Summary:

- Pepsi faces persistent headwinds, including financially-constrained consumers, product recalls, and higher capital spending, impacting cash flows and putting its long dividend streak at risk.

- Despite some revenue growth in Beverage North America and Europe, overall revenue missed estimates, and management revised organic growth expectations to low single-digits.

- Pepsi’s acquisition of Siete aims to tap into the Gen Z market and healthier snack trends, potentially boosting long-term growth despite current challenges.

- With limited upside at current prices and a forward P/E of 21.59x, I rate Pepsi a hold until its segments show improvement.

MoMo Productions/DigitalVision via Getty Images

Introduction

PepsiCo (NASDAQ:PEP) is a fairly new holding in my portfolio. As a conservative investor who also focuses on growth, I thought what better company to add than Pepsi. They have faced their fair share of headwinds, which I’ll discuss later in the article.

Most of us buy equities with hopes of nice price appreciation along the way. However, even those considered to be of the highest quality go through tough periods of underperformance, which seems to be the case for Pepsi currently.

In this article, I discuss the company’s latest third quarter earnings, dividend safety, and why share price appreciation is likely to remain stagnant until the company gets back on the path to growth.

Previous Thesis

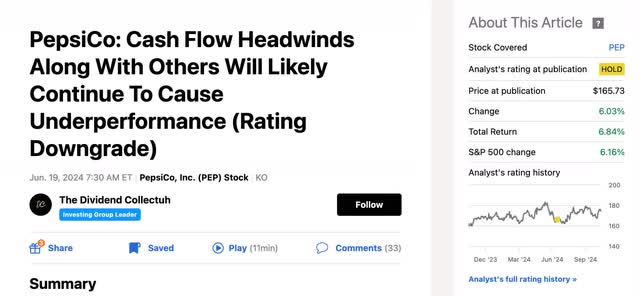

I last covered the snack giant roughly a month before reporting their Q2 earnings in July, where I downgraded them to a hold. Since then, the stock has traded roughly in line with the S&P, up 6.03% compared to 6.16% for the index.

Due to financially constrained consumers as well as product recalls, PEP had a tough first quarter, specifically within some of its segments. This, along with higher capital spending, has suppressed the company’s cash flows, ultimately putting their long dividend streak at risk in my opinion.

During Q1, their cash flows had been negative, failing to cover its dividend for the quarter. But management increased the dividend by roughly 7% to $1.355, a testament to management’s confidence going forward. I also discussed that I assumed they would be able to cover the dividend for the full year with its cash flows, similarly to 2023.

Fastgraphs had an end of year price target of $199.49 for the beverage maker, which, I assumed, was a bit too optimistic considering the company’s then, and still existing headwinds. As a result, I had a price target of $177, slightly above the current share price of $176 at the time of writing.

Headwinds Still Persist

As previously mentioned, during Pepsi’s Q3 earnings announced earlier this month, headwinds within some of the company’s segments were still an issue. Particularly within their snack segments, Frito-Lay North America and Quaker Foods North America.

Year-over-year both segments saw revenue decline. In their Frito-Lay segment revenue declined 1.1%, while the Quaker Foods segment saw revenue decline double-digits by 13.25%. In the chart below, you see how their segments performed, likely due to higher for longer interest rates continuing to place downward pressure on consumer financials.

|

Q3’24 |

Q3’23 |

|

|

Frito-Lay North America |

5,888B |

5,954B |

|

Quaker Foods North America |

648M |

747M |

This has been an issue for the beverage and snack giant for a while now, but the question remains, how are they going to combat this issue? Inflation, despite the FED 50 basis points cut in September continues to be an issue, especially food inflation. And if this persists, it will only continue to be a headwind for Pepsi going forward.

One way I think Pepsi will look to tap into growth is by targeting Gen Z consumers. The Coca-Cola Company (KO) has seemingly been light years ahead in this category. I discussed how KO was targeting Gen Z consumers, and how this should propel growth moving forward for the company in an article you can read here.

Pepsi CEO discussed this during earnings:

If we think about the long-term growth potential of the food business in the U.S., we are very positive about the long-term trends. We’ve seen Gen Z snacking patterns and food patterns being in a way that favors the growth of our category. They are snacking more. They are eating mini meals vs large meals. And that favors our brands and the number of occasions that the category will grow. So long-term, we feel very good about it.

While KO has gotten off to a good start with targeting Gen Z consumers with their Studio X platform created in 2023, Pepsi is making moves with the acquisition of Siete earlier this month, the Mexican-American food maker.

The acquisition is expected to compliment PEP’s portfolio with the additions of Mexican snacks. Additionally, Siete was created to bring awareness to heritage-style Mexican foods. They are also a healthier option being grain and dairy-free.

Before the acquisition, I had never heard of Siete, but being a shareholder of PEP, I decided to give it a try. I can say firsthand their products taste great, and I expect the acquisition to do well moving forward. Especially, since consumers are more health conscious than they were before.

Solid EPS Growth Expected, But Is It Enough?

Pepsi did see some revenue growth in two of its segments, Beverage North America and Europe. Revenue grew slightly from $7.161 billion to $7.175 billion while Europe saw revenue grow from $3.704 billion to $3.946 billion. Additionally, earnings per share managed to beat analysts’ estimates coming in at $2.31, a $0.06 increase from the year prior.

Revenue missed estimates by $460 million at $23.32 billion and declined from $23.45 billion in Q3’23. This was due to gross and operating profits both declining from the year prior. However, management still expects solid EPS growth to $8.15 for the full-year, up from $7.62 in 2023. This is in comparison to KO who expects 5% to 6% growth for the full-year from $2.69 in 2023.

PEP did trim organic growth for the full-year, and now expect low, single-digits from 4% prior. The refreshed outlook was driven by a longer than expected recovery from U.S. consumers as well as geopolitical headwinds impacting their international business as well.

In the Africa, Asia, and Latin America segments, revenue declined in which you see in the chart below.

|

Q3’24 |

Q3’23 |

|

|

Africa, Middle East, & South Asia |

1,552B |

1,615B |

|

Asia Pacific, Australia, New Zealand, & China Region |

1,195B |

1,217B |

|

Latin America |

2,915B |

3,055B |

Dividend Safety & Balance Sheet

During the quarter, Pepsi continued to decrease its share count from the prior year by repurchasing shares. And while this will likely increase earnings going forward as well as their dividend safety, their operating cash flow still saw a decline from 2023. This stood at $6.220 billion during Q3, more than an 18% decline from $7.630 billion the year prior.

Additionally, CAPEX was higher this year at $2.850 billion vs $2.537 billion in 2023. This decreased their free cash flow from $5.093 billion to $3.370 billion. Adding in dividend paid during the quarter of $5.369 billion vs $4.941 billion last year, PEP was not able to cover the dividend with free cash flow during the quarter.

However, they did have ample liquidity on their balance sheet of $7.3 billion. And while I expect Pepsi’s dividend safety to remain intact for the foreseeable future, this is something dividend investors should keep a close eye on going forward. For FY24, PEP expects to repurchase $1 billion worth of shares and pay $7.2 billion in dividends.

According to SimplyWallSt, PEP’s cash flows should be sufficient to cover the dividend for the full year with $10.729 billion expected. Looking out beyond 2025, free cash flow is expected to drop a bit to $10.723 billion, then grow to $11.912 billion by 2026.

The company also had $6.524 billion in short-term debt and roughly $38.5 billion in long-term debt. So, this along with higher capital spending and cost conscious consumers will likely cause dividend safety concerns in my view.

No Margin Of Safety

As previously mentioned, I expect Pepsi’s share price to trade rangebound until investors are confident in the company’s ability to grow going forward. Using Fastgraphs, Pepsi does offer some upside with a price target of roughly $182.

However, I wouldn’t advise buying here with a forward P/E of 21.59x. If you’re looking to invest, the beverage and snack giant offers little upside at the time of writing. Although I’m a shareholder, I purchased Pepsi in the low $160’s and am only looking to add in the $150’s or below.

But comparing Pepsi to Coca-Cola, the former is trading below its peer who has a forward P/E of 24.70x, slightly above PEP’s 5-year average of 24.19x. To be fair, KO has had the much better year, up 28.79% to just 8.21% for the latter.

If Pepsi returns to its 5-year average, this would make them more attractive, offering double-digit upside to a price target of roughly $197. But as previously mentioned, due to their current headwinds, I see little upside until their segments improve.

Risks & Takeaway

Pepsi could also see some downside should the company miss their earnings estimates for the full-year. And with management revising their organic growth for the year down from 4% to low single-digits, this is a real possibility.

Moreover, with inflation, particularly food inflation remaining sticky, this will also continue to cause downward pressure for consumers, ultimately impacting PEP’s segments.

Pepsi has remained resilient this year despite headwinds and seems to be on the right track with the acquisition of Siete earlier this month. This, in my opinion, is a smart move and I expect this to do well as consumers are more focused on healthier snack options.

This will also likely resonate well with Gen Z consumers, likely positively impacting growth in the company’s snack segments. And while Pepsi remains a favorite stock amongst conservative dividend investors, due to their persistent headwinds, negatively impacted cash flows, and little upside expected, I continue to rate them a hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.