Summary:

- PepsiCo’s strategic moves, including expanding its beverage portfolio and sustainability initiatives, position it for long-term growth and profitability.

- Financial analysis shows PEP trading at a discount to historical and peer averages, with strong economic profitability and promising EPS growth trends.

- Technical analysis indicates a buy opportunity at $158, with a target price of $182, supported by strong support levels and diminishing downside momentum.

- Despite macroeconomic risks and competition, PEP’s fundamentals and innovative strategies suggest a favorable long-term investment outlook.

Rattankun Thongbun

I think PepsiCo (NASDAQ:PEP) offers a really good investment opportunity for sustained growth and profitability. The company’s strategic moves reflect the company’s focus on adaptability in dynamic markets. My financial analysis finds PEP trading at a significant discount to historical and peer averages, with strong economic profitability and promising EPS growth trends. My technical analysis further supports a “buy” strategy as the stock tests a strong support level at $158, coupled with diminishing downside momentum.

Before moving on to financial and technical analysis, I would like to start the article by commenting on PEP’s important developments and strategies that will affect the company’s long-term strategies.

Business Developments

Expanding the Beverage Portfolio

PEP has launched a new addition to its sparkling water portfolio, bubly burst, in March 2024. The company aims to continue the success of the original bubly brand, which was introduced in 2018. Bubly burst aims to strengthen PEP’s presence in the competitive sparkling water market. I see the company’s desire to appeal to health-conscious consumers as a great strategy as the importance of healthy living is increasingly recognized today.

PEP’s Sustainability

The Greenhouse Accelerator Program in Asia Pacific is a great example of PEP’s commitment to sustainability and innovation. In September 2024, the company announced Alternō, a forward-thinking initiative designed to develop next-generation solutions that address sustainable agriculture and the circular economy. In addition to investing in sustainability, PEP is enhancing its leading position in addressing global environmental issues through its seven ongoing pilot initiatives. I consider this a truly valuable move by the company, especially at a time when sustainability and renewable energy are so high on the agenda worldwide.

Partnerships

PEP has strengthened its presence in the entertainment space by signing an eight-year beverage agreement with Topgolf in May 2024. The partnership aims to bring PEP’s beverage portfolio to Topgolf locations across the United States. Beyond beverage offerings, the partnership also offers Topgolf-exclusive beverages, innovative glass designs and special experiential activations.

In general, when looking at qualitative data, PEP does not look bad at all. Constantly creating new projects and making new partnerships are factors that increase the value of the company in my eyes, especially in the long term.

Financial Analysis

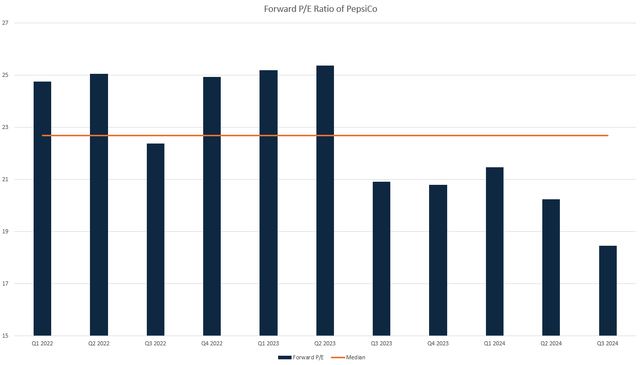

Price to Earnings Ratio

I would like to start by examining the company’s price-earnings ratio, which is different from the normal financial analysis schedule. The company’s price-earnings ratio is currently at 18.45. This level is 18.70% lower than the company’s historical average of 22.68. Therefore, the company is trading at a very discounted price compared to its historical average.

Image created by Yavuz Akbay with data from gurufocus.com (gurufocus.com)

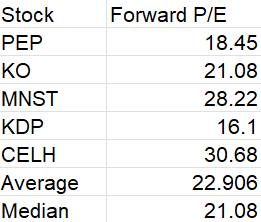

The price to earnings ratio of PEP was compared to its key competitors, including The Coca-Cola Company (KO), Monster Beverage Corporation (MNST), Keurig Dr Pepper Inc. (KDP) and Celsius Holdings (CELH). The analysis revealed that the average P/E ratio of these competitors is 22.90 with a median of 21.08. Based on this comparison, PEP is currently trading at a 20% discount relative to its industry peers.

Image created by Yavuz Akbay with data from gurufocus.com (gurufocus.com)

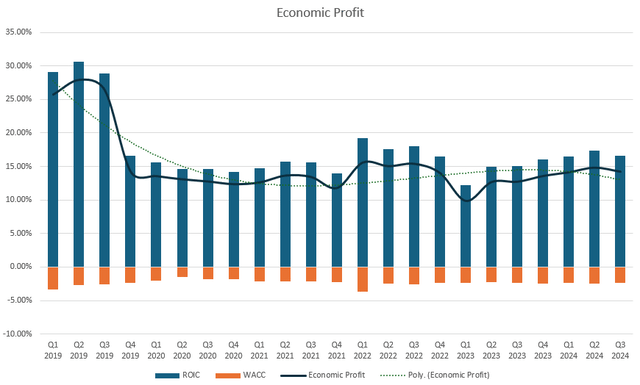

Economic Profitability

I think I should do the economic profitability analysis that I do for every stock and think it gives very good results for PEP. Economic profitability analysis is a calculation method that normalizes the value of the stock to the opportunity cost of risk-free instruments by taking into account the return of the invested capital and the weighted cost of capital.

An analysis of economic profitability indicates that PEP maintained a profitability rate of over 25% prior to 2020 which declined to a range of 10-15% in the subsequent years. A key consideration in economic profitability analysis is whether profitability remains positive or negative. Since PEP consistently meets this criterion, it can be concluded that the stock is likely to follow an upward trend in the long term.

Image created by Yavuz Akbay with data from tradingview.com (tradingview.com)

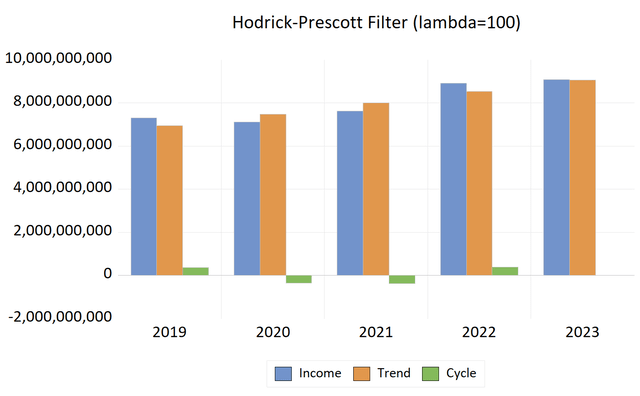

Net Income

While doing this analysis, I found seasonality in PEP’s annual net income data, and therefore I thought it would be appropriate to use the Hodrick-Prescott filter. I use the Hodrick-Prescott method to identify trends in seasonal quarterly or annual data and to determine whether the data deviates from the trend. When I apply the Hodrick-Prescott method to the annual net income data, I get a result that predicts net income in 2024 will be $9.63 billion. Since the data deviates from the filter by an average of $370 million each year (green bar), I set the net income expectation for 2024 to $9.26 billion.

Image created by Yavuz Akbay with data from tradingview.com (EViews)

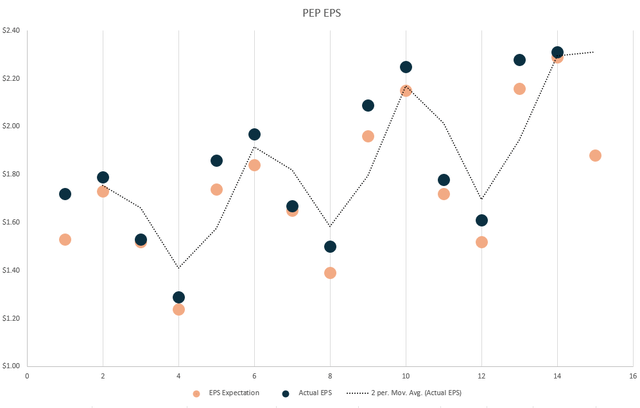

Earnings Per Share

In my net income projection, I calculated that PEP’s expected net income for the next quarter would be $1.21 billion, which would yield an expected earnings per share of $1.88. When analyzing PEP’s historical EPS distribution chart, it is clear that the lowest EPS of the year is usually reported in the fourth quarter. Given that PEP’s EPS announcements have always been higher than expected, I expect the company to report an EPS above expectations for the next quarter as well.

Image created by Yavuz Akbay with data from earningshub.com (earningshub.com)

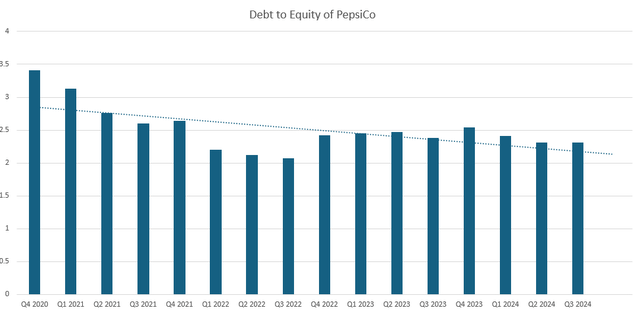

Leverage Ratios

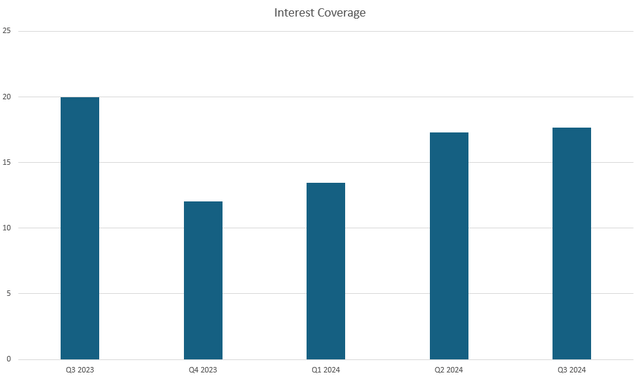

Finally, since PEP KO is a fairly mature company, it tends to finance itself with debt. Therefore, I think leverage ratios should be taken into consideration. There are two leverage ratios that can be used here. One is debt-to-equity and the other is interest coverage ratio. I will use both because I think this method is much healthier.

Image created by Yavuz Akbay with data from tradingview.com (tradingview.com)

First of all, when you look at the D/E ratio, it is seen to be above 3 until the second quarter of 2021 and above 2 since then. This indicates a large debt burden. When you look at this ratio alone, it means that the company’s risk coefficient is high. However, as I said at the beginning, this can be met normally in mature companies, so the interest coverage ratio of a company with a high debt burden should be looked at first so that a healthier comment can be made.

Image created by Yavuz Akbay with data from gurufocus.com (gurufocus.com)

PEP’s interest coverage ratio increased to 17.68 in 2024. Considering that an interest coverage ratio above 3 is normally considered very good we can clearly see that PEP can manage its debts really well.

Risks and Challenges

PEP has strong fundamentals and promising growth prospects, but there are a few dangers and difficulties that could compromise my judgement. Macroeconomic uncertainties, especially the University of Michigan’s latest consumer sentiment survey that projects inflation to rise from 2.6% to 2.9% next year, could start to dampen consumer spending, which could squeeze margins. Additionally, increased competition from competitors like KO and the new brands we see a lot these days could erode market share. I tell my followers to carefully consider these factors when considering a “buy” strategy.

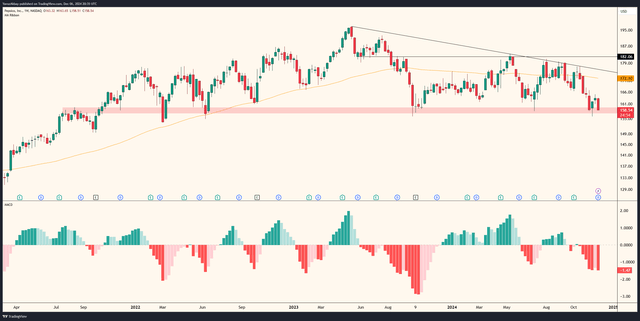

Technical Analysis

When I look at the PEP price chart in the weekly time frame, I have to say that the moving average breakout in September 2023 is especially critical. This moving average breakout took the stock down to $158 the support level it tested many times in 2021 and 2022. Then this support was tested twice in 2024 and the stock is currently priced above the support. I think this support is a solid support and contains a buying opportunity. The reason for this is not only the price action but also the fact that the downward momentum has completely run out, as the histogram of the MACD indicator clearly shows.

I said that the $158 level is a good opportunity to buy, I need to add target prices to this. My first target is both the 120-week moving average and the downtrend level of $172. In case of a breakout of this level, I am targeting $182. This level has also been used as support and resistance many times.

Conclusion

As a result, PEP’s innovative product launches and sustainability activities point to further upside for the company. My financial analysis shows that the stock is trading at a discount to both its historical average and its industry peers, potentially offering a lucrative buying opportunity. My technical analysis shows that we are now on the verge of an upside as the stock shows signs of a recovery from a key support level. My target price for PEP is $182, with a buy opportunity at $158.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PEP over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.