Summary:

- PepsiCo’s Q1 ’24 net sales slightly exceeded consensus estimates, with declines in volumes for FLNA and PBNA.

- International markets show strong growth potential, particularly in India, but may pressure operating margins.

- QFNA faced significant challenges with product recalls, impacting sales and operating margin, leading to the closure of a plant.

- We maintain our $151 target price and Sell rating given the overvaluation relative to our DCF and peers, and continued overhang of GLP-1 and Russia risks.

Fotoatelie

Summary

PepsiCo’s (NASDAQ:PEP) Q1 ’24 net sales of ~$18.3bn came in above consensus estimates by ~1%. Volumes declined by ~2% vs consensus at ~3%, with Frito-Lay North America (“FLNA”) declining ~2% (vs consensus -1.5%) PepsiCo Beverages North America (“PBNA”) declining ~5% (vs consensus -5%). Its price/mix growth of ~5% was broadly in line with consensus at 5.4% in most geographies. Operating income of ~$2.9Bn came in ~4% ahead of consensus but did not include ~$170MM of product recall costs at Quaker Foods North America (“QFNA”), which was worth 6 points of operating income growth. Including these costs, Core EPS is in line with consensus at ~$1.52.

With the pressures highlighted in our initial report persisting, we continue to believe Pepsi’s valuation is stretched and maintain our target price of $151/share and Sell rating.

Earnings Update

International

As sales growth in North America continues to normalize, PepsiCo’s international segments are starting to draw more attention from investors. Sales outside of North America represented ~39% of total sales in 2023, and its international footprint is relatively concentrated (n.b., top 5 markets representing ~19% of group sales, with the remainder split amongst another ~190 countries).

In the 10 years preceding COVID, Pepsi’s international markets saw ~8% organic sales growth p.a., +4x North America’s ~1.6% growth, and carrying the group’s average of growth of ~4%. We see the greatest long-term opportunity in India, where it has a robust local snacks portfolio (i.e., Kurkure, etc.) and its beverages portfolio has largely been refranchised to the local operator, Varun Beverages.

Despite the strong growth profile in international segments, it is important to note that faster international sales growth pressures the group’s operating margin. Granted, this pressure is less pronounced now than it has been in recent years due to improving profitability in LatAm (n.b., aided by favorable currency movements) and in Russia.

In Q1, PepsiCo’s international segments saw 9% organic sales growth, more than offsetting the weaker performance in North America (-0.6%).

APAC

The APAC division saw 12% volume growth in Q1, driven by 12% growth in convenient foods (i.e., snacks) and offset by a slight decline in beverages. China represents ~57% of Pepsi’s APAC sales, and a disclosure in the 10Q indicated a double-digit snacks volume growth compared to a high-single-digit comp in the prior year, though beverage volumes declined by mid-single-digits (n.b., low-single-digit growth in the prior year).

Russia

Russia is coming off 2 years of soft volume comps in both its convenient foods and beverages portfolios, driving double-digit volume growth in these categories in Q1. Pepsi’s European division (of which Russia represents ~27% of sales) posted a 3% volume growth in Q1. Growth in Russia helped offset the double-digit volume declines in France, which came about as a result of disputes with retailer Carrefour.

QFNA

QFNA suffered from 2 product recalls in December ’23 and January ’24 for potential salmonella contamination in certain granola bars and cereals, both stemming from the Danville plant in Illinois.

The Danville plant has been quarantined. QFNA only has 5 plants, so the impact on sales has been material. In Q1, QFNA’s sales declined by ~24%, and its operating margin fell to -7.6% (n.b., ~21% excluding the recall-related costs). Management expects the impact of the recall to moderate over the balance of the year.

In April ’24, it was announced that the Danville plant would be permanently closed by June ’24. The plant closure will make more than 500 employees redundant (n.b., ~2% of Danville’s population). We understand that the investment required to remediate the potential contamination issues was too costly, which drove the decision to close it.

Production from Danville will be reallocated to other facilities, likely to the large plant in Cedar Rapids, Iowa (n.b., the largest cereal milling plant in the world). It is unclear whether additional capex will be required to facilitate this, adding further risk to the near-term financial outlook.

PBNA

PBNA volumes declined ~5% in Q1, with carbonated soft drink (“CSD”) volumes declining ~3% and non-carbonated beverages (“NCB”) volumes declining ~7%.

Excluding the contribution from Celsius ((CSD)), we estimate NCB volumes declined by low double-digits, mostly due to Gatorade (n.b., disclosures in the 10Q indicate double-digit volume declines vs a high-single-digit decline in Q1 ’23). As discussed in our previous report, the sports drinks category has become incredibly competitive, which we believe will lead to sustained pressure on Gatorade’s volumes.

CSD volumes were aided by the launch of Mountain Dew Baja Blast as a permanent line extension. As discussed in our previous report, Mountain Dew faces secular volume pressure as consumers shift towards sugar-free energy drinks. PBNA saw ~6% price/mix growth in the quarter, with the negative mix effect from Gatorade volumes offset by pricing and growth at Celsius.

FLNA

FLNA missed consensus expectations for all key metrics, with volumes declining ~2% vs consensus at 1.5%, price/mix of +3% vs consensus at +3.6%), resulting in sales of ~$5.7bn (n.b., ~0.5% below consensus) and an operating margin of ~27.8% (n.b., -90bps to consensus at 28.7%).

Valuation

In our view, Pepsi’s valuation is quite stretched for a business we see delivering ~6% long-term EPS growth p.a. with considerable risks clouding the picture. As we discussed in our previous report, GLP-1 agonists are a risk to FLNA, a division that has historically driven roughly half of the group’s organic growth. Additionally, Russia accounts for ~5% of the group’s EPS, which presents a set of potential risks (i.e., potential impact of sanctions, cash expatriation, etc.).

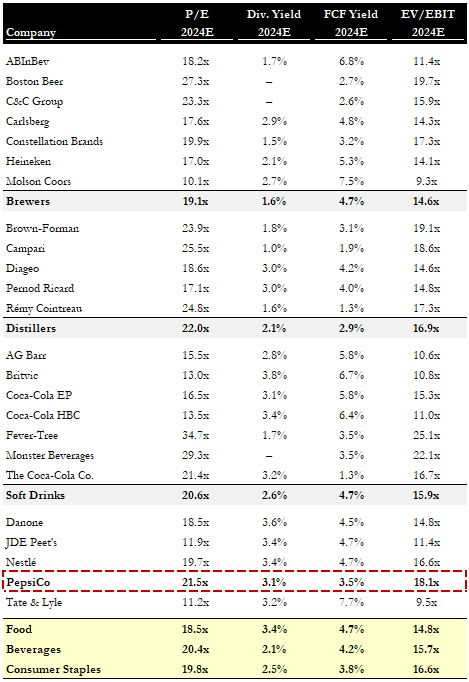

Our $151 target price implies a forward P/E of ~19x, a modest ~5% discount to the long-term average, and is based on a 10Y DCF model. We assume a 7.5% WACC, ~4% post-currency sales growth, ~17% operating margin in year 10 and ROIC of ~19%. This equates to ~19x forward P/E with a ~3% yield and implied return of -8%. We maintain our Sell rating.

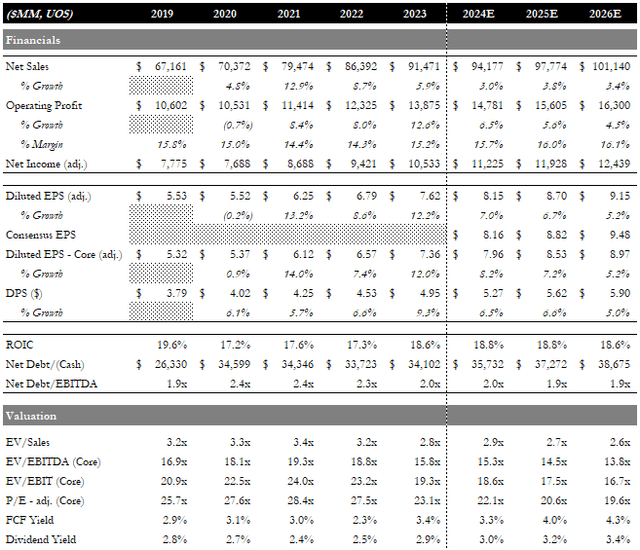

Forecast & Multiples (Empyrean)

The company is trading at a ~13% premium to the consumer staples sector’s ’25E P/E (n.b., historical premium is ~ 10%). Pepsi’s higher ROIC justifies a premium to peers, but we see the current premium as being too high, given our forecast for sector-average organic sales growth (~4% p.a.) led by price/mix and a below-average operating margin which is reliant on cost savings.

Trading Comps (Empyrean)

Risks to our forecasts include (1) weaker US consumer spending, (2) the seizure of Pepsi’s Russian assets, (3) greater adoption of GLP-1 agonists affecting FLNA’s sales, and (4) a deeper decline in PBNA’s volumes.

Upside catalysts include: (1) US snacking habits proving more resilient than anticipated, (2) commodity costs easing, and (3) better progress in energy drinks following Rockstar’s packaging refresh.

Conclusion

Despite beating consensus estimates on certain metrics, we see Pepsi as being overvalued in the context of continued volume pressure at PBNA and FLNA, recalls at QFNA, and the overhang of its Russian businesses. We maintain our Sell rating and $151 target price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.