Summary:

- PepsiCo will report Q2 results on Thursday.

- Though shares have given back some gains, PEP stock is still trading near its highs.

- The pricing environment and the performance of their Frito-Lay and Beverage divisions are three key areas on watch ahead of earnings.

- New developments pertaining to the usage of aspartame could also factor into investor discussions, though I am less concerned.

- Expectations are high heading into the release, leaving PepsiCo stock at heightened risk of a pullback. Any weakness, however, would be seen as an attractive opportunity to “buy the dip.”

Fotoatelie

PepsiCo (NASDAQ:PEP) is scheduled to report its second fiscal quarter earnings in the pre-market session on Thursday. Here’s what investors need to know.

PepsiCo Key Stock Metrics

Shares currently command a premium trading multiple to their peer, Coca-Cola (KO), and to their own five-year averages. The stock trades at 25x forward earnings estimates. This compares to KO’s 23x and the broader S&P’s (SPY) 18.9x.

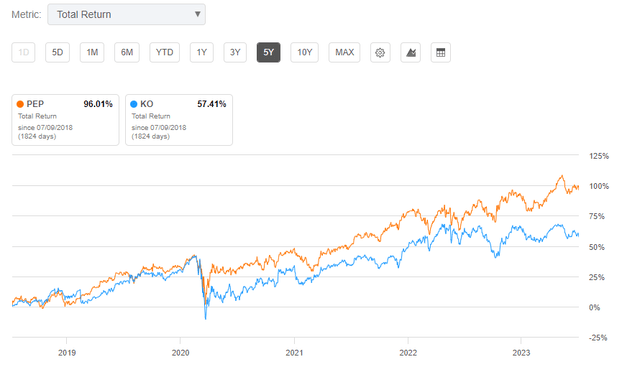

I view this premium as justified. Over the past five years, PEP has returned nearly 100% to investors. This outpaces both KO and the broader markets. PEP stock is also up about 3.5% YTD, while KO is down the same way in the other direction.

Seeking Alpha – Total 5-YR Returns Of PEP Compared To KO

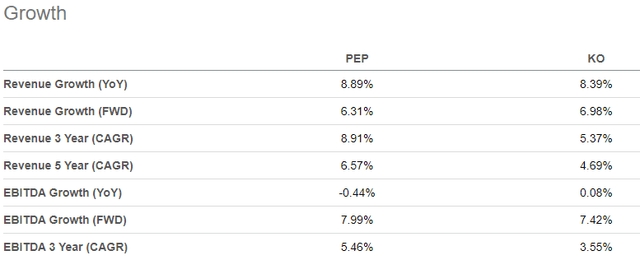

PEP has also posted strong growth rates, nearly 7% compound revenue growth over the past five years versus just over 4.5% by KO over the same period.

Seeking Alpha Peer Comparison Tool – Revenue & EBITDA Growth Of PEP Compared To KO

And most recently, PEP reported Q1 organic revenue growth of 14.3%. This was about 230 basis points above the growth rate turned in by KO.

PEP Guidance and Estimates

PEP also paired their first quarter results with positive revisions upwards in guidance. Full-year organic revenues and core constant currency EPS are expected to grow 8% and 9%, respectively. This is up from previous guidance of 6% and 8%. For their part, KO left their guidance unchanged.

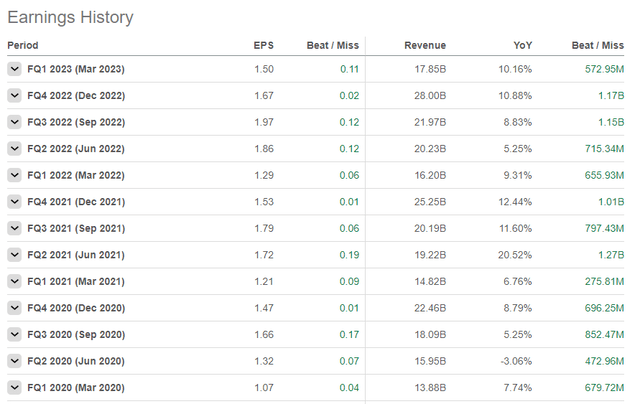

The increased expectations are noteworthy, given PEP’s history of continually coming in ahead of set projections.

Seeking Alpha – PEP Earnings History

For Q2, consensus targets are for +$21.7B in revenues and $1.96/share in EPS. While PEP has set a higher bar, their past track record provides confidence of their ability to meet or exceed expectations.

What To Watch In PepsiCo’s Q2 Earnings

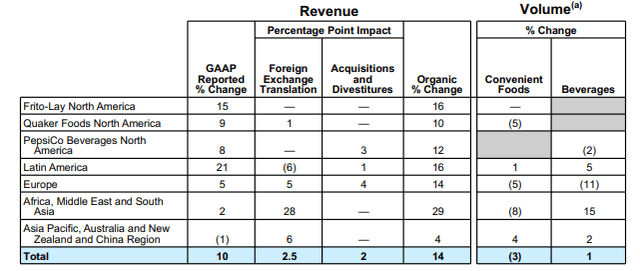

Pricing: Though PEP is reporting double-digit sales growth, this is driven almost entirely by pricing. Total organic revenues, for example, were up 14% in Q1. But volume was negative in their convenient foods and up just 1% in beverages, with a notable 2% decline in their namesake division.

Q1FY23 PEP Earnings Release – Summary Of Revenue/Volume Growth By Division

A more normalized level with respect to pricing is likely to increase volume expectations. CFO, Hugh Johnston, had previously said that the company’s price increases would slow in conjunction with the inflation rate. And in Q1, CEO, Ramon Laguarta, said that PEP has “mostly taken the pricing already this year” necessary to cover their inputs. This suggests the onus of the company will soon be on volume as opposed to pricing.

It may not be as soon as some may expect, however. A recent report by The Wall Street Journal (“WSJ”) noted that prices continue to increase in the area of supermarkets known as “the center store,” which is a section that stocks less perishable items, such as snacks and other essentials. Citing data by NielsenIQ, the WSJ noted that prices for potato chips rose an average of 17% from last year. And while overall food inflation has pulled back, “dry groceries” were up 12% in May compared to 5.8% by the broader category.

Given the stickiness in pricing, I expect pricing to remain a primary factor in Q2 results.

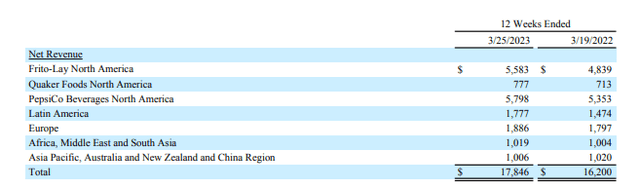

Frito-Lay North America (“FLNA”): Though volume was flat in their FLNA division, PEP reported market share gains in the macro and savory snacks categories. Gains here are important since the unit is one of their most promising growth segments. Five years ago, the unit accounted for less than 30% of quarterly sales. Its share has now closed in on beverages. As standalone units, each account for about a third of total quarterly sales.

Q1FY23 PEP Earnings Release – Comparative Summary Of Net Revenue By Division

FLNA has also been the strongest unit in recent periods. In Q1, their namesake unit turned in their third consecutive quarter of double-digit organic revenue growth. But FLNA exceeded this mark with six consecutive quarters. The growth in the unit was also 400 basis points greater than that reported by Beverages.

In my view, I am expecting a 7th consecutive quarter of double-digit growth. One broader theme throughout the Q1 earnings season was commentary noting the greater composition of consumables as a share of sales. Companies, such as Walmart (WMT), Target (TGT), Dollar Tree (DLTR), and Ollie’s Bargain Outlet (OLLI), among others, all noted this trend in sales.

What this suggests is that though consumers are cutting spending on other discretionary areas, they continue to prioritize simple luxuries, such as the savory snacks offered by PEP. From a positioning standpoint, PEP is at an advantage due to their market share gains in prior quarters. The May retail report that showed increases in spending on food/beverage stores and food services/drinking places provides further support of the positive trend in spending behaviors.

Beverages: Stellar results leave little to doubt about PEP. But if there is one area of concern, it is in their namesake unit. Volumes were down again in Q1. And it was down against the market share gains reported by KO in their total nonalcoholic ready-to-drink beverages. Laguarta pushed back against the notion that the competitive environment is getting worse. He also noted that one-off factors, such as inventory levels associated with Gatorade, had a contributing impact on results.

One topic that could be raised by analysts is the expected declaration of aspartame by the World Health Organization (“WHO”) as “possibly carcinogenic to humans.” Though this is a key ingredient for both PEP and KO, the latter is expected to face the bigger short-term threat.

While this topic is worth the discussion, I am more confident of PEP’s ability to navigate around it due to Laguarta’s leadership. An in-depth feature by the WSJ on the CEO and his willingness to double-down on PEP’s core business in the face of rising health concerns surrounding “junk food” showed that Laguarta has an act of adapting for the better. I expect that his past efforts in lowering unwanted ingredients in their snacks and beverages will prove to be a differentiating trait if PEP is ultimately forced to rework their products in response to any potentially new developments.

Is PEP Stock A Buy, Sell, Or Hold?

Expectations are high for PEP. And this is largely due to PEP’s own making. Unlike KO, PEP raised their full-year outlook following a blowout first quarter. And the raised guidance notably came in the face of a slowing macroeconomic environment.

The company is on a streak in terms of double-digit organic sales growth, especially in their FLNA and Beverages unit. A break in the streak could disappoint investors who have become accustomed to otherwise. Market impatience is also likely to increase if PEP exhibits no signs of an impending shift from pricing to volume. The focus on volume is even more pertinent in their namesake unit.

Uncertainties pertaining to WHO’s views on aspartame is another downside risk heading into the release. If PEP is expected to make significant investments to respond, this could result in a pullback in forward guidance. On a similar note, given the outperformance so far, any negative revisions to the full-year outlook for any reason would likely jolt investors into selling.

Despite the heightened risk of a pullback, I believe PEP is well-positioned to break through $200/share. A greater balance in sales between their Frito-Lay and Beverage divisions due to the rapid growth and market share gains in the former is one factor supporting this view. Irrespective of other areas, I am confident that the Frito-Lay division will turn in their 7th consecutive quarter of double-digit organic growth when PEP reports results. In addition, I don’t view the issue surrounding aspartame as overly noteworthy, considering CEO, Ramon Laguarta’s, past finesse in adapting their products to meet consumer and regulatory concerns.

The stock currently has about 10% potential upside to $200/share ahead of earnings. Should the company disappoint on the day of, a “buy-the-dip” would be warranted provided PEP posts another quarter of double-digit organic growth in FLNA and leaves full-year guidance unchanged.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.