Summary:

- PEP is a solid performer for turbulent times.

- The company pays a current dividend yielding 2.5%.

- PEP is selling below fair value.

- The stock has a potential upside of 33%.

Spencer Platt/Getty Images News

I recommend a long position in PepsiCo, Inc. (NASDAQ:PEP). PepsiCo is a market leader in non-alcoholic beverages and snacks. I believe PEP’s current valuation does not recognize the growth potential of its business in both the domestic and international markets. I have a 12-18-month target price of ~$240.

Description of Business

PepsiCo is a global food and beverage company with a history that stretches back more than 100 years. The company was founded in 1898 by Caleb Bradham, who created a carbonated soft drink called “Pepsi-Cola.” The drink was initially sold at soda fountains and was later bottled and sold nationwide. In the 1950s, PepsiCo expanded beyond carbonated soft drinks with the acquisition of Frito-Lay, a snack food company. The company continued to grow and diversify over the following decades, expanding into new categories and markets around the world. Today, PepsiCo is a global leader in the food and beverage industry, with a portfolio of well-known brands including Pepsi, Mountain Dew, Lay’s, Gatorade, Tropicana, and Quaker, among others.

Market Trends in the Food and Beverage Industry

There are several trends currently shaping the food and beverage industry. PepsiCo, like many other food and beverage companies, is focusing on health and wellness, sustainability, convenience, innovation, and premiumization. The company has introduced several healthier product options, such as lower-sugar and lower-calorie beverages, as well as healthier snack options. PepsiCo has also made efforts to reduce its environmental impact, such as by increasing its use of renewable energy and reducing its waste. In terms of convenience, the company has introduced single-serve options and ready-to-drink beverages. PepsiCo has also launched several innovative products, such as flavored water and plant-based snacks. The company has also introduced premium versions of some of its products, such as premium sodas and high-end snack brands.

It’s difficult to make accurate predictions about the future performance of a specific company, as it depends on a wide range of factors such as market conditions, competition, and internal business decisions. That said, it’s likely that PepsiCo will continue to focus on health and wellness, sustainability, convenience, innovation, and premiumization in the coming years. The company might also explore new market opportunities, such as in emerging markets or in areas such as plant-based protein. It is also possible that PepsiCo will face challenges, such as increased competition or changing consumer preferences.

Risks That Could Potentially Impact PepsiCo’s Performance

Competition: PepsiCo faces competition from other major beverage and snack companies, as well as from smaller, local players. This competition can impact the company’s market share and profitability.

Changing consumer preferences: Consumer preferences can change rapidly, and if PepsiCo fails to anticipate or adapt to these changes, it could negatively impact the company’s performance.

Economic downturns: Economic downturns can lead to reduced consumer spending on non-essential items, such as snack foods and beverages, which could negatively impact PepsiCo’s sales.

Supply chain disruptions: PepsiCo relies on a complex global supply chain to source raw materials and distribute its products. Disruptions to this supply chain, such as due to natural disasters or political instability, could impact the company’s operations and profitability.

Regulatory risks: PepsiCo is subject to a wide range of regulations, and changes to these regulations or non-compliance with them could result in financial penalties or reputational damage for the company.

Cybersecurity risks: Like all companies, PepsiCo is vulnerable to cybersecurity threats, and a successful cyberattack could have significant consequences for the company’s operations and reputation.

Competition

PepsiCo is a global food and beverage company that operates in a highly competitive industry. Some of the main competitors of PepsiCo are as follows:

The Coca-Cola Company (KO): Coca-Cola is a global leader in the beverage industry, and competes with PepsiCo in the carbonated soft drink market.

Nestle (OTCPK:NSRGY): Nestle is a global food and beverage company with a wide range of products, including bottled water, coffee, and frozen foods.

Unilever (UL): Unilever is a global consumer goods company with a strong presence in the food and beverage industry, including in the ice cream, tea, and spreads categories.

Kraft Heinz (KHC): Kraft Heinz is a global food and beverage company with a strong presence in the packaged food market, including in categories such as condiments, cheese, and snacks.

Danone (OTCQX:DANOY): Danone is a global food and beverage company with a strong presence in the dairy and plant-based products markets.

PepsiCo competes with these and other companies in various categories and markets around the world.

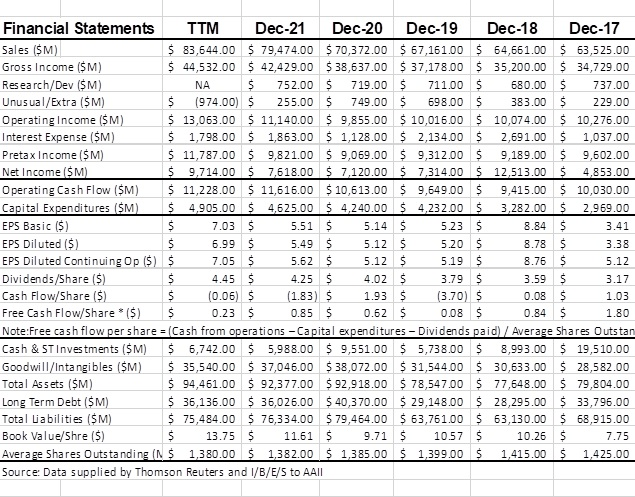

Review of Financial Statements

Source: Data supplied by Thomson Reuters and I/B/E/S to AAII

PEP’s sales growth rate for the past five fiscal years is 4.8%. For the past three years, including the COVID-19 pandemic, it averaged 7.1%. The important thing about these growth rates is that they’re endurable.

Gross income grew significantly over the five-year period at a rate of 46.3%. During COVID-19, growth slowed to 6.4% but picked up to 7.7% for the trailing 12 months ended September 2022. Notable is that the Novy-Marx gross profit to total assets is a very strong 47%. Novy-Marx postulates that the GP/A ratio is predictive of future profits. Profitability as measured by ROIC and CFROI are very strong, with both earnings and cash returns on invested capital of ~20%.

Net income grew at a slow 3.8% over the past five years and, not unexpectedly, declined (15.2%) during COVID-19. Net Income growth resumed in the trailing 12 months at a rate of 19.3%. More importantly, free cash flow remains strong.

The company has continued to increase dividend payouts throughout these periods. Dividends grew 7.5% over the five-year period, 5.8% during COVID-19, and 6.1% for the trailing 12 months. Operating, profitability, and solvency ratios have fluctuated during the turbulent times, but have remained close to their five-year averages.

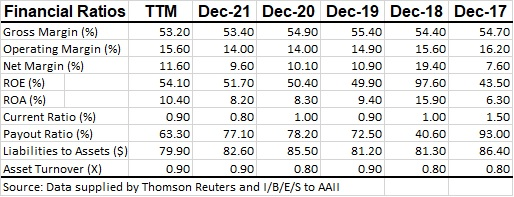

Source: Data supplied by Thomson Reuters and I/B/E/S to AAII

Valuation

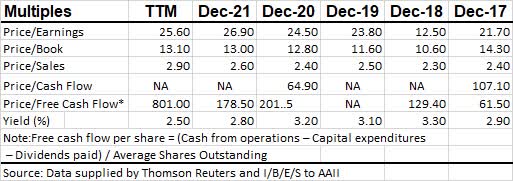

Source: Data supplied by Thomson Reuters and I/B/E/S to AAII

On the face of it, it certainly looks as if PEP is currently overpriced. Except for FY 2018, PEP has traded in the mid-20s price/earnings range. The three-year average P/E is 25x and the five-year average P/E is 21.9x.

Though price/book might have lost some of its relevance in recent years, PEP is selling at levels that exceed its three-year, five-year and seven-year price/book averages. PEP is also selling above its average three-year, five-year, and seven-year price/sales ratios.

It would appear as if PEP is trading at very high price/earnings ratio. This might indicate that PEP is overvalued, or it indicates the market expects strong growth in the future. The market is assigning PEP a price/estimated earnings of 26.7.

I am not a believer in using price multiples as a basis for determining value. A low P/E is supposed to indicate value. A company with poor prospects and with troubles that are not short term deserves a low multiple. This would be a classic value trap.

Another reason a company might sport a low multiple is that the market is assigning the low multiple because of short-term problems. The market is notorious for thinking no further than the next quarter.

The third reason is that the market is simply mispricing the security. I also find using the discounted cash flow model as deficient. The DCF model depends on analysts’ projected cash flow growth long into the future, as well as interest rates, while holding the company’s business model static during the projected years. How many analysts included in their 2019 models the COVID-19 epidemic, raging inflation, and higher interest rates? Few, I think. In addition, free cash flow yield is about 5%, above the 10-year Treasury note yield, another reason to suggest PEP is moderately undervalued.

I have chosen to use a model based on economic profit and value the company assuming no growth. This method tells me what the company’s fair value is today. If the company is trading at fair value, then I consider the company’s shares for purchase. I also establish a margin of safety below fair value and a potential upside based on financial strength.

Ratings Summary

| SA Authors | Hold | 3.27 |

|---|---|---|

| Wall Street | Buy | 3.56 |

| Quant | Hold | 3.47 |

Factor Grades

| Now | 3M ago | 6M ago | |

|---|---|---|---|

| Valuation | D- | D- | D |

| Growth | D | D | D+ |

| Profitability | A+ | A+ | A+ |

| Momentum | B+ | A- | A- |

| Revisions | A- | A- | C |

The SA ratings summary presents a mixed bag of opinions, with Wall Street calling PEP a buy while both SA authors and the SA quant models rating PEP a hold. Notably, the Factor Grades rate PEP’s profitability A+ and revisions A-. Ultimately, profitability drives share price. The valuation factor received a grade of D-, automatically resulting in the neutral rating. I have a 12- to 18-month time frame to see the convergence of my value estimate with the market’s valuation.

Summary

PepsiCo’s shares are currently mispriced. The company has a worldwide footprint in multiple industry segments. It has remained profitable over time, notwithstanding the COVID-19 pandemic, rising interest rates, inflation, and the supply chain crisis. These problems will pass in time.

As of Dec. 29, 2022, I attach a fair value of ~$202.70 to PEP. This suggests an upside of 11.4% from the close. I believe PEP has a potential upside of $243 going forward for a return, excluding the dividend, of ~33%. At present, I consider PEP a good long-term investment for the patient investor.

Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.