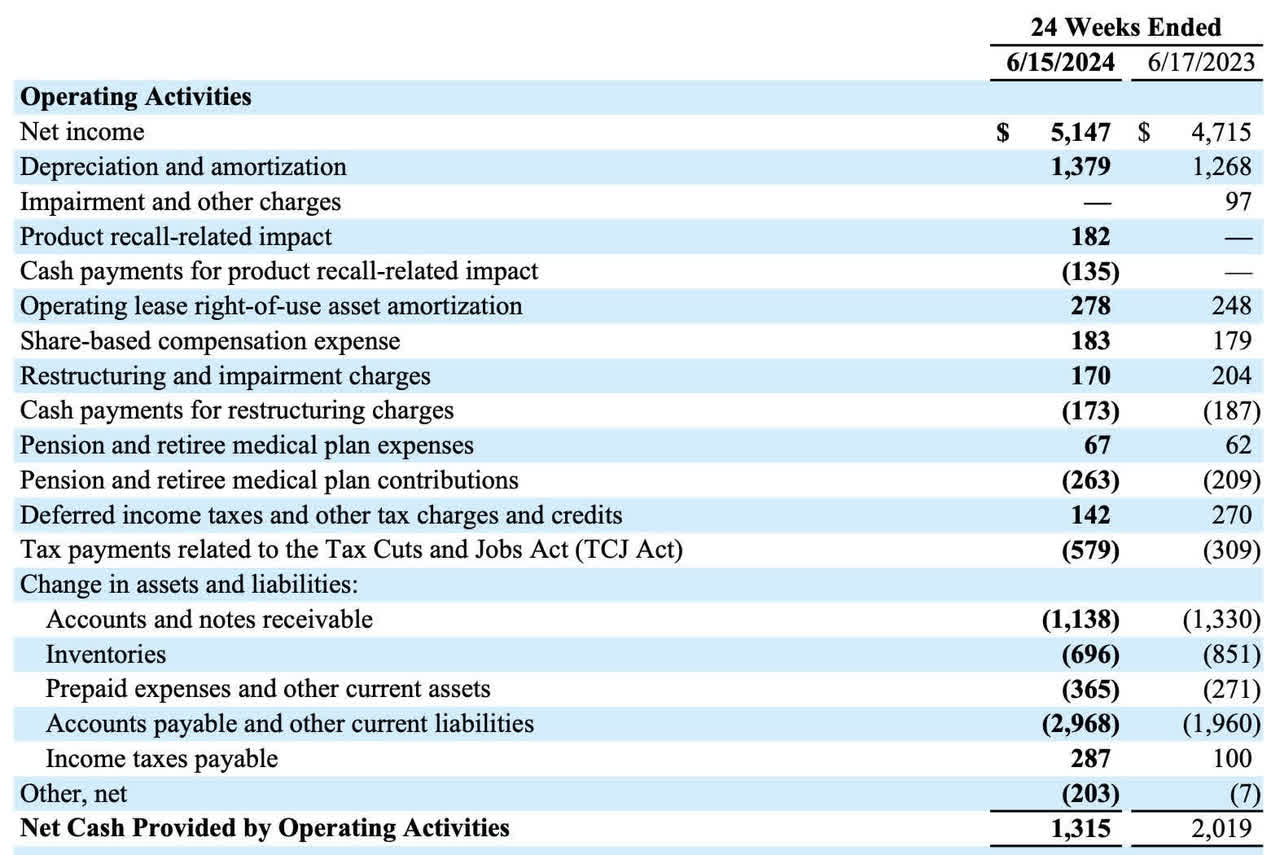

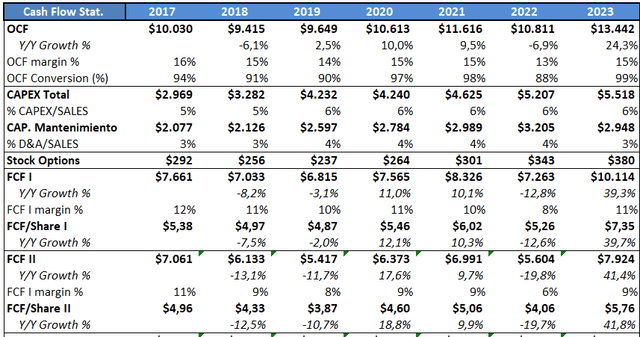

Overall, the semester was lackluster and poor, especially when you look at the cash flow and how cash is decreasing due to capital investments and less-than-ideal working capital management. Additionally, they continue to pay a dividend that represents an increasing portion of cash, partly financed with debt.

Source: PepsiCo Q2 2024 – 10-Q Filing

Capital Allocation

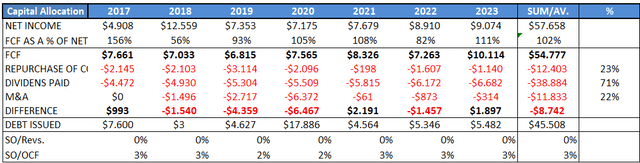

Pepsi is a Dividend King that has effectively managed its capital to create value for shareholders in a mature business. Its current Dividend Yield is 3.3% and has grown at an 8% CAGR over the past 6 years. I would expect similar growth in the future. Pepsi rarely repurchases shares, which is a positive aspect when its stock is somewhat pricey. Stock-based compensation accounts for only 3% of OCF, and the company has allocated 21% of its free cash flow over the past 7 years to acquisitions. Although it has issued debt to continue paying dividends, which have payouts exceeding 75%, I would not expect significant growth in this area. However, if the stock price drops, they should increase share buybacks.

Source: Author’s Representation

Financials

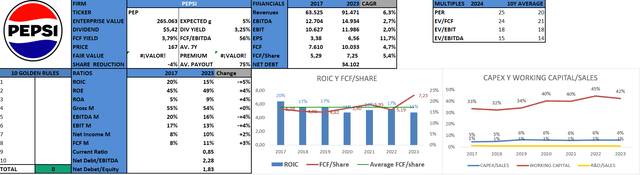

Here are Pepsi’s financials updated with the 2023 figures. The increases in EPS have clearly outpaced sales growth, but if we look at free cash flow per share (which I will discuss in more detail shortly), we see some discrepancies. Margins, except for the bottom line, generally decline due to a series of accounting adjustments. The company’s returns have also decreased in recent years, although 2017 presented the toughest comparison. The average ROCEs obtained have been 17%, which is better than market averages for a mature, somewhat capital-intensive company.

Considering the net CapEx (free of D&A), investments in working capital, and M&A activities, the reinvestment rate averages 43%. When multiplied by the 18% returns, this yields the 7%-8% growth I expect for the company’s bottom line in the future.

Source: Author’s Representation

I would like to make a comment on the calculation of free cash flow. I use two different methods to calculate it. The first: OCF – D&A – SBC. The second: OCF – CAPEX. Depending on the method used, the figures can vary, and the discrepancies have increased in recent years following the rise in capital expenditures. It will be up to each investor to choose the method they prefer, though it should be noted that target prices will vary accordingly.

Source: Author’s Representation

Valuation

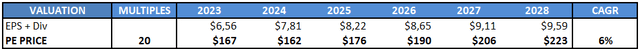

I believe that Pepsi’s sales will continue to grow at a rate of around 5% over the next few years, but as volumes return to positive growth, it won’t have as much impact on margins, which I estimate will remain at 15% EBIT. I have set the tax rate at 20% and the share buyback rate at -0.3%. With these assumptions, we get EPS growth of around 8%. If we apply a multiple of 20 times and consider the dividends that can be distributed, the current price results in a 6% IRR over the next 5 years. Conversely, if we buy Pepsi at around $150 (which I will explain shortly), the returns increase to 8%. I believe a multiple of 20x is appropriate, but if anyone thinks it could be higher, then the expected returns would increase accordingly.

Source: Author’s Representation

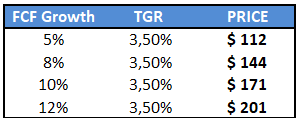

We can also perform a reverse DCF to determine what growth rates the market is discounting in Pepsi’s valuation. With a terminal growth rate of 3.5% (2% from price increases and 1.5% from volume growth) and a discount rate of 10% (the minimum I require for my investments), we find that the market is discounting a free cash flow growth rate of 10%. Applying an 8% growth rate with the same assumptions gives us a fair value of $144. Conversely, if we consider a bearish scenario where FCF grows at only 5%, the fair value drops to $112. It’s worth noting that the company’s $34 billion in net debt (2.07x Net Debt/EBITDA) significantly impacts the valuation.

Source: Author’s Representation

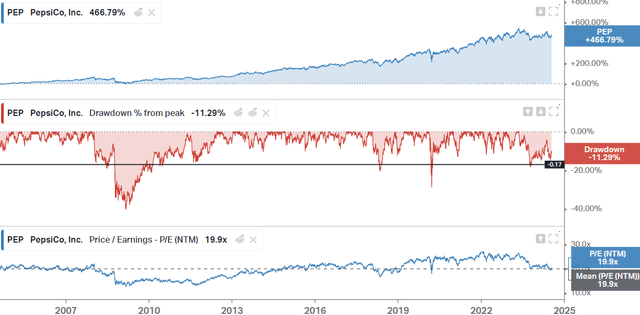

Given all this, I believe Pepsi is trading at fair value or perhaps slightly above it. Despite this, I don’t think it’s reason enough to sell if it’s already in the portfolio, so I rate the stock as a hold.

Other Important Graph

Pepsi has provided a total return to its shareholders of 466% (9.1% CAGR), although over the past 10 years, it has underperformed compared to the S&P 500. Drawdowns between 20% and 25% represent significant declines for the company, which would give us a buying range of $147-$157, closer to the fair values obtained.

Source: Koyfin

Risks

I believe the risk of a slowdown in its figures due to a recession is temporary. I also think Pepsi has sufficient capacity to continue pivoting its product portfolio toward healthier alternatives, although this is easier to achieve in beverages.

The risk I see is that it may have broken its value proposition due to the price increases. A correction in prices (as mentioned in the conference call) will negatively impact its figures in the short term, but if it helps recover volumes and increases consumption and recurrence among customers, these factors are positive in the long term and have a greater impact on the company’s terminal value.

Lastly, I don’t think it’s positive that they continue to increase the dividend artificially through debt. Although neither the debt nor the interest payments pose significant problems for the company, it is a situation they have created for themselves by not managing their working capital effectively, leading to a reduction in cash. Inventory days have increased by 25% in recent years, and the cash conversion cycle has grown substantially. This is something they need to manage more carefully.

Conclusion

I believe that, after everything said, Pepsi could be an attractive option for those pursuing a Dividend Growth Investing (DGI) strategy, but it’s not quite right for me at the moment. For now, I will stay on the sidelines, although it’s a company I like to follow due to its implications with Celsius.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.