Summary:

- PepsiCo is selling for one of its richest valuations ever in January 2023, using enterprise value calculations and comparisons to overall inflation.

- Previous recessions have created struggles for growth, with actual EPS declines in the last 3 economic contractions.

- I rate this defensive leader a Sell, until price retreats enough to produce smarter valuation support.

Joe Raedle/Getty Images News

I have written on PepsiCo (NASDAQ:PEP) several times over the years with a bullish slant. Currently, however, I am less enthusiastic about its immediate prospects for two reasons. An excessive valuation on slowing growth is the primary reason for concern. And, my second worry is a recession this year could send income levels in reverse, at least for a year or two. My investment conclusion is a 15% to 20% drop into the $130 to $145 share range may be on deck, which may not occur until the autumn months. At that point, after the dimensions of the recession are clearer, Pepsi may be in a stronger position for investor purchase.

My risk/reward analysis review is near-record enterprise value overpricing and a free cash flow yield far below the prevailing rate of CPI inflation are worries not easily remedied without a big share price decline, during a likely recession. To a degree, Pepsi may be sitting at a double-whammy inflection point of peaking valuations and underlying operating results. I am torn, giving the company a Hold rating. So, I will go out on a limb and put a Sell view on the stock for a 12-month outlook. A mild selloff during the year is the most probable scenario, in my opinion.

Valuation Remains Steep

My biggest gripe with Pepsi is the stock is absolutely overvalued vs. decades of historical comparisons. It usually sits at a premium valuation to the S&P 500, but I fear the premium today is not entirely warranted during a possible contraction in sales and earnings.

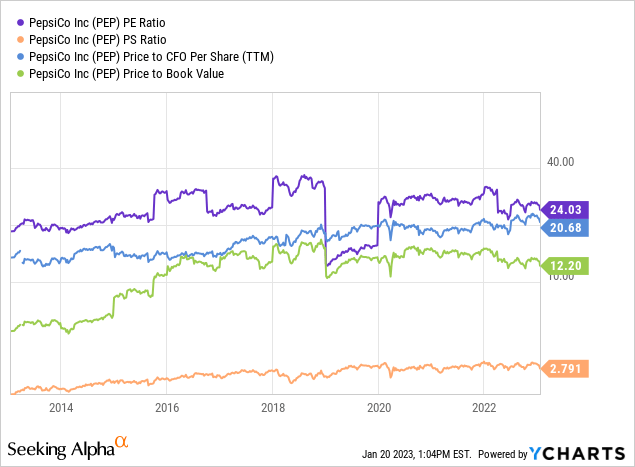

When we review “basic” fundamental ratios over the last decade, Pepsi looks expensive, but not dramatically in excess. On price to trailing earnings (24x), sales (2.8x), cash flow (20x), and book value (12x), the company holds roughly the same setup as early 2018. It also sits in the 70th percentile for a 10-year valuation, which could be overcome with above-average company growth.

YCharts – PepsiCo, Price to Trailing Earnings, Sales, Basic Cash Flow & Book Value, 10 Years

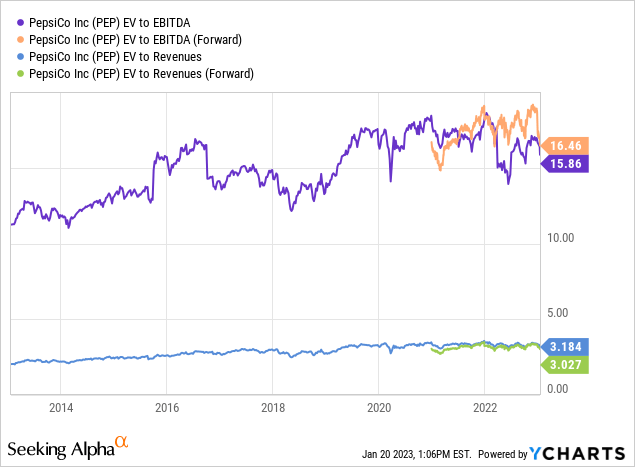

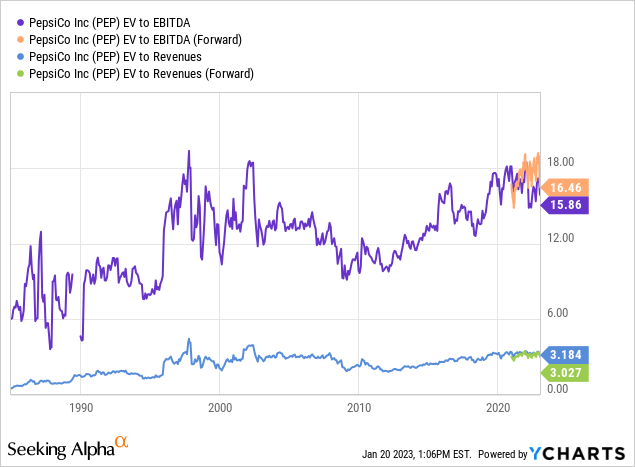

However, when we include expanding debt totals, and a cost-structure cut to the bone, enterprise value calculations highlight a truly extreme price for new buyers. On EBITDA (16x) and revenues (3.1x), measured over decades since 1986, Pepsi may be a screaming and leading Avoid choice today. Over the last 36 years, Pepsi has been more expensive than today only 2% of the time (putting EV to EBITDA and sales together in combination)!

YCharts – PepsiCo, Enterprise Value to EBITDA & Revenues, 10 Years YCharts – PepsiCo, Enterprise Value to EBITDA & Revenues, Since 1986

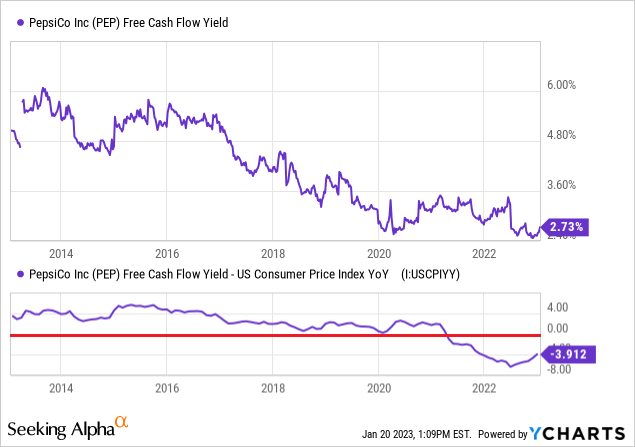

Perhaps of greater immediate concern is Pepsi’s free cash flow yield is failing to keep up with general CPI inflation. Why do you want to invest in a business delivering less money in your pocket than cost-of-living increases? This has been a huge problem for the whole U.S. equity market since 2021, and I have explained this idea over and over again as a total drag to price (especially in the Big Tech space on Wall Street).

Below is a 10-year graph comparing the theoretical business return to a single owner looking at actual repeatable cash flow, not needed by operations to keep the lights on, as a function of the price to own that cash flow (2.7%). While Pepsi (and most all large U.S. equities) have been able to at least cover the rate of inflation with free cash flow as long as I have invested, the 2021-present setup is a large NEGATIVE number. Today’s -3.9% real rate of return with YoY inflation at +6.6% is not acceptable to me.

The stocks I choose to invest in MUST be able to deliver a cash return above the inflation rate, either this year or next, for me to have any mathematical, common-sense interest in owning the asset. Maybe I am old fashioned, but the math is the math.

YCharts – PepsiCo, Free Cash Flow Yield vs. CPI Inflation Rate, 10 Years

Using the extended EV stats and a minimum free cash flow yield vs. inflation yardstick for investment decision-making, Pepsi should be avoided for the time being. You may disagree, but a reset of the valuation to properly account for operating risks and the potential for even higher inflation rates a few years out is only possible with a sizable share price cut.

Recessions Do Drag Down Results

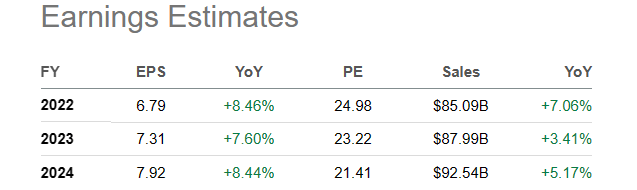

The rotten valuation setup is only part of the bear argument. The other point to seriously contemplate is Pepsi may be on the verge of disappointing income and sales results in 2023-24. Current Wall Street analyst estimates may prove quite rosy in retrospect, depending on the severity of a looming recession (indicated by the inverted Treasury yield curve from Q4 2022 into today, which I have discussed at length in other articles).

Seeking Alpha Table – PepsiCo, EPS & Sales Estimates for 2022-24, WS Analyst Consensus, January 20th, 2023

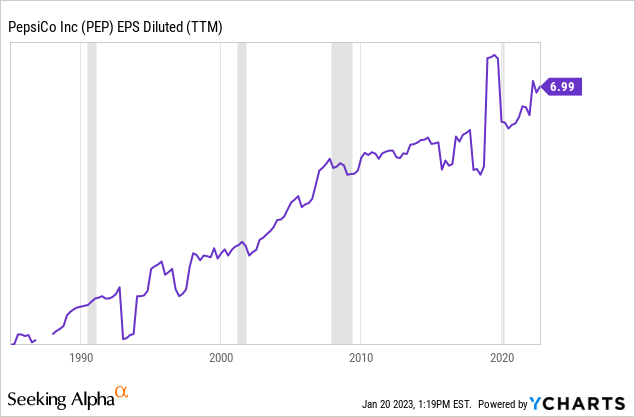

Sure, Pepsi is a defensive play, where junk food sales hold up relatively well during economic contractions. Yet, it is such a large enterprise, recessions have normally been able to create somewhat weaker sales and earnings for the company. Here’s the track record (pictured below). The company was able to generate slight EPS growth during the 1990-91 recession, but overall income results were hurt by the 2001-02, 2007-09, and 2020 recessions.

YCharts – PepsiCo, Earnings Per Share Since 1986, Recessions Shaded in Grey

Final Thoughts

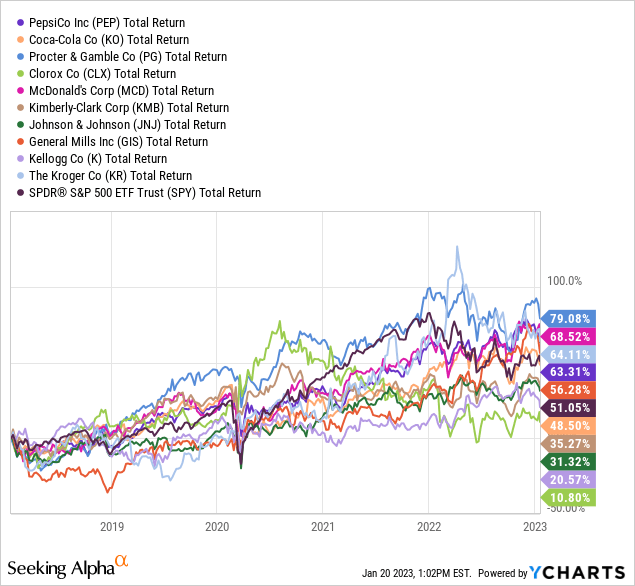

Pepsi has been a solid performer over recent years. On a 5-year total return chart (2.7% current dividend yield), shares have outperformed (with a +63% advance) both its main competitor Coca-Cola (KO) and the popular SPDR S&P 500 Index ETF (SPY), while outlining equivalent or better gains vs. the vast majority of consumer staple/food manufacturers like Procter & Gamble (PG), Clorox (CLX), McDonald’s (MCD), Kimberly-Clark (KMB), Johnson & Johnson (JNJ), General Mills (GIS), Kellogg (K), or grocery-store giant Kroger (KR).

YCharts – Major U.S. Consumer Staples, 5-Year Total Returns

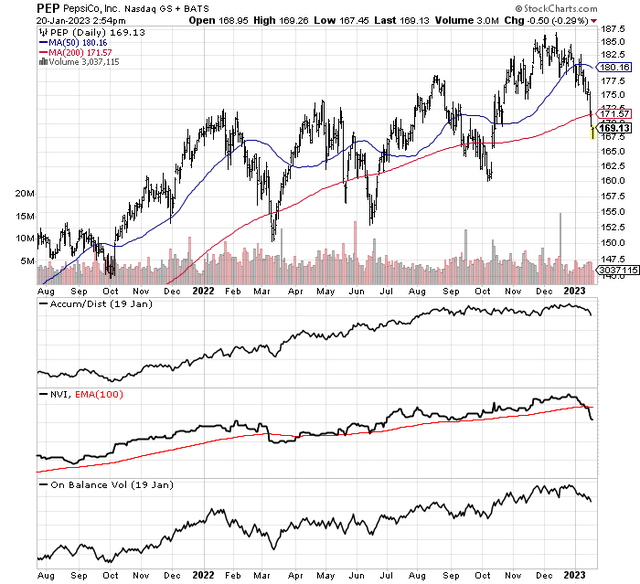

But, this trend of outperformance may be ending. The latest weakness in PepsiCo’s stock price during January is very concerning. It is possible the top for 2023 is already in place, ushering in a zigzag lower this year. Declining below the 200-day moving average is always the first step to check off on your technical pattern watch box, before bigger quote drawdowns appear. Does this guarantee Pepsi will be a major loser in 2023? No, however, the reversal in many of my favorite momentum indicators seems to confirm the selloff is more than a garden-variety retracement. I rank it as the worst selloff since February-March of last year.

StockCharts – PepsiCo, 18 Months of Price & Volume Changes with Momentum Indicators

I have no interest in either being long or short shares. If you have owned Pepsi for many years, selling is an option, assuming you can deal with the tax bill. Otherwise, I suggest investors desiring a long-term position avoid the stock until lower prices appear. For example, a drop under $150 a share coinciding with a slide in CPI rates under 4% (not guaranteed) and improving free cash flow generation by the autumn (which will be difficult to accomplish in a recession), would deliver a significantly better argument/environment to own the company. To me, owning risk-free cash returns of 4% to 4.5% presently is a wiser choice.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author’s opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author’s best judgment at the time of publication, and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.