Summary:

- PepsiCo has underperformed due to cyclical vulnerabilities, but remains attractively priced and has strong cash management.

- Despite challenges, PEP has grown net revenue and free cash flow, with potential for dividend growth as conditions improve.

- PEP’s valuation suggests upside potential, with a discounted cash flow indicating a fair value of about $188 per share.

- The cooling of inflation and future interest rate cuts should provide relief to consumers. This may serve as a catalyst to higher sales volume going forward.

- Based on historical data and capital efficiency, EPS for the upcoming Q2 report may fall within the range of $2.10 to $2.20.

Fotoatelie

Overview

As a dividend growth investor, I love the ability to collect income from companies that have very visible product portfolios. The cusp of summer is here and that means lots of barbeques, family gatherings, and events that will have PepsiCo (NASDAQ:PEP) products. I previously covered PEP and discussed how the price drop made it more attractive than Coca-Cola (KO). This time around, I wanted to provide an updated valuation and talk about how the lackluster recent performance can be attributed more to cyclical vulnerabilities rather than fundamental issues within. I will be providing my personal thoughts on the upcoming earnings as well.

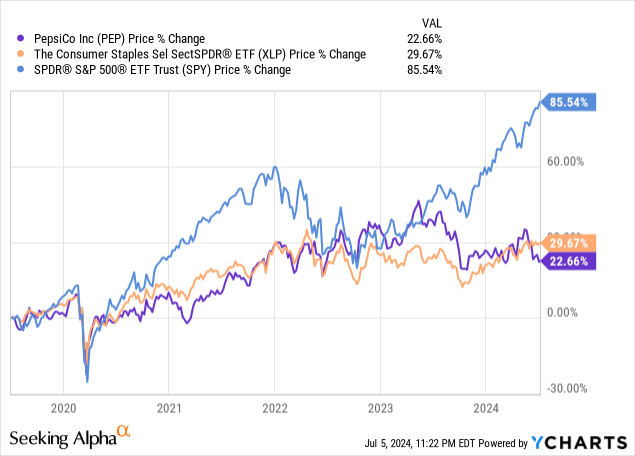

We can see that PEP has lagged the S&P 500 (SPY) over the last five-year period. However, this isn’t unique, since we can also see that the consumer staples sector (XLP) has also be underperforming. This underperformance can likely be linked to factors such as elevated interest rates and continued high inflation levels month after month. This sort of environment encourages tightening consumer spend and, as a result, PEP has experienced slower sales growth than normal. Despite the slower growth rates, PEP has managed to offset this by strengthening their balance sheet with increased cash positions.

In addition, PEP remains attractively priced from a valuation perspective. I believe that the price of PEP remains heavily suppressed by the current high interest rate environment. Despite the slower growth rates, PEP has still ultimately managed to grow when other consumer-based peers are struggling to maintain the same momentum. Let’s first take a look at the current financial picture and why I believe that PEP still remains a buy despite the underperformance.

Pepsi Earnings Preview

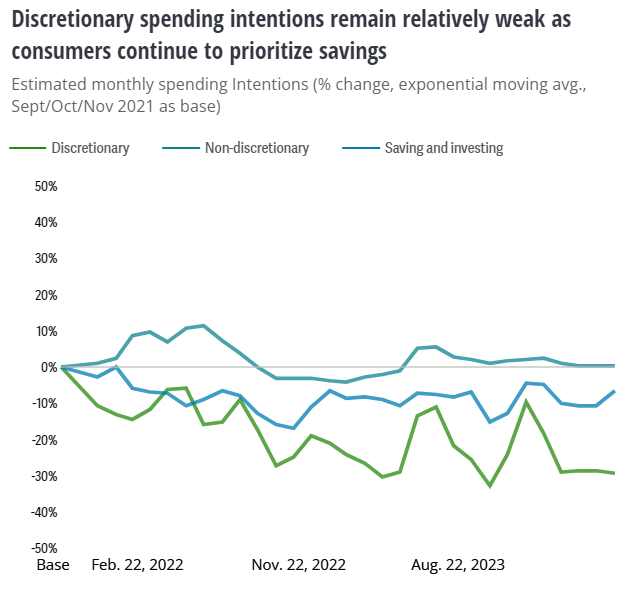

PEP’s portfolio of products has allowed the company to have several different avenues that generate revenue. The North America beverage channel brings in about 30% of the net revenue while the Frito-Lay portfolio brings in about 27% of the net revenue. Data compiled by Deloitte shows us that consumer spending has continued to decrease while consumers prioritize saving in an effort to offset higher inflation levels and higher interest rates.

Deloitte

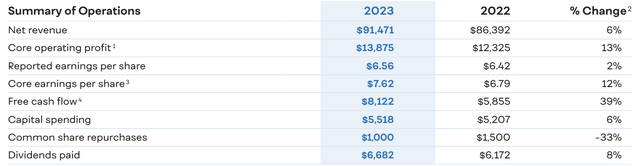

Despite these challenges, PEP has been able to grow year over year net revenue. Taking a look at their last annual report, we can see that net revenue increased by 6% year over year. Most importantly, free cash flow has increased by 39% year over year, totaling $8.1B. PEP has boosted their free cash flow by shaving down expenses through different cost-saving initiates and job layoffs. For instance, PEP continues to lay off employees within the Frito-Lay segment as a way to offset slower sales growth and maintain profitability momentum. Creating a larger emphasis on cash during times where the sector goes through lower sales volume helps put PEP in an ideal situation to manage these headwinds efficiently.

If PEP is able to maintain this level of free cash flow growth going forward, there’s a likely chance that the dividend will also continue to grow at a sufficient pace. This free cash flow can also be used to increase capital expenditure to continue growing their strong portfolio of products. Capital spending did increase 6% year over year and this trend is likely to continue as it attracts new customers through new products and promotions. They are able to grow these cash flow levels by implementing price increases in all segments, across all regions of operations. While this was a good way to offset lower volumes throughout the pandemic era, I don’t know how necessary these price increases are to maintain growth going forward.

As interest rates are cut and inflation continues to cool, these things may serve as a catalyst to higher consumer spending. We’ve already seen inflation tick down for two consecutive months and this could give the consumer a bit of relief which translates to an increased likelihood of sales volumes increasing. The higher volume of spending could eliminate the absolute need to continue increasing prices. I stay cautious that squeezing customers too much could cause them to shift their focus to cheaper alternatives in the snack and beverage category.

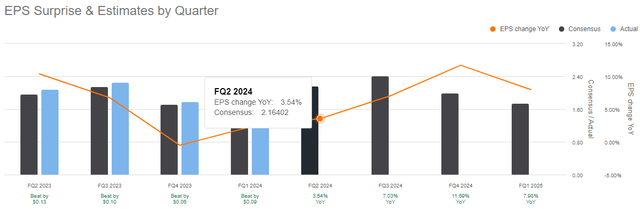

PEP will be announcing their Q2 earnings on July 11th and I believe that the quarter will show continued strength in their balance sheet, even if sales are slumped. Since PEP continues to prioritize strong cash management, I think there’s a possibility that we see free cash flow grow. Earnings per share for their Q1 results amounted to $1.48 but Q2 has historically been a stronger quarter for PEP.

This leads me to believe that its possible we can see a higher EPS of at least $2.10 – $2.20, which would align with the consensus EPS estimate of $2.16. Q2 earnings per share has continued to grow year after year since 2020. After all, the fiscal year guidance still sees an estimated 4% increase in organic revenue and an 8% increase in core constant earnings per share.

Liquidity remains strong, however, with cash and equivalents totaling $8B as of the latest report. For reference, PEP ended the year 2022 with cash equivalents sitting at $4.9B. Additionally, when rates were near zero levels in 2020, their long-term debt total sat at $40.3B, but this has since come down to $37.7B which is more ideal in this high interest rate environment. PEP should be able to navigate these headwinds as cash from operations totals $12.79B and cash per share sits at $5.85, which sits well above the sector median of $1.63.

Vulnerabilities & Comparison

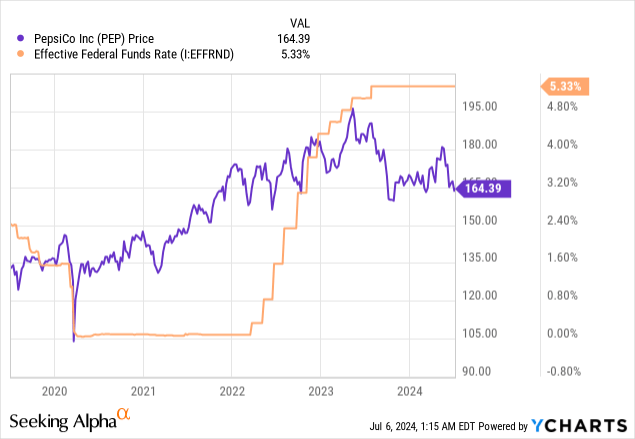

Interest rates remain a vulnerability to consumer-facing companies like PEP. It’s no coincidence that as interest rates were cut to near zero levels in 2020, the price of PEP started to rapidly appreciate consistently until interest rates started to get hiked. Throughout the course of 2022, interest rates were consistently increased and as rates approached their peak, PEP’s price lost its upward momentum and eventually retracted back to the current level and stabilized.

Interest rates increase the cost of borrowing and may slow any growth initiatives that PEP may want to pursue. Their long-term debt sits at one of the highest levels ever over the last decade, now totaling $37.7B. If portions of this debt were issued on a floating rate bases, this would mean that it is more expensive to maintain this debt balance, as interest payments would rise.

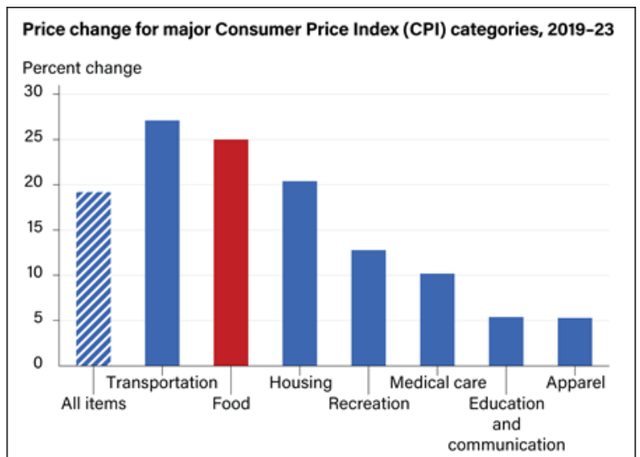

On the consumer side of things, higher interest rates also contribute to lowered consumer spend. Taking a look at the consumer price index changes, we can see that food related costs have increased by about 25% between 2019 to 2023. As a result, this may cause lots of consumers to shift their spending to cheaper alternatives. This is a huge vulnerability since there are plenty of store-branded alternative potato chip and soda options out there. There is survey data to support the fact that 54% of shoppers say they’ll choose store-branded grocery items as a substitute for national brands.

Store branded alternatives are typically cheaper, which adds to their appeal during these unfavorable market conditions. I imagine that a lot of consumers out there are able to stomach the marginal difference in taste and quality of these snack and soda products if it means they get to save a bit of money. As mentioned, the continual price increases that PEP has been implementing have a finite lifespan, and it’ll eventually tire the consumer and cause them to shift their dollars elsewhere.

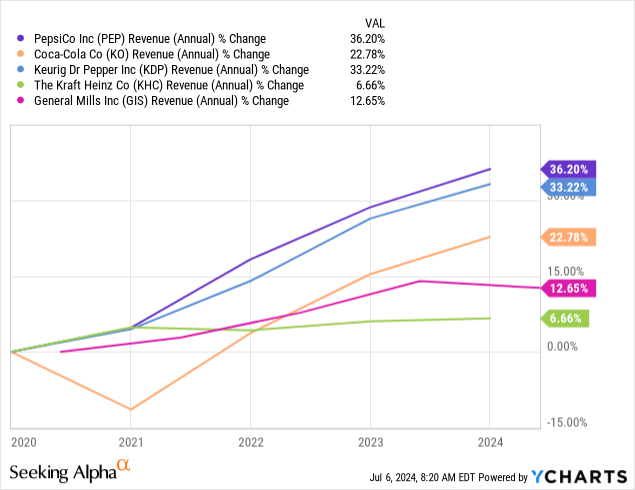

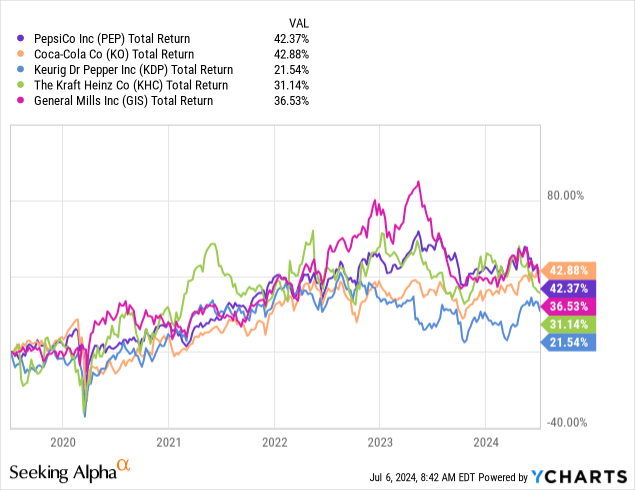

The consumer sector continues to underperform the rest of the market, but PEP has remained one of the top choices in the sector. Just to serve as a comparison, I’ve grouped together some beverage and snack peers that operate in similar market spaces. We can see that the revenue growth of PEP has outpaced these peers, totaling 36% over a five-year span.

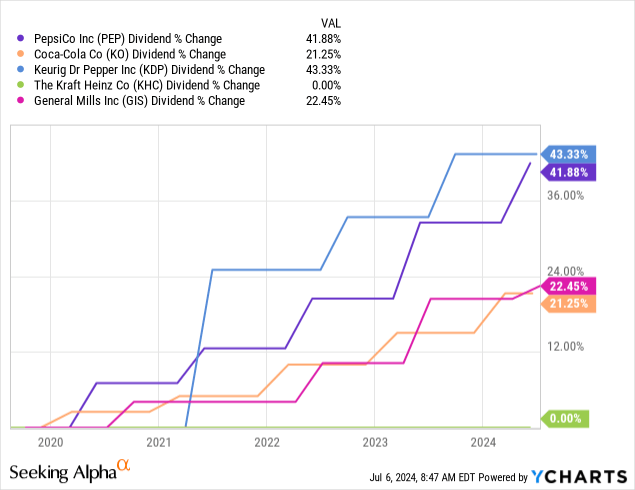

Even when comparing the total return over the last five years, we can see that PEP is on the top end of the range, only being beat by Coca-Cola. However, KO has a much slower dividend growth rate and doesn’t have as steady of an earnings growth performance since the pandemic.

Even when looking at the dividend growth over the last five years, PEP also remains at the top end of the range. The combination of these performance metrics makes PEP the most well-balanced option to gain exposure to the consumer sector. PEP provides an excellent level of dividend growth, revenue consistency, cash and equivalents buffer, and strong pricing strategy that has offset lower volumes.

The Recovery – Valuation

PEP remains attractive priced in terms of valuation metrics. PEP’s valuation has always traded at a premium to the sector medians, so in this case, it would be more appropriate to compare PEP to its own five-year average ratios. For instance, PEP currently trades at a price to earnings ratio of 24.7x compared against the sector median price to earnings ratio of 19.6x. However, PEP’s five-year average price to earnings ratio is closer to 26.5x. In addition, PEP’s price to book ratio sits at 11.8x, which undercuts its five-year average price to book ratio of 13.6x. These metrics may indicate that there is some upside to be captured here when conditions in the sector improve.

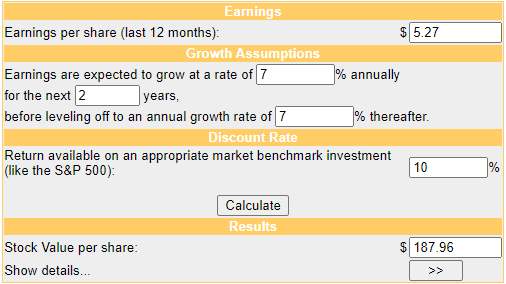

Wall St. analysts seem to agree with this consensus, based on their average price target of $185.03 per share. This would represent a potential 12.5% price upside from the current level. The highest price target sits at $210 per share, while the lowest price target sits at $151 per share. In order to get another source of reference for an estimated price target, I also wanted to run a discounted cash flow calculation. Free cash flow per share sits at $5.27 and while management provided an estimated EPS growth target of 8%, I wanted to manage expectations and consider any potential underperformance. Therefore, I thought a 7% estimated growth rate was a reasonable input here.

I wanted to keep the estimated growth rate at 7% even after the initial two years in the table below so that expectations can be aligned with the sector median. The year-over-year median EBITDA growth for the sector sits at 6.9%. Additionally, PEP’s own five-year average revenue growth is about 7.25%, so I think that using a 7% baseline growth rate is totally reasonable when looking forward.

Money Chimp

With these inputs in mind, we come to an estimated fair value of $187.96 per share. From the current price level, this indicates a potential upside of over 14% which closely aligns to the Wall St. price target. When you consider this potential upside is accompanied by a growing dividend, we have the opportunity to capture a double-digit return by accumulating here.

Pepsi Dividend Growth

PEP’s management has proven to value the dividend growth by maintaining consistent raises. PEP recently increased their dividend by 7% and the latest quarterly dividend sits at $1.355 per share, making the current dividend yield 3.3%. The dividend remains well-supported despite the ongoing headwinds. The payout ratio currently sits at 66%, which is aligned with the five-year average payout ratio of 67%. I believe that the payout ratio can be improved once sales start to increase and operating profit margins improve. As long as the payout ratio doesn’t rise above the 70% mark, I feel confident that PEP will be able to maintain.

PEP has crossed into dividend king territory by consecutively raising dividends for over 51 years in a row. The dividend growth has been quite solid and delivers the level of growth sufficient enough to compound dividend income over time. For instance, the dividend has increased at a CAGR (compound annual growth rate) of 8.1% over the last ten years. Even on a smaller time frame of five years, the dividend has increased at a CAGR of 6.6%.

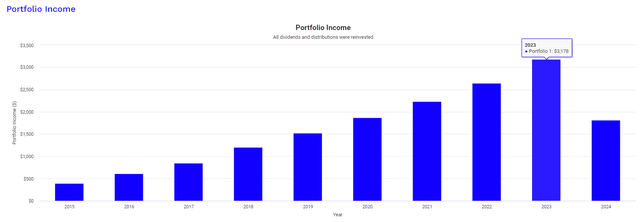

This level of consistent growth makes it ideal for dividend growth investors that wish to have a source of reliable dividend income. To visualize this, I ran a back test of a $10,000 investment over the last year. This graph also assumes that you added a fixed monthly contribution of $500 to your investment, as well as reinvested all dividends back into PEP to help accumulate more shares and compound your income quicker.

In 2015, your dividend income would have totaled $392. Fast forwarding to 2023 reveals that through a combination of a long-term outlook and continual accumulation of more shares, your dividend income would have now grown to $3,178. This means that your income would have almost 10x’ed over the last decade holding period. Most importantly, the dividends received from PEP are classified as qualified dividends. This means that the income received from PEP would be treated at the most favorable tax rates. This is what makes PEP such a valuable holding for investors looking to eventually retire off their dividend income.

Takeaway

In conclusion, PEP remains a compelling buy at these levels. The company’s efficient cash management and ability to continue growing revenue in unfavorable conditions is a testament to the high quality here. The upcoming earnings will likely show continual improvements in the balance sheet as cash equivalents grow while debt gets eliminated. From a valuation standpoint, I think there is the potential for a solid double-digit upside to be captured here, which can be fueled by the eventual increase in sales volume from lower interest rates. The combination of lower interest rates and cooling inflation should ultimately contribute to earnings growth moving forward. In the meantime, I plan to continue collecting a growing stream of dividends until market conditions improve.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.