Summary:

- PepsiCo, Inc.’s Q3 earnings report is anticipated to show modest revenue growth but strong EPS performance, continuing its trend of beating EPS estimates.

- Quaker Foods’ performance remains a concern due to product recalls and declining revenues, impacting overall company growth.

- The North America Beverage segment shows strong margin expansion despite revenue declines, driven by zero sugar variants and Gatorade.

- Given current uncertainties and valuation concerns, I downgrade PepsiCo to a HOLD rating while emphasizing its appeal to income investors due to strong dividend growth.

marijoe101/iStock via Getty Images

Introduction

PepsiCo, Inc. (NASDAQ:PEP) is scheduled to release its Q3 earnings on Tuesday, October 8 before the market open. In this article, I investigate the key developments that investors need to watch out for in the company’s Q3 report.

A Recap of Q2 Results

PEP had a mixed second quarter. While adjusted EPS of $2.28 beat analyst estimates by $0.12, Q2 revenues of $22.5 billion missed estimates by $91.2 million and were up only 0.8% y/y. The primary factor driving the revenue miss was the fall in demand because of consecutive quarterly price hikes of its products for more than two years.

Global sales volumes continued their downward trajectory, falling 3% in Q2, marking the eighth consecutive quarter of declining volumes. Finally, the company’s organic revenue grew just 1.9% in Q2, which forced the management to revise down their expectations of this metric. More specifically, post the Q2 results, management announced that it was expecting organic revenues to grow 4% for the full year, rather than the previous guidance of “at least 4%.” Apart from this change, PEP’s management kept the rest of the outlook for the full-year unchanged.

Q3 Expectations

For the third quarter, according to LSEG Data (formerly Refinitiv), revenues are expected to come in, on average, at $23.84 billion, which translates to a y/y growth of 2.1%. Adjusted EPS is expected to come in at $2.3, which represents a y/y growth of 6.98%.

The company, according to LSEG data, has beaten revenue estimates in eight of the last ten quarters, with an average positive surprise of 3.16%.

|

Average Positive Surprise |

3.16% |

|

Average Negative Surprise |

-1.13% |

|

Quarter |

Revenue Surprise |

|

Q1 FY22 |

4.28% |

|

Q2 FY22 |

3.65% |

|

Q3 FY22 |

5.45% |

|

Q4 FY22 |

4.31% |

|

Q1 FY23 |

3.63% |

|

Q2 FY23 |

2.73% |

|

Q3 FY23 |

0.26% |

|

Q4 FY23 |

-1.94% |

|

Q1 FY24 |

0.98% |

|

Q2 FY24 |

-0.31% |

Sources: LSEG Data (formerly Refinitiv), Author’s Calculations.

On the EPS front, however, the company, during the same period of the last 10 quarters, has always beaten estimates, with an average positive surprise of 5.40%.

|

Average Positive Surprise |

5.40% |

|

Quarter |

EPS Surprise |

|

Q1 FY22 |

4.6% |

|

Q2 FY22 |

7.11% |

|

Q3 FY22 |

6.83% |

|

Q4 FY22 |

1.25% |

|

Q1 FY23 |

7.97% |

|

Q2 FY23 |

6.45% |

|

Q3 FY23 |

4.44% |

|

Q4 FY23 |

3.55% |

|

Q1 FY24 |

6.07% |

|

Q2 FY24 |

5.68% |

Sources: LSEG Data (formerly Refinitiv), Author’s Calculations.

Finally, as far as the market reaction goes, the company’s impressive track record of beating EPS estimates has had a greater impact than revenues, with seven of the last ten quarterly reports seeing a positive stock reaction, post their release. On average, PEP’s stock has jumped 1.5% since its earnings release.

Despite the downward revision of its organic sales growth guidance in the previous quarter, the stock did jump by 3.53%, demonstrating how much importance investors place on the company’s earnings. This is unsurprising, in my opinion, given that PEP has been a play for income investors rather than for growth investors due to its track record of strong dividend growth. For instance, its TTM 1-year dividend growth rate, according to Seeking Alpha, stands at 9.23%, significantly higher than the sector median of 4.1%, and has a sector relative grade of B+. Furthermore, the 12-month forward dividend per share growth stands at 7.76%, once again considerably higher than the sector median of 4.65%, and has a sector relative grade of A-. The increased focus on dividends does suggest that PEP’s investors are more focused on the company’s ability to beat earnings than sales.

|

Average Stock Price Reaction |

+1.49% |

|

Quarter |

7-day Price Reaction |

|

Q1 FY22 |

0.07% |

|

Q2 FY22 |

-1.3% |

|

Q3 FY22 |

5.46% |

|

Q4 FY22 |

2.99% |

|

Q1 FY23 |

3.6% |

|

Q2 FY23 |

3.82% |

|

Q3 FY23 |

0.42% |

|

Q4 FY23 |

-2.99% |

|

Q1 FY24 |

-0.74% |

|

Q2 FY24 |

3.53% |

Sources: LSEG Data (formerly Refinitiv), Author’s Calculations.

Performance of Quaker Foods an Important Factor to Consider

Now that the company can no longer take advantage of price increases to boost margins, the focus must shift toward how the company’s segments perform in a more normalizing environment. One segment, which investors need to watch out for carefully, would be Quaker Foods North America. The segment’s performance has fallen off a cliff this fiscal year, as the company faced the twin shocks of product recalls and weakening growth. More specifically, PEP was forced to undertake a massive recall of Quaker Chewy bars last year, totaling 22 million cases. Since then, the segment has heavily weighed down on PEP’s results.

For instance, in the first quarter, the segment’s revenues declined 24% y/y and core operating profit declined 35% y/y. The second quarter was no different, with revenues of the segment declining 18% y/y and core operating profit declining 23% y/y. PEP has closed the factory in Danville, Illinois since, and in prepared remarks post Q2 results, management said that they expect the revenue impact from the recalls to “moderate as the year progresses.” However, at the beginning of the third quarter, regulators released a warning letter, highlighting that the closure of the factory may not have been enough to prevent the contamination spreading to other facilities. According to the FDA, PEP let “salmonella fester at the facility for as long as four years.”

The period when the letter was made public implies that it is highly unlikely that consumers would have been confident to resume their purchases during the third quarter. As such, I would expect the segment to post negative growth, both in terms of revenues and operating profits. The question investors need to consider is not whether the growth would be negative, but what the magnitude of deceleration would be.

Can Beverages Sustain Their Margin Expansion?

PEP’s North America Beverage business may have seen its revenues decline significantly, but its operating margins have been expanding at an impressive rate. It has been nearly a year since I last covered PEP (coincidentally, I initiated coverage by analyzing its Q3 FY23 report). At the time, the beverages segment was performing well in terms of margins. Since then, the segment has continuously posted declining revenue growth, but its margins have maintained their momentum. For instance, in the previous quarter, despite registering a meager 1% organic revenue growth, the segment saw its core operating profit jump 17% and core operating margins expand by 200 bps, making it the fourth consecutive quarter of margin expansion.

The company’s zero sugar variants as well as its Gatorade business have been driving the margin expansion, with the latter even managing to gain market share in the sports drinks category. According to Technavio, the global sports and energy drinks market is set to grow by $106.7 billion from 2024-2028, which translates to a CAGR of 13.52% during the forecast period. Despite the strong growth potential, the market does face challenges, as consumers move away from drinks with high sugar content. To counter that, PEP’s Gatorade has expanded into new categories, including unflavored water. At the same time, the company has also expanded beyond the Gatorade bottle into other categories such as enhancers, tablets, and powders.

These initiatives have helped PEP maintain strong margins for its Beverages business. Given that this has been one segment that has continued to maintain strong growth, investors, in my opinion, need to watch out for how this segment performs in the third quarter.

Valuation

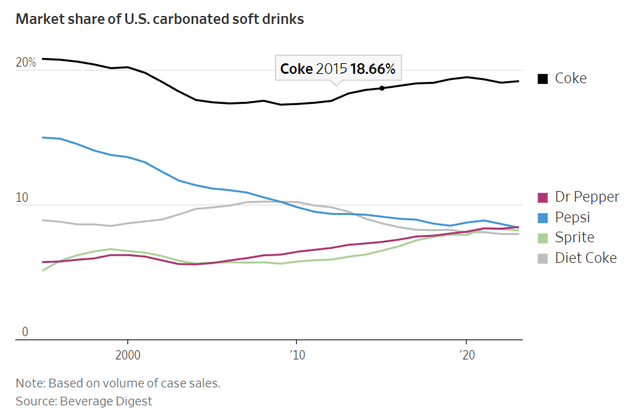

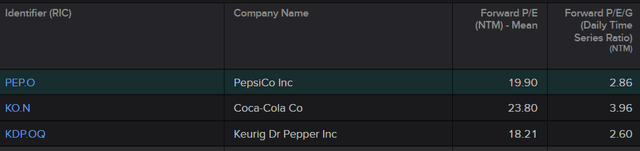

PEP has had a flat performance so far, with the stock down 0.44% YTD. The company currently trades at a forward P/E of 19.9x, slightly higher than Keurig Dr Pepper (18.2x) but cheaper than its main rival, Coca-Cola Co. (23.8x). The reason I have used these companies for comparison is that while KO continues to lead the US beverage market, PEP has fallen down the pecking order and now remains in the No. 3 spot thanks to the remarkable rise of Dr Pepper. As such, from a valuation perspective, it makes sense to compare these three.

Beverage Digest (as reported in the Wall Street Journal)

On a historical basis, PEP is undervalued compared to both its 5-year historical median value (23.6x) and its 10-year historical median value (21.3x). However, the market dynamics have changed for PEP, both in terms of rising competition and the negative impact of the Quaker Foods product recalls. As such, in my opinion, PEP doesn’t deserve these multiples.

Comparison of P/E of PEP and its Peers (LSEG Data (formerly Refinitiv))

The last time I wrote about PEP, I had a price target of $181 based on a forward P/E of 22.5x and a projected FY24 EPS of $8.03. The company is on track to at least match my EPS target, but today, given the headwinds, both from a macro perspective and from a company perspective, a multiple of 19.9x makes more sense. At this multiple and a projected EPS of $8.03, the price target would be $160, which is about 7% lower than current levels.

A lower price target does not necessarily mean that investors should dump the stock ahead of its earnings. As shown earlier, PEP’s stock has almost always risen post its earnings report. In addition, the company has a history of raising its dividends. Given its ability to generate strong earnings, even when revenues weaken, I would expect its dividend track record to remain intact. For these reasons, I wouldn’t sell PEP at these levels, especially before the earnings. Having said that, I am downgrading the stock to a HOLD rating from a BUY, from a valuation perspective.

Concluding Thoughts

PEP has a solid track record of beating EPS estimates every quarter. Despite this positive, when one looks at the company, there are far too many uncertainties today. The product recall debacle at Quaker Foods continues to haunt the company, and it is highly unlikely that the company will see an uptick in revenues from this segment anytime soon. While its beverages business has been delivering on margins, the company has lost the No. 2 spot to Dr Pepper in the US, which, once again, raises questions.

From a valuation perspective, PEP doesn’t deserve to have a high multiple anymore in my opinion, given that it has lost its pricing power and given the degree of uncertainty surrounding the company. However, the company continues to be a safe bet for income-loving investors, given its strong track record of dividend payouts. All things considered, the company’s aura of invincibility surrounding the EPS and margin expansion may just be slipping away, and as such, going into its Q3 report, I would not be a buyer of the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.