Summary:

- PepsiCo produced a solid Q1 and provided strong guidance, so I reevaluated the numbers to see if it was time to start a position.

- PepsiCo continues to generate large returns for shareholders, but its numbers don’t support the current valuation when compared to The Coca-Cola Company.

- The Coca-Cola company trades at a more attractive valuation, has better margins, and has more EPS growth out to 2032 compared to PEP.

- I want to start a position in PepsiCo, but I see more upside today in shares of The Coca-Cola Company.

Fotoatelie

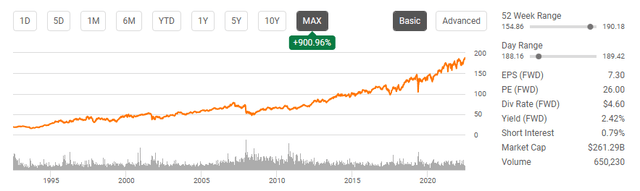

PepsiCo (NASDAQ:PEP) is an iconic American company that continues to deliver positive returns and a growing dividend for its shareholder base. Over the long run, shares of PEP have grinded higher and have been relatively immune to rising rates, inflation, or recessions. PEP just reported a top, and bottom-line beat in Q1, generating $17.85 billion in revenue and non-GAAP EPS of $1.50. Shares of PEP are sitting around their all-time highs and yielding 2.42%. PEP has an outstanding business comprised of staples across the food and beverage industry that include Pepsi, Dole, Doritos, Gatorade, Lay’s, Mountain Dew, Ocean Spray, and Tropicana, to name a few. PEP has been a company I have wanted to invest in, but the valuation hasn’t made sense to me when The Coca-Cola Company (KO) has better margins, is more profitable, trades at a more enticing valuation, and has a larger yield. I wouldn’t sell PEP if you’re a shareholder, but for investors such as myself who want to own this Dividend King, I think there is currently a better opportunity in KO and will wait for a better entry point in PEP.

PEP delivered a strong Q1 2023, and analysts see sequential growth in EPS through 2032

In Q1 2023, PEP generated $17.85 billion in revenue and produced $1.94 billion in net income. PEP’s revenue grew 10.16% YoY, and management is projecting that PEP will deliver 8% of organic revenue growth and 9% core constant currency EPS growth in 2023. PEP is planning on returning $7.7 billion to shareholders, which will consist of $7.7 billion in dividends and $1 billion in buybacks. There isn’t much to complain about when it comes to PEP. This is a company that has increased its total revenue by $21.62 billion (32.56%) since 2013 and its gross profit by $11.43 billion (32%) while keeping its gross profit margins relatively flat as they were 53.77% in 2013 and now they are 53.55% in the TTM.

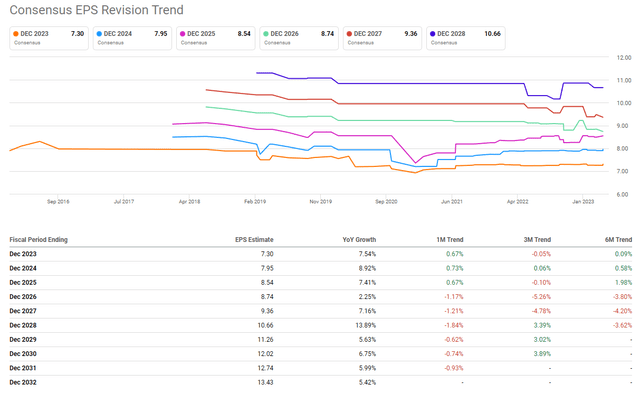

PEP is still projected to see significant growth throughout the next decade. In 2022, PEP delivered $86.39 billion in revenue and generated $6.46 of EPS. In the short term, the analyst’s community sees PEP generating $7.30 in EPS for 2023 and $7.95 in EPS for 2024. PEP’s revenue is projected to grow to $90.5 billion in 2023 and $95.09 billion in 2024. Over the long term, PEP is expected to grow its EPS to $13.43 in 2032, which is a 107.89% increase. This translates to an average annual EPS increase of 10.79%. PEP is also projected to grow its revenue to $136.2 billion in 2022, which is a 57.65% ($49.8 billion) increase from the $86.39 billion generated in 2022. PEP is projected to grow its revenue at roughly 5.77% annually through 2032.

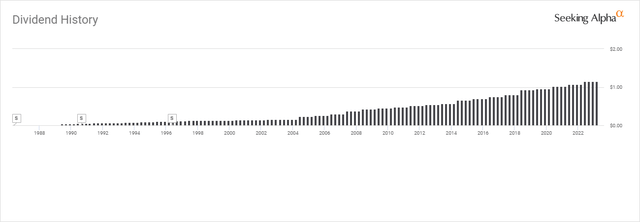

These projections are great for shareholders as it provides a framework for the future of PEP’s dividend. You don’t get to Dividend King status without strong financial stability. PEP has increased its dividend annually for the past 50 years, no matter what the economic landscape was. Since June of 1996, when PEP last split shares, they have paid 108 quarterly dividends, amounting to $50.14. PEP’s next dividend in June should mark its 51st annual dividend increase, and future projections indicate that many more increases are coming.

Today, PEP is paying a dividend of $4.60 per share, which is 71.21% of its 2022 EPS. In 2022, PEP increased its annual dividend by 6.48%, as it went from $4.32 to $4.60. Over the previous 5-years, PEP has had an average annual dividend growth rate of 7.39%. If PEP maintains its 7.39% average annual growth rate, its dividend will grow from $4.60 to 9.38 over the next decade. If PEP slows down a bit and the dividend grows annually by 6%, the dividend will grow to $8.24 in 2032. This is in line with EPS projections, as in 2032, PEP is projected to generate $13.43 in EPS, and a 70% payout ratio would put the dividend at $9.40. This is $0.02 of PEP continuing its annual dividend increases at the 7.39% dividend growth rate. PEP is on track to double its EPS over the next decade, which should increase the dividend to over $9 per share in 2032. Based on PEP’s track record, there is no reason this wouldn’t be attainable, considering the quarterly dividend has grown from $0.54 in 2012 to $1.15 in 2022.

While there isn’t much to complain about as PEP has been a great investment, the valuation looks rich compared to KO

PEP has been a great investment that I have missed out on as I decided to invest in KO because it represented a better value proposition based on the metrics I look at. That’s not to say that PEP will go down, I just saw more value in allocating capital toward KO rather than PEP. After looking at the numbers again, I still see more value in KO’s shares which is still leaving me on the sidelines with PEP.

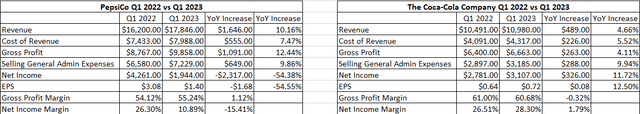

After looking at the Q1 numbers for KO and PEP, KO looks stronger. In Q1 of 2023, PEP increased its revenue by 10.16% to $17.85 billion. They generated $9.86 billion in gross profit, and $1.94 billion in net income. Gross profit increased by 12.44% YoY, yet net income fell -54.38% YoY. PEP’s EPS also fell -$1.68 (-54.55%) from $3.08 to $1.40. PEP operated at a 55.24% gross profit margin and a 10.89% profit margin in Q1 of 2023. KO, on the other hand, generated -38.47% less revenue ($10.98 billion) compared to PEP in Q1 of 2023, yet they produced 59.82% more in net income ($3.11 billion) and operated at a 60.68% gross profit margin, and a 28.3% profit margin. KO’s EPS also grew by 12.5% YoY to $0.72 compared to PEP’s declining -54.55%.

Steven Fiorillo, Seeking Alpha

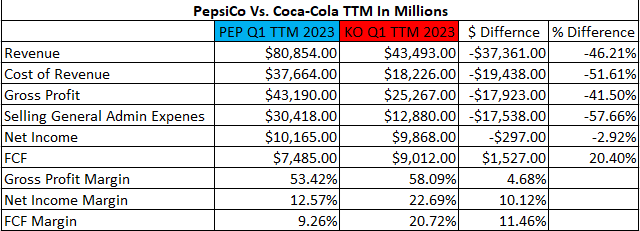

When I compare PEP and KO on a trailing twelve-month (ttm) basis, the story is very similar. Over the TTM, PEP has generated $88.04 billion in revenue, $47.14 billion in gross profit, $6.58 billion in net income, and $5.33 billion in FCF. PEP’s gross profits increased 11.46% YoY while net income declined by -35.26% and FCF declined by -28.83%. In the TTM, PEP had a gross profit margin of 53.55% while its profit margin was 7.48%, and its FCF yield was 6.05%. KO has generated -46.21% of PEP’s revenue in the TTM at $43.49 billion, yet KO produces almost the same amount of profit, more FCF, and operates at higher margins. KO operated at a 58.09% gross profit margin which is 4.68% higher than PEP, and generated $9.87 billion in net income, which was -2.92% less than PEP, but its profit margin was 10.12% higher at 22.69%. KO also produced $1.53 billion more FCF and had a 20.72% FCF yield which is 11.46% larger than PEP.

Steven Fiorillo, Seeking Alpha

Looking at future growth, PEP generated $6.46 in EPS during 2022, while KO generated $2.20. The analysts are projecting that PEP will increase its EPS by 107.89% to $13.43 in 2032. KO is projected to increase its EPS by $2.53 or 115% over the same period. PEP has a market cap of $261.29 billion and is trading at a price to FCF of 49.05x, while KO’s market cap is $276.15 billion, placing its price to FCF at 30.64x. From a growth, margin, and valuation perspective, I would rather buy shares of KO today than PEP.

Conclusion

I liked the quarter that PEP delivered, I like its brand portfolio, and it’s a Dividend King, but the valuation is still too high for me. I want to be a shareholder, but there is more value in shares of KO. If KO was trading near the same valuation as PEP, I would feel differently, but it isn’t. PEP’s margins are significantly lower than KO’s, and their EPS growth over the next decade is expected to trail KO’s by 7.11%. Today you can get shares of KO at 30.64x its FCF compared to PEP trading at 49.05x its FCF, and KO has a slightly larger dividend yield at 2.88%. I wouldn’t sell PEP because it will probably continue to appreciate, but if you’re looking to put capital to work, KO looks like a better value.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.