Summary:

- PEP has delivered another brilliant quarter, double beating the consensus estimates while projecting expanding gross margins from H2’23 onwards.

- This is a testament to its robust branding, higher pricing realization, and sustained emphasis on digitalization/ automation/ streamlined global operations.

- The management also feels confident enough to raise its FY2023 guidance, further implying the company’s highly defensive offerings at a time of uncertain macroeconomic outlook.

- However, the PEP stock also trades at an elevated NTM P/E of 25.09x, compared to its 3Y pre-pandemic mean of 21.04x, suggesting its fully baked-in upside potential.

- This is a highly possible risk indeed, with its prospects potentially deflated once the Fed pivots and its pricing power declines as inflation moderates.

MilesStones/iStock via Getty Images

PEP Remains A Viable Investment Thesis For The Highly Optimistic

We previously covered PepsiCo (NASDAQ:PEP) in June 2023, discussing its financials and stock outperformance despite the contraction in sales volume and peak recessionary fears.

Based on its historical movement, it also seemed that the stock had formed a floor at $180, likely supporting its upward movement depending on its FQ2’23 results.

For now, it is apparent that the PEP management has delivered another brilliant quarter, with FQ2’23 revenues of $22.32B (+25.1% QoQ/ +10.4% YoY) and adj EPS of $2.09 (+39.3% QoQ/ +12.3% YoY), double beating the consensus estimates of $21.73B and $1.96 by a wide margin.

Most importantly, the expanding gross margin at 54.7% (-0.6 points QoQ/ +1.2 YoY) in the latest quarter suggests its robust branding and pricing realization at a time of tightened discretionary spending.

This improvement is likely aided by the emphasis on productivity through its aggressive investments in digitalization and automation, while streamlining its global operations, likely to sustain the expansion of its gross margins from H2’23 onwards.

Therefore, while PEP’s operating expenses have further ballooned to $8.54B (+18.2% QoQ/ +15.7% YoY), we are not overly worried yet, since its operating margins have also expanded to 16.3% (+1.7 points QoQ/ +6.1 YoY) in FQ2’23.

Its net interest expense remains minimal at -$201M (inline QoQ/ -14.8% YoY) as well, thanks to the management’s stellar interest rate hedges, despite the stable long-term debts of $36B (-3.9% QoQ/ inline YoY) in the latest quarter.

This strategy has directly insulated PEP’s profitability despite the elevated interest rate environment, easily sustaining the FQ2’23 shareholder returns of $1.88B (+6.8% QoQ/ -5.5% YoY) and FY2023 guidance of $7.7B (inline YoY).

Perhaps the H1’23 outperformance is the reason why the management felt confident to raise the FY2023 core EPS guidance to $7.47 (+10% YoY), compared to the previous number of $7.27 (+7% YoY), implying the company’s highly defensive and sought after offerings despite the uncertain macroeconomic outlook.

Impressive indeed, especially since the consumer appetite for PEP’s convenient food grows in volume by +1% YoY in the North America, despite the accelerating price increases by +14% YoY in the latest quarter.

In the meantime, the beverages volume in the North America has declined moderately by -4.5% YoY, likely suggesting the consumers’ tightened spending as prices rose by +10%.

However, with the overall impact being net positive globally, with PEP’s top-line still expanding by +13% and bottom line by +15% in the latest quarter, despite the declining convenient food volume by -3% and beverages by -1%, we are not overly concerned for now.

As a result of these promising developments, we concur with the CFO’s statement that its products remain an “affordable treat,” with its top and bottom lines likely to stay secure over the next few quarters.

So, Is PEP Stock A Buy, Sell, or Hold?

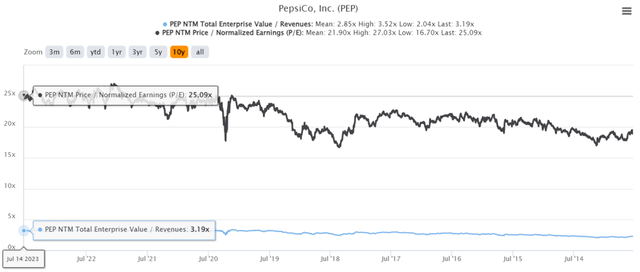

PEP 10Y EV/Revenue and P/E Valuations

Perhaps this is why the PEP stock continues to trade at a premium, with NTM EV/ Revenues of 3.19x and NTM P/E of 25.09x, compared to its 1Y mean of 3.20x/ 24.86x, 5Y mean of 3.13x/ 23.51x, and 10Y mean of 2.85x/ 21.90x, respectively.

Based on its valuations and the market analysts’ FY2025 adj EPS projection of $8.64, we are looking at a long-term price target of $216.77, suggesting a notable upside potential of +15.1%.

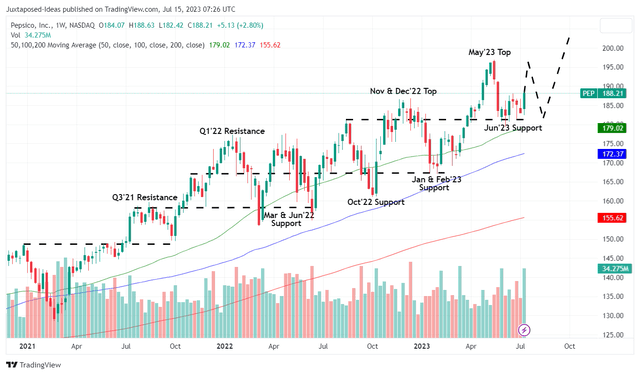

PEP 3Y Stock Price

Based on our bullish projection, the PEP stock is likely to rally and potentially bouncing off $180 in the near term, before breaking out a new top by sometime in September 2023.

As a result, highly optimistic investors may consider adding at those levels for an improved margin of safety. Even then, the portfolio must be sized appropriately, preferably matching their dollar cost averages.

Then again, there is a good chance that PEP’s valuations may be moderated nearer to its 3Y pre-pandemic means of 21.04x as well, suggesting a dramatically lower price target of $181.78 and a fully baked-in upside potential.

This is a possible risk indeed, due to the uncertain macroeconomic outlook and the natural flight-to-safety, since PEP is a highly defensive Consumer Staple stock with great execution thus far, with its prospects potentially deflated once the Fed pivots and its pricing power moderates.

As a result of the potential volatility, we will not be adding here, given our much lower dollar cost averages of ~$100s, resulting in our Hold rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.