Summary:

- PepsiCo’s current high yield suggests a potential mean reversion, indicating upside for investors despite recent business and macroeconomic concerns.

- Pepsi’s long-term stability, global presence, and strong brand portfolio make it a solid investment, even amid short-term uncertainties.

- Despite recent financial setbacks and lower growth projections, Pepsi’s valuation remains attractive, especially compared to historical P/E ratios and competitor Coca-Cola.

- Initiating a position at around $150 per share offers a fair price, good starting yield, and potential valuation upside for a stable portfolio addition.

Riska

Introduction

The concept of mean reversion is one I consider in times of extreme valuations for a given stock, both to the up- and downside. It’s not a principle I’d make use of for an immature growth company that went through its IPO merely years ago. However, for mature and stable companies, I find it to be quite useful and indicative.

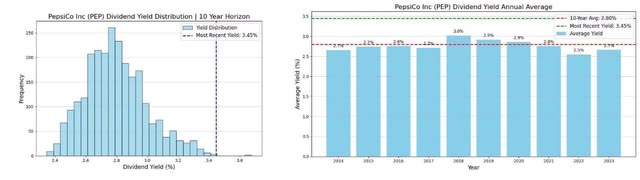

Pepsi Yield Distribution (Dividendclub)

In the illustration above, you can observe the frequency of PepsiCo’s (NASDAQ:PEP) (“Pepsi” going forward) yield over the past decade. 2.8% yield has been its most frequent trading point, while today, the yield is an outlier compared to the average. For mature companies, operating in a predictable environment, their valuation on traditional metrics such as price to earnings, often appear fairly stable, offering the opportunity to consider the idea of a reversion to the mean. Now we arrive at the idea suggesting that if Pepsi is trading at quite a higher yield, it should at some point come back to its mean, indicating there is upside to be had for those investing at the current yield. There is potential trouble ahead for Pepsi, which I’ll come back to later, but what company has not faced uncertainty, especially when as old as Pepsi, just for it to be a blip on the radar over time. There is one important note, which is that this concept doesn’t make sense if the underlying business is deteriorating, which we’ll have a look at later.

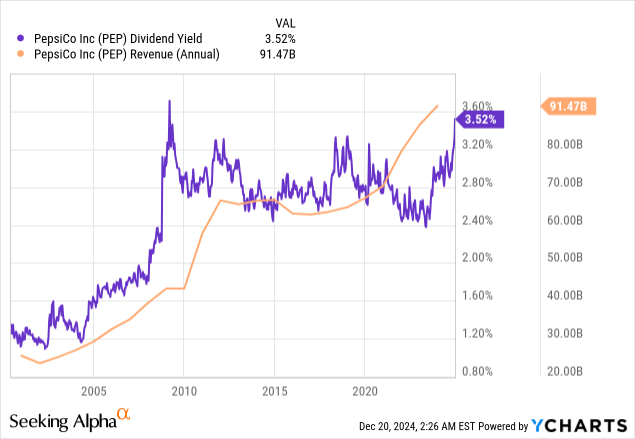

The graph below offers a comparison of business performance relative to the yield graph seen over the past decade. According to this, Pepsi hasn’t offered a better starting yield, except in very extreme occasions, since we entered this millennium (The financial crisis and Covid-19), while all that time steadily growing its business footprint.

Weighing the current opportunity, I need to ask myself one question in particular. Will Pepsi be around in years? Decades? If I find that answer to be yes, and I do, then I arrive at the conclusion that Pepsi stock is currently on sale. Why so? Well, despite being sold in more than 200 countries globally and offering a product everybody knows, dealing in an extremely saturated market, Pepsi keeps growing its revenue. It does so due to significant pricing power and favourable market conditions.

This is, of course, seen from the helicopter perspective, and we need to zoom in a bit to observe the granularity of the situation.

Is It Too Good To Be True? Is There A Reason Why Pepsi Is Offering Its Best Starting Yield In Years?

Rarely does stock’s go on discount unless something is up. The question is then whether it’s something underlying with the business indicating you might be investing into a rotten apple, or whether it’s the market pendulum that’s swinging a bit too far, simply providing one with a good opportunity.

I’m a believer in the second answer to that question in this case, but there are no guarantees, and Pepsi could trade sideways from here and for years to come, or worse, continue its downwards trajectory leading into a continued decline.

Pepsi News Headline After Earnings Q3-2024 (Seeking Alpha)

Pepsi released its most recent financial quarter (Q3-2024) on October 8th and while it delivered a narrow EPS beat, the forward guidance and slowdown in the business caused concern in the investor community, sparking downwards pressure on the stock, resulting in above 6% in lost value since then.

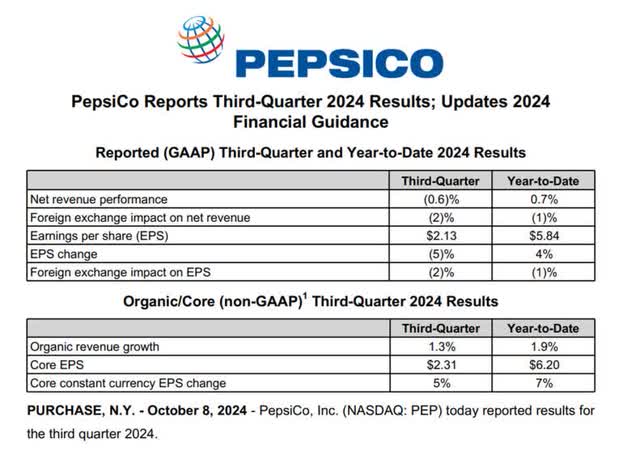

Pepsi Earnings Overview (Seeking Alpha)

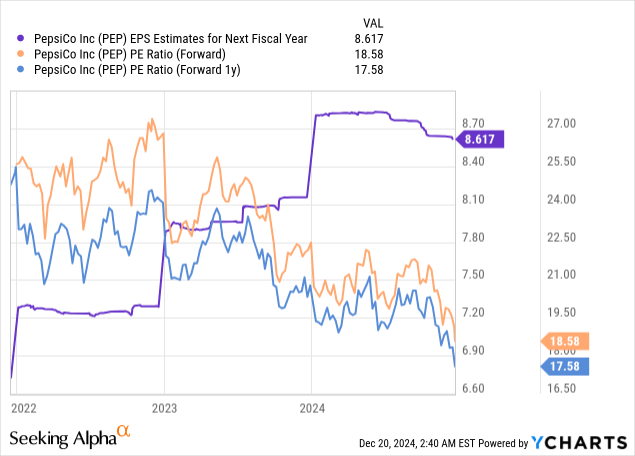

As we can see, this has resulted in a number of downwards EPS revisions and caused general concern related to the growth outlook. That is factual and shouldn’t be twisted or taken lightly, but company growth, no matter the company, was never linear, and it’s these opportunities that can allow investors to make the best of a given situation.

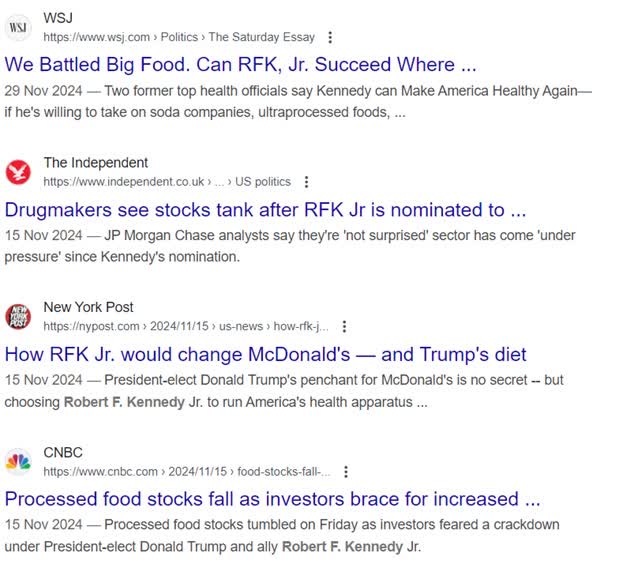

What comes on top, is the new US administration, with growing concern that president-elect Donald Trump having chosen Robert F. Kennedy as his next secretary of the department of health and human services, may drive closer scrutiny amongst companies operating within processed food and beverages. The news landscape is flooded with articles portraying what could be quite a bit of uncertainty for the consumer staple companies out there.

Google Search For New Administration (Google)

It’s therefore clear that Pepsi is currently suffering from concerns related to both its business as well as the macroeconomic environment. Not a great cocktail.

This concern, as any other, is fair, and it is reason enough that the stock shouldn’t trade at a premium, but I would then ask how many times a given company has come under potential scrutiny from an administration who had its own agenda and specific list of wishes coming into, or being in, power. I’m sure we could dig up a number of other similar situations where the media were forecasting doom on behalf of the Pepsi’s of the world. I would then allow myself to question how many times those concerns have turned out to become reality. Personally, I try and solve such a potential calamity via diversification, never overexposing myself to any individual company, after all, I’m no Warren Buffett, and I’d like to reach retirement without risking it all on one bet.

I prefer to stay in the helicopter and look at the facts:

- PepsiCo Inc was established 126 years ago in 1898, employing more than 300,000 people globally.

- Flagship products, just to mention a few, includes Pepsi, Mountain Dew, Lay’s, Gatorade, Tropicana, Quaker Oats, Cheetos, etc.

- PepsiCo products are enjoyed by consumers more than 1 billion times any given day of the year across 200 countries.

- Of worldwide top-selling non-alcoholic beverages, PepsiCo owns two of the top ten brands (Pepsi-Cola and Gatorade).

With such a well-established brand, I’m feeling fairly confident that when I look at this particular moment in ten years, I won’t even remember why Pepsi stock was trading in a valley, that it will be a blip on the radar. The question is of course whether someone investing at this point in time will experience better than, or worse than, the average market return. This requires the right valuation as a starting point, which I’ll come to in a minute.

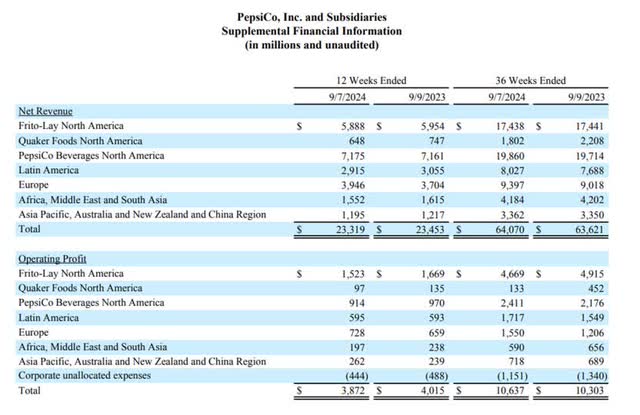

PepsiCo 8K Filing Overview Table (PepsiCo Investor Relations)

If we take a look at the financials, it’s not pristine reading as growth YTD after three quarters is a measly 0.7%, well below inflation. Observing the latest quarter, and we see the cause for the weak performance and concern as both topline and EPS contract.

If you dive deeper into the 8K-filing, you will see that all geographical zones, except Europe, showed contraction on both revenue and EPS during Q3-2024. Revenue and earnings for Pepsi are not even distributed, and therefore the most interesting economic zone to observe, would be North America, which makes up the vast majority of total business. Roughly 61% of revenue comes from North America, as can be observed into the illustration below. While there is no growth YTD, there is stability, though of course a slight decline if we take inflation into consideration.

PepsiCo 8K Filing Revenue and Profit Split (PepsiCo Investor Relations)

Management then provided a new guidance for the 2024 FY, expecting a low-single-digit increase in revenue, compared to a prior expectation of 4%.

Taking a pause and reflecting upon the outlook we haven’t even discussed for instance the impact of GLP-1 medicines (The obesity drugs that inhibit appetite), and they might impact consumer staple companies business over time, but I would again argue not to overstate whatever that potential impact may be. A few years ago, analysts expected Amazon (AMZN) to steal the retail revenue from traditional mortar and brick companies such as Target (TGT) which caused a significant stock price depreciation over a period of a year or two. Then during Covid, analysts expected that people would transition to conducting the majority of their healthcare professional appointments online, causing a massive stock price appreciation for Teledoc (TDOC). Guess what, none of those downwards or upwards pressures lasted, and I’m expecting Pepsi to bounce back as well.

Analyst consensus estimates for FY2025 arrive at a revenue increase of 3.3% and an EPS increase of 5.71%. If we assumed the stock price should expand in-line with the EPS growth, we would arrive at a return below the long-term average of the stock market. However, the last parameter to consider, would be the valuation.

Valuation

Time to wrap it up, so let’s get straight to it.

Despite the recent decline, Pepsi isn’t exactly cheap, as earnings contract in line, meaning you would need a relatively larger downwards move in the stock price to offset the earnings decline.

The illustration above gives insight into the growing unease amongst analyst, with a clear reduction in forward EPS consensus estimates. At the same time, the stock has retraced its steps to the point where the forward 1y P/E is now down to just above 17.5. As I mentioned, this isn’t downright cheap for a company with limited growth, but if you think back to the first illustration of this article, then you would remember that Pepsi has grown its revenue consistently over time, and I would expect the same to happen going forward, with reference to market power and product portfolio.

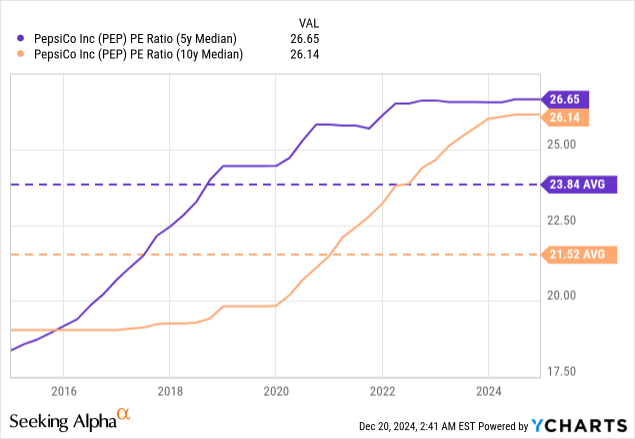

If we observe the P/E ratio over an extended period from a mean point of view, it becomes clear that the stock has traded at a substantially higher P/E multiple than what is currently the case, especially in recent years. Now, we have experienced a strange market since the onset of Covid in particularly, where the market has granted companies a higher multiple, but for a stalwart business like Pepsi, I don’t think it’s wrong for it to have a P/E ratio slightly above 20. After all, this is a great company with a long and proven track record. However, past performance is no guarantee of future performance, and just because the valuation used to be higher, doesn’t mean it should bounce back to that level. In my point of view, a P/E ratio above 25 is too much, but there is also a lot of room between 17.5 and 25.

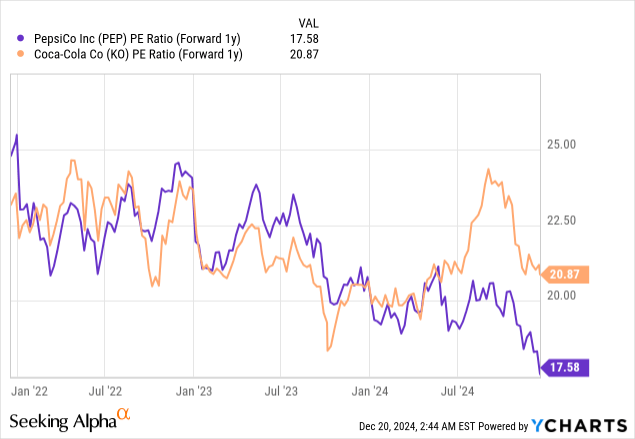

The last sanity check would be the comparison with Coca-Cola (KO), where I would argue Pepsi has the more interesting portfolio of products due to its processed food and snack division. I’ll be quick to recognise that Coca-Cola has the more profitable business of the two on a gross margin comparison, but I believe Pepsi is better positioned for growth over time.

My conclusion is that I would be comfortable buying Pepsi around the $150 mark per share, which is exactly what I’ve now done as I’ve initiated a position. Pepsi will not be the high-flying growth vehicle that will catapult my portfolio ahead of the market by a long stretch, but every portfolio needs stability and companies who are well weathered from inflation, and in my mind, Pepsi is one such company.

This is, in my opinion, an opportunity to buy a great company at a fair price, locking in a good starting yield with valuation upside.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP, TGT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.