Summary:

- PepsiCo has underperformed the market year to date and by a significant margin.

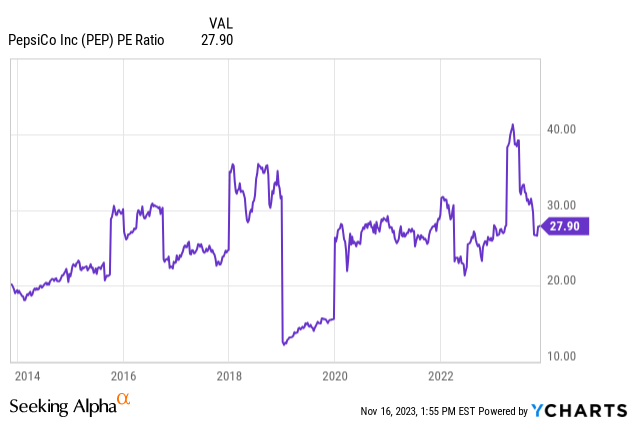

- The combination of shifting market sentiment and worries about declining volumes has led the stock to a historically low valuation.

- I find the worries overexaggerated, as aggressive price increases and the timing relative to competitors are the main drivers for lower volumes, and these are temporary.

- Trading at an attractive valuation with ample margin of safety, I rate PepsiCo a Buy.

darios44/iStock Editorial via Getty Images

PepsiCo (NASDAQ:PEP), one of the largest staples suppliers in the world in terms of revenue, reported third-quarter results that beat expectations, with EPS of $2.25 beating by $0.10, and revenue of $23.45B coming in inline.

PepsiCo’s results were quite impressive, which allowed the company to upgrade its guidance for 2023 and provide a positive outlook for 2024.

As impressive as the results were, investors are justifiably questioning the sustainability of PepsiCo’s price-driven growth. Let’s answer that question.

Underperformance Year-To-Date

I started covering PepsiCo back in March with a Buy rating, claiming its exceptional quality should overcome the slight overvaluation at the time. That didn’t turn out so well, as PepsiCo trailed the market by nearly 19% since then.

Before we look forward, I think it’s a valuable exercise to try and understand the reason for the company’s underperformance. If I’m expecting a company to provide market-beating returns in the future, I should be able to explain what caused its underperformance so far.

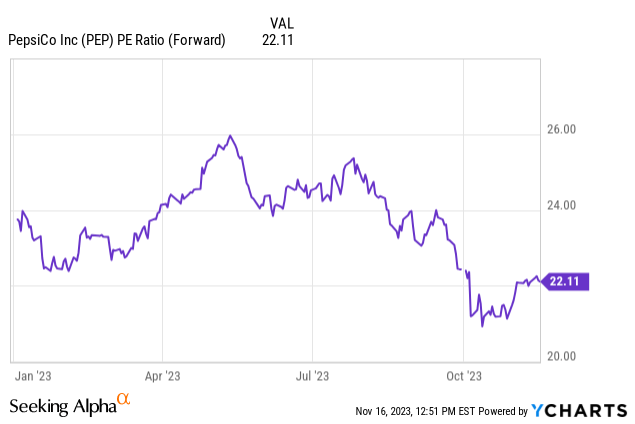

And with PepsiCo, I don’t think it’s going to be a tough task. We can see a very clear multiple contraction during the year. While PepsiCo continued to beat and raise EPS, the market continued to downgrade the company.

And with a very mature stalwart in Pepsi, I really don’t think it’s because investors are disappointed with the company’s future prospects. I regard the multiple contraction primarily to the market’s shift toward a risk-on mode, leading investors to seek exposure to faster-growing companies, specifically in the tech sector.

Aside from weakening market sentiment, which always fluctuates, the other major concern that I believe caused the contraction is PepsiCo’s reliance on price increases for growth.

Investors always prefer volume-driven growth, rightfully so, because price increases can only take you so far.

For context, PepsiCo’s revenues grew 12% organically year-to-date, with a negative 3% volume growth, reflecting a price contribution of nearly 15%. So, should investors be worried about PepsiCo’s brands losing desirability? Let’s find out.

PepsiCo Gained Share In Every Core Segment

In previous articles, I said the most important aspect to monitor with a mature and stable company like PepsiCo is the company’s ability to protect or increase its market share.

As long as PepsiCo grows at a good pace relative to its competitors, investors can trust the company’s scale and veteran management to be able to drive operational leverage and grow EPS at a steady pace.

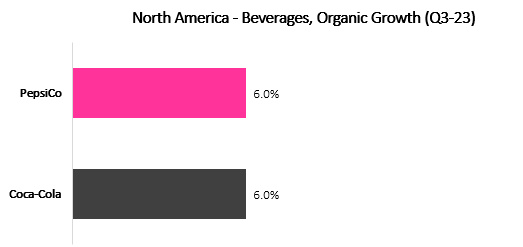

Created by the author using data from the companies’ financial reports.

Let’s begin with the most famous lines of business for PepsiCo, and a comparison to its longtime nemesis, Coca-Cola (KO). In the third quarter, PepsiCo and Coke grew their North America beverages business at the same rate of 6%. Coke’s growth was driven by a price contribution of 5% and a volume contribution of 1%, whereas PepsiCo had a 12% price increase offset by negative 6% growth.

There are a few things to consider here. First, it’s the chicken and the egg question of whether Pepsi’s negative volume was the reason for the more aggressive pricing action, or whether the pricing caused a decline in volume.

Generally, Pepsi takes pricing action to protect margins, not sales. Furthermore, it was “late to the party” when it came to pricing, as Coca-Cola raised prices at pretty much a similar rate but over a longer period which began earlier.

Another thing to note is that surprising to many people, PepsiCo’s business in North America is significantly larger than Coca-Cola’s, with sales of nearly $7.2B in the quarter compared to Coke’s $4.5B. In terms of absolute dollars, PepsiCo grew by $405M, whereas Coke grew by $253M.

Reflected by their EBIT margins, PepsiCo’s and Coke’s business models are quite different, as the former does everything in-house, whereas the latter relies on outsourcing.

So the dollar beat isn’t as impressive as it might seem, but still, I think it’s safe to say PepsiCo is performing at least on par with Coca-Cola, so that’s a check.

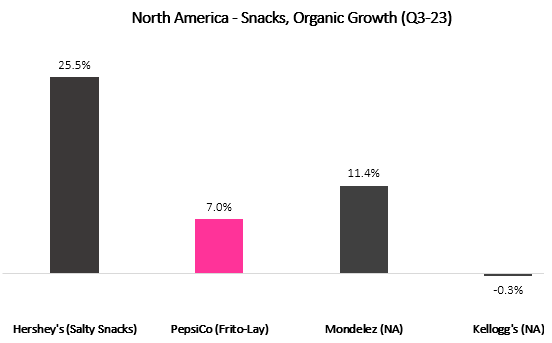

Created by the author using data from the companies’ financial reports.

Switching gears to snacks, we can see that both Hershey’s (HSY) and Mondelez (MDLZ) outgrew Pepsi, with 25.5% and 11.4% organic growth compared to 7.0%.

With regard to growth drivers, Hershey’s had a 22.2% contribution from volume and mix, with the rest of organic growth attributed to pricing. Mondelez took a 6.8% pricing increase accompanied by 4.6% volume growth. And just like with the beverages business, PepsiCo’s negative volume of 0.5% was more than overcome with a 7.5% price growth.

Yet again, PepsiCo was the most aggressive on pricing, which probably led to declining volumes. Similar to the beverages segment, PepsiCo is materially larger than its peers, with sales of nearly $5.95B in the quarter, compared to Mondelez with $2.85B and Hershey’s with a much smaller $0.34B.

In absolute dollar growth, PepsiCo outgrew Mondelez by $100M and Hershey’s by $320M, reflecting share gains. And unlike the beverages business, PepsiCo is also much more profitable than the other two, with operating margins of 28.0% compared to margins in the high teens for Mondelez and Hershey’s.

Another check for Pepsi.

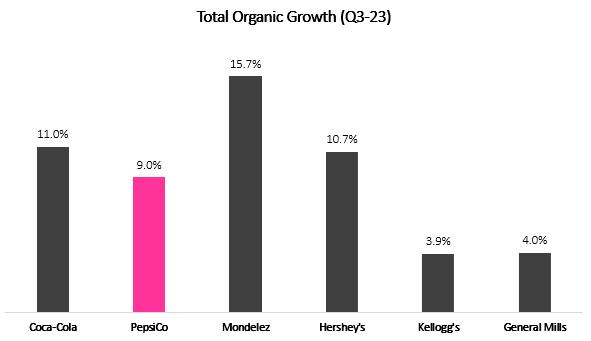

Created by the author using data from the companies’ financial reports.

Lastly, let’s look at the consolidated results of the peer group, which paints the global picture of the industry. We can see PepsiCo at fourth place in terms of organic growth with 9%, trailing each of the three significant competitors we discussed.

Forgive me for the repetitiveness, but it’s important to once again emphasize just how bigger Pepsi is, with sales of nearly 2x the size of Coca-Cola, 2.6x of Mondelez, and nearly 8x of Hershey’s.

With dollar growth of more than $1.93B, PepsiCo gained significant global market share over its competitors in the quarter, with Mondelez coming in second place seeing growth of a little over $1.22B, and Coca-Cola a close third with $1.18B.

Taking all of the above into account, I see PepsiCo as the overall leader in the group, despite its volume declines. I estimate that the timing of PepsiCo’s price increase had a major effect on its volumes, and expect volumes will turn positive in the near term, forecasting a more balanced growth buildup from here.

Valuation

Since there are no material changes from my last disclosed financial model, I chose to tackle valuation from a different angle this time.

In the above graph, we can see that PepsiCo is trading at a 28x multiple over its trailing twelve-month earnings. This number is not representative, as PepsiCo had one-time charges due to the divestiture of its Russia business, as well as a significant impairment for its SodaStream holding, and a one-time gain from the sale of Tropicana.

Considering all of the above, let’s look at the current non-GAAP P/E which is at 22.3x. As we can see, that’s historically a low multiple for PepsiCo, which traded above the 20x threshold for almost the entirety of the last decade.

It’s hard to argue with the fact that PepsiCo, at least relative to its historical valuation, is cheap. Looking at consensus EPS estimates for 2024, which stand at $8.15 earnings per share, we get a multiple of 20.5x over next year’s earnings.

In my view, there’s no reason why PepsiCo shouldn’t see its multiple at the very least maintained at today’s levels, and a less conservative estimate would expect that margins return to historical means of approximately 24x.

PepsiCo targets long-term EPS growth at a high-single-digit pace from a combination of revenue growth, margin expansion, and buybacks. Historically, it was more than able to achieve this target. The market is growing at a low-to-mid-single-digit pace, and PepsiCo has a long track record of market share gains.

Considering a stable multiple, high single-digit EPS growth, and a 3% starting dividend yield, the path for double-digit returns is quite simple. And at the current valuation, we’re getting a decent margin of safety, as the stock is trading 10% below historical multiples.

Conclusion

PepsiCo underperformed the market throughout 2023. The combination of shifting market sentiment and worries about declining volumes has led to a significant multiple contraction.

Despite industry dominance and continued market share gains, PepsiCo is now trading at a multiple that’s historically low, especially relative to the market’s average.

I expect PepsiCo to continue providing double-digit returns through steady EPS growth and dividends. With a very decent margin of safety at current levels, I rate the staples empire a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.