Summary:

- I recommend a BUY for PepsiCo with a 12-month price target of $203.08, reflecting an 18.2% premium.

- PepsiCo’s diversified portfolio and strategic acquisitions bolster its market position amidst competitive pressures and evolving consumer trends.

- Falling inflation and commodity prices are expected to improve PepsiCo’s SG&A margin, enhancing profitability.

- PepsiCo’s proactive investment in health-conscious products and e-commerce channels positions it for sustained, long-term growth.

Editor’s note: Seeking Alpha is proud to welcome Leonard Lim as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

antorti

Investment Thesis

I opine that PepsiCo, Inc (NASDAQ:PEP) is an undervalued stock with mouthwatering prospects. With its margins poised to improve due to falling commodity prices and projected growth due to investment strategies and new product lines, I anticipate refreshing returns from the beverage behemoth.

I am proposing a BUY recommendation with a 12-month price target of $203.08 (20.9% premium as of 06/11/2024).

Business Overview

PepsiCo, Inc. is a global convenient food and beverage business with an expansive portfolio of product offerings developed organically and acquired. PepsiCo produces and sells its products through myriad distribution channels in more than 200 countries.

PepsiCo’s beverage lineup includes carbonated soft drinks (CSDs), functional hydration (energy and sports drinks), and ready-to-drink (RTD) coffee and tea. Its convenient food brands offer salty, savory, and breakfast products. Most notably, the business is responsible for brands such as Pepsi, Gatorade, Lay’s, Doritos, and Cheetos.

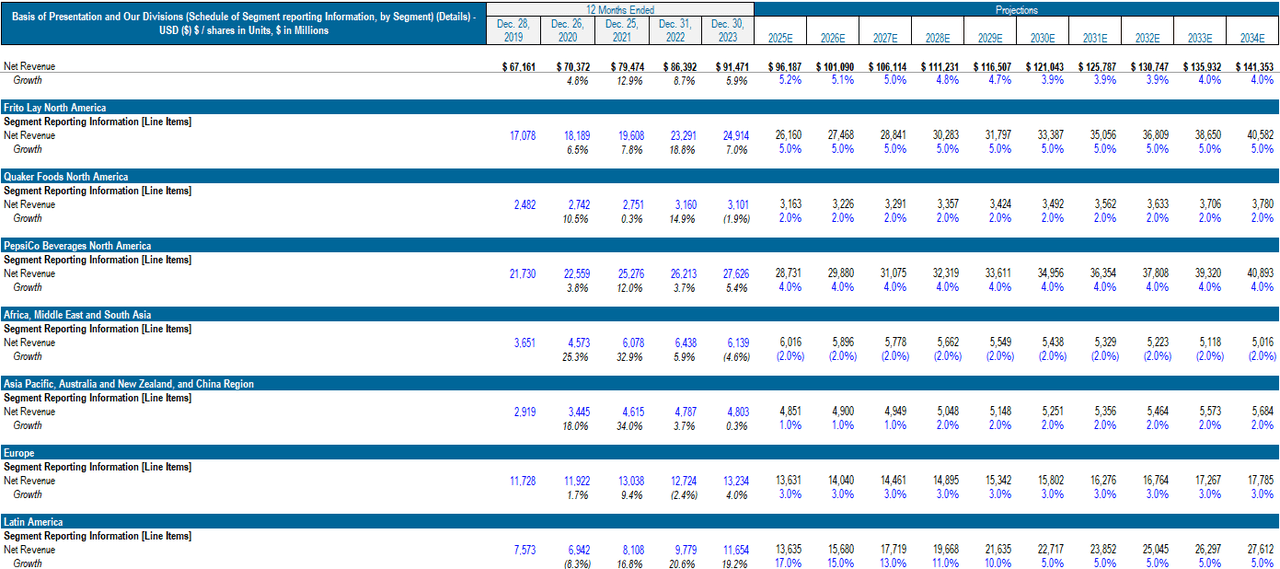

Accounting for a whopping 60.8% of PepsiCo’s 2023A sales, the North America segment is organized into three divisions: Frito-Lay North America (FLNA), Quaker Foods North America (QFNA), and PepsiCo Beverages North America (PBNA). Given its strong customer concentration in NA, the firm has been resolutely diversifying its business, with a mounting presence in Europe and Latin America. The other 39.2% of 2023A sales comprise the following operating segments: Europe, Latin America (LatAm), Africa, Middle East and South Asia (AMESA), and Asia Pacific, Australia, New Zealand and China (APAC).

Down South, LatAm appears to be the beverage behemoth’s rising star. LatAm’s net sales consistently grew between 16% and 21% in the last 3 fiscal years, owing to a burgeoning middle-class and rapid urbanization.

Across the Atlantic, while its YoY revenue growth does not hold a candle to LatAm’s, Europe remains PepsiCo’s second-biggest stream.

APAC sales have lagged, with a disappointing 0.3% increase from FY2022 to FY2023.

In Q3 2024, PepsiCo outperformed Q2 2024 at the top line, raking in $23,319 mn compared to the previous fiscal quarter’s $22,501 mn. Its Q3 revenue was also a significant step up from Q1 2024, where it only generated $18,250 mn. I would interpret this consistent rise in revenue as a sign of PepsiCo’s new “positive choice” F&B products’ popularity with the masses, and would base my future revenue assumptions on such consistent growth.

However, PepsiCo’s bottom line deteriorated in Q3 2024. SG&A expense rose significantly from $7,285 mn in Q1 2024 to $8,534 mn in Q2 2024, and finally to $9,051 mn in Q3 2024. As a result, operating income (EBIT) fell from $4,048 mn in Q2 2024 to $3,872 mn in Q3 2024. Net Income also fell by $153 mn QoQ. The rise in SG&A and consequent fall in EBIT and NI are consistent with the rise in commodity prices, especially energy prices. In my investment thesis, I will substantiate why I believe that the company’s margins will improve in future.

While PepsiCo’s Q3 financial results are not ideal, they still beat earnings and have room for improvement. I opine that the company’s prospects are not fizzing out.

Industry Overview

PepsiCo operates in the ultra-competitive non-alcoholic beverage industry (consumer staples sector) and has the second-highest market share behind The Coca-Cola Company. Other beverage and convenience food competitors include Keurig Dr Pepper Inc, Nestle S.A., Monster Beverage Corporation, and Kellanova amongst others.

Estimated at a market size of $1,223.93 billion in 2023, the global non-alcoholic beverages market is expected to grow at a CAGR of 7.4% from 2024 to 2030.

The retail landscape is highly cyclical and dependent on myriad factors – the economic climate, shifting tastes & preferences, trends, industry consolidation, and digitisation. To maintain its market share, PepsiCo has to compete with its rivals on all fronts. PepsiCo has been able to keep pace with The Coca-Cola Company in the U.S. liquid refreshment beverage (LRB) industry, accounting for 19% and 20% of retail sales in 2023 respectively. However, PepsiCo’s slice of the foreign CSD pie remains significantly underwhelming. Therefore, PepsiCo has had to rely on strategic acquisitions of many convenient food brands to maintain its leading position in the retail industry. Expanding into other subsectors of the retail landscape has been a successful gamble for the company. With a plethora of brands under its belt, its revenue streams are highly diversified geographically and operationally.

Industry Trends

More recently, the industry has been shaped by growing consumer health consciousness, environmental consciousness, and preference for direct-to-consumer sales channels.

Health Consciousness

Consumers aiming to live a healthier lifestyle prefer food and beverages low in sugar, sodium, and fat. This diet change has incentivised the industry to shift towards producing healthier alternatives, or risk losing market share to their competitors. The growing consumption of weight loss drugs is, in my view, the biggest current headwind to the industry, under the assumption that patients will avoid consuming CSDs and unhealthy convenience food while trying to shed their body weight.

Environmental Consciousness

Consumers have also become more conscious of their carbon footprint, and prefer environmentally and ethically sustainable products (2020 McKinsey US consumer sentiment survey). Consider how fast fashion has fallen out of style with eco-friendly consumers in recent years – brands such as H&M and Zara have been accused of greenwashing and contributing heaps of textile waste. The use of non-recyclable and non-biodegradable plastics by companies such as Starbucks and McDonald’s has also drawn criticism.

Rise of DTC Channels

The growing want for convenience has also engendered the preference for direct-to-consumer sales channels, namely e-commerce platforms which provide delivery services. Should there be another pandemic lockdown, F&B companies that are quick to roll out their e-commerce applications and direct-to-consumer initiatives will be well-poised to catch a windfall.

Porter’s Five Forces Analysis

Industry Rivalry

Strong – With hundreds of different LRB and CSD options on the shelves, consumers have little to no switching costs, and are spoilt for choice. Brand loyalty is not a significant factor for revenue stickiness in the beverages and convenience food industry, as consumers have ever-changing taste buds and will consume whatever quenches their thirst and satisfies their hunger. PepsiCo’s competitors are also aggressive in their marketing and promotions, with regular discounts to encourage sales. Firms are extremely acquisitive in the industry, with larger firms always on the hunt for smaller players to integrate horizontally with. There is a high rival consciousness in the industry.

PEP is no stranger to competition – decades of competing with other F&B giants on the shelves have led to an ever-present need for innovation and market savviness. I opine that the key to maintaining (rather than gaining) market share in such a saturated industry is keeping up with the times and responding to changes in consumer tastes faster than, or at least, keeping pace with, competitors. With PEP’s renewed ESG initiatives, the addition of healthy F&B alternatives, and new DTC channels, PEP is unlikely to cave to competitive pressure in this pseudo-arms race.

Threat of Substitutes

Moderate – Pepsi’s LRBs and CSDs are constantly competing with those of other brands. For instance, PepsiCo’s Pepsi cola drinks are direct competitors to The Coca-Cola Company’s Coca-Cola drinks. PepsiCo’s functional hydration beverages, such as Gatorade, are strong substitutes for other brands such as Monster Energy and Red Bull. Furthermore, consumers increasingly prefer unique drinks such as Boba Tea, or healthier alternatives such as fruit juices. Rising health consciousness among consumers threatens the CSD industry – PepsiCo has to continually innovate to offer low sugar and low sodium beverages to protect its market share.

I believe that PEP will only be moderately affected by substitutes such as fruit juices because consumers may prefer the convenience of having a ready-to-drink, albeit unhealthier beverage rather than a blended fruit juice which may be unsweetened but requires the straining and/or blending of fresh fruit. Substitutes to bottled drinks have existed since the dawn of civilisation and yet, the beverage industry has only thrived and ballooned over the last century. PEP will continue to cater to the growing health-conscious consumer base to make the choice between convenient beverages and self-prepared beverages less difficult.

Threat of New Entrants

Weak – The beverages industry is extremely saturated and potential entrants face heavy competition on the shelves. Potential entrants risk having to spend exorbitant amounts on marketing and sales campaigns, while long-established brands have the luxury of higher margins and brand loyalty. Furthermore, initial low popularity means that they will be unable to reap economies of scale. Consider Prime Hydration, a functional hydrational beverage released by internet personalities Logan Paul and KSI. Prime Hydration was initially a hit when it first released in 2022, riding on the popularity of the company’s founders. However, with each bottle being priced as high as $3.50, consumers are shunning it for alternatives that cost only half the price.

Hence, I believe that PEP will not lose a worrying proportion of its market share to these weak attempts at market disruption.

Bargaining Power of Buyers

Strong – As mentioned above, PepsiCo’s customers have the luxury of choice between myriad brands and have minimal switching costs. Furthermore, there is a high level of information in the market regarding pricing and product quality (in the form of nutritional information), so consumers can make their own informed, discretionary shopping decisions.

PEP also has a relatively high customer concentration (as mentioned above in the Business Overview) and depends on the USA for 60% of its sales. Its revenue is thus highly sensitive to consumer demand in one singular country. Any defects or health hazards discovered in its products, even if localized in the USA, would lead to innumerable product recalls, immense inventory write-downs, and unearned revenue. While PEP remains committed to diversifying its customer base by expanding into LatAm and APAC, the USA will likely remain a core division within the next decade.

Bargaining Power of Suppliers

Weak – PepsiCo’s suppliers of ingredients and packaging materials have weak bargaining power due to the diversity of PepsiCo’s supplier base. With operations in more than 200 countries, PepsiCo is able to source for cheap inputs globally, reducing reliance on any single supplier. PepsiCo is also a mass producer, and bulk purchases of factor inputs will lead to favorable terms with its suppliers.

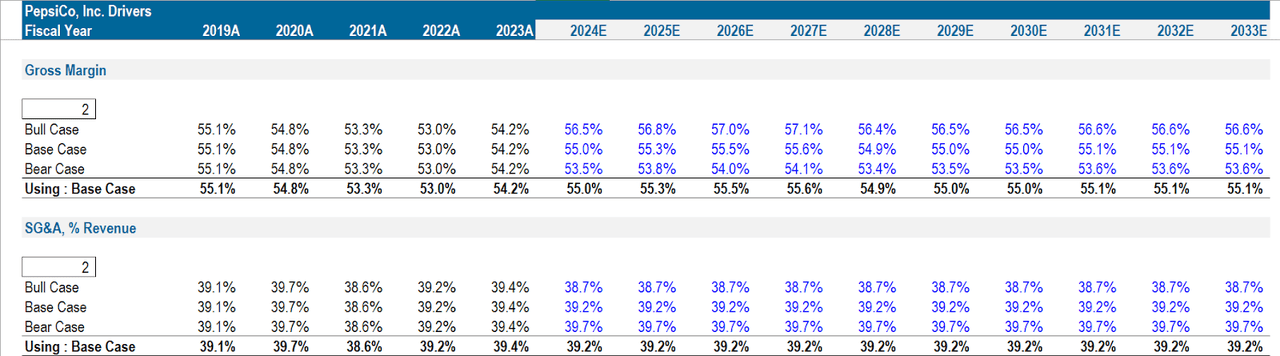

PepsiCo’s SG&A margin will improve due to falling inflation and commodity prices

PepsiCo’s SG&A margin (excluding operating lease expense) rose from 38.6% in 2021A to 39.4% in 2023A, driven by higher commodity prices, inflation, supply chain disruptions, and labor shortages. Commodities such as energy are key factor inputs in the manufacturing and transportation of PepsiCo’s products and have become costlier due to external factors such as the ongoing conflict in Ukraine. While the conflict shows no sign of resolution, global inflation has fallen significantly over the past 2 years and the job market is heating up. The annual inflation rate in the US slowed for a sixth consecutive month to 2.4% in September 2024 and inflation in the Eurozone fell to 1.8% in September 2024 (Trading Economics). However, inflation remains stubbornly high in LatAm and AMESA.

According to Trading Economics, most commodities such as Brent, crude oil, natural gas, heating oil, and ethanol amongst others have decreased by more than 10.0% YoY. Projections of falling commodity prices are supported by Saudi Arabia and OPEC’s plans to hike oil production and drop their $100 per barrel oil price target to win back market share. OPEC+, a consortium of OPEC and its allies such as Russia, intend to raise output by 180,000 barrels per day in December (Reuters).

Considering the various cost factors, I believe that PepsiCo’s SG&A margin will decrease slightly, considering a prolonged conflict in the Middle East and/or Ukraine.

Cost Assumptions (Author’s Calculations)

The hype around weight loss drugs has been overly punitive to PepsiCo’s share price

I believe that analysts are overestimating the impact of weight loss drugs on PepsiCo’s share price. Patients using Novo Nordisk’s Ozempic and Eli Lilly’s Mounjaro have reported severe cravings of junk food and convenient food, contrary to the notion that patients on weight loss drugs will avoid unhealthy food like the plague.

I believe that there is room for the beverages and convenience food market to grow, even in a generation where consumer consciousness about health is elevated. PepsiCo has anticipated this shift in consumer taste and has introduced more positive health choices to its product lineup that use less added sugars, sodium, or saturated fat. The company is also selling “more products with functional ingredients and positive nutrition including legumes, whole grains, fruits and vegetables, nuts and seeds, dairy, protein (including plant-based proteins), fiber, micronutrients and hydration” according to its 2023 Annual Report. In 2023, PepsiCo announced two new ambitious nutrition goals, which aim to further reduce sodium and deliver 145 billion portions of diverse ingredients annually by 2030.

I foresee that health conscious consumers, especially those on weight loss drugs, will satisfy their cravings through PepsiCo’s new healthy food and beverage alternatives.

PepsiCo’s investment strategy enables it to stay abreast of dynamic consumer trends, sustaining its long-term growth

Traditional retailers have to digitize their sales channels or e-commerce channels and hard discounts will cut into their market share. PepsiCo has been investing in its e-commerce platforms and direct-to-consumer channels to appeal to consumers’ growing desire for convenience. It intends to leverage AI models to capture consumer preferences and trends. For instance, brands under PepsiCo such as Tostitos and Doritos had pop-up booths and street vendors in sport and music events, giving high accessibility to consumers.

Catering to growing consumer eco-consciousness, PepsiCo has been developing new packaging designs and technology, reducing plastic usage and adopting recyclable, compostable, biodegradable, reusable, or otherwise sustainable packaging. PepsiCo remains devoted to achieving net-zero emissions and becoming net water positive.

Valuation

PepsiCo is currently trading at $167.85, 91.5% of its 52-week high ($158.03 – $183.39).

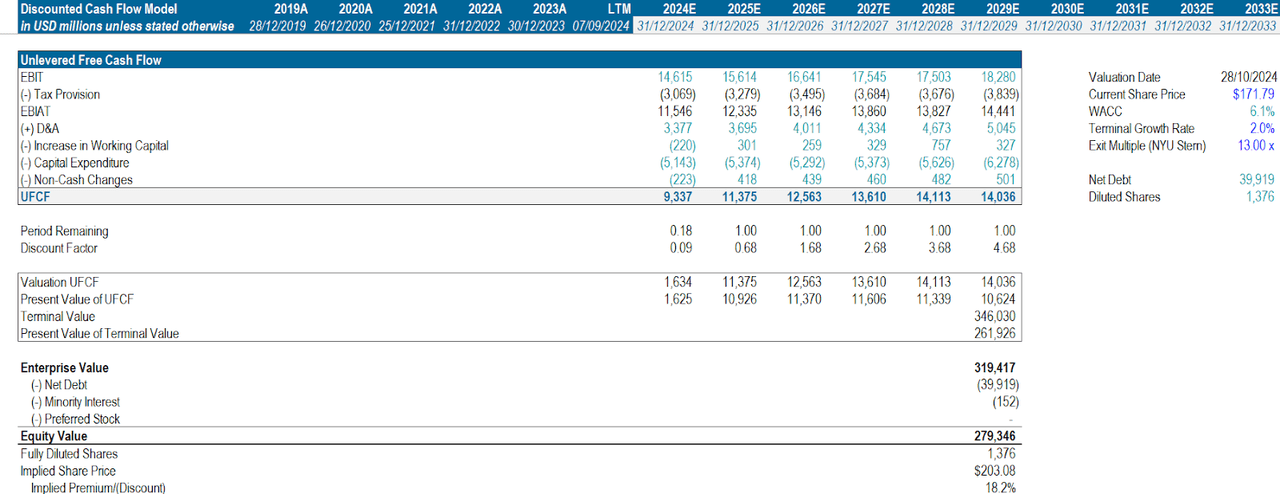

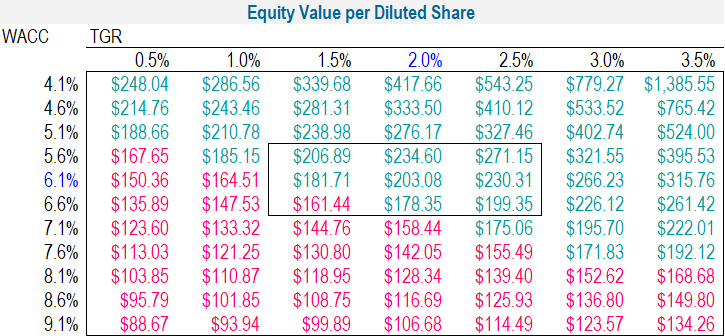

My DCF model yields an implied share price of $203.08, within a range of $161.44 – $271.15 per share under sensitivity analysis to a range of terminal growth rates (1.5% – 3%) and WACCs (5.6% – 6.6%).

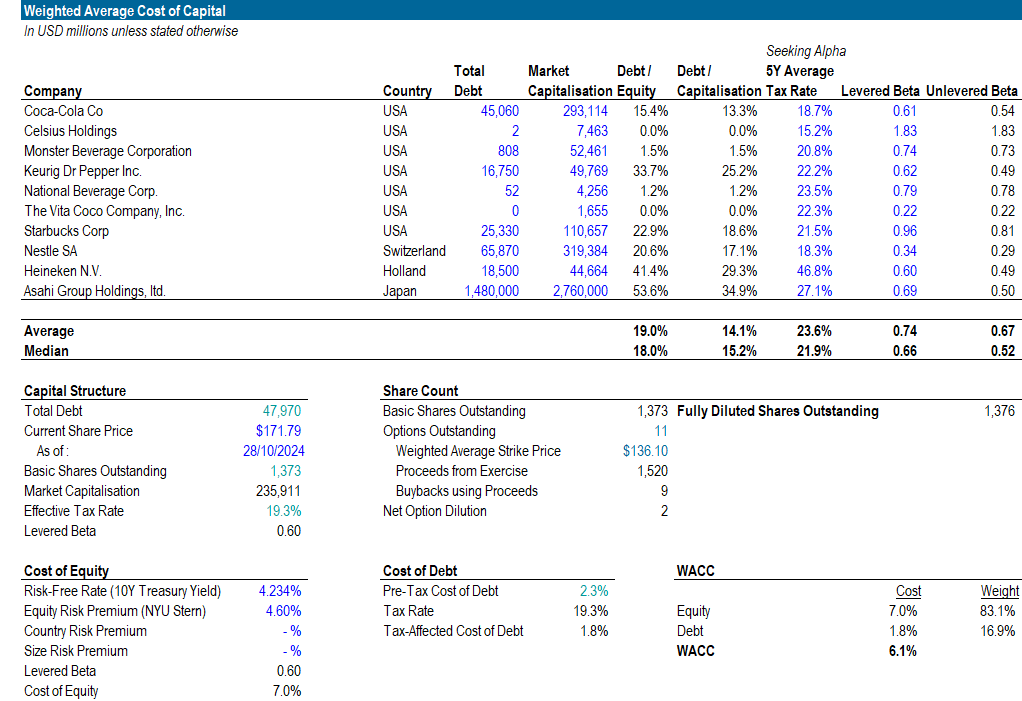

Discount Rate Calculation (Author’s Calculations)

All data in blue font colour are hardcodes that were pulled using online financial data platforms such as Yahoo Finance and the companies’ annual reports. The assumptions such as risk-free rate and equity risk premium are based on the 10Y US Treasury Bond Yield and NYU Stern Professor Aswath Damodaran’s website respectively. Given that PepsiCo is a mega-cap company, I assumed a 0.0% size risk premium, as well as a 0.0% country risk premium given that it is domiciled and operates mainly in the USA.

Enterprise Value to Equity Value Bridge (Author’s Calculations)

I assumed a 2% terminal growth rate, which is a slightly conservative estimate of the US annual GDP growth rate based on its historical data. Although I had forecasted 10 years of financial data (2024E to 2033E), I intentionally stuck to using only 5 years for my UFCF DCF to not inflate my derived target share price.

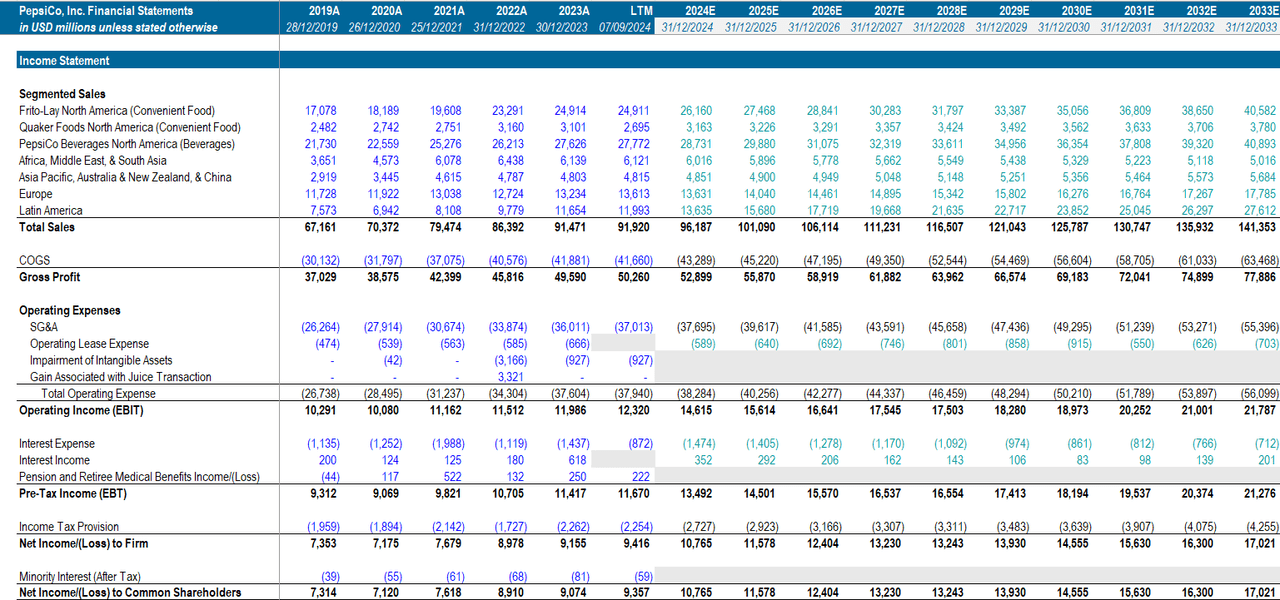

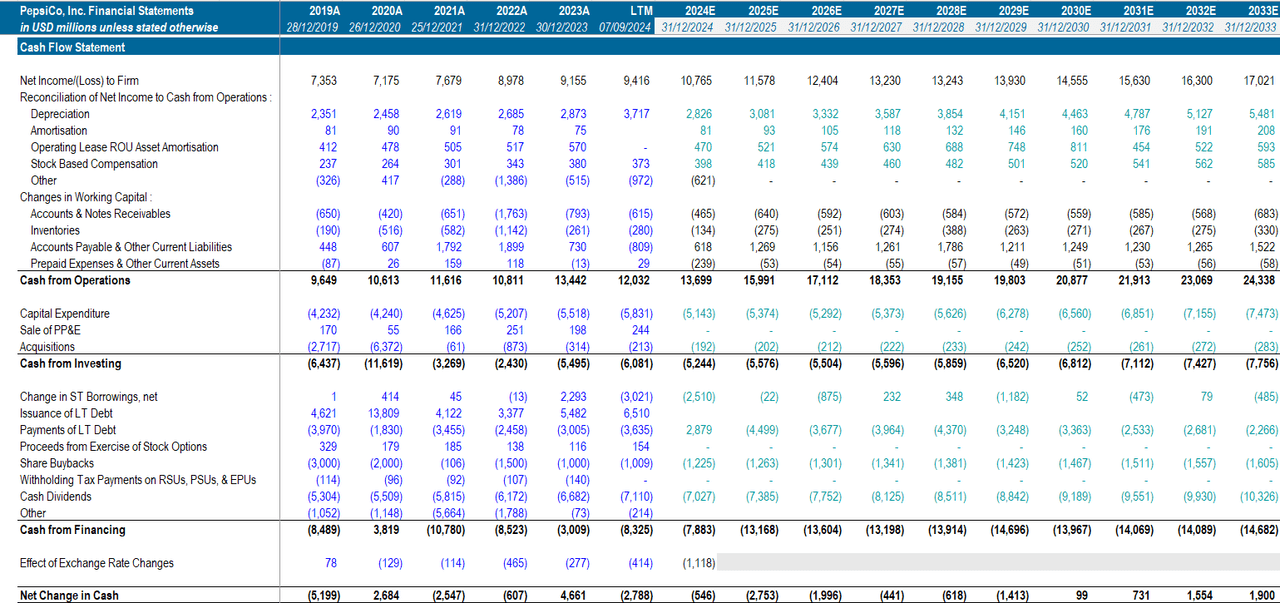

PEP’s track record of consistent, recurring, and profitable cash flows (see Income Statement and Cash Flow Statement tables attached below) reinforced my decision. Had PEP only recently achieved profitability, I would have used all 10 years of forecasted data for my UFCF DCF as a reasonable runway for PEP to reach stable and predictable cash flows.

Sensitivity Analysis (Author’s Calculations) Revenue Analysis and Assumptions (Author’s Calculations)

For my revenue growth assumptions, I either used an average of the historical growth rates and assumed that YoY growth would remain constant, or assumed a slightly LOWER growth rate (than 2023A’s) and assumed that it would remain constant in the future. I acted based on conservatism.

For LatAm’s projections, I assumed that it would be able to sustain a double-digit growth rate (which gradually decreases) for the next 5 fiscal years due to PepsiCo’s nascent expansion efforts in the continent, as well as its track record of double-digit growth rates (from 2021 to 2023 as illustrated above).

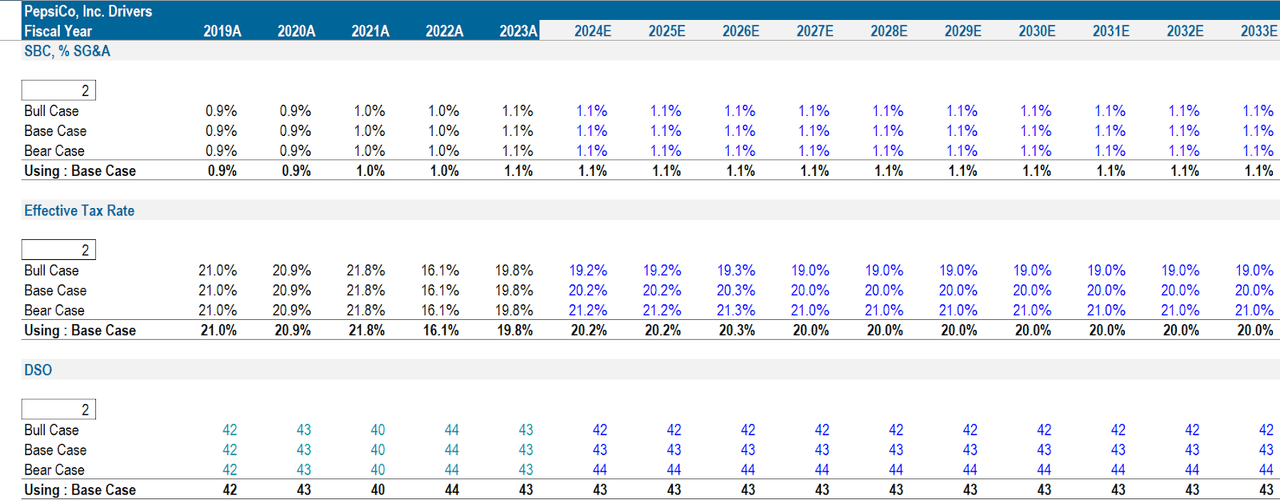

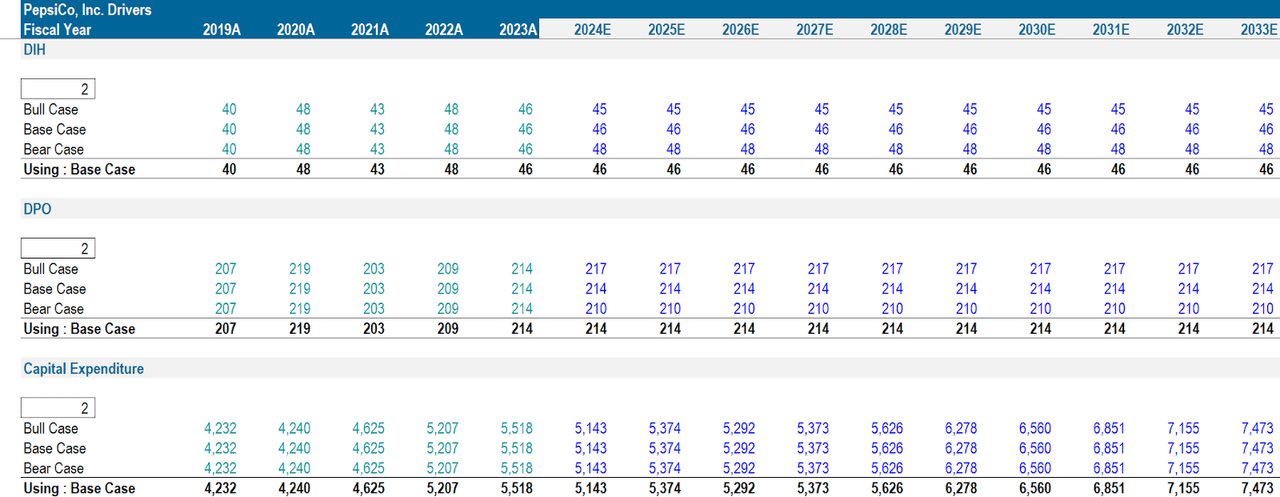

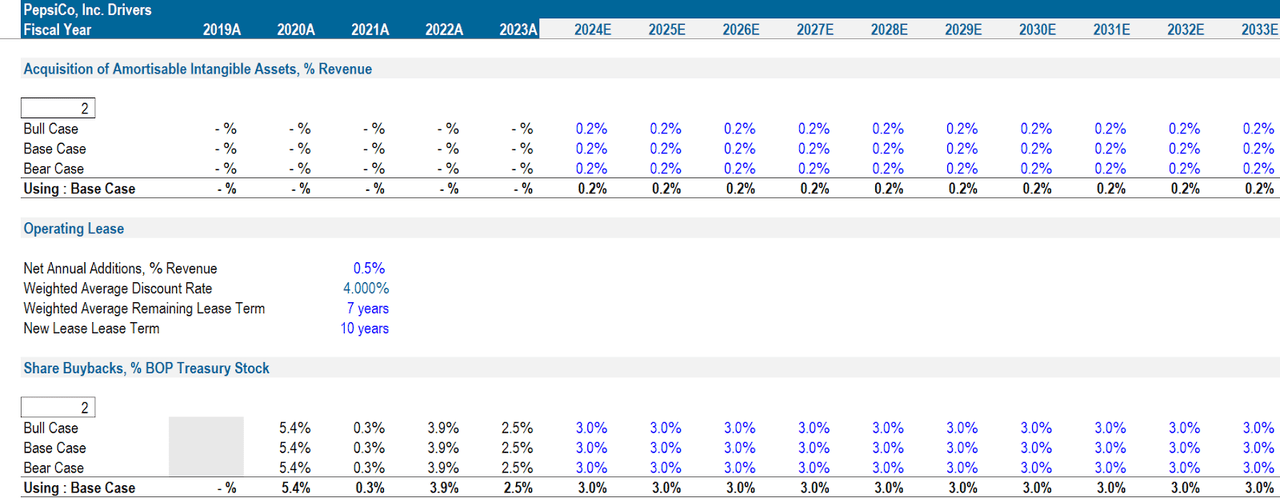

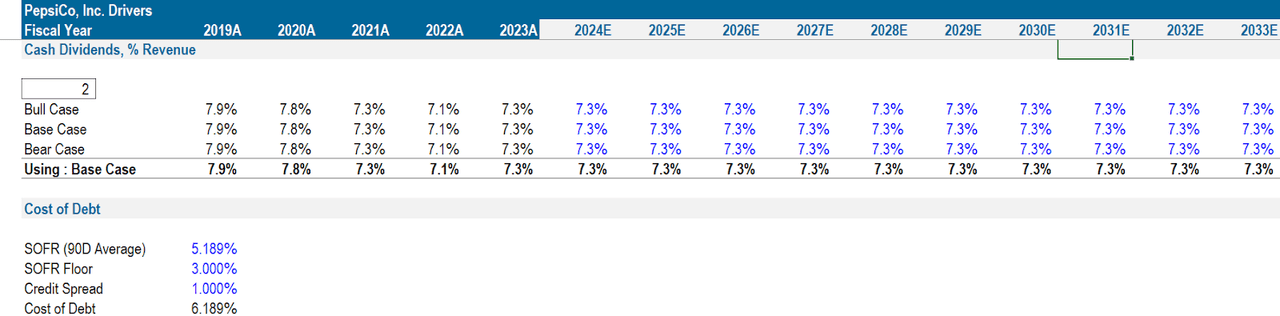

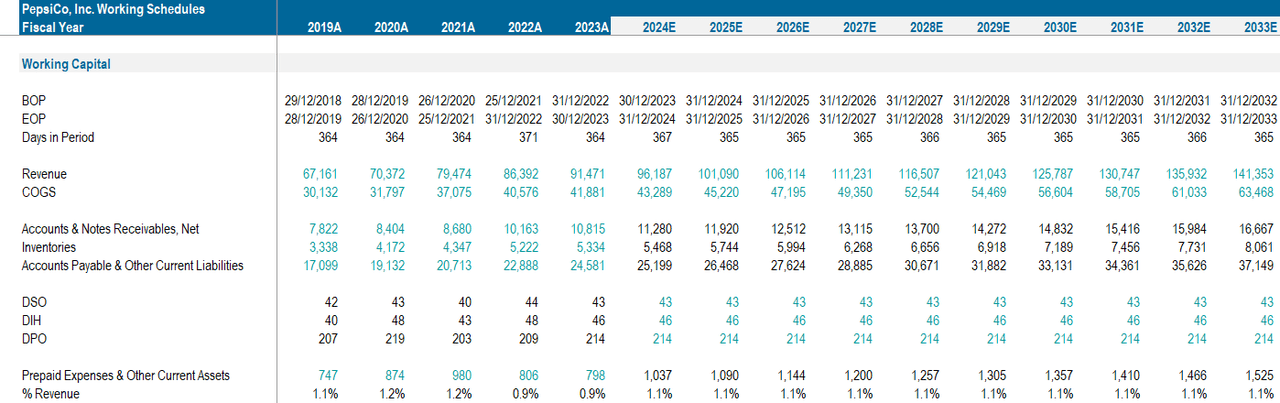

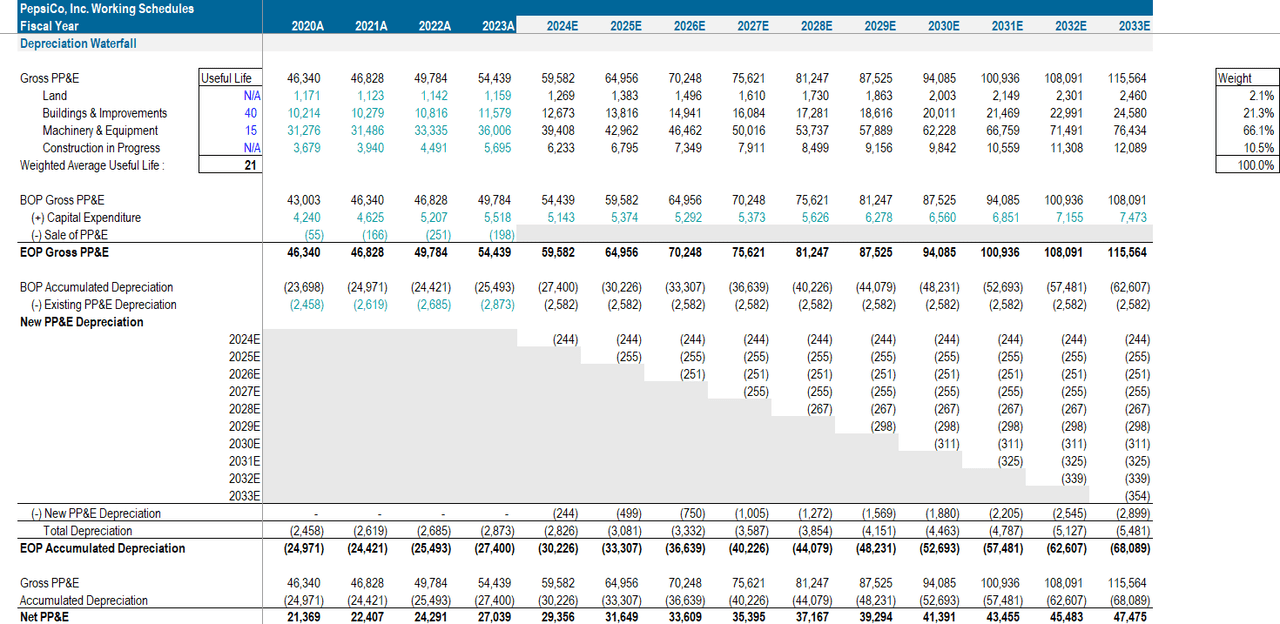

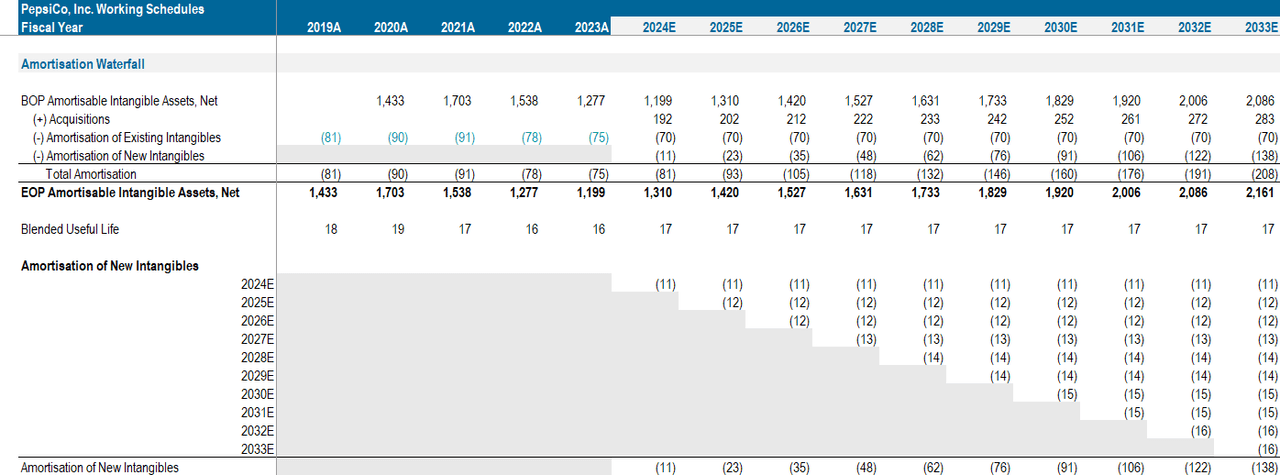

Model Drivers & Working Schedules

Attached below are all the other underlying assumptions that contributed to the building of my working schedules, which in turn resulted in my projected financial statements and DCF valuation.

I assumed that PEP’s stock-based compensation ratio (as a % of SG&A Expense) would remain consistent with 2023A’s while I used a more conservative effective tax rate assumption (ranging from +20bps to +50bps) across the next 10 years. Given that PEP’s days of sale outstanding (DSO), days of inventory held (DIH), and days of payables outstanding (DPO) remain relatively consistent and deviated minimally from 2019A to 2023A, I stuck with 2023A’s DSO, DIH, and DPO throughout the next 10 years. I used Capital IQ analysts’ estimates for the annual capital expenditure forecast.

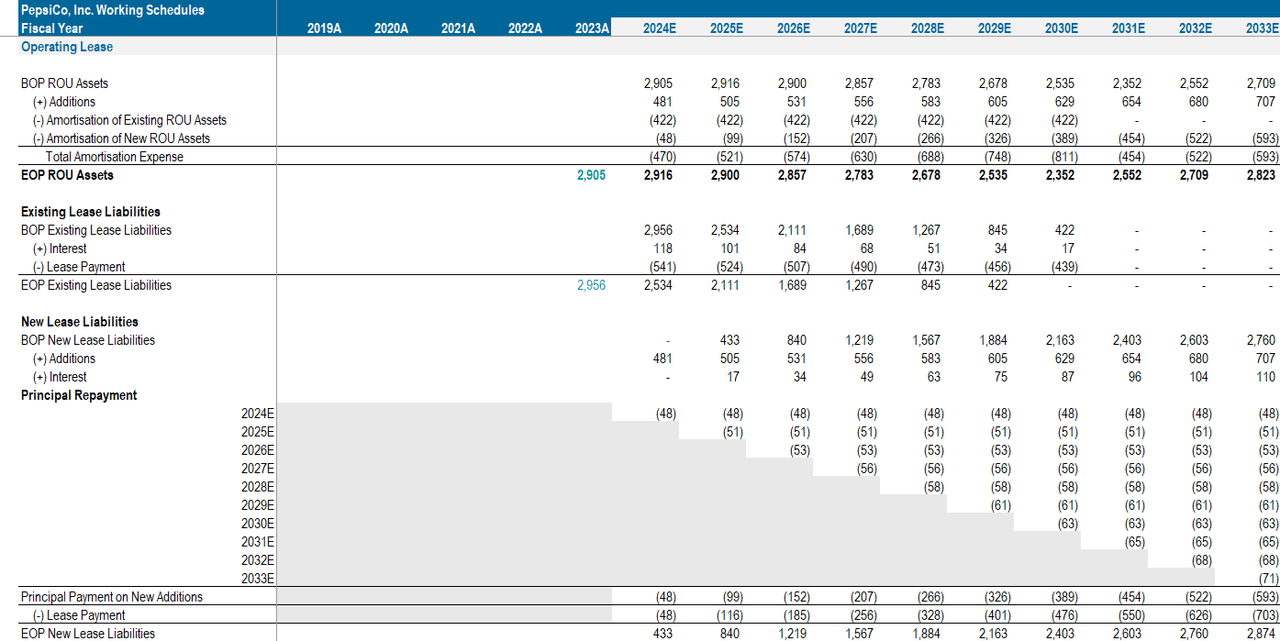

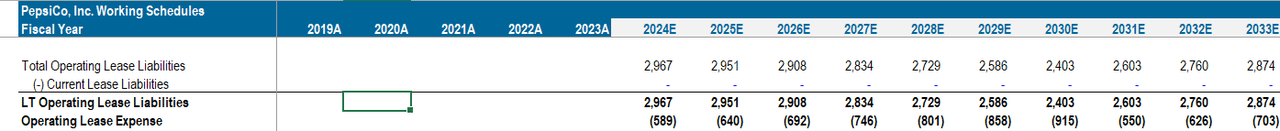

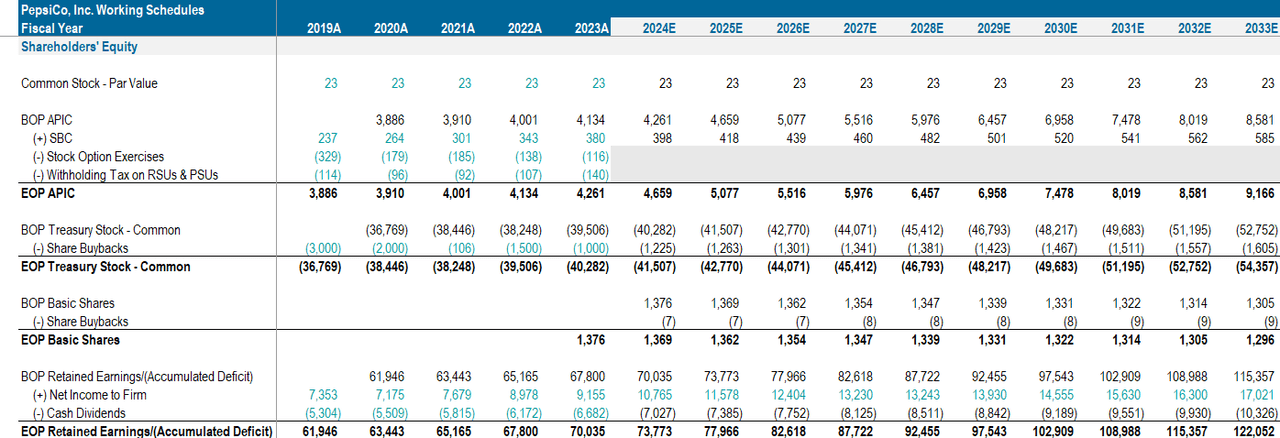

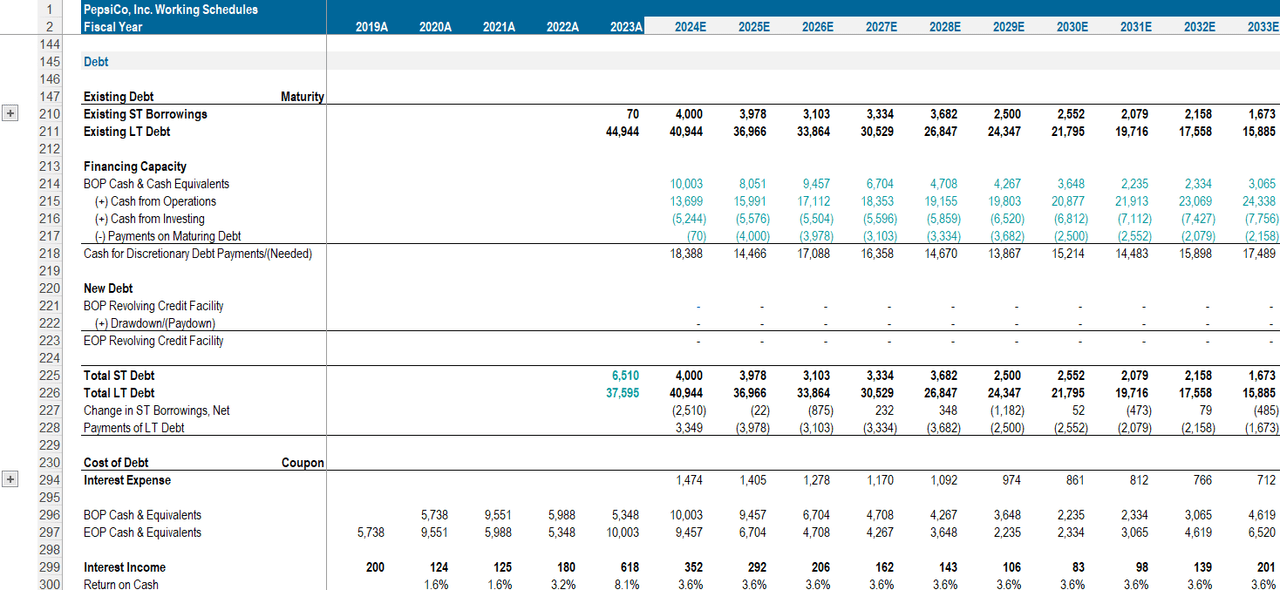

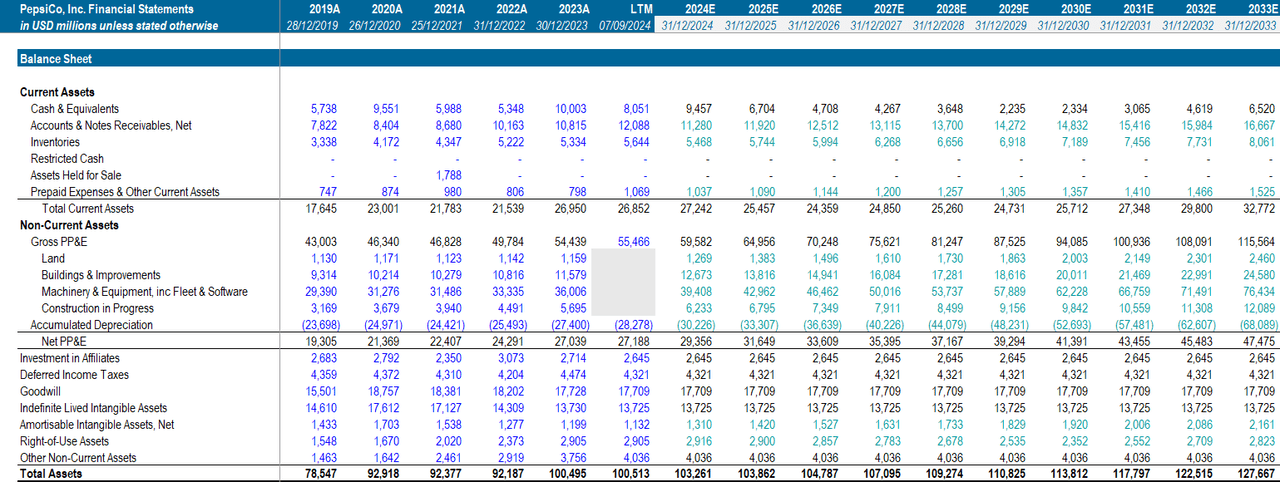

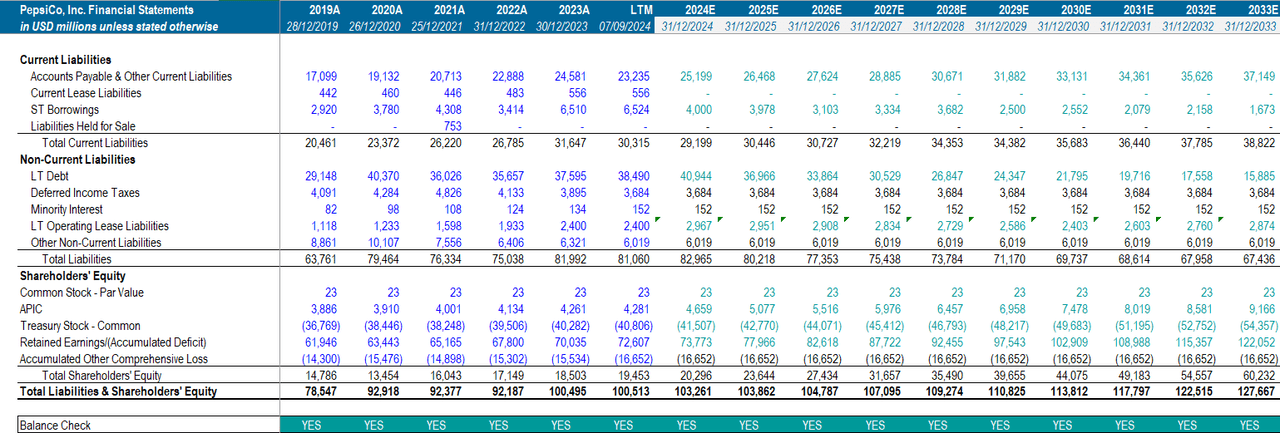

Drivers & Assumptions (Author’s Calculations) Drivers & Assumptions (cont’d) (Author’s Calculations) Drivers & Assumptions (cont’d) (Author’s Calculations) Drivers & Assumptions (last) (Author’s Calculations) Working Capital Schedule (Author’s Calculations) Depreciation Waterfall (Author’s Calculations) Amortization Waterfall (Author’s Calculations) Operating Lease Schedule (Author’s Calculations) Operating Lease Schedule (cont’d) (Author’s Calculations) Shareholders’ Equity (Author’s Calculations) Debt Schedule (Author’s Calculations) Income Statement (Author’s Calculations) Cash Flow Statement (Author’s Calculations) Balance Sheet (Author’s Calculations) Balance Sheet (cont’d) (Author’s Calculations)

Investment Risks

Ingredients found in PepsiCo’s beverages and convenient food products may be found to be unsafe for consumption or mislabelled (high risk, moderate likelihood)

Should PepsiCo sell any products with quality issues or safety hazards, they would have to recall and destroy their products and inventory and would make a huge loss due to the unearned revenue and cost of production. PepsiCo may even have to pay large litigation expenses if taken to court. Customers will also lose confidence in the safety of PepsiCo’s other product offerings, leading to decreased sales volume across the firm’s portfolio.

I believe that this downside risk would jeopardize a long position in PepsiCo. Upon evaluation, I would consider its likelihood to be moderate. On December 15, 2023, PepsiCo announced a product recall of the Quaker Oats North America brand after it discovered a Salmonella infection in its factories. On January 31, 2024, PepsiCo announced an expansion of the previous recall to include additional cereals, bars, and snacks with the potential to be contaminated with Salmonella. On March 9, 2024, PepsiCo also initiated a voluntary recall of some sugar-free and caffeine-free Schweppes Ginger Ale products because they contained full sugar.

Thus, given PepsiCo’s prudence in identifying product quality issues and safety issues and voluntary recalls, I believe that the likelihood of such an issue impacting its business is moderate instead of high.

Damage to PepsiCo’s brand name or image can adversely affect its business (high risk, low likelihood)

Socially or ethically reprehensible acts done by PepsiCo could lead to a boycott of its products, diminishing sales.

As mentioned above, PepsiCo’s commitment to implementing ESG initiatives and avoiding controversy reduce the likelihood of having its reputation damaged.

Conclusion

In essence, I anticipate refreshing returns from PepsiCo, and I would recommend readers to take a long position in its stock. A telltale sign or investment catalyst that I would look out for would be the decline in quarterly SG&A (and also the improvement in quarterly Net Income).

Having examined the core operations and results of the company, and the industry trends that PepsiCo is well-poised to capitalise on, I believe that the company’s stock is overlooked and undervalued.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.