Summary:

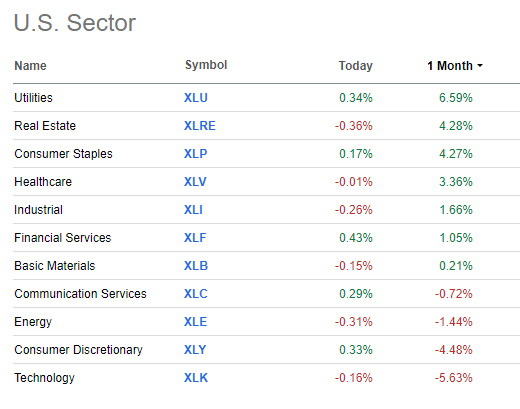

- PepsiCo is treading water in the Consumer Staples sector, a group that is performing well in the S&P 500.

- Quarterly results for PEP showed a beat in EPS but a miss in revenue, with challenges in the snack and soft drink market but strong ex-US numbers.

- PEP continues to reward shareholders with buybacks and dividends, with analysts predicting growth in earnings and dividend yield.

- I outline key price levels on the chart to monitor.

Jonathan Knowles

PepsiCo (NASDAQ:PEP) continues to tread water, while the Consumer Staples sector is actually among the top areas of the S&P 500 over the past month. Defensive niches have indeed been preferred by investors as volatility rose and retreated. Despite the 8% S&P 500 incline since the crash low following a weekend of turmoil in the Japanese market two weeks ago, we are still in a bearish calendar stretch.

The past two years have featured an uptick in volatility among global stocks from August through the start of the fourth quarter. Hence, I’m cautious about the SPX in the short term, but also believe Staples could continue to hold their own.

I reiterate a buy rating on PEP, one of the biggest weights in the Consumer Staples sector. I see its valuation as attractive after a mixed Q2 report, while its technical situation is lackluster.

Staples Catch a Bid M/M

Seeking Alpha

Back in July, PepsiCo reported a decent set of Q2 results, but investors weren’t all that thrilled. Quarterly EPS verified at $2.28, a $0.12 beat, while revenue of $22.5 billion, up just 0.8% from the same quarter last year, was a material $100 million miss. Shares dipped 0.2% after the report.

The guidance was not all that impressive either. PepsiCo’s management team now expects this year’s top line to increase by 4% versus the previous organic revenue growth outlook of “at least 4%.” Core constant currency EPS is seen increasing by 8%, not far from the S&P 500’s average.

Digging into the quarterly numbers, the bottom line beat was driven by solid productivity levels and decent cost control. It has been a challenge for soft drink and snack companies as GLP-1 weight loss drugs cast a shadow right now and as some deflationary trends in goods, along with a consumer pushback, weigh on sales. Hence, Frito-Lay volumes fell 3% in the quarter as private-label brands continue to grow in prominence among households. PepsiCo will likely have to consider reducing margins to re-attract cost-conscious consumers, so that’s a key risk.

Other investment risks include adverse currency changes, a weaker macroeconomic environment, and heightened competition, including those from generic brands. Strength in its international market was particularly encouraging, but a global downturn could reduce its performance there.

But the firm continues to reward shareholders with buybacks and dividends. Share repurchases summed to $1.0 billion, while dividends clocked in at $7.2 billion. What’s more, as the US Dollar Index gives back all of its 2024 gains, we could see a notable Q3 FX tailwind in the upcoming earnings report, so be on guard for upward earnings revisions.

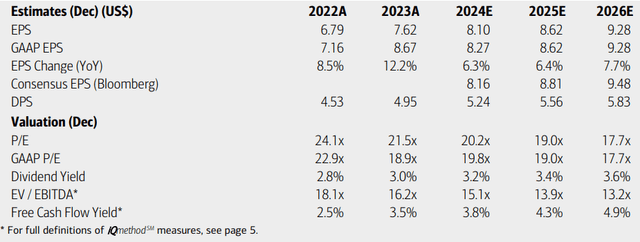

On the earnings outlook, analysts at BofA see EPS rising by 6% this year, with mid-to high-single digit profit trends through the out year and 2026. The current Seeking Alpha consensus estimates show a bit better short-term earnings growth, potentially rising to $9.43 of operating EPS by 2026 on sales growth of between 2.7% and 4.4%.

Dividends, meanwhile, are expected to rise by about $0.30 per year, resulting in a yield that should remain more than 150 basis points above that of the SPX as the P/E drifts lower if the share price hold current levels.

PepsiCo: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

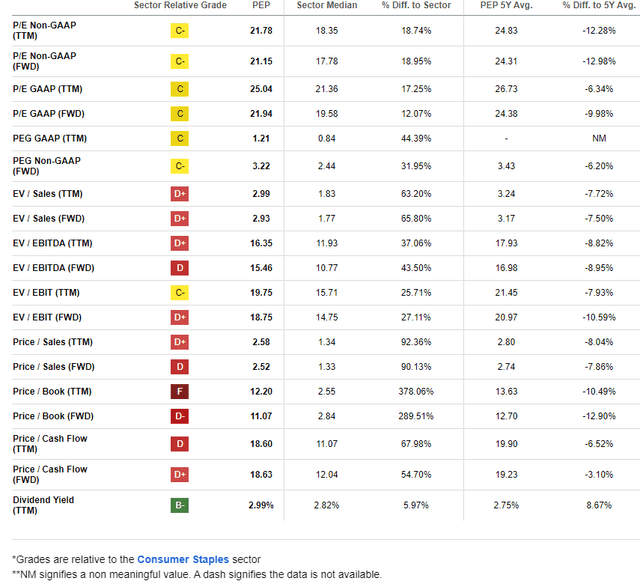

On valuation, if we assume forward non-GAAP EPS of $8.50 and apply the stock’s 5-year earnings multiple of 24.3, then shares should trade near $207. I am growing more concerned about the multiple, though, considering the reality that households are pushing back on brand-name products.

Thus, I’m reducing my earnings multiple to just 22 – that is still slightly above the broader market’s P/E. As a result, the intrinsic value target is now $187. That makes PEP still a buy, but I am less upbeat compared to earlier this year.

PEP: Mixed Valuation Metrics

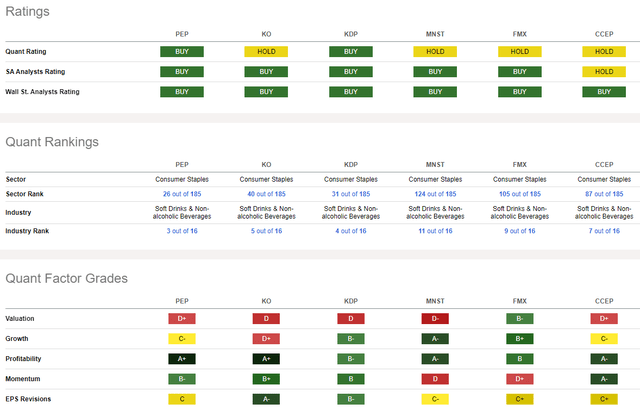

Compared to its peers, PEP features a weak valuation rating, but shares almost always boast a premium earnings multiple. The good news is that the dividend yield is above the long-term average, while free cash flow has been consistently robust. But the growth picture is not all that sanguine compared to expectations for the overall US large-cap market.

Moreover, there have been a high 13 EPS downgrades from the sellside in the past three months, compared with just a trio of upgrades. PEP’s share-price momentum is nothing to write home about, too, and I’ll outline key price points to watch as we approach the final quarter of 2024.

Competitor Analysis

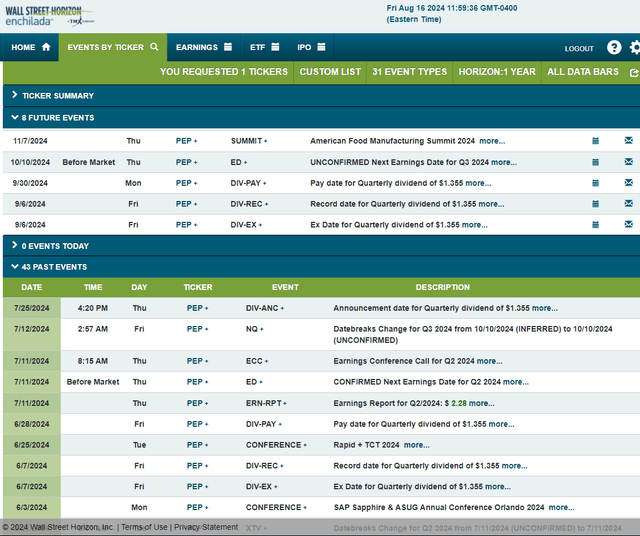

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q3 2024 earnings date of Thursday, October 10 BMO. Before that, the stock trades ex the $1.355 quarterly dividend on Friday, September 6. No other volatility catalysts are seen on the calendar in the near term.

Corporate Event Risk Calendar

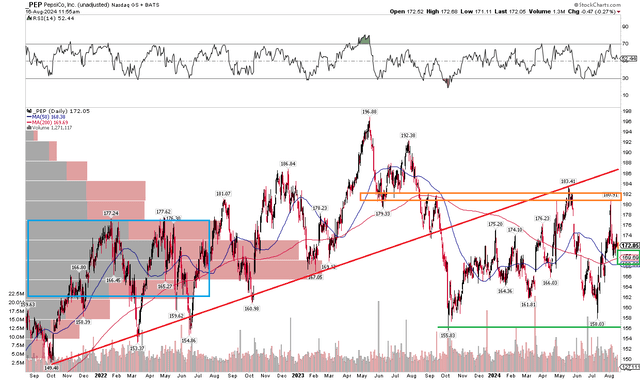

The Technical Take

PEP’s technical view is not one that will catch the attention of momentum investors. Notice in the chart below that choppy price action has occurred ever since the $237 billion market cap company saw its stock price top out in May of last year. A protracted downtrend to a low of $156 ensued through the following October, and despite a recovery to $183 this past May, the bears have re-asserted their presence in the overall trends.

With a flat long-term 200-day moving average, the bulls and bears continue to duke it out. I like that PEP is above the 200dma and 50dma, but we really need to see price climb above the $180 to $183 zone to help support the thesis of a new uptrend. All the while, support is at the low from the past two years – between $155 and $158. I expect the current area to remain in play given a high amount of volume by price centered right where PEP trades today.

Overall, the choppy chart makes me even less upbeat about PEP, but it remains a solid long-term candidate, particularly if intermarket trends continue to favor Consumer Staples.

PEP: Continued Soft Momentum, A Trading Range Emerges

The Bottom Line

I have a buy rating on PEP. I see the stock as adequately undervalued despite mixed financial performance lately and an ongoing neutral technical situation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.