Summary:

- Pepsi has strong pricing power and a well-diversified product portfolio, positioning it well in the face of inflation.

- The snacks category is a major driver of revenue and operating profits for Pepsi, and the company has shown the ability to pass on higher costs to consumers.

- Pepsi’s stock is currently trading at a premium and its upside is capped, but its robust dividends provide some downside protection.

Fotoatelie

Investment Thesis

If I were to summarize PepsiCo’s (NASDAQ:PEP) prospects in two words, “pricing power.” I will also add the strategic diversification of this brand’s product portfolio that helps management navigate the Pepsi boat through the choppy waters of uncertain inflationary trends on the horizon.

Through my historical analysis of Pepsi’s evolution as a well-diversified consumer staples brand as well as its strong operating history, I believe Pepsi is well positioned to ride any oncoming wave of inflation.

However, my valuation models suggest that Pepsi is trading at a premium relative to its history and to the sector in which the food and beverage giant is a part. For now, I will hold a neutral view on Pepsi.

Summarizing Pepsi’s road so far

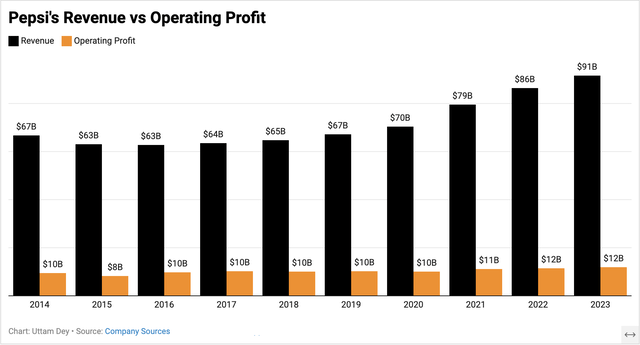

Pepsi is one of the largest food and beverage consumer brands in the world, recording ~$91.5 billion worth of sales last year, up ~6% y/y. Operating profits for Pepsi were ~$12 billion, indicating an operating margin of ~13.1% in FY23, as can be seen below.

Pepsi’s revenue and operating profits growth over the last 10 years (Company sources)

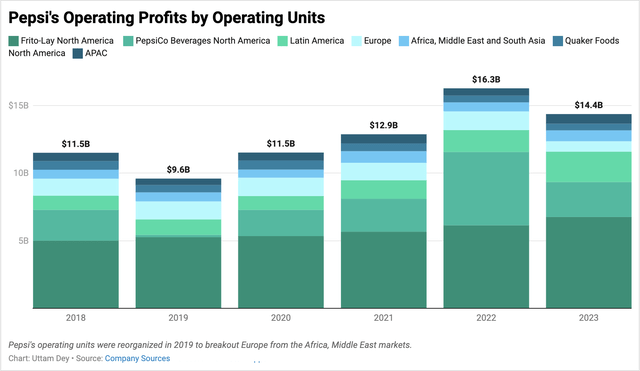

In the words of Pepsi’s CEO himself, “the business is about 60% convenient foods and about 40% beverages.” While the company is known for its iconic eponymous beverage, Pepsi is also quite well diversified in the snacks category, actually accounting for a larger share of the company’s revenues and operating profits, as can be seen below.

Pepsi’s operating profits by Operating Unit since 2018 (Company sources)

The company operates through seven operating units, with its snacks unit Frito Lay North America (FLNA) and its beverages (PBNA) being its two largest units, driving growth, while FLNA and the Latin America (LATAM) units record significantly higher margins than Pepsi’s total operating margin, as noted earlier. In FY23, FLNA recorded a 27% operating margin, whereas Pepsi’s LATAM business reported a 19% operating margin. AMEA (Africa, the Middle East, and South Asia) reported 13.1% operating margins, while APAC (Asia Pacific) reported 15% margins, either at or above Pepsi’s total operating margin.

The FLNA unit that is responsible for Pepsi’s snacks and chips is clearly one of Pepsi’s biggest drivers of high-margin revenue for the company, per my observation. This segment has benefited Pepsi during times like the surge in inflation that was observed in 2022, where Pepsi benefited from the pricing power and changing wallet share spent by consumers who were forced to abandon their discretionary purchases and re-allocate wallet spend towards daily staples such as beverages and snacks, etc. The benefits of elastic demand can be seen in the organic change in Pepsi’s sales versus pricing power, especially during 2022.

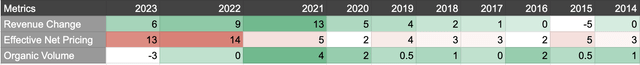

Pepsi has been able to command higher prices which still support revenue despite volume staying flattish (All numbers in percentages) (Company sources)

These trends showcase the strength in Pepsi’s pricing and the ease with which the company has been able to pass on its higher input costs to the consumer. Since FY21, Pepsi has raised its net effective prices by ~11%, on average, which has provided an ample boost to its revenue, growing about 10% on average, while organic volume average growth has been relatively flat. I believe these are structural trends that the company can benefit from, especially if inflation remains embedded in the economic systems across the world.

How Pepsi floated through all the choppiness during the inflationary 1970s

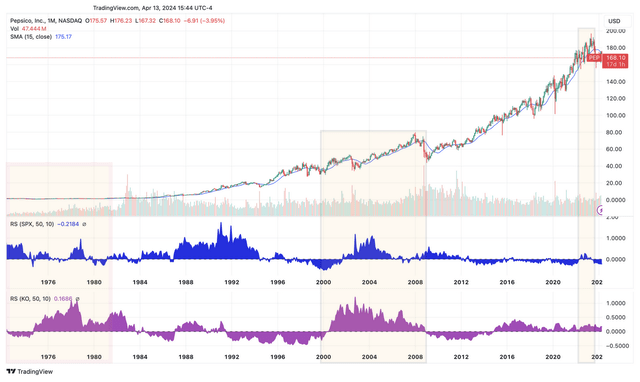

To augment my argument around why Pepsi can be a great buy if inflation were to continue its upward trajectory again, I reviewed Pepsi’s stock performance during the 1970s, as seen in the chart below. I have also added a few other areas of outperformance, such as the post-dot-com era and the inflation seen in 2022.

Pepsi outperforms markets during periods of high inflation seen during the 1970’s (TradingView)

What is visible to me is that Pepsi has outperformed the broader markets, especially during the 1970s inflation, because it was able to retain the strength in its pricing power that helped its operating profits. An old analysis by the NYT shows how Pepsi was able to retain 12.3% of its revenue as earnings due to increased dollar volume from the acquisition of Frito-Lay.

Part of the reasoning for purchasing Frito-Lay was to take advantage of rising demand for snacks at the beginning of the inflationary 1970s, while using the power of its distribution network to push Frito-Lay’s chips and snacks from coast-to-coast.

Today, I believe, Pepsi sits on the cusp of those tailwinds it saw in the 1970s if inflation were to continue gaining from current levels. A previous executive for Pepsi perfectly summed up the view of why Pepsi’s snacks will continue to outperform in another interview that I found from 1986, after the world saw one of the worst periods of inflation.

If Colgate or Procter put toothpaste on sale, you may buy six tubes, and you’re not going to come back for a while.

On the other hand, if you buy a six-pack of Pepsi, or two six-packs, or two bags of chips, by the next time you go to the store, they’re all gone.

A study by market research group Circana, cited by WSJ last year, shows how almost half of U.S. consumers have three or more snacks daily—up 8% in the last two years, according to the market research firm. Most of these trends are being seen primarily in the Millennials and Gen Z consumer base, as reported by Mintel and cited by Fortune magazine. Increasingly, these generations are eating more snacks to offset the rising prices of food.

These trends augment the prospect of future growth quite nicely for Pepsi’s FLNA segment, which has already shown strong revenue and operating profit growth rates. I believe Pepsi would be able to shine as it did before on the strength of its snacks business, especially if inflation returns like we saw in the previous eras.

Valuation shows Pepsi’s upside is capped

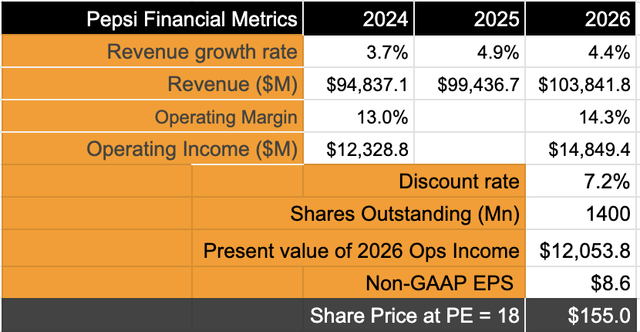

To value Pepsi’s stock, I will use base-case scenarios modeled close to analyst expectations. I believe the 2024 numbers are in line with the guidance given by management.

Here are my assumptions:

-

GAAP operating margins should grow back to their long-term operating margins of ~14% as the company benefits from expanding margins due to increased pricing power.

-

The discount rate of 7% is near market expectations, which I believe is fair given its long-term trends.

Pepsi’s Valuation (Author)

Given these assumptions, I estimate Pepsi’s GAAP operating profits will grow ~8%, in line with the S&P 500’s long-term estimates. In that case, a PE of 18x would be warranted given the relative growth rates. Assuming the valuation multiple is applied, I estimate a target price of ~$155, which represents a downside of ~8% in Pepsi’s stock value. In my larger portfolio, I do hold Pepsi, but I have intentionally kept it as a small position for now, allowing me room to cost average further into Pepsi in the event it trails closer to my target range.

On a relative basis too, Pepsi also appears to be slightly overvalued when compared to the forward PE of the S&P Consumer Staples sector (SP500-30). Per the last update, Pepsi’s forward PE stands at 21.2x versus the Consumer Staples sector’s forward PE of 20.2x, which represents about 5% of the downside.

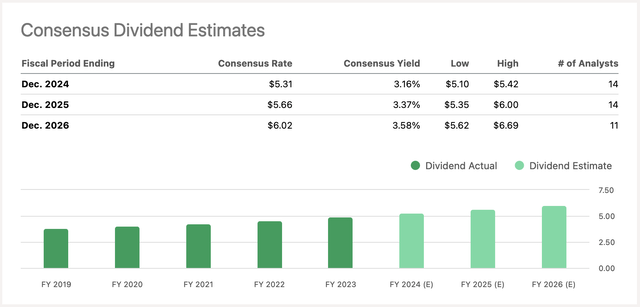

However, Pepsi’s robust dividends should help in absorbing some of that moderate downside risk that is presented by my valuation model. Currently, management projects the cash dividend payout to increase by 7.8% in FY24, slightly lower than the rate of dividend payout in FY23, which grew by 8.3%. So far, consensus estimates for FY24 yield are projected to be 3.2%, as seen below.

Consensus Dividend Estimates for Pepsi (SA)

Risks and Other factors to look for

In the last quarter of FY23, investors got a taste of how demand for weight-loss drugs can suddenly change the narrative for many consumer staple stocks such as Pepsi that are in the food and beverage business. Comments from Walmart’s management weighed down further on food and beverage stocks after Walmart’s CFO mentioned possible impacts they were already seeing from GLP-1 drugs such as Ozempic, Wegovy, and Mounjaro. In the Q3 call, management did not divulge too many details about the impact, just saying that they don’t see the impact yet. In my opinion, this is still a huge unknown area for me, which I will eagerly be tracking.

One of the ways I am doing this is by looking at early signs provided by NielsenIQ data that show that while overall CSD volume (carbonated soft drinks) declined 1.5% with a solid average price gain of +5.2% for 4 weeks through March 23, Pepsi has seen larger volume declines of about 2.9% despite the 4.3% price increase for those same 4 weeks.

This is also on the back of larger CSD volume declines seen in Pepsi for the 4-week period ending February 24, where volume was down 4.3% on a 5.5% average price gain while total carbonated soft drink volume declined 1.5% on a 4.3% average . price gain for 4 weeks through February 24, per NielsenIQ data.

These trends from the 1st quarter of FY24 are likely to pose some headwinds for Pepsi for now.

Conclusion

I believe long-term tailwinds for Pepsi remain in light of recent headwinds and risks that I mentioned earlier. I am confident the company’s stock will offer investors attractive entry points over the coming months due to the stock’s stability and defensive nature, especially if inflationary risks were to increase, but Pepsi’s upside remains capped at the moment, per my analysis.

I rate Pepsi as a Hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.