Summary:

- PepsiCo has elevated the company’s revenue growth from a weak period preceding 2018.

- The growth hasn’t come easily – constant acquisitions from 2018 forward, growing marketing costs and capital expenditures, and high inflation have boosted the growth.

- In Q1, volumes were down by half a percent year-over-year due to a weak performance in North America. The company still reaffirmed a stronger 2024 outlook.

- The current valuation seems fair, and is in line with multiple peers’ valuations in terms of the forward P/E.

burwellphotography

PepsiCo, Inc. (NASDAQ:PEP) manufactures and sells a massive portfolio of convenience food and drink brands with global operations. For example, the well-known company owns the Pepsi, Mountain Dew, Lipton, and Gatorade drink brands, and brands such as Doritos, Lay’s, and Cheetos on the snack side. In 2023, 61% of sales came from North America, with the rest of PepsiCo’s revenues coming from all over the world.

The stock has returned in a stable manner, appreciating at a CAGR of 7.7% within the past ten years. PepsiCo has also earned the dividend king status with 51 years of constant dividend growth. The stock currently has a dividend yield of 3.01%, and the company also distributes profits through constant share repurchases.

Ten Year Stock Chart (Seeking Alpha)

Don’t Expect Too Much Organic Growth

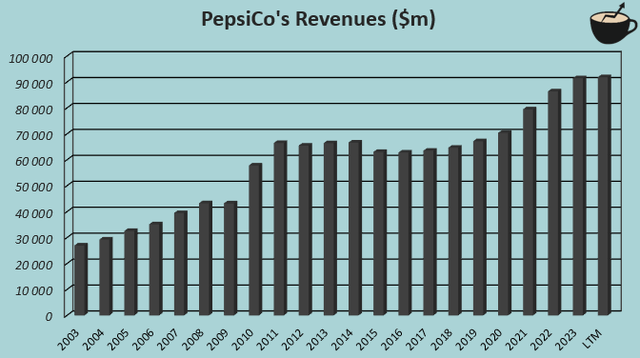

PepsiCo has achieved a good amount of long-term revenue growth, with a CAGR of 6.3% from 2003 to 2023. The growth has come in waves, for example, the company had multiple years of weak growth between 2011 and 2018. PepsiCo has since revitalized the growth after a weaker period, achieving a CAGR of 6.9% from 2018 to current trailing revenues as of Q1/2024. The company targets a long-term growth target of 4-6% as outlined in the 2024 CAGNY presentation.

Author’s Calculation Using TIKR Data

The recent years’ growth has partly been achieved through high inflation and more frequent acquisitions, though. For example, in 2021, while PepsiCo’s revenues increased by 12.9%, underlying volumes only increased by 2.5% as inflation boosted the year’s growth, and in 2022 volumes were flat despite revenue growth of 8.7%. As inflation continues to come down, with food only showing a 2.2% year-over-year inflation in the United States in April, PepsiCo’s growth is likely to slow down significantly.

After multiple years of no cash acquisitions, PepsiCo has been more active in M&A from 2018 forward, boosting the growth non-organically. The company has spent around $11.8 billion from 2018 to 2023 in cash considerations to fuel acquisitions, boosting growth. Most notably, PepsiCo acquired the energy drink manufacturer Rockstar for an initial consideration of $3.85 billion. In the same period from 2018 to 2023, divestment has generated cash proceeds of $4.5 billion, significantly less than the acquisition sum.

In addition to acquisitions, PepsiCo’s strategy has also relied on increased organic investments recently. The company’s marketing spend had increased from $4.2 billion in 2018 to $5.7 billion in 2023, and capital expenditures have grown even more from $3.1 billion into $5.3 billion in the same period.

To summarize, while PepsiCo targets a growth of 4-6%, I don’t believe that the growth is easily or cheaply achieved. High inflation and continued heavy investments are behind the company’s recent years’ elevated growth. In my opinion, investors should expect future growth very cautiously, and keep a close eye on organic volume growth as a critical KPI.

Healthy But Downward Trending Operating Margin

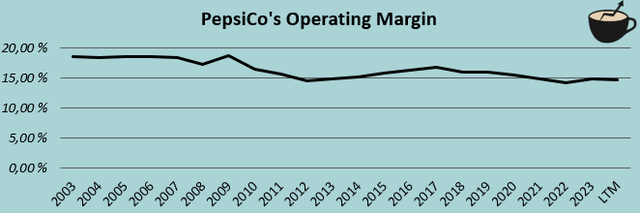

PepsiCo has a healthy and non-volatile operating margin, currently trailing at a level of 14.7%. The level is below PepsiCo’s average of 15.5% from 2014 to 2023, although with only by a small amount. The slight downward trend in the operating margin further slows down PepsiCo’s organic earnings growth – organically, the company’s earnings growth is minimal.

Author’s Calculation Using TIKR Data

The company has outlined a target to grow the operating margin. In the CAGNY 2024 presentation, PepsiCo communicated a target of 0.2-0.3 percentage points in core operating margin expansion. As cost inflation continues to slow down, I believe that PepsiCo could be positioned to capture some margin expansion. Still, the company has historically already had excellent pricing power, and the targeted margin expansion should be taken critically until clear signs of leverage are shown.

Q1 Financial Results

PepsiCo reported the company’s Q1 results on the 23rd of April, posting revenues of $18.25 billion and a normalized EPS of $1.61. The reported revenues corresponded to a year-over-year growth of 2.3% or 2.7% without currency headwinds, and the normalized EPS saw an increase of $0.11 from Q1/2023. Both revenues and the normalized EPS beat analysts’ expectations, although with very moderate beats. Revenues beat estimates by $146 million, and the normalized EPS had a beat of $0.09.

The revenue growth was carried by international revenues, as North American revenues were dragged by -24% in the small Quaker Foods segment. Revenues from Europe saw the largest organic year-over-year growth, with 10%. Critically, while total revenues grew, the growth was still carried by inflation as volumes decreased by half a percent in the first quarter.

The company reaffirmed the FY2024 outlook and continues to expect at least 4% in organic revenue growth, 8% in core constant currency EPS growth with a 20% tax rate assumption, and shareholder cash returns of approximately $8.2 billion. The outlook seems to estimate improving conditions, as the Q1 results didn’t reach a 4% organic revenue growth.

A Fair Valuation

Relative Valuation

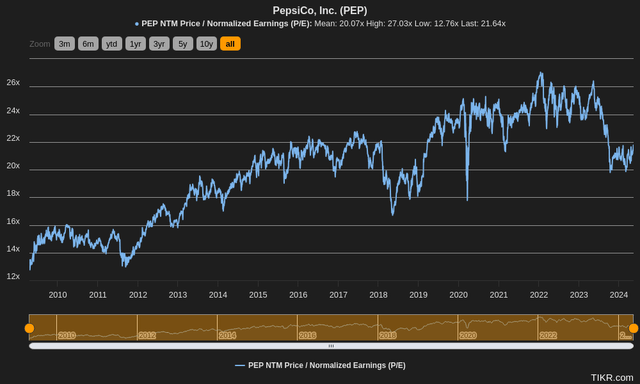

With PepsiCo’s revitalized growth, the stock’s forward P/E has been on a mostly upward trend, with the stock going from a low of a forward P/E of 12.8 in H1/2009 into a high of 27.0 and a current forward P/E of 21.6. The current forward P/E gives an earnings yield of 4.62%, near the US’ 10-year bond yield of 4.36% – growth is clearly priced into the stock.

PepsiCo has a good number of large competitors with comparable valuations. For example, The Coca-Cola Company (KO) has a forward P/E of 22.4, Unilever (UL) a forward P/E of 19.1, and Kellanova (K) a forward P/E of 17.1. PepsiCo’s P/E of 21.6 is roughly in line with competitors.

DCF Model

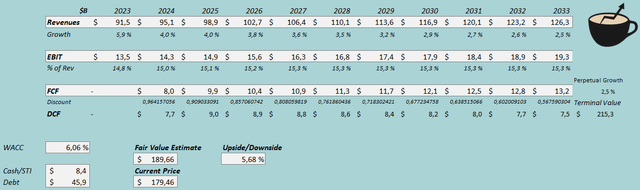

To estimate a rough fair value for the stock, I constructed a discounted cash flow (“DCF”) model. In the DCF model, I estimate very modest growth, with a 4% organic revenue growth estimate for 2024 and 2025. Afterward, I estimate the growth to slow down gradually into a perpetual growth rate of 2.5%, representing a total CAGR of 3.3% from 2023 to 2033. For the EBIT margin, I estimate very slight leverage as PepsiCo targets margin leverage; from 2027 forward, I estimate the EBIT margin to be 15.3%. PepsiCo’s cash flow conversion is fairly good, but is clouded by significantly high capital expenditures at the moment.

With the mentioned estimates, the DCF model estimates PepsiCo’s fair value at $189.66, posing very modest upside. The stock seems likely to continue its historical, stable performance in the future as well, and doesn’t seem to provide a likely significant over or underperformance.

DCF Model (Author’s Calculation)

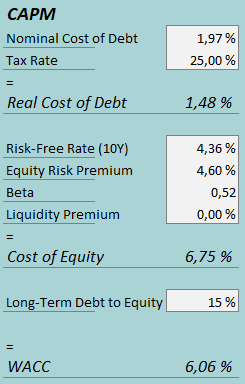

A weighted average cost of capital of 6.06% is used in the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q1, PepsiCo had $226 million in interest expenses. With the company’s current amount of interest-bearing debt, PepsiCo’s annualized interest rate comes up to an incredibly low 1.97%. PepsiCo leverages debt well, and I estimate a long-term debt-to-equity ratio of 15%. For the risk-free rate on the cost of equity side, I use the United States’ 10-year bond yield. The equity risk premium of 4.60% is Professor Aswath Damodaran’s latest estimate for the United States, updated on the 5th of January. Yahoo Finance estimates PepsiCo’s beta at a figure of 0.52. As PepsiCo’s stock is extremely liquid, I don’t add a liquidity premium that I usually add. As such, the cost of equity stands at 6.75% and the WACC at 6.06%.

Takeaway

PepsiCo has had a history of growing revenues modestly and returning a significant amount of capital to shareholders. Yet, investors should be cautious of expecting too much growth in the future – after a weak growth period from 2011 to 2018, PepsiCo has spent an increasing amount on acquisitions, marketing, and investments to bolster growth into a better level. In addition, high inflation has boosted growth during the past couple of years, with volumes staying quite stagnant. The Q1 results showed modest revenue growth, again aided by inflation, as volumes came down by half a percent.

Still, the company’s total financial performance has been decently good and incredibly stable. PepsiCo, Inc. stock is valued at a P/E comparable to that of its peers, and my DCF model estimates the stock to be valued fairly. I believe that investors are likely to see a future with similar stock returns as in the past decade, and as such, I have a hold rating on PepsiCo, Inc. stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.