Summary:

- PepsiCo significantly outperformed the broader indexes last year as it benefited from soaring inflation.

- The latest earnings results continue to show double-digit revenue and EPS growth thanks to price increases.

- However, inflation is now coming down which should be a headwind for growth moving forward.

- Current valuation also seems elevated on a historical basis.

- I rate the company as a hold.

Fotoatelie

Investment Thesis

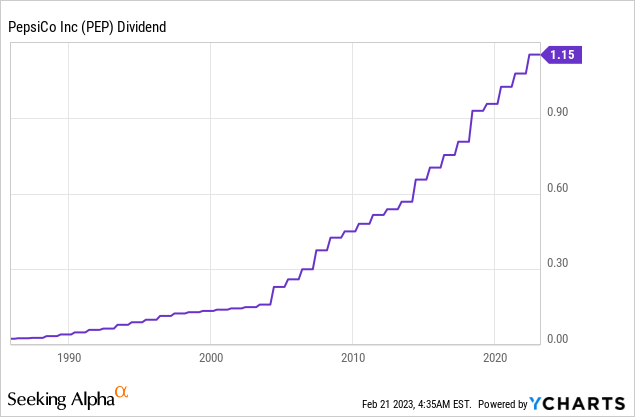

PepsiCo (NASDAQ:PEP) stock is one of the best SWAN (sleep well at night) stocks in my opinion. The company has a diverse product portfolio with some of the most iconic brands in the world. It has consistently grown its top and bottom line and offers a solid dividend yield.

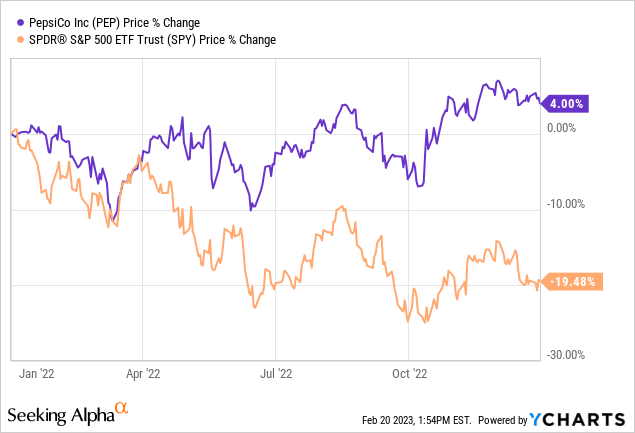

Despite facing a tough macro backdrop, it still managed to grow revenue by 9% last year as inflation significantly benefited its pricing power. This resulted in its share price up 4% during a bear market, vastly outperforming the S&P 500 Index which declined over 19%. However, inflation is starting to come down which should post significant headwinds on pricing. The current valuation also seems quite elevated on a historical basis. I like the company but I do not see further upside potential at the moment. Therefore I rate PepsiCo as a hold and will wait for a better entry point.

Q4 Earnings

PepsiCo announced its fourth-quarter earnings earlier this month and continues to show strong growth thanks to price increases.

The company reported revenue of $28 billion, up 10.9% YoY (year over year) from $25.2 billion. Organic sales growth was 14.6% YoY. The increase is driven by strong traction in Frito-Lay and Quakers. Frito-Lay grew 25% from $6.2 billion to $7.7 billion while Quakers grew 16% from $912 million to $1.1 billion. Most of the increase is contributed by price increases (the company did not provide exact figures), while the volume for convenient foods actually declined 2% YoY as demand weakens.

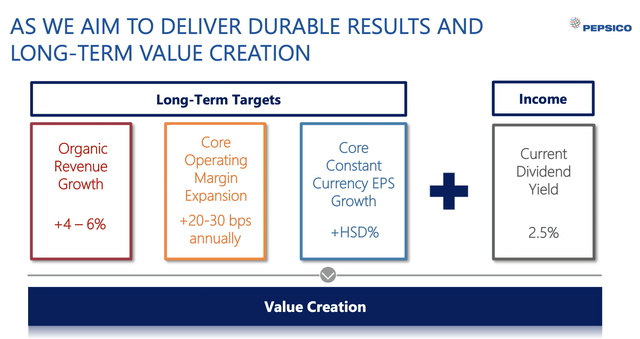

Bottom line growth was in line with the top line. Gross profit margin increased 30 basis points to 50.1% as price increase outpaced cost increase. The core constant currency EPS was $1.53 compared to $1.67, up 10% YoY. The company also initiated guidance for FY23, which is a bit soft as inflation tames. It expects revenue and EPS growth to be 6% and 8% respectively. It also announced a 10% dividend increase in annual dividend from $4.60 to $5.06, representing a forward yield of 2.61%. This marks the 51st consecutive dividend increase which is very impressive.

Unsustainable Price Increases

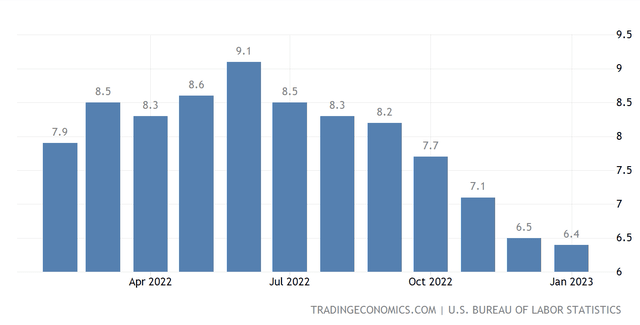

Unlike most companies, inflation has actually been a solid tailwind for PepsiCo in the past two years. Thanks to its strong branding, the company is able to increase prices by a much wider margin compared to the inflation rate. For instance, prices of PepsiCo’s products have increased by double-digit percentages last year compared to the CPI (consumer price index) which peaked at 9.1% in June.

However, price increases are likely coming to an end as the CPI is finally starting to head lower. As shown in the chart below, it has declined rapidly from 9.1% in June last year to 6.4% in January, with further decrease expected throughout the year. The company now has less reason to justify its price increases to customers. While the current inflation rate is still highly elevated, this should still be a meaningful headwind for the company’s pricing due to overlapping effects. Huge price increases are also very unsustainable because they will eventually impact sales volume. In the latest quarter, the volume of PepsiCo’s snacks actually declined by 2% as customers are turning to cheaper alternatives. The company’s growth should start to normalize as the inflation tailwind fades.

Stretched Valuation

PepsiCo’s current valuation seems a bit stretched in my opinion. The company is currently trading at a PE ratio of 27.46x which is elevated on a historical basis. It represents an 8.3% premium compared to its 5-year average PE ratio of 25.36x. For dividend buyers, the dividend yield is also getting less attractive. The current yield of 2.57% is below its 5-year average yield of 2.82%, not to mention the widening spread compared to the 10-year treasuries, which is currently at 3.85% due to rising rates. I think the premium can be justified last year as the company was a solid inflation hedge thanks to strong pricing. However, the tailwind is now gone and growth should start to normalize, as indicated in the latest guidance. With a fwd EPS growth rate of only 8%, I do not think there is further upside from a high twenties PE ratio.

Investors Takeaway

PepsiCo is a high-quality consumer staples company and also a dividend king, but I do not think now is a great time to buy or add. The company benefited significantly from inflation and a lot of growth from the past year has been contributed by price increases. However, inflation has likely peaked and price increases should moderate which will impact growth. Demand is also starting to show some weakness as consumers are getting more sensitive with pricing. The current valuation is also a bit expensive with multiples above its historical average while growth normalizes. Therefore I rate the company as a hold and will wait for future weaknesses.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.