Summary:

- PepsiCo and its high-quality portfolio of brands tend to provide shelter in tough economic environments, as well as sequential and steady growth.

- As one of the largest consumer staple companies in the convenient foods and beverage categories, PepsiCo enjoys sticky demand and immense pricing power.

- PepsiCo is defying the law of large numbers and constantly outgrows its smaller peers. Its markets are projected to grow at 5% CAGRs, and PepsiCo is expected to outperform.

- PepsiCo is one of those companies that always seems overvalued on paper. Waiting for a bargain price with such high-quality companies can be a frustrating endeavor.

- I estimate PepsiCo’s fair value at $192.9 per share, 9.8% above the current market price, and rate the stock a Buy. I believe now is a good time to initiate a position and DCA into a more significant stake.

Fotoatelie

PepsiCo (NASDAQ:PEP) is a true blue chip, with a portfolio of timeless, high-quality, renowned brands. The company’s operations in the global convenient foods and beverage markets are as stable as they come. While PepsiCo provides shelter in times of volatile markets, it also provides sequential growth and steady market-beating shareholder returns. Although its current multiples suggest it’s slightly overvalued, I project the company will grow into its multiple, as its margins expand and revenues will continue to increase. Despite its higher multiple, I believe PepsiCo should be a cornerstone in every long-term investor’s portfolio and rate the stock a buy, with a fair value of $192.90. I suggest investors initiate a position at current prices and aim to increase it over time on the occasional pullback, although when it comes to PepsiCo pullbacks are rare and are usually of small magnitude.

Company Overview

PepsiCo, Inc. “manufactures, markets, distributes, and sells various beverages and convenient foods worldwide. The company operates through seven segments: Frito-Lay North America; Quaker Foods North America; PepsiCo Beverages North America; Latin America; Europe; Africa, Middle East, and South Asia; and Asia Pacific, Australia and New Zealand and China Region”.

PepsiCo has an 8% share of the global convenient foods market and a 9% share of the global beverages market, both of which are expected to grow by 5% a year for the foreseeable future. The company owns a portfolio of worldwide renowned brands, including Lay’s, Doritos, Cheetos, Gatorade, Pepsi, Mountain Dew, Quaker, 7UP, Mirinda, Tostitos, and a whole lot more.

PepsiCo’s CAGNY 2023, Presentation

PepsiCo serves wholesale and other distributors, food service customers, grocery stores of all forms, e-commerce retailers, and direct consumers, through a network of direct-store delivery, customer warehouses, and distributor networks, as well as e-commerce platforms and retailers.

PepsiCo is oftentimes compared to Coca-Cola (KO) (and I’m no exception, see next section), but the truth is there are a lot of differences between the two companies. PepsiCo’s product offerings are significantly more diversified than Coca-Cola’s, as 58.0% of its revenues come from convenient foods, and only 42.0% come from beverages, whereas Coca-Cola is 100% concentrated in the beverage category.

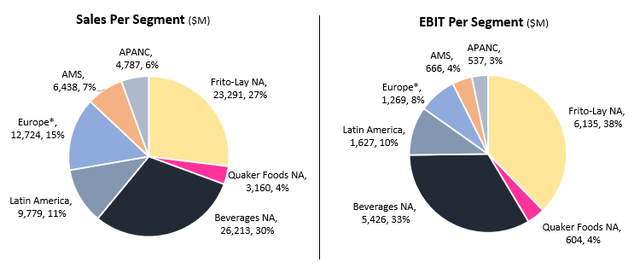

Created by author using data from PepsiCo’s 10-K; AMS = Africa, Middle East, South Asia; APANC = Asia Pacific, Australia, New Zealand, China; *Adjusted for one-time charges

PepsiCo’s non-beverage categories, at least in North America, are more profitable, as their contribution to EBIT is larger than their contribution to sales. The non-beverage categories are also the fastest growing.

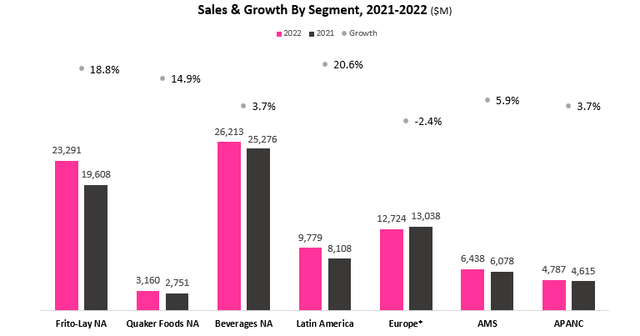

Created and calculated by author using data from PepsiCo’s 10-K

Overall, besides Europe which is weighed down by divestitures of operations in Russia, PepsiCo is delivering great results all across the board. For a consumer staple company the size of PepsiCo to be able to grow revenues at high single-digits on a reported basis and mid-double-digits on an organic basis is truly impressive.

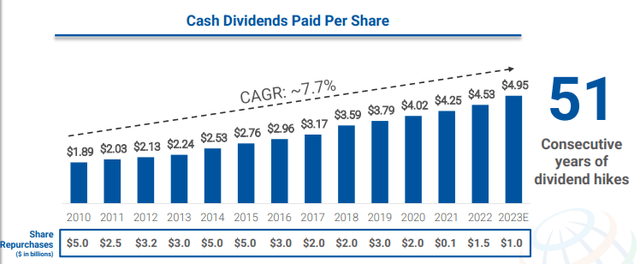

The company is a dividend aristocrat with 51 consecutive years of dividend increases and has a long track record of returning cash to shareholders. With its arguably recession-proof portfolio of worldwide brands, PepsiCo will probably be around to pay and grow dividends for many more generations to come.

PepsiCo’s CAGNY 2023 Presentation

Investment Thesis – Brand Value & Pricing Power

PepsiCo and its portfolio of brands are a worldwide phenomenon with operations in more than 200 countries and total revenues of more than $86B. In an old-timer and a behemoth like PepsiCo, I look for two important attributes to assess whether it’s an attractive long-term investment which will provide compounding shareholder returns – ambition and relevancy.

First, I want to see that the company is still ambitious, meaning it’s still attempting to grow and increase efficiency, as opposed to squeezing what’s left from its old brands. This attribute is reflected in the company’s regular operating metrics, which we will examine in the next section.

Second, I want to make sure the company’s brands remain relevant, meaning the company is either keeping or gaining market share. This attribute is best reflected in the company’s organic growth, as it’s a combination of price, mix, and volume of existing brands.

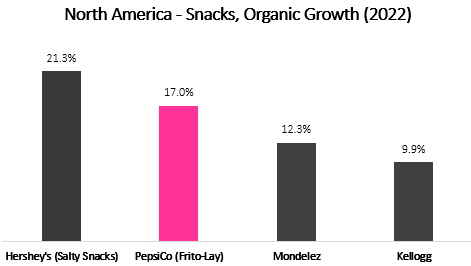

Created and calculated by author using data from the companies’ financial reports

In the Snacks category, PepsiCo grew organically by an impressive high-double-digit percentage. It outgrew Mondelez (MDLZ) and Kellogg (K), but lagged Hershey (HSY). This is all the while more impressive considering the fact that PepsiCo’s Frito-Lay segment generated revenues of $23.2B, compared to the much smaller Hershey’s $1B, Mondelez’s $9.7B, and Kellogg’s $8.9B. Looking at the Snacks category, PepsiCo checks all my boxes. Although it’s the largest by a wide margin, the company is mostly outgrowing its smaller peers, reflecting pricing power, and relevancy.

Created and calculated by author using data from the companies’ financial reports

In the Other Foods category, which includes cereal, oats, pasta, and other dry foods, PepsiCo also wins against General Mills (GIS) by four percentage points. It should be noted General Mills is much larger, with revenues of $12.2B in the last twelve months, compared to PepsiCo’s $3.2B. So PepsiCo wins, but with an asterisk. By itself, a 13.0% organic growth reflects the strength of the demand for PepsiCo’s products, even at times when other staple categories are seeing trade-downs.

Created and calculated by author using data from the companies’ financial reports

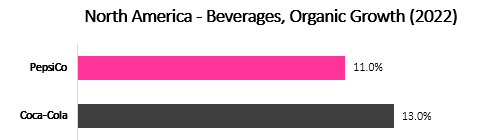

This wouldn’t be a real analysis of PepsiCo without comparing it to Coca-Cola right? well, Coca-Cola outperformed PepsiCo in terms of organic growth in 2022. However, PepsiCo has a much larger presence in the beverage market in North America, with total sales of $26.2B compared to Coca-Cola’s $15.7B. Let me be clear, I’m not arguing PepsiCo is a higher-quality beverage company. I am arguing it’s quite impressive to see it grow almost at the same pace as Coca-Cola, which is a much smaller and beverage-only company. In my view, both companies’ beverage brands have immense brand value and strong pricing power.

Created and calculated by author using data from the companies’ financial reports

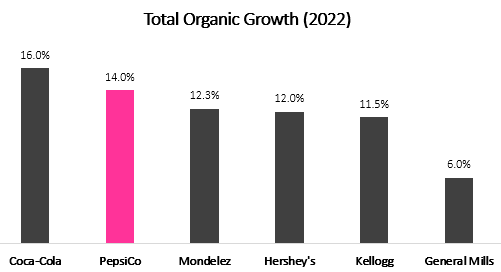

On a consolidated basis, we find PepsiCo in second place after Coca-Cola in terms of organic growth. Not to sound too repetitive, but PepsiCo generated more than twice the revenues of Coca-Cola in 2022, with total sales of $86.4B. Needless to say, PepsiCo is much larger than the rest of the companies on our list.

Overall, I find PepsiCo’s growth numbers to be extraordinary. The company is either first or second in every category in terms of organic growth, despite it being the largest among the list in terms of sales. To me, this is clear proof that PepsiCo’s brands are more relevant than ever. The company is able to pass most of its costs to its customers and possesses strong pricing power, which is what makes PepsiCo such a stable business.

Competitors & Multiples

As we established PepsiCo has a strong brand value and extraordinary pricing power, it’s time to see how those are reflected in the company’s financials. I’m looking to see that despite its size, PepsiCo remains an industry leader in terms of growth, shareholder returns, and profitability.

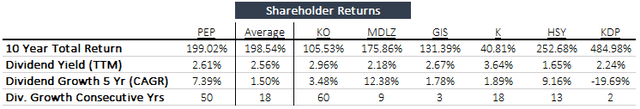

Created by author using data from Seeking Alpha. Data as of March 24th, 2023

For the past 10 years, PepsiCo outperformed most of its peers in terms of total returns. The company has been raising dividends for 50 consecutive years and yet, it’s still growing at an above-average pace. PepsiCo’s 5-year dividend growth is more than twice as larger as Coca-Cola’s, however, the latter has a longer record.

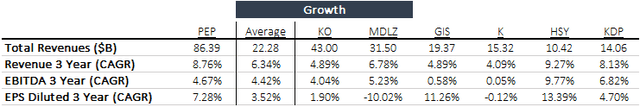

Created by author using data from Seeking Alpha. Data as of March 24th, 2023

It was also the largest company by far in terms of sales and was able to outperform its peers’ revenue, EBITDA, and EPS growth in the past 3 years. Only the much smaller Hershey has beaten PepsiCo’s revenue growth. Although the EBITDA and EPS outperformance gaps aren’t as impressive, it’s important to note 2022 included non-recurring write-offs which sway the EPS numbers a little bit.

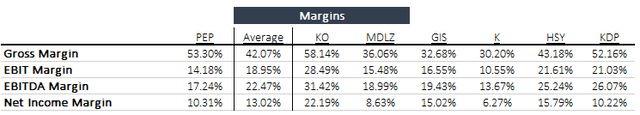

Created by author using data from Seeking Alpha. Data as of March 24th, 2023

I was quite surprised to see PepsiCo isn’t among the leaders in terms of profit margins. The company’s gross margin is second only to Coca-Cola, but its EBIT, EBITDA and Net Income margins are relatively low, even if we take out the non-recurring items in the last year. Generally, we can’t expect PepsiCo to have Coca-Cola-like margins as we know it’s engaged in other operations, some of which are less profitable. However, this still does not explain lagging competitors like General Mills or Hershey.

Before Covid-19, PepsiCo’s margins were higher by 2-3 percentage points, as the higher gross margin was fully included in the operating margins. PepsiCo is dealing with cost inflation that caused its margins to go down, but it’s affecting its peers as well.

The bottom line is PepsiCo’s margins are not as impressive as I’d like. That being said, I believe one of the reasons the company is so successful is its relatively cheaper offerings. PepsiCo’s beverages are cheaper than Coca-Cola’s and some of its food offerings are at lower price points. In addition, PepsiCo has several joint partnerships where it acts as a pure distributor, like the ones the company has with Celsius Holdings (CELH) and Starbucks (SBUX).

All in all, I think PepsiCo’s margins will go up in the upcoming years and return to their historical levels. However, we can’t expect the company to become an industry leader in that regard, as it offers lower price points and has lower-margin business segments, like distribution for third parties.

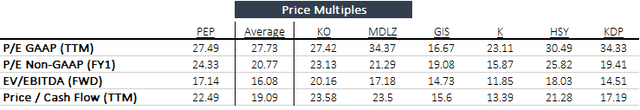

Created by author using data from Seeking Alpha. Data as of March 24th, 2023

It’s no surprise PepsiCo trades at above-average multiples. As we understand it’s the leader among many product categories which are essential to customers, meaning they will continue to buy them, repeatedly, during any financial condition, we understand why the entire peer group is trading at multiples that are significantly higher than the market average, and why PepsiCo is at the higher end of the group.

I believe the main metric investors should look at when evaluating PepsiCo is EV/EBITDA, as the company’s immense infrastructure carries large amounts of depreciation. In that aspect, I find a multiple of 17.1 to be reasonable.

Taking all of the above into account, I arrive at the conclusion PepsiCo is fairly valued. However, as arguably one of the highest-quality companies in the world, a fair valuation is probably a great entry point. PepsiCo provides investors with exposure to the world’s most valuable and recession-proof consumer staple brands, and that comes with a price.

Valuation

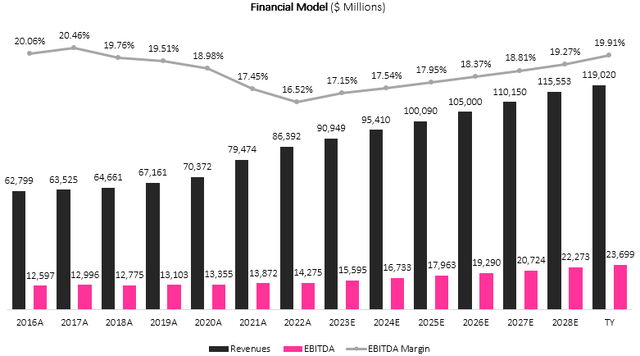

I used a discounted cash flow methodology to evaluate PepsiCo’s fair value. I assume PEP will grow revenues at a CAGR of 4.9% between 2022-2028, which is according to the company’s long-term growth targets. I believe revenues will grow at that pace due to constant capacity enhancements, steady price increases, and the company’s ability to continue to bring in new products with a focus on new trends like healthier snacks or zero-sugar drinks. I find this growth rate to be conservative, as it assumes PepsiCo will grow at the pace of the convenient foods and beverage markets, although historically PepsiCo outperforms the market and its peers as it constantly gains more market share.

I project PepsiCo’s EBITDA margins to increase incrementally up to 19.9%, as inflation eases and the supply chain recovers, along with new manufacturing lines finishing their ramp-up stage. This is not outside of the company’s reach, as we already saw higher margins in the past. It’s important to remember companies like PepsiCo usually don’t decrease prices, which means that after price increases to mitigate inflation have been made, PepsiCo’s margins are projected to expand as inflation eases.

Overall, my assumptions result in EBITDA growth higher than revenues, reflecting operational leverage and cost-efficiencies. This is according to the management’s guidance of sequential operating margin expansion at a rate of 20-30 bps per year.

Created and calculated by author using data from PepsiCo’s financial reports and author’s projections

Taking a WACC of 7.2%, I estimate PEP’s fair value at $265.7B or $192.90 per share, which represents a 9.8% upside compared to its market value at the time of writing. While this does represent an arguably high P/E multiple on 2023 earnings (26.8), I believe PepsiCo will see significant margin expansion in the upcoming years, which is why its near-term multiples will look a bit inflated.

Near-Term Projections

I find it important to provide additional details regarding my near-term financial projections in order to provide both the readers and me with the ability to measure the accuracy of the investment thesis. This allows me to easily assess whether an earnings report is good or bad, and what adjustments I have to make in my model.

When it comes to PepsiCo, my near-term projections are close to the consensus. For Q1-23, I expect revenues of $17.4B, EBITDA of $2.9B, and net income of $1.8B, whereas the consensus projects $17.2B in revenues and a similar net income. After the April earnings release, we will see who came closer and I will update my model accordingly.

Risks

The first risk I would address is the resiliency of PepsiCo’s pricing power. At times of deteriorating financial conditions, a major concern for investors is customers trading down. I find that risk to be very vital for the consumer staples category, but not in the sub-categories where PepsiCo operates. While we see household products companies like Procter & Gamble (PG) and Kimberly Clark (KMB) lose significant market share and volumes to private labels, it’s much harder and more expensive for retailers to produce substitutes for PepsiCo’s products.

Obviously, consumers will have to strategize short term what they do with their more limited budgets, and we’re seeing our categories actually not being impacted so much now because people are prioritizing food over discretionary. And within food categories like ours where private label has less of penetration there, we’re being prioritized by consumers.

— Ramon Laguarta – Chairman and CEO, 2023 CAGNY Conference

In addition, regarding price elasticity, it’s clear that some customers will have to reduce consumption, and we’re already seeing volume declines for PepsiCo, Coca-Cola, and essentially every other competitor. However, these volume declines are also a result of tough comparisons, and PepsiCo’s management included these in its guidance.

Another cause for concern is bad acquisitions. PepsiCo’s impairments for 2022 totaled almost $3.2B, causing a significant decrease in GAAP net income. The write-offs took place for SodaStream, as well as for Mabel and Pioneer. It’s important to understand that almost every acquisition that occurred before the rate hikes is due for an impairment, as the discount rates for future cash flows increased materially. According to PepsiCo’s management, the current goodwill accounts on the balance sheet are better representative, and we shouldn’t expect significant impairments in the near term.

It was really a couple of things that that drove it. Number one is obviously as you mentioned pre pandemic, interest rates were awfully low and prices were pretty high for a number of these assets. And as we’ve sort of moved forward, we’ve taken a hard look at the cash flows, sort of in a post pandemic world. Combine that with the fact that interest rates are obviously materially higher, so we’re discounting those cash flows at a different rate. The couple that I’d point to, during the course of the year. Mabel in Brazil was one, Pioneer a little bit as well. And then SodaStream where, SodaStream is more of a consumer discretionary type of purchase compared to our — the balance of our portfolio. And as you would expect, behaved more like a consumer discretionary purchase. So we took the opportunity to look at the numbers going forward on that, and the investment posture we were going to have in that business. And as a result, we wrote down a piece of that business as well. So I think we put ourselves in a spot now we’re in a, in a higher interest rate world, we’re in a better position in terms of where we’ve marked those assets to.

— Hugh Johnston – Vice Chairman & CFO, Q4-22 Earnings Call

The last risk I’d address is valuation. PepsiCo’s current forward P/E ratio of 24.7 is higher than the 17.97 ratio of the S&P 500 (SPY). It’s also higher than PepsiCo’s 5-year average of 23.8. Many market participants believe such a premium isn’t justified for a slow-growth company like PepsiCo, with mid-term projections for 4%-6% revenue growth and high-single-digits EPS growth. In my view, the premium is justified due to PepsiCo’s exceptional quality, which is best demonstrated by the extremely low volatility and very small drawdowns of the stock.

During the last 5-years, PepsiCo outperformed the market with an 89% total return compared to SPY’s 62%. PepsiCo’s max drawdown occurred in the Covid-19 market crash and amounts to 28%, compared to SPY’s 33%. Additionally, PepsiCo’s Sharpe ratio is 0.74, way larger than SPY’s 0.54.

Overall, PepsiCo is considered a “safe haven” by some and there’s a reason for that. The demand for its products is very sticky, and the company has shown resiliency in prior economic downturns. I believe investors can rest assured the company will be able to overcome any challenge and withstand any economic environment.

Conclusion

PepsiCo is one of those companies that never seem to be undervalued. Waiting for a bargain price with such high-quality companies could be a frustrating and unrewarding endeavor. As I estimate PepsiCo’s fair value at $192.90 per share, which is 9.8% above the current market price, I rate the stock a Buy. I believe the current price provides an attractive entry point to initiate a position and begin dollar cost averaging into a larger position.

Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.