Summary:

- PepsiCo is trading higher following a strong Q1FY23 earnings release while the broader markets trade slightly down.

- Driving shares higher are positive revisions to guidance, as well notable strength in key markets.

- At new 52-week highs, investors may not be in a rush to jump straight into the shares. But the stock, nevertheless, is a worthy inclusion in any diversified investment portfolio.

Fotoatelie

PepsiCo (NASDAQ:PEP) is fresh off their Q1FY23 earnings release and the stock is trading about 2% higher on the day. This compares favorably to the broader markets, which are down slightly.

One factor moving shares is their strong quarterly performance, which came in better than expected and was paired with positive revisions to guidance. Organic revenue is now expected to grow 8% during the year. This compares favorably to a prior forecast of 6%.

In addition, the company reported that their price/mix, an important metric that tracks prices as well as product mix, packaging, and size, was up 16% for the period. This includes price increases of about 13%-14%. For comparison, Coca-Cola (KO), which released results yesterday, reported an 11% increase in price/mix.

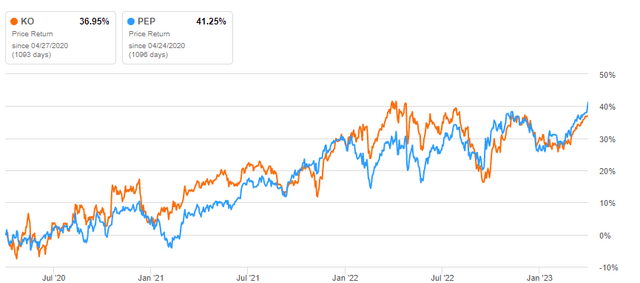

Over the past three years, PEP has outperformed KO by a modest margin.

Seeking Alpha – 3-Yr Returns Of PEP Compared To KO

And the share price outperformance has continued in more recent periods, with shares up just over 9% over the past year and nearly 6% on a YTD basis, both of which outshines KO.

Seeking Alpha – 1-YR Return of PEP Compared To KO

PEP is priced accordingly at a forward multiple a few turns above KO. Given their recent performance and momentum, I view the premium as justified. While investors may find it best to wait for a better entry point, shares remain attractive at current pricing. For one, the outlook appears promising, especially in emerging markets. And the company’s vast product offerings of relatively inexpensive consumables position the stock nicely to outperform during recessionary periods. For investors seeking to hunker down in advance of any incoming downturn, PEP is one stock that can shine through both the good days and the bad days.

Strong Overall Revenue Growth

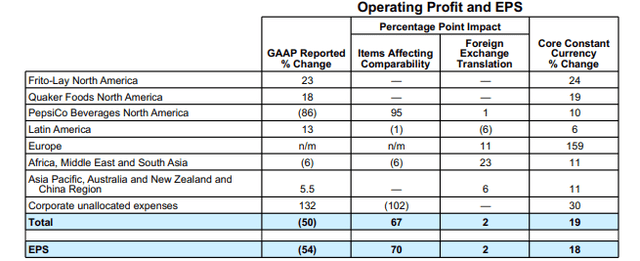

In the first fiscal quarter of the year, PEP reported total net revenues of +$17.8B. This was up 10.2% on a YOY basis and +$580M better than expectations. At +$2.6B, total operating profit was down 50% from last year, due primarily to the gain on sale associated with the sale of their juice brands in the prior year. This one-time transaction also accounted for the 17.8% decrease in operating margins in the current period.

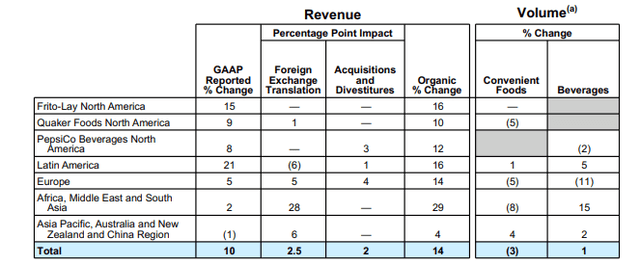

Positive Contributions From Most Operating Regions

Within their individual segments, all reported positive contributions to revenue growth, except for their Asia Pacific (“APAC”) region, which turned in a 1% decrease during the period. Declines here, however, were primarily due to a 6% impact relating to unfavorable foreign exchange (“forex”). But adjusting for this, sales were up in the region on an organic basis by 4%.

Q1FY23 Earnings Release – Summary Of Quarterly Revenues By Region

Notable Strength In Africa, Middle East, And South Asia (“AMESA”)

Another region that was held back by unfavorable forex was the AMESA region. Here, the effects were even more pronounced, as unfavorable forex contributed to a 28% impact on net revenues. Additionally, the forex effects also contributed to a 23% decline in operating profit during the period.

On an organic basis, though, the region reported organic growth of 29%, which was the strongest among all regions.

Convenient food volumes did decline by 8% during the period, but this was offset by 15% growth in their beverage unit, due primarily to double-digit growth in India.

Compared to other regions, AMESA was held back to a greater degree by higher commodity costs, such as cooking oil and packaging materials. In addition, operating and advertising/marketing costs were also elevated during the period. Altogether, these variables contributed to a 77% impact on the overall 6% decline in operating profits.

Q1FY23 Earnings Release – Summary Of Operating Profit By Region

A Worthy Portfolio Holding Through Any Business Cycle

PEP turned in strong first quarter results and included positive revisions to guidance in the release. And after adjusting for the negative forex effects, strength was particularly strong in their emerging markets. Organic growth in the AMESA region, for example, was stronger than all other reportable regions.

This was led by double-digit volume growth in their beverage unit in India, which is a country that is likely to figure to be a significant driver of future product sales.

CFO Hugh Johnson did note that the company is preparing for a mild recession this year. But despite this, consumers are still spending on their branded products, such as Cheetos and Mountain Dew, even as prices continue to grow at double-digit rates.

Some consumer trade-down was noted. For example, instead of purchasing single-serve cans, some consumers are opting for the two-liter bottles, which provide more bang for the buck. In addition, some consumers are also pulling their wallets from more high-end grocery stores to the mainstream ones.

At any rate, simple indulgences such as chips and soda continue to be difficult luxuries to pass up on, even during recessionary periods. It is because of this that PEP will likely continue to outperform in the periods ahead.

At current trading multiples, it does trade at a premium to peer, KO, but I view this as justified given recent performance, which includes a stronger price/mix ratio and, what I view, to be a more promising outlook in emerging markets, such as India.

In recessionary periods, consumers can always reach for their simple luxuries without breaking the wallet to get through challenging events. Likewise, PEP is one stock that I view as capable of performing through any business cycle. As such, I am revising my prior outlook on the stock to a “buy” from a “hold” previously.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.