Summary:

- The US salty snacks sector is exiting its pandemic-induced supercycle, and experiencing a moderation in growth rates, impacting the outlook for Frito-Lay North America.

- Pepsi Beverages North America continues to experience volume challenges, but the inclusion of Celsius may help improve the picture.

- PepsiCo’s current valuation is too high given our projected EPS growth and significant risks, including the impact of GLP-1 agonists on FLNA’s success and the potential seizure of Russian businesses.

Brandon Bell/Getty Images News

Summary

The US salty snacks sector is exiting its pandemic-induced growth supercycle, with industry growth rates moving from ~9% p.a. during 2019-2023 to ~3% p.a. in the coming years. This will affect Frito-Lay North America’s (“FLNA”) short-term growth prospects. Over a longer timeframe, the emergence of GLP-1 agonists may impact volumes, which is significant considering FLNA’s contribution to half of Pepsi’s organic profit growth since 2000. The sparkling product segment within Pepsi Beverages North America (“PBNA”) saw a ~4% decline in volume in 2023, despite efforts to stabilize the portfolio. The inclusion of Celsius is projected to slightly increase PBNA’s volume growth to ~0.4% p.a., which is ~1% below consensus. Cost reductions are expected to balance the operating leverage challenges the sparkling portfolio faces, leading to stable operating margins, in contrast to the consensus expectation of a mid-teens margin by 2026.

Pepsi’s (NASDAQ:PEP) current valuation reflects a ~22x one-year forward P/E ratio, which represents a ~10% premium over its historical average and a ~20% premium compared to its peers in the staples sector, despite similar long-term organic sales growth prospects and lower operating margin. Our price target is ~$151 per share.

We believe that Pepsi’s current valuation is too high, given our projection of ~6% EPS growth over the coming years and several substantial risks that are not priced in. Of particular concern is the impact of GLP-1 agonists on the future success of FLNA, a sector that has consistently accounted for 50% of Pepsi’s organic profit growth, and the potential seizure of its Russian businesses. Given these risks and the downside implied by our target price, we rate the shares a Sell.

Earnings Update

Pepsi’s Q4 2023 results missed consensus sales expectations by ~2%. Volumes decreased ~4%, missing the consensus estimate of a ~2% decrease. This included a 2.5% decrease for FLNA, compared to -1.3% expected, and a 7% decrease for PBNA, against -5.3% expected. Additionally, a product recall at Quaker Foods North America (“QFNA”) further weighed on results, with an 8% volume decline compared to last year’s 7% decline. However, the price/mix increase of 9% was slightly more favorable than the 8.2% consensus estimate, partly due to inflation-driven pricing growth in Argentina and Turkey.

Core EPS of $1.78 was ~3% higher than the consensus estimate of $1.72. It is important to note that if the costs associated with the recall were included, EPS would have missed by ~0.5%, ending Pepsi’s 55-quarter streak of meeting or exceeding consensus earnings expectations. EPS was also supported by lower-than-expected interest expense of ~$136MM, which was ~30% lighter than the consensus estimate of ~$197MM.

We were focused on the ’24 organic sales growth forecast, especially considering the company’s early guidance during its Q3 results in Oct-23, which suggested growth “towards the upper end” of the long-term 4-6% range. However, the company revised its guide to “at least” 4% organic sales growth for ’24, lower than the ~5% consensus estimate. The company anticipates growth to be weighted towards the back half of the year, due to the ongoing impact of the product recall. Despite the subdued top-line growth forecast, EPS guidance of $8.15 implies a 7% YoY growth, which aligns with the consensus, supported by normalizing commodity costs.

End of the Snacking Supercycle

FLNA is a significant component of Pepsi’s profitability, contributing ~27% of sales in 2023, and ~42% of operating income (n.b., before corporate expenses). Since 2000, FLNA has driven ~25% of Pepsi’s organic sales growth, largely attributed to its strong and concentrated brand portfolio (n.b., top five brands generate ~60% of its sales). Additionally, FLNA has contributed to ~50% of Pepsi’s organic operating profit growth.

The performance of FLNA is crucial to the narrative of Pepsi’s stock. Despite our current bearish position on Pepsi as a whole, we are relatively optimistic about FLNA. However, our forecast for FLNA’s long-term organic sales growth is slightly below consensus, reflecting a more conservative stance on volume growth.

In 2023, FLNA achieved an organic sales growth of 9%, driven by a 10% increase in price/mix, and offset by a 1% decline in volumes. Between 2019 and 2023, FLNA maintained an average growth rate of about 10% p.a., significantly above its average growth rate of ~5% p.a. from 2000 to 2019. This period reflects a broader supercycle in the salty snacks category, influenced initially by COVID-related increases in home snacking and inflation-driven price increases.

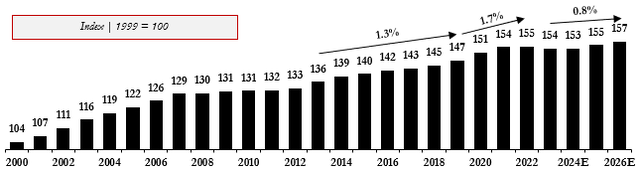

FLNA Volumes Index (Empyrean; PEP)

FLNA holds ~60-70% share of manufacturer sales within the salty snacks category. The robust growth over the last four years is largely a function of COVID and inflation, and will not be sustainable over the long-term. Supporting this position, management’s commentary during the Q4 results referred to an anticipated “normalization” of growth.

We are estimating a normalization in the salty snacks category’s manufacturer sales growth to a 3% CAGR over the next three years, with FLNA expected to slightly outperform at a 3.5% CAGR. This outperformance is partly due to FLNA’s strong brand portfolio, which is weighted towards value-priced and indulgent snacks. In contrast, companies like Hershey, which have diversified into ‘healthier’ snacks, have experienced a slowdown in specific segments (e.g., popcorn), as lower-income consumers seek snacks with greater value for satiety.

Components of Growth

FLNA’s net sales per pound have increased by ~29% in the last two years, reflecting its strong brand power and distribution systems, and the resilience of the snacking category. The ~13% CAGR over these two years is significantly greater than the pre-pandemic decade’s CAGR of ~1%. Net sales per pound have grown steadily and reliably over the past several decades, with the exception of a slight decline in 2010 following the GFC. Despite certain retailers (e.g., Walmart) discussing price “deflation”, we do not see negative net pricing growth for FLNA products as a credible risk, given its significant brand and bargaining power.

FLNA Net Sales per Pound ($) (Empyrean; PEP)

On price/mix growth in 2024, we anticipate growth in single-serve formats within the convenience channel, which remains untracked by scanner data, to contribute positively to the mix. We also expect FLNA to refine its pricing and packaging strategies, along with promotions in the retail channel, to achieve ~3% price/mix growth, materially in line with consensus.

On the volume outlook for 2024, the pandemic-induced spike in snacking has receded. Utilizing the decade pre-pandemic (2010-2019) as a baseline, our analysis indicates that per-capita consumption in 2023 nearly reverted to 2019 levels, following two years of significant pricing growth across the industry. With pricing expected to normalize and a trend towards less at-home snacking, we project flat volumes for the salty snacks category in 2024. Beyond this, we anticipate a return to the pre-pandemic growth rate of ~1.2% p.a. for category volumes, driven by a 0.7% annual increase in per-capita consumption and 0.5% population growth.

GLP-1 Agonists

Focusing on FLNA, preliminary studies indicate a reduced preference for savory items (e.g., potato chips) among GLP-1 agonist users, and an average ~35% decrease in total caloric intake. These medications could potentially impact FLNA’s volume growth over the long term; however, the research at this stage involves a relatively small sample size.

Additionally, data from Prime Therapeutics suggests a ~68% discontinuation rate for GLP-1 agonist therapy within the first year. Post-discontinuation, there tends to be a significant rebound effect, with studies indicating that up to two-thirds of lost weight is regained within two years. Given the high cost of these medications and the observed low adherence rates, we are hesitant to adjust our long-term organic volume growth forecast. Regardless, these medications do pose a downside risk to our forecasts and consensus estimates.

FLNA Margin Pressure

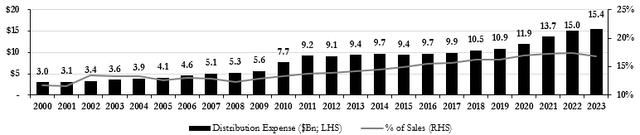

FLNA’s primary commodity costs are also normalizing, though they remain elevated above pre-pandemic levels. We expect this normalization to contribute to expansion of the division’s gross margin, though likely offset by an increase in operating costs. At Pepsi’s group level, selling and distribution expenses as a percentage of sales fell ~50bps YoY to 16.8%, driven by lower US freight rates as a result of lower oil prices.

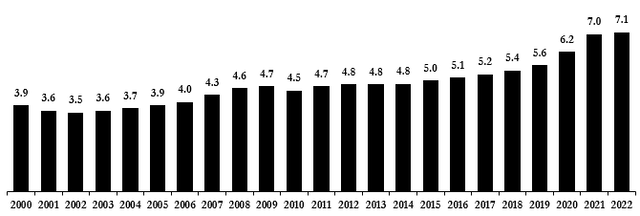

PEP Distribution Expense (Empyrean; PEP)

During the Q4 call, management mentioned its plans to boost advertising and marketing (“A&M”) spending in 2024. A&M spending in 2023 was ~6.2% of sales, a ~20bps increase YoY (n.b., still below the pre-pandemic level of ~7.0% in 2019). Excluding Russia, where A&M was suspended in March 2022, A&M spending was ~6.5% of sales in 2023, still ~50bps lower than pre-pandemic.

It’s important to note that A&M spending plans among FLNA’s peers for 2024 are varied. Hershey, for instance, indicated that its A&M spending as a percentage of sales would remain stable YoY in its Q4 2023 results. In contrast, Kellanova suggested an increase in A&M expenditures for 2024.

The shift in category mix towards single-serve packs is also projected to improve profitability and margins. We estimate FLNA’s an operating margin of 27.9% in 2024, slightly above consensus estimates of 27.7%, and a ~60 basis point YoY expansion.

Challenges in Beverages

A central aspect of our Sell recommendation is based on our perspective that the anticipated volume growth and margin expansion for Pepsi’s domestic beverages segment, PBNA, which constitutes 30% of group sales and 19% of operating income before corporate expenses, are overly optimistic. This optimism presents a risk for potential downgrades to consensus earnings forecasts.

In this analysis, we examine PBNA’s recent performance, which has fallen short of our expectations and has not kept pace with competitors. We also reassess PBNA’s long-term outlook in light of significant changes to its portfolio over the last two years.

The strategies of the three major soft drink companies in North America in 2023 have shown similarities, with most price adjustments made in 2022 to counteract commodity price inflation. Some of these adjustments occurred mid-year and were expected to carry over into the following year, with limited additional pricing actions anticipated for 2023.

PBNA differed in its approach by postponing its annual 2022 pricing adjustments, typically enacted after Labor Day, to the beginning of 2023. This resulted in weaker pricing relative to its peers in 2022, followed by stronger pricing in 2023. Despite this, PBNA reported a slight volume growth in 2022, which was below Coca-Cola’s ~1% organic volume growth in North America (excluding the impact of the BodyArmor acquisition) but aligned with Keurig Dr Pepper’s (KDP) performance.

However, in 2023, PBNA experienced a 5% decline in volumes, markedly underperforming its peers throughout the year. This decline was partially due to the timing of its price increases, but also ongoing weaknesses in carbonated soft drink (“CSD”) volumes, changes to Gatorade’s distribution, and the optimization of promotions for certain water products. It’s important to note that as of this analysis, Coca-Cola and KDP have yet to report their fourth-quarter results for 2023, but Coca-Cola’s North American volumes decreased by just 0.5% in the first nine months of 2023, while KDP’s volumes grew by ~0.5% (compared to PBNA’s 4.5% decline over the same period). The consensus forecasts anticipate modest volume growth for both TCCC and KDP in the fourth quarter, resulting in slightly positive volume growth for the entire year.

PBNA’s volume performance in recent years has been influenced by a series of portfolio adjustments:

- In the first quarter of 2022, Pepsi formed a joint venture for its North American juice operations, creating the Tropicana Brands Group (“TBG”) in partnership with PAI Partners. Pepsi retained a 39% interest in this venture. While PBNA continued to distribute the more lucrative single-serve juice formats, the divestiture of the juice business is estimated to have negatively affected reported volume growth by ~2% in 2022. This adjustment did not impact organic volumes, and notably, it excluded large-format juices from PBNA’s organic sales figures.

- During the third quarter of 2022, Pepsi acquired an ~8.5% stake in Celsius Holdings, a company specializing in ‘clean’ energy drinks, for $550MM and established a distribution agreement within the US. Starting on 1 October 2022, Celsius began transitioning its North American distribution network to PBNA. This transition, however, coincided with the cessation of PBNA’s distribution of Bang energy drinks in June 2022, which largely neutralized the financial benefits of the new partnership with Celsius.

- From the fourth quarter of 2022, Gatorade products sold in retail outlets began moving from a warehouse distribution model to a direct-store-distribution (“DSD”) system, aimed at improving market execution. In Q4 2023, this transition was ~90% complete.

- At the beginning of 2023, Pepsi introduced several enhancements to its carbonated soft drink (“CSD”) lineup. These included the launch of Starry, a rebranding with a new Pepsi logo in North America, and a reformulated version of Pepsi No Sugar.

- On the third-quarter 2023 earnings call, the CEO highlighted that reducing less profitable promotions for large-format water products had a negative impact of about 2.5% on PBNA’s volumes. While such adjustments are part of routine business operations and should be considered within organic volume calculations, for modeling purposes, this factor is delineated separately to illustrate its effect on our 2024 volume projections.

Celsius Distribution

The most significant enhancement to PBNA’s portfolio is the incorporation of Celsius into its organic sales growth starting in 2024. Based on disclosures from Celsius’ quarterly filings, the transition to PBNA’s robust distribution network has significantly boosted Celsius’ sales growth in North America for 2023. The transition was well executed, with PBNA now handling ~75% of Celsius’ North American sales.

PBNA has expanded Celsius’ presence in retail and convenience stores, increasing store penetration from ~65% to 95%. Additionally, PBNA is extending Celsius’ reach into new markets, such as food service, and is improving performance in the convenience channel, which accounts for about 70% of energy drink sales in the US. Celsius has also benefitted from access to around 50,000 of PBNA’s coolers, with an additional 20,000 Celsius-branded coolers placed in stores during 2023 to drive sales growth. Prior to the distribution agreement, Celsius had only 2,700 coolers.

We rely on consensus expectations for Celsius’ sales growth in North America from 2024 to 2026 to calculate the volume benefit for PBNA. Celsius is anticipated to achieve a CAGR of ~29% in its North American sales during this period, supported by expansion into Canada in the first quarter of 2024.

Our estimates also consider Celsius’ impact on PBNA’s broader financials. We assume that PBNA distributes Celsius products with a 20% markup to its customers, which supports price/mix growth but results in a dilutive gross margin of 20%. Given PBNA’s established distribution infrastructure, the SG&A expenses for Celsius as a percentage of sales are likely significantly lower than Pepsi’s group average. This efficiency contributes to an operating margin for Celsius that we estimate to be in line with PBNA’s overall average.

In Jan-2024, Pepsi introduced Rockstar Focus. Similar to Celsius, Rockstar Focus comes in 12 oz cans, contains 200mg of caffeine, and is sugar/calorie free. It sells for $2.99/can, positioning it as a premium product relative to Celsius and Monster’s Reign Storm. The premium price point is justified by unique ingredients, including Lion’s Mane.

Rockstar Focus appears to be PBNA’s foray into the ‘clean’ energy drink segment, which has previously challenged the market share of the core Rockstar brand in the U.S. Monster Beverage is also looking to revitalize its Bang brand and reclaim shelf space that has been lost to emerging ‘clean’ energy drink brands like Celsius in recent years.

The allocation of shelf space for Rockstar Focus raises questions. If it replaces existing core Rockstar products, there could be a risk of cannibalization. Additionally, there are operational concerns about whether PBNA will allocate adequate resources to Celsius, given its lower-margin distribution model compared to Rockstar Focus, which is likely to generate operating margins around 30%.

In a broader context, Pepsi announced a brand refresh for Rockstar in both North American and international markets in February 2024. This update follows a previous rebranding effort just two years earlier. Frequent rebranding can indicate a lack of strong brand identity, and we are skeptical that this latest visual update will significantly enhance Rockstar’s market performance.

Furthermore, in 2024, Celsius plans to extend its distribution to the UK through a partnership with Suntory, not involving Pepsi’s UK bottling partner Britvic, which has been expanding its sales team to support Rockstar. While Celsius’ core ‘clean energy’ proposition might not directly compete with Rockstar, it will necessitate shelf space, potentially impacting Rockstar. Historically, Rockstar has struggled in the UK energy drink market, with its category value share decreasing from 7% in 2017 to ~1% currently.

Where’s the Fizz?

The environment for Pepsi’s carbonated soft drink (“CSD”) portfolio has been challenging, with U.S. consumption declining since its peak in the early 2000s until the pandemic. Our estimates suggest that total per capita consumption of the CSD category has fallen by 38% from its peak, with Pepsi’s CSD consumption experiencing a more significant decline, roughly halving since 2000.

In response to this prolonged period of underperformance, Pepsi initiated several measures in Q1 2023. These included reformulating Pepsi Zero Sugar in the U.S. to improve taste, reducing its caffeine content, and adjusting the blend of artificial sweeteners. Additionally, the Pepsi logo in North America was rebranded for the 20th time in March 2023. Furthermore, PBNA replaced Sierra Mist with Starry, a new lemon-lime CSD brand.

Despite the scope of Pepsi’s beverage portfolio, CSDs still account for roughly half of PBNA’s volumes, making the stabilization of this category crucial for the company’s long-term success. Despite attempts to rejuvenate its CSD portfolio, PBNA’s performance significantly lagged peers in 2023, despite PBNA’s annual pricing round being postponed to the beginning of 2023, resulting in stronger price/mix throughout the year relative to competitors. However, this delay also meant PBNA faced relatively weaker pricing in 2022, with its CSD volumes still underperforming those of its peers.

Considering these factors, we prefer to analyze PBNA’s performance over a two-year span starting from Q1 2022, when inflation-driven pricing began following the start of the Ukraine conflict. Since then, we estimate that PBNA’s CSD volumes have declined by ~2% each quarter, on average, while both Coca-Cola and KDP have seen their North American CSD volumes grow by ~1% each quarter.

Consequently, scanner data consistently indicates value share losses for PBNA’s CSD portfolio in the U.S. (n.b., comprising ~93% of PBNA’s sales) over the last two years. Despite various initiatives by PBNA, CSD volumes continue to slide it is losing market share to competitors.

Looking ahead, Pepsi’s recent efforts have largely centered on stabilizing the Trademark Pepsi brand. Our analysis, drawing from the company’s annual disclosures, suggests that Trademark Pepsi volumes have declined by about 2.7% annually on average since 2000. This casts doubt on the notion that the 4% decline in CSD volumes for 2023 presents an easier comp for subsequent periods, an argument that could arguably have been made for nearly two decades. There’s little evidence to suggest that the rebranding and reformulation efforts for Pepsi and Pepsi Zero Sugar will prove meaningful.

In contrast, Coca-Cola’s management of the Trademark Coca-Cola brand has seen significant improvement post-pandemic, marked by successful initiatives such as the reformulation of Coca-Cola Zero Sugar and limited-edition innovations. Against this backdrop, we anticipate continued volume pressure on Trademark Pepsi, which still represents a substantial portion of PBNA’s CSD volumes.

Similarly, Mountain Dew, comprising 25-30% of PBNA’s CSD volumes, has experienced even more rapid declines than Trademark Pepsi in recent years, despite innovation in its sugar-free variants. The brand’s original high-sugar, high-caffeine proposition faces structural challenges as consumers, particularly younger cohorts, are increasingly preferring low-calorie energy drinks (e.g., Celsius, Monster Ultra).

In 2024, Pepsi plans to increase its investment in Mountain Dew and introduce Baja Blast as a permanent offering, though it’s uncertain if this will prove a sustainable solution to the brand’s struggles.

More Competition Against Gatorade

Pepsi’s non-carbonated beverage (“NCB”) portfolio, anchored by Gatorade, has outperformed its carbonated soft drinks (“CSDs”) portfolio. Since acquiring Gatorade in 2001 through its merger with The Quaker Oats Company, we estimate that Gatorade has achieved annual sales growth of ~7% p.a. and now contributes ~30% of PBNA’s sales. Gatorade’s sales growth accelerated to ~9% p.a. starting in 2018, following the launch of Gatorade Zero Sugar, broadening the brand’s appeal to health-conscious consumers.

The profitability of Gatorade fluctuates based on the extent of marketing and sponsorship activities in any given year. Typically, we estimate that Gatorade maintains an operating margin in the high teens, which is significantly higher than PBNA’s overall margin, and slightly above the group average. In 2023, Gatorade experienced a high single-digit sales growth, but saw a high single-digit decrease in volumes, marking its weakest volume performance since the GFC.

The transition of Gatorade’s distribution to the direct-store-distribution (“DSD”) model in retail stores may have led to modest inventory reductions by customers, which we expect to normalize in 2024. However, some of the volume declines could be attributed to consumer pushback against significant price increases and increased competition from new entrants (e.g., Prime).

Despite the foregoing, Gatorade’s retail sales grew ~3% in 2023, according to Nielsen IQ data, while competitor Prime emerged as a standout performer in the North American sports drink category in 2023. Prime’s retail sales increased sixfold and captured ~6% of the category’s value share.

Despite significant marketing investments and the launch of innovative products, the Powerade brand has struggled. In Q1 2024, BodyArmor launched a Zero Sugar SKU, targeting health-conscious consumers with a product free of artificial flavors, colorings, and sweeteners, and offering higher potassium content than Gatorade Zero. However, BodyArmor Zero Sugar lacks sodium, an essential electrolyte for rehydration, which may limit its effectiveness and appeal compared to Gatorade Zero among athletic consumers.

Given the high potassium content of BodyArmor Zero Sugar, its marketing is likely to emphasize this aspect, potentially appealing to consumers interested in supplementation rather than rehydration. This positioning suggests that BodyArmor Zero Sugar may appeal to a similar consumer as Prime, focusing on taste and natural ingredients rather than rehydration capabilities. As a result, we believe the threat to Gatorade Zero’s sales from BodyArmor Zero Sugar is modest and confined to consumers seeking to reduce artificial ingredient intake.

Looking ahead, we expect a significant marketing push behind BodyArmor in 2024, which may require increased A&M spend for Gatorade. Despite this, our long-term outlook for Gatorade remains unchanged, with expectations for sustained mid-single-digit sales growth, driven by a balance of volume and price/mix.

A key long-term consideration is the impact of the younger consumer demographic attracted by Prime. If these consumers become long-term sports drink adopters, it could potentially support Gatorade’s volume growth.

In summary, while consensus forecasts may be overly optimistic about PBNA’s long-term volume growth in a mature and increasingly competitive North American soft drinks market, our more conservative estimate still sees a modest volume growth contribution from Celsius. However, ongoing declines in the CSD portfolio are expected to continue. Regardless, the increasing proportion of NCBs in PBNA’s portfolio could provide a slight boost to operating margins due to favorable category mix effects.

New CFO and New PBNA CEO

Pepsi has recently undergone several significant management changes, including:

- Hugh Johnston, the CFO and a 34-year Pepsi veteran, retired in November 2023, and was replaced by Jamie Caulfield, who previously served as the CFO of Pepsi Foods North America.

- In January 2024, CEO of PBNA, Kirk Tanner, retired after a 32-year tenure to become the CEO of Wendy’s. He will be replaced by Ram Krishnan, who is currently the CEO of International Beverages and Chief Commercial Officer at Pepsi.

The recent executive changes might also serve as a turning point for reconsidering the structure of Pepsi’s North American bottling operations. This topic was broached during the fourth-quarter 2023 earnings call, suggesting the possibility of another round of refranchising for the bottling segment.

Historically, Pepsi divested its four anchor bottlers in 1999, anticipating that these entities would merge with and consolidate smaller bottling territories, thereby enhancing the efficiency and profitability of the U.S. bottling system. However, the performance of CSD volumes, which then represented roughly 90% of total volumes, declined following the spin-off, leading Pepsi to reacquire these bottlers in 2010.

It remains uncertain how another spin-off of the bottlers would enhance the execution of Pepsi’s North American beverage operations. However, such a move could mechanically improve PBNA’s margins by transitioning it to the more lucrative concentrate model.

‘Non-GAAP’ Adjustments

The product recall in the fourth quarter of 2023 led to $136MM in costs for Pepsi, which we believe were primarily inventory write-offs. These costs were classified as exceptional and excluded from Pepsi’s ‘core’ operating income calculations.

For QFNA, the reported ‘core’ operating margin was 20.3%. However, if the recall costs were included, the margin drops to 15.9%, down from 19.3% in 2022. This suggests the operating margin for QFNA in Q4 2023 was just 4.5%. At the group level, Pepsi’s ‘core’ operating income for Q4 2023 would have been 4.3% lower at ~$3.2Bn including the recall, leading to a 3.3% miss from consensus, rather than the reported 1% beat.

Additionally, $104MM of recall costs were excluded from Pepsi’s ‘core’ net income. Including these costs, the ‘core’ EPS would have been $1.71, 4.3% lower than reported, and would have missed consensus by 0.5%, ending its 55-quarter streak of meeting/exceeding consensus estimates.

Russia Overhang

Pepsi’s operations in Russia, its third-largest international market in 2023, contributing ~4% to group sales, stand out due to their scale compared to peers, with net sales of around $3.6Bn, 19 manufacturing plants, and ~20,000 employees. Pepsi’s experience in Russia, especially post the 2011 acquisition of Wimm-Bill-Dann (WBD), Russia’s largest dairy producer at that time, has been complex. Before the pandemic and Ukraine war, sales had declined by one-third from post-acquisition levels, impacted by slow organic growth, rising milk prices, and currency devaluation.

However, sales have grown ~26% since 2019, driven by organic growth and favorable currency movements in 2022. The growth was widespread across the portfolio, with a significant portion from the dairy sector, which we estimate accounts for up to half of its sales in Russia and includes essential consumer products like Domik v Derevne and the infant formula Agusha.

Following its announcement that it would suspend production of Pepsi-Cola and other branded sparkling beverages in Russia, the market expected slower sales growth for Pepsi’s Russian beverage portfolio. Although there was volume pressure in 2022, it was offset by strong price/mix growth, partly due to a focus on higher-revenue single-serve formats, as Pepsi-Cola concentrate was limited. The sparkling beverage portfolio was later supplemented with local brands, but beverage volumes still saw a slight decline in 2023.

Conversely, weaker beverage sales were balanced by robust growth in convenient foods, with significant volume increases in 2023 following a decline in 2022. As a result, total Russian volumes saw a mid-single-digit percentage increase in 2023.

The devaluation of the rouble impacted dollar sales in 2023, and it’s uncertain if Pepsi adjusted its prices in Russia to counter this, especially given the strong pricing in 2022 and the company’s efforts to recuperate volumes. The effect of the Russian sugar tax implemented in July 2023 on Pepsi’s beverage pricing is also unclear.

Looking ahead, we project an 8% organic sales growth in Russia for 2024, followed by mid-single-digit growth thereafter. Despite providing a boost to organic sales growth in Europe in 2022, Russia posed a challenge to European organic sales growth in 2023.

Half of Pepsi’s sales in Russia come from the dairy business, which we estimate had a high-single-digit operating margin before the conflict, broadly in line with WBD’s margin at the time of acquisition in 2011. We estimate the snacks and beverages businesses in Russia have mid-teens and low double-digit operating margins, respectively, suggesting an overall operating margin of around 10.5% for Russia in 2021, slightly dilutive to Pepsi’s group operating margin.

Pepsi suspended advertising in Russia in 2022, and we assume slightly less A&M spending in Russia, leading to a mid-teens operating margin estimate for 2022 and 2023. This implies that Russia contributed ~4% to Pepsi’s group operating income in 2023.

Cash repatriation from Russia is currently not feasible, and we assume the business has a net cash position after two years of strong local-currency EBIT growth. With Russian interest rates averaging around 10% in 2023, the local business likely generated positive interest income, further benefiting from Russia’s 20% corporate tax rate, slightly lower than the US rate.

In summary, we estimate Russia contributed about 4.5% to Pepsi’s 2023 EPS, a figure not officially disclosed by the company but important for assessing Pepsi’s valuation and risk/reward profile. The potential for asset seizure in Russia, as seen with competitors like Danone, poses a significant but currently unreflected risk in Pepsi’s valuation. Despite the seizure of competitor assets, the risk associated with Pepsi’s operations in Russia seems underappreciated by the market.

Estimates

Our projections for 2024 include organic sales growth of 4.6%, driven by 0% volume growth and 4.6% price/mix growth.

Looking ahead to 2025 and beyond, we model organic sales growth of 4.3% p.a. This forecast is 50-100bps p.a. below consensus and aligns with the lower end of Pepsi’s long-term goal of 4-6% organic sales growth p.a., and the historical average from 2010 to 2019.

For 2024, we expect international markets to lead Pepsi’s organic sales growth, as has been the case over the past two decades. We estimate ~8% growth in international markets and 2% growth in North America for 2024, with the latter being impacted by QFNA. After a rebound in 2025, our long-term forecast includes 6% organic sales growth annually in international markets, above the 3% annual growth expected in North America.

Faster sales growth in international markets relative to North America is projected to drive modest operating margin pressure of 5-10bps each year.

Pepsi’s operating margin was stepped down following the 2010 acquisition of its North American bottlers, which has since impacted the group’s profitability. In 2023, Pepsi’s ‘core’ operating margin improved by 85bps to 15.2%, with 20bps of this improvement attributable to the exclusion of product recall costs in QFNA.

For 2024, we anticipate ~30bps expansion in operating margin to 15.5%, which is slightly below consensus of 15.7%, as reduced commodity costs are partially reinvested towards A&M. From 2025 onwards, we expect a slower margin expansion of 15-20bps p.a., compared to consensus at ~30bps p.a. and below Pepsi’s long-term guidance of a 20-30bps increase p.a.

- For 2024, we forecast EPS of $8.15, in line with guidance and consensus.

- For 2025, we forecast EPS of ~$8.7, ~2% below consensus.

- For 2026, we forecast EPS of ~$9.1, ~4% below consensus.

Valuation

Based on our estimates, Pepsi is trading at an NTM P/E ratio of ~22x, a ~10% premium over its long-term historical average of ~20x. This is lower than the 24x average observed since the 2019 CAGNY conference when the company’s shares experienced a re-rating following the introduction of higher long-term targets by the then-new CEO.

Pepsi’s valuation is also at a ~20% premium relative to the consumer staples sector, compared to its historical ~10% premium. While Pepsi’s relatively higher ROIC justifies a premium valuation compared to peers, we believe that the current premium is not warranted given our projections.

Pepsi’s share price underperformed in 2023, declining by ~6% despite a ~4-5% increase in consensus EPS estimates for 2023 and 2024. This underperformance was driven by the increased risk posed by GLP-1 agonists, highlighted by Walmart’s third-quarter results in August 2023.

Our price target for Pepsi is ~$151/share, derived from a 10-year DCF, assuming a WACC of ~7.4%, ~4% post-currency sales growth p.a., a ~17% operating margin in year ten, a ROIC of ~19%, and long-term growth of 2.5% p.a. This valuation implies an NTM P/E of 18.8x and 15.9x EV/EBIT, and with a ~3% dividend yield, implies a total shareholder return of -9%.

Downside Risks

Potential downside risks to our forecasts include:

- Weaker-than-expected US consumer spending

- Potential seizure of Pepsi’s Russian assets

- Larger-than-anticipated impact from the adoption of GLP-1 agonists on FLNA’s sales

- Further deterioration in PBNA’s volume performance amidst a challenging competitive landscape.

Upside Risks/Catalysts

Conversely, upside risks include:

- More resilient US snacking habits than anticipated

- Greater-than-expected easing of commodity costs

- More favorable outcomes in the global energy drinks category following Rockstar’s packaging refresh.

Conclusion

In our assessment, Pepsi’s valuation appears high for a company that we estimate will achieve ~6% annual EPS growth over the long term, accompanied by significant risks to these earnings. Notably, GLP-1 agonists pose a potential threat to the long-term performance of FLNA, a division that has historically contributed to half of Pepsi’s organic profit growth. We initiate at Sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.