Summary:

- Defensive Consumer Staples stocks faced headwinds in 2023 due to factors such as rising interest rates and a stronger dollar, but some of those issues are reversing.

- PepsiCo’s stock performance has been lackluster, but its valuation is compelling, particularly as market yields dip.

- The company’s steady growth trajectory and strong outlook make it a buy, despite some technical caution.

- I highlight key price levels to monitor heading into 2024.

smirart

There was a slew of headwinds for defensive Consumer Staples stocks at the onset of the second half of 2023. GLP-1 weight-loss drugs captured a lot of attention while, at the macro level, interest rates were on the rise, making high-yield Staples less attractive. Furthermore, a stronger dollar did no favors for large multinationals. The growth trade was also in full force as the Magnificent Seven powered the mega caps to gains that large-cap value names could only wish for. Some of these tides could be turning, but price action in PepsiCo (NASDAQ:PEP) remains lackluster while its valuation is compelling.

I have a buy rating on the stock based on its valuation and steady growth trajectory.

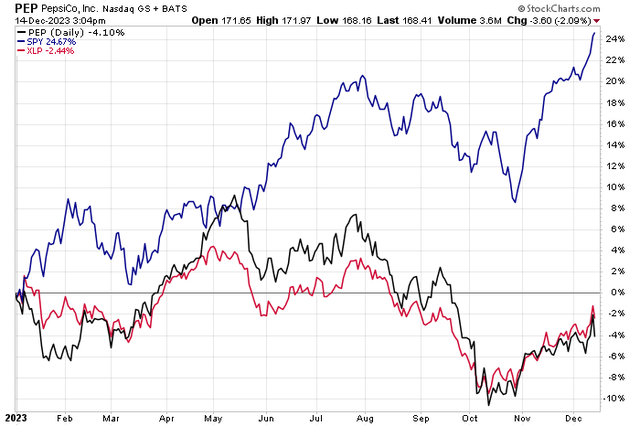

PEP, Staples Underperform the SPX in 2023

Stockcharts.com

According to Bank of America Global Research, PepsiCo, a global snack and beverage company, manufactures and markets salty and convenient snacks, carbonated and non-carbonated beverages, and foods. Divisions include Frito-Lay North America (FLNA), Quaker Foods NA, North America Beverages (NAB), Latin America, Europe Sub-Saharan Africa (ESSA), and Asia, Middle East, and North Africa (AMENA). Key exposures include the UK, Mexico, India, and China. Brands include Pepsi Cola, Mountain Dew, Gatorade, Tropicana, Frito-Lay, and Quaker, among others.

The New York-based $239 billion market cap Soft Drinks & Non-Alcoholic Beverages industry company within the Consumer Staples sector trades at an above-market 22.8 forward non-GAAP price-to-earnings ratio and pays a yield nearly twice that of the S&P 500 at 2.94% as of December 13, 2023. Ahead of earnings due out in early February, shares trade with a low 14% implied volatility percentage, while short interest on the stock is modest at 1.1%.

Back in October, PEP reported a healthy quarterly profit (a beat and raise). Q3 non-GAAP EPS of $2.25 topped consensus estimates by a dime while a 6.7% jump in the top line and an 8.8% rise in organic sales helped send the stock modestly higher. While shares wavered in the sessions that followed, PEP managed to stage a rally amidst market volatility. In terms of its outlook, the management team expects 13% core constant-currency EPS growth in 2023 – impressive considering how inflation rates have trended lower, though we are just about done with this fiscal year.

Next year, organic revenue is seen toward the upper end of its 4% to 6% target, which was an increase from the previous expectation. Positive guidance is due, in part, to visibility in consumer inflation trends and improved productivity, according to the management team. Key risks for Pepsi include unfavorable currency moves in the FX markets, but those tend to be short-lived and mean-reverting – also, the dollar has dipped to fresh multi-month lows lately, so that could be a tailwind for this multinational company. Also, reduced sales due to lower demand as a result of the GLP-1 weight-loss drugs is an unknown at this point.

On the plus side, Wells Fargo recently came out in favor of food-related stocks given their mediocre performance in 2023, pulling valuations down to 20-year lows in some instances. A large firm like PepsiCo is seen as having tremendous pricing power, and able to weather some of these near-term headwinds. Something else to consider is that with lower Treasury yields, a somewhat high yielder and dividend aristocrat like PEP appears in a better light for income investors.

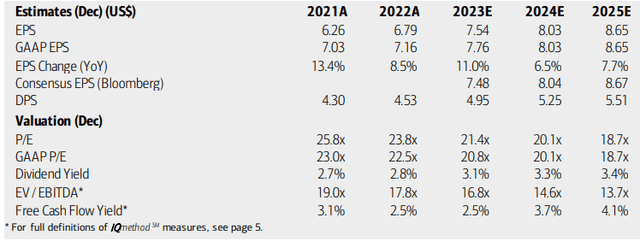

On valuation, analysts at BofA see earnings rising 11% this year, but then moderating to the mid-to-high single-digit range in the out years. The current consensus forecast, per Seeking Alpha, suggests operating EPS may rise at an 8% clip through 2025 with top-line growth closer to 5%. With decent operating leverage and reliable free cash flow, dividends per share are seen climbing over the coming quarters. With forward earnings multiples in the low 20s, the stock is not a bargain, but it’s rare to be able to buy PepsiCo with a significantly below-market P/E given its high-quality factor characteristics.

PepsiCo: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

BofA Global Research

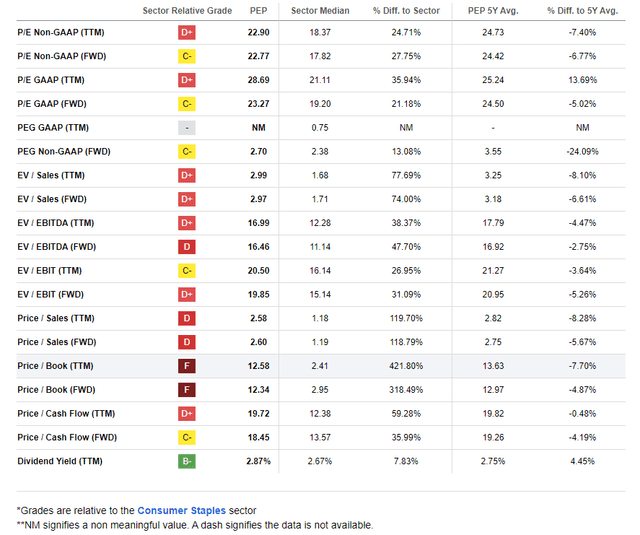

If we assume normalized non-GAAP EPS of $8 over the next 12 months and apply its 5-year average P/E of 24.4, then shares should be near $195. I assert that its historically elevated earnings multiple is warranted given the firm’s history and ability to pay solid dividends and buyback shares. What’s more, most of PEP’s valuation metrics are currently modestly below their long-term averages.

PEP: A Premium Valuation, Historically Cheap on Earnings

Seeking Alpha

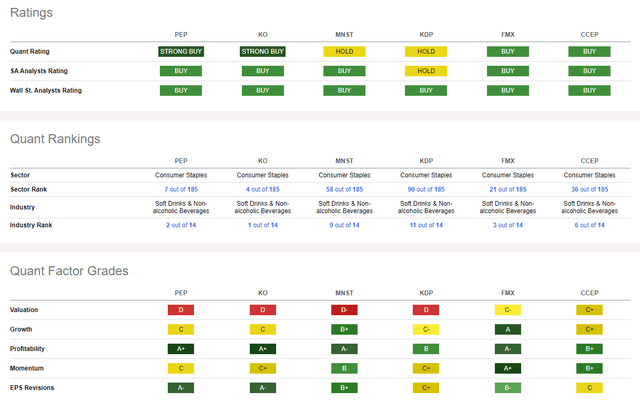

Compared to its peers, PEP features a premium valuation, much like Coca-Cola (KO) and Keurig Dr Pepper (KDP). While growth prospects are not extraordinarily strong, earnings quality is robust, and profitability trends are best-in-class within the US Consumer Staples sector. I would like to see improved share-price momentum, and I will detail key price levels to monitor later in the article. Nevertheless, with a string of 12 consecutive earnings beats, and three straight impressive quarters relative to expectations, EPS revision trends are favorable as we head into the new year.

Competitor Analysis

Seeking Alpha

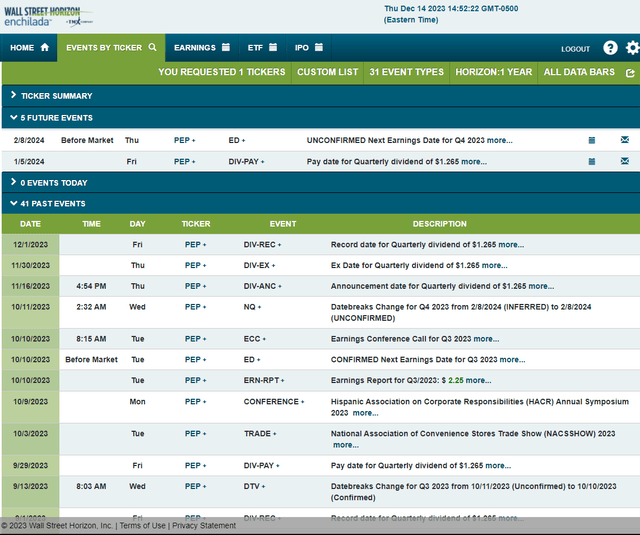

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 2023 earnings date of Thursday, February 8. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

Wall Street Horizon

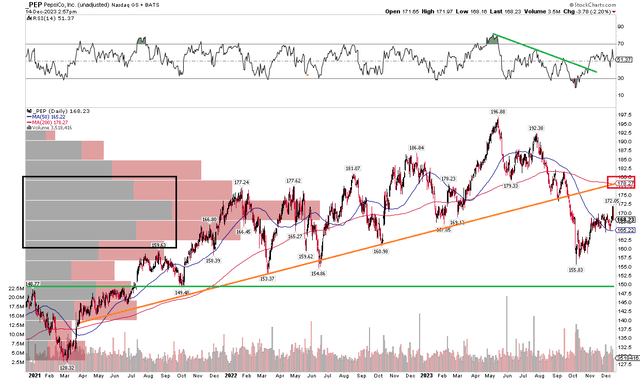

The Technical Take

PEP has been a relative laggard in 2023. Notice in the chart below that this perceived safety play has underperformed the S&P 500 by nearly 30 percentage points thus far on the year, though it’s right on par with the Consumer Staples sector. Shares broke a key uptrend support line back in September during a steep selloff that did not attract buyers until PEP touched $155 – back where it traded during the first half of 2022. Also, the long-term 200-day moving average has turned negative in its slope, and that trendline indicator now has confluence with the former support line. Thus, $175 to $180 could be a pain point for the bulls on rally attempts.

But also take a look at the RSI momentum oscillator at the top of the graph – it broke out from a downtrend in November, a possible sign of a bullish move in price action. Still, with a high amount of volume by price up to about $185, it will be tough for the bulls to bring the stock back quickly. The good news is that we have a support level at $150 to monitor.

Overall, PEP’s chart is not all that great right now given its relative weakness and break of trend.

PEP: Bearish Trendline Breakdown, Support Near $150, $180 Resistance

Stockcharts.com

The Bottom Line

I have a buy rating on PepsiCo. I see the stock has significantly undervalued but acknowledge that the technicals warrant some caution following a disappointing back half of 2023.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.