Summary:

- Company’s stock price has dropped by over 15% from its recent high.

- The business has a great moat with possible expansion opportunity abroad.

- Possible issues come from the free cash flow side and a low current ratio.

- I believe PepsiCo is a buy opportunity today offering investors stability and a great dividend. Moreover, it is fairly priced considering the dividend discount model valuation.

Editor’s note: Seeking Alpha is proud to welcome Niccolo Braccini as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

OlgaMiltsova/iStock via Getty Images

PepsiCo (NASDAQ:PEP) is a good business with an incredible economic moat driven by its famous brands and I see it as a compelling buy opportunity today. It has grown at a reliable pace in the last decade and it can expand further investing in foreign markets. It is a dividend king paying around 3% in dividends each year and they can continue growing in the future. However the company has some issues on the free cash flow side that is already solving considering the Q3 2023 data.

I will quickly make a PepsiCo stock overview, discuss its economic moat and possible growth opportunities, have a look at the possible risk factors and finally conclude with a valuation.

Stock overview

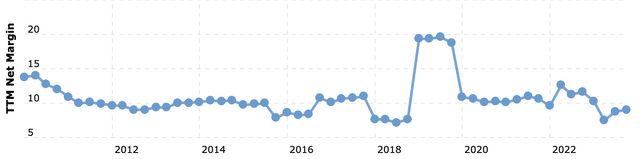

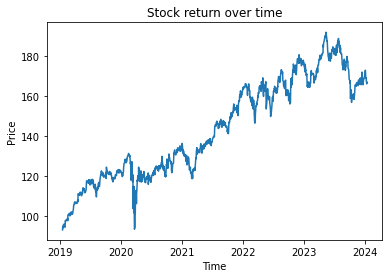

Even though PepsiCo stock has seen significant capital appreciation in the last decade, the price has fallen over 15% from its recent high, leaving many investors to wonder if now is the right time to buy.

5 years stock quotation (Author’s Calculation)

The drop in stock price is primarily attributed to a specific factor: the rise in interest rates has prompted many investors to favor risk-free rate bonds over stock dividends. As long-term investors, we do not need to be overly concerned about macroeconomic shifts; instead, we should seize these opportunities to enhance our performances.

The company’s moat and growth opportunities

Today, PepsiCo stands as a massive conglomerate encompassing various food and beverage brands that are among the most recognizable in the world. Examples include Pepsi, Lays, Lipton, Cap’n Crunch, Doritos, Gatorade, and many others. Each of these brands boasts a diverse range of products worldwide. The company consistently invests in and innovates new products within these brands, not only to maintain freshness, but also to venture into new categories.

This extensive brand portfolio gives PepsiCo a significant edge in the marketplace. Consumers have developed strong mental associations with these brands over decades, whether through marketing campaigns, partnerships or their embedded presence in culture. People have grown up with these brands-seeing, eating, drinking, and hearing about them. The power of branding acts as a formidable defense against competitors and new entrants, creating a substantial economic moat. In fact, consumers are more inclined to choose Lays chips or Doritos over a generic or private-label alternative.

The defensive nature of PepsiCo’s business model becomes evident in its significant pricing power. Over the last two years, during periods of inflation, PepsiCo was able to strategically raise prices to offset rising costs. Like many other companies in the food sector, I consider PepsiCo to be non-cyclical, able to navigate through economic cycles without worrying about consumer spending.

The stock price increase in the last decade aligns closely with the growth of earnings per share, a metric that has been accelerating in recent years.

Company’s EPS (Macrotrends.net)

Revenue per share is growing at a 10 years compound annual growth rate of 3.97%, as for the EPS, the pace of growth is accelerating with a 3 years CAGR around 9%.

Revenue of the company (Macrotrends.net)

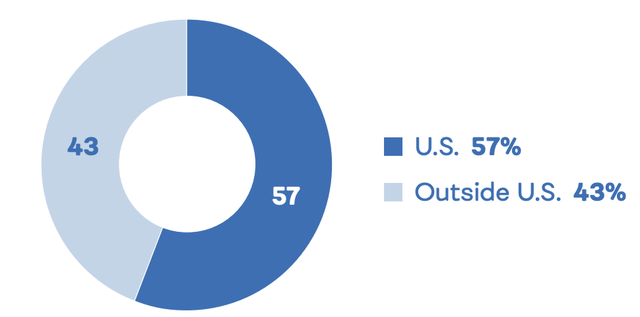

While the company is already a giant, I perceive further expansion opportunities in the foreign market. In fiscal year 2022, the company generated 57% of its revenues in the United States and 43% internationally. The foreign markets present a significant growth opportunity for the company in the coming years, as many products widely available in the United States have yet to be introduced in several other countries. As an example from Italy, in my local store, only a few brands such as Pepsi, Gatorade, and Lays are available. This indicates that the company has a plethora of brands at its disposal that are still “American made.” Expanding the distribution of these brands internationally could unlock new revenue streams and contribute to the company’s overall growth strategy

Split of company revenues (Company 10K)

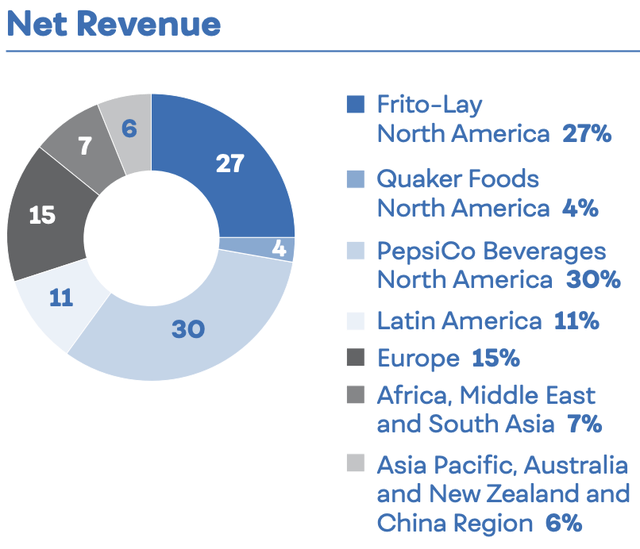

As the company continues to expand its reach, there is an anticipation of increased revenues and operating profits. Over the next five years, as an investor, I would expect the company to leverage the proceeds from the U.S. market to further expand its presence abroad. Specifically, I anticipate a focus on Asia, which is not only the most populated geographical area in the world but also represents a relatively small revenue segment for the company currently. Over time, I would be pleased to observe an alignment between these segments, signifying successful expansion and a broader global market share for the company. This strategic move could lead to enhanced financial performance and shareholder value.

Net revenue segments (Company 10K)

Expansion indeed comes with costs, and as the company extends its operations into new regions, I anticipate a slight decrease in net margin. This is a common outcome when entering unfamiliar markets, as there are increased operational costs associated with setting up and managing new facilities, adapting to different regulatory environments, and establishing distribution networks. While this temporary reduction in net margin is expected, the long-term goal is for the company to capitalize on the growth potential in these new regions, ultimately leading to a positive impact on overall profitability. Monitoring how efficiently the company manages these expansion-related costs and the subsequent returns from new markets will be crucial for investors assessing the success of the global expansion strategy.

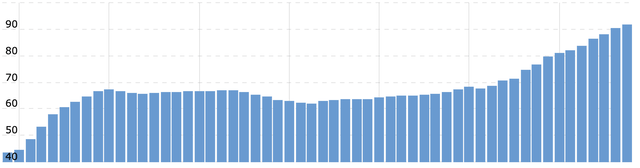

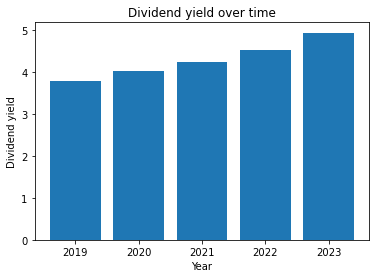

Despite free cash flow stagnation, the company has continued growing its dividend payment. The 10-year CAGR of the dividend is 8.4%, and the most recent increase was a significant 10%, marking the 50th annual dividend increase.

Dividends over time (Author’s Calculation)

Considering the general performance of the company, the dividend is sustainable even though in the short term the free cash flow payout ratio passed from an average of 72.4% over the last decade to an incredible peak of 110,1% in fiscal 2022. In other words, the company collected 4.06$ per share in FCF and paid 4.47$ in dividends. Despite the challenges in the free cash flow payout ratio, the EPS payout ratio remains stable at around 70%.

I see PepsiCo as a very conservative company and the recent 10% increase in dividend payment must mean that the management team feel very confident for the future ahead. It is likely that they would expect their operating cash flow will grow and they may cut some of the capital expenditures as they reported in the latest report.

PepsiCo maintains a strong balance sheet with more than 10 billion dollars in cash on hand and 39 billion dollars in net debt, which is less than four times annual operating cash flow. In my view, debt is not a problem for the company.

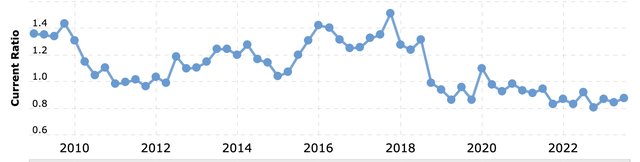

Since 2020, the company’s current ratio has been consistently lower than one, indicating that current assets are less than current liabilities. Although it is not a significant issue, it would be better to see a reversal in this trend in the next years. I would start having some doubts whenever the ratio comes lower than the 0.75-0.8 range but for now the situation is acceptable.

Current ratio trend (Macrotrend.net)

Risks

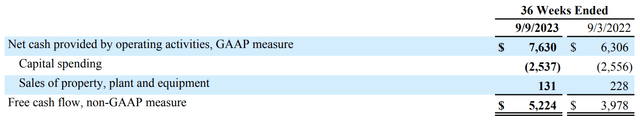

Now we address a significant concern related to PepsiCo. Despite the income statement indicates a healthy and growing company, there are notable issues on the free cash flow side. Over the past decade, unlevered free cash flow has experienced a modest 0.84% CAGR, while annual capital expenditures nearly doubled from $2.7 billion in 2012 to $5.2 billion in 2022, resulting in a decline in free cash flow.

Fortunately, there are signs that the management team is actively addressing this concern, as evident from Q3 2023 earnings data. Over the past 36 weeks, operating cash flow increased significantly to $7.64 billion, marking a 20.9% year-over-year rise. Capital expenditures slightly decreased to around $2.5 billion, leading to a notable 31.3% improvement in free cash flow, which reached $5.22 billion.

Considering 2022 as a challenging year for free cash flow, from a long-term investor perspective, there is an anticipation of a reversal and consistent growth in free cash flow each year. As PepsiCo approaches a maturity stage, it becomes crucial for the company to transform into a ‘cash cow,’ capable of generating substantial returns for shareholders by reducing capital expenditures.

If the management team fails to achieve this minimum outcome, I will shift from a bullish to a neutral perspective. Given the company’s current high Price/Earnings (P/E) ratio of 27.5, investing would become too risky without a clear improvement in free cash flow.

Valuation

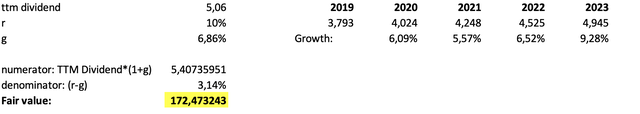

Let’s now take into account all the assumptions in order to make a valuation of the company. Since PepsiCo is a Dividend king, it is better to evaluate it through a dividend discount model to study the fair value of the company.

PepsiCo valuation (Author Excel sheet)

On the right side of the sheet are reported the yearly dividends for the last five years and their respective growth. On the left side are computed the expected dividends for fiscal year 2024, 5.06$ per share, considering a 10% annual return for the investment (r) and the average dividend growth for the last 5 years (g) which is equal to 6.86%. Applying the formula reported in the picture I got a value of 172$ per share. Given that the current market price is around $166, I believe this represent a favorable opportunity to initiate a position in the stock and benefit from future dividends.

Conclusion

PepsiCo’s strong brand presence, resilience in the face of economic challenges, commitment to dividend growth, and strategic international expansion make it an appealing prospect for investors, offering both stability and potential for future gains.

Overall I view PepsiCo as a high-quality company that will continue to grow into the future at a reliable pace. Although the company is excellent, it does face some challenges with its free cash flow and current ratio, I would prefer to buy it at a 10-15% discount from its fair value

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PEP over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.