Summary:

- PepsiCo is one of the largest consumer goods companies in the USA and is often viewed as a safe haven by investors during times of market volatility.

- Inflation has pinched consumers’ wallets and it looks like PepsiCo’s margins have begun to take a hit.

- Is PepsiCo’s strong EPS growth and returns on invested capital enough to make up for its deteriorating margin profile?

Brandon Bell/Getty Images News

Introduction

As inflation pinches consumer wallets today I’d like to highlight one company that is under increased pressure due to that inflation… PepsiCo (NASDAQ:PEP), one of the largest beverage and snack companies in the world.

Its brands: Lays, PepsiCo, Quaker Oats, Gatorade, and Mountain Dew are known worldwide for their tasty, borderline addictive qualities.

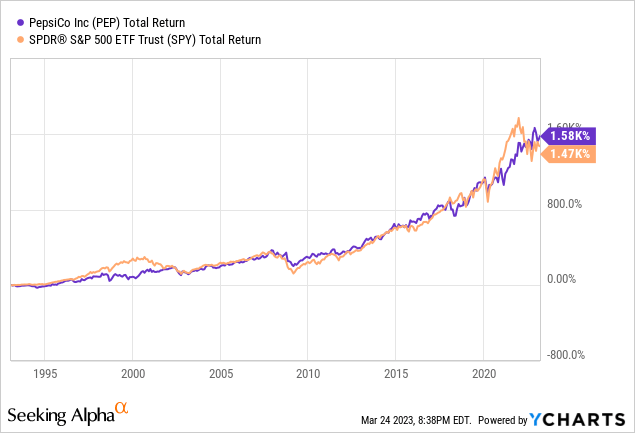

PEP stock holds similar notoriety among investors due to its massive size, at nearly a $250B market cap, and its reputation as a safe investment during times of market volatility. Given the consistent share price performance, even in times of hardship, it’s no shock that investors seem to flock to PepsiCo when doubt is afoot.

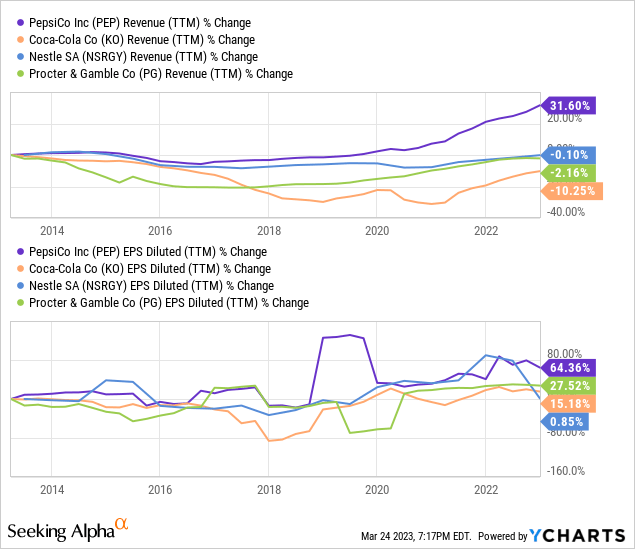

Furthermore, the financial performance at PepsiCo has been strong having demonstrated steady growth over the last decade with revenue growth of 31.6% which is above average for the industry.

Additionally, PepsiCo has achieved impressive earnings per share growth of 64.4% since 2013, which surpasses its peers like Coca-Cola and Nestle (more on this later).

Within this article, I’ll:

-

Provide an overview of the business and recent developments

-

Discuss the financial performance versus peers

-

Highlight the risks facing PepsiCo and discuss where shares could go from here

PepsiCo Overview

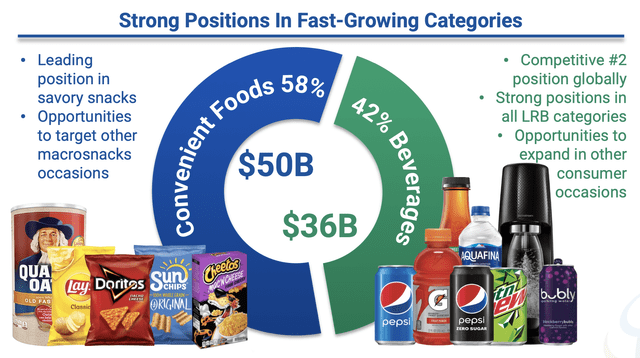

Ah, PepsiCo, what do I really need to tell you about PepsiCo? PepsiCo is the beverage and snack behemoth based in Purchase, NY, home to numerous billion-dollar + brands split among the snack and beverage categories.

Something unique about PepsiCo is that they focus on both food and beverages, companies like Coca-Cola (KO), and Monster (MNST) focus just on beverages while others like Kellogg (K) and General Mills (GIS) cater exclusively towards food.

PepsiCo is unique.

This diversification provides them safety from shifting consumer trends. As consumers shift away from sugary beverages, they may continue to purchase healthy oats from Quaker or sparkling water from Bubly.

Apart from Nestle (OTCPK:NSRGY), PepsiCo is seemingly alone in its “wide-net” strategy to cater to consumers in this way. This unique strategy lends multiple benefits, for example, PepsiCo could negotiate lower advertisement rates for its suite of products, which cover more categories, than a smaller company could while targeting just one niche. Selling multiple products also puts them in a stronger position to negotiate with grocers like Costco, who are notorious for their strong-handed approach to negotiation.

And based on their financial performance in 2022 it seems like the strategy is working…

2022 Performance

Let’s briefly discuss how PepsiCo faired last year which was quite a strong year according to many metrics. They had more than 14% organic revenue growth and 10% growth in core constant currency operating profit. These are the highest growth levels the company has achieved in the last decade. Additionally, the company grew its core constant currency earnings per share by 11%, even in the face of a challenging macro-environment.

The fourth quarter was particularly impressive, with PepsiCo finishing the year strong with 14.6% organic revenue growth. This was the fifth consecutive quarter of double-digit growth for PepsiCo, demonstrating some good momentum.

To support its brands PepsiCo continues to invest heavily in marketing, advertisements, and capital (over $10B last year, per their annual report).

Furthermore, PepsiCo’s announced a 10% increase in its annualized dividend, effective in June 2023, marking its 51st consecutive dividend per share increase. Seeing a company that consistently grows its dividend speaks to the competence of management, and the stability of its business model.

Financials

Now that we’ve discussed what makes PepsiCo so unique and their financial picture last year let’s zoom out and evaluate their financial performance versus peers over a greater time horizon.

Revenue and EPS

PepsiCo has grown its sales by 31.6% over the past decade while peers like Nestle and Procter & Gamble (PG) are relatively flat. 31.6% growth over 10 years is quite slow in most industries but given the stability of the consumer staples industry, this is actually above average and should be counted as a plus for PepsiCo.

In terms of EPS growth, PepsiCo is again, best in class with 64.4% growth since 2013. This compares favorably to Coca-Cola’s growth of just 27.5% and Nestle, which is essentially flat over the ten-year period.

Margins

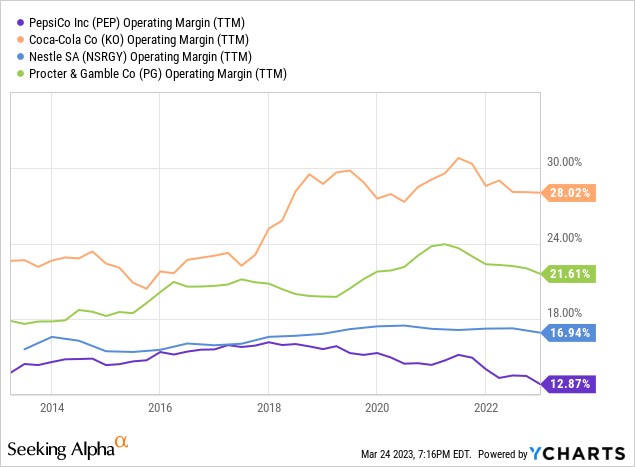

Unfortunately for PepsiCo, it appears that some of its revenue growth is coming at the cost of profitability. While inflation has been a challenge for all companies, few companies are more exposed than consumer staples companies which rely so heavily on commodities and labor. While PepsiCo’s peers have also seen margins decline over the last year it appears that PepsiCo has been hurt especially badly making its worst-in-class margin profile even weaker.

In defense of PepsiCo, while its margins are lower its business is not perfectly comparable to P&G or Coke which have different business models. P&G is focused on non-consumable goods while Coke is focused on beverages but most of its low-margin bottling operations are handled by other companies allowing them to focus on the higher margin parts of the business.

If you’re interested in learning more about how the bottling operation can be a detriment to margins I would suggest you read my latest article on Coca-Cola FEMSA (KOF) where I discuss how the industry is inferior and therefore struggles in the margin arena.

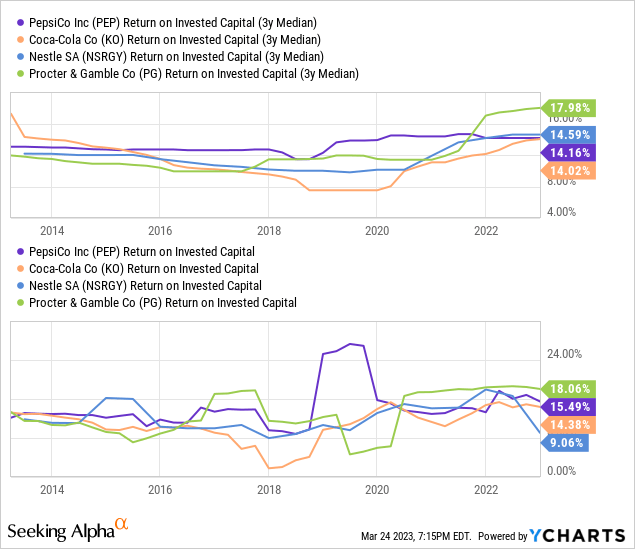

Return on Invested Capital

One strong point for PepsiCo is that they have been relatively efficient capital allocators over the past decade. With a 15.5% 3-year median ROIC PepsiCo has consistently deployed investors’ capital into projects with strong double-digit returns. P&G has also performed well on this metric but they have been less reliable historically to maintain these returns.

My personal benchmark for ROIC is 10%; I want to invest in companies that have a proven track record of allocating capital into projects that yield more than the long-term historical average of the S&P (~10%).

Risks

As far as risks go, the number one risk that concerns me is inflation. Yes, much has already been said about inflation but its effects could seriously harm the business of PepsiCo. In the event of runaway inflation consumers may flee to private-label goods to save money. While I personally believe brands like Gatorade and Doritos are less likely to be replaced for private label goods than toilet paper, for example, it does remain a risk and at a certain price point, it may become a larger issue. PepsiCo already has a relatively weak margin profile so they are especially exposed. If I were in management, I would be looking at lower margin parts of the business, such as manufacturing, and thinking hard if that is a business I would want to be in the longer term.

Valuation and Conclusion

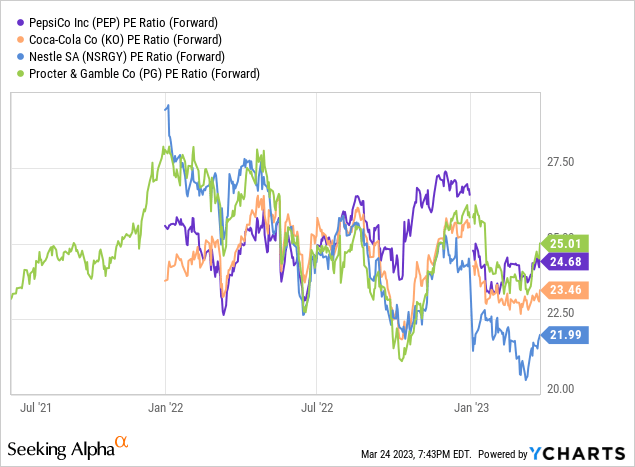

To wrap it up, PepsiCo is a perplexing investment, they have grown revenue and earnings per share faster than its peers and have strong a strong track record for its returns on capital but its margin profile is the weakest and appears to be deteriorating.

On the valuation front, PepsiCo is priced at the top of the heap at 25x forward earnings estimates and in line with its historical average. Given the uncertainty around inflation and the weakening margin profile, I would argue that it should trade at a lower multiple compared to where it traded historically.

Still though, 25x is not especially stretched and they may benefit from a flight to safety from investors during a recession so the downside may be capped.

Ultimately, for all the reasons discussed above, I rate PepsiCo stock a Hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please note that this article is for informational purposes only and should not be construed as investment advice. It is important to do your own research and consult with a financial advisor before making any investment decisions.