Summary:

- On October 10, 2023, the company published its financial report for the third quarter of 2023, which showed excellent results despite pessimism from financial market participants.

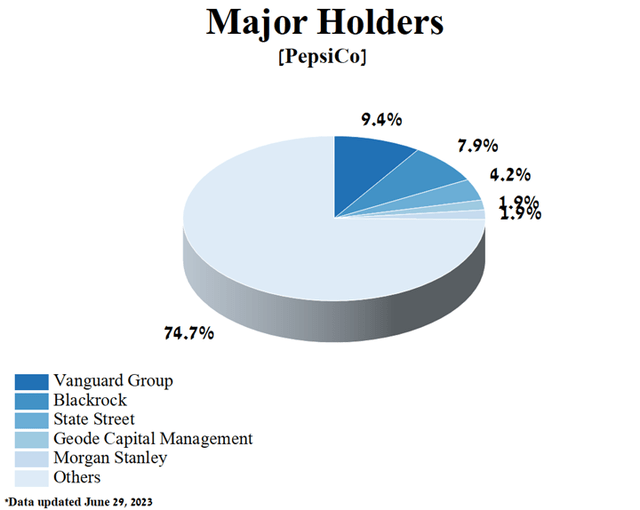

- The company’s top five shareholders, well-known Wall Street giants, including Vanguard Group, Geode Capital Management, Morgan Stanley, State Street, and BlackRock, collectively hold 25.27% of the company’s shares.

- The company’s Non-GAAP P/E [TTM] is 21.86x, 38% higher than the sector average and 11.46% lower than the average over the past five years.

- We believe that medicines such as Novo Nordisk’s Ozempic and Lilly’s Mounjaro are unlikely to impact PepsiCo’s revenue in the coming quarters significantly.

- We initiate our coverage of PepsiCo with a “hold” rating for the next 12 months.

CoffeeAndMilk/E+ via Getty Images

PepsiCo (NASDAQ:PEP) is one of the largest multinational companies renowned for its diverse product range, which includes popular food products such as Cheetos, Lay’s, and Doritos, as well as well-known carbonated beverage brands such as Pepsi-Cola, SodaStream, and Mountain Dew.

PepsiCo is a defensive stock. This means that PepsiCo’s share prices remain more stable and less susceptible to market fluctuations than companies in the industrial and technology sectors. We believe that this is especially important since the outbreak of conflict in the Middle East sharply increases the likelihood that some Arab countries may impose an embargo on oil and natural gas supply to countries that support Israel, as happened from 1973 to 1974.

On October 4, 2023, in an interview with Bloomberg, John Furner said that in the overall basket of Walmart customers, there is a decrease in the number of products purchased and the calories in them.

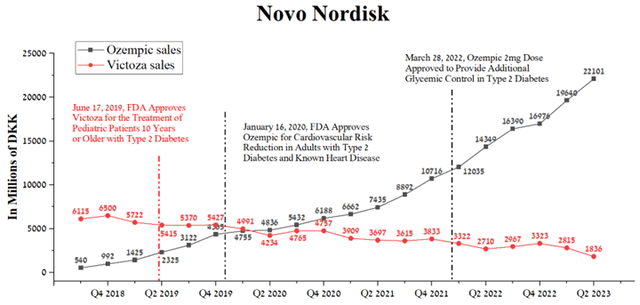

We believe that medicines such as Novo Nordisk’s Ozempic (NVO) and Lilly’s Mounjaro (LLY) are unlikely to have a significant impact on PepsiCo’s revenue in the coming quarters. Sales of Ozempic (semaglutide), a medicine primarily used to treat type 2 diabetes, were approximately DKK 22.1 billion in Q2 2023, an increase of 12.5% compared to the previous quarter.

Author’s elaboration, based on quarterly securities reports

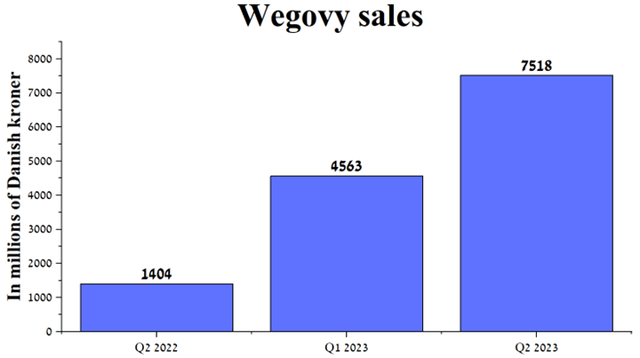

On the other hand, demand for Wegovy (semaglutide), approved by the FDA to target obesity at the end of 2022, remains exceptionally high. So, Novo Nordisk’s drug sales amounted to about DKK 7.52 billion for the 2nd quarter of 2023, an increase of 64.8% compared to the previous quarter.

Author’s elaboration, based on quarterly securities reports

Despite the significant increase in sales of these medicines in recent years, this does not substantially impact PepsiCo’s financial position. Moreover, revenue in most of the company’s divisions continues to grow year over year, with the exception of the Africa, Middle East, and South Asia (AMESA) division, whose sales decreased by 6.4% compared to the third quarter of 2022.

For 51 years, PepsiCo has maintained a policy of increasing dividend payments year after year. The company’s dividend yield is 3.2%, making it a preferred choice in conservative investors’ portfolios.

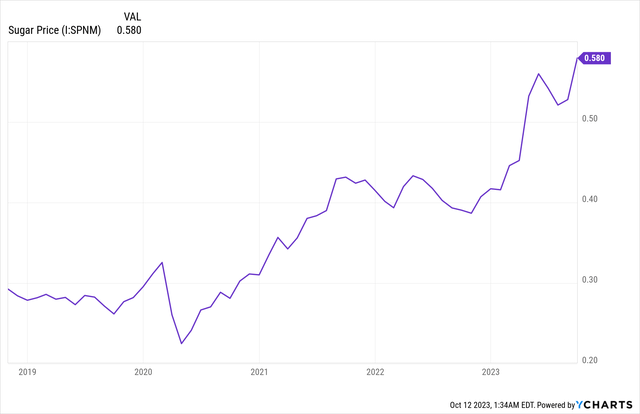

Despite the rising cost of sugar, a key ingredient in PepsiCo’s beverage portfolio, the company remains attractive to large institutional investors.

The company’s top five shareholders, well-known Wall Street giants, including Vanguard Group, Geode Capital Management, Morgan Stanley, State Street, and BlackRock, collectively hold 25.27% of the company’s shares.

Author’s elaboration, based on Yahoo Finance

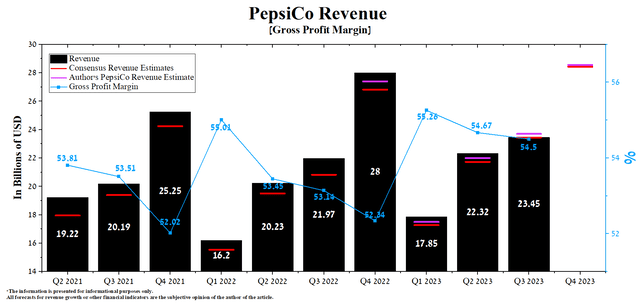

The company’s revenue for the three months ended September 9, 2023, amounted to $23.45 billion, which is 5.1% more than the previous quarter and 6.7% more than the third quarter of 2022. At the same time, PepsiCo’s actual revenue has consistently beaten analysts’ consensus estimates in recent years, indicating that financial market participants are conservatively assessing its prospects.

Author’s elaboration, based on Seeking Alpha

According to Seeking Alpha, PepsiCo’s revenue for the fourth quarter of 2023 is expected to be $28.06-$29.06 billion, up 6% year-over-year and 21.7% higher than analysts’ expectations for the previous quarter. On the other hand, according to our model, the company’s total revenue will be $28.55 billion.

PepsiCo’s quarterly and year-on-year revenue growth will be driven by an increase in the price and range of its products and the start of the winter holiday season, which will significantly boost demand for the company’s soft drinks and potato chips. These factors, in particular, will mitigate the negative impact of a slower recovery in Chinese consumer spending and weakening emerging market currencies against the US dollar.

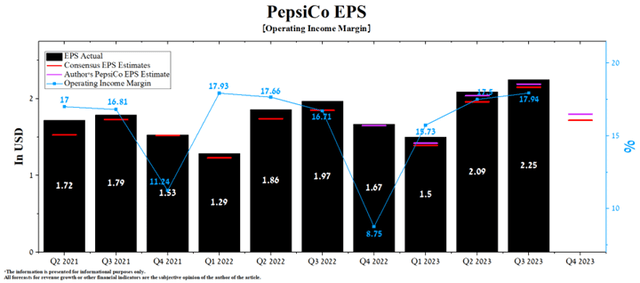

We forecast that PepsiCo’s operating income margin will reach 15.5% by 2023. At the same time, in 2024, this financial indicator will increase to 16.1%, thanks to a decrease in the cost of raw materials for the production of beverages, optimization of labor costs, and expansion of the product range.

Moreover, Q3 Non-GAAP EPS was $2.25, up 14.2% year-over-year, and just as importantly, it continued its trend of beating analysts’ consensus estimates in recent quarters. According to Seeking Alpha, PepsiCo’s fourth-quarter EPS is expected to be $1.7-$1.75, down 7% from the consensus estimate for Q3 2022. At the same time, according to our model, PepsiCo’s EPS will be higher than this range and amount to $1.8.

The company’s Non-GAAP P/E [TTM] is 21.86x, which is 38% higher than the sector average and 11.46% lower than the average over the past five years. At the same time, PepsiCo’s Non-GAAP P/E [FWD] is 20.94x, which indicates its slight overvaluation by Mr. Market during the rising US household debt.

Author’s elaboration, based on Seeking Alpha

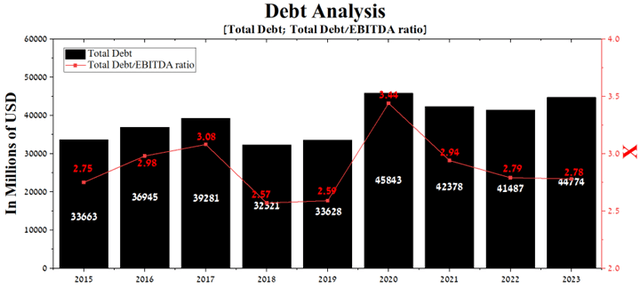

As of September 9, 2023, PepsiCo’s total debt was approximately $44.77 billion, an increase of 5.7% compared to 2021. On the other hand, due to the significant growth of the company’s EBITDA in recent quarters, the total debt/EBITDA ratio decreased from 2.94x to 2.78x.

Author’s elaboration, based on Seeking Alpha

Given the stable cash flow, the company’s growing gross margin in recent years, and increasing product prices, we do not expect it to have significant difficulty repaying its senior notes maturing between 2024 and 2050.

Conclusion

PepsiCo is one of the largest multinational companies renowned for its diverse product range, which includes popular food products such as Cheetos, Lay’s, and Doritos, as well as well-known carbonated beverage brands such as Pepsi-Cola, SodaStream, and Mountain Dew.

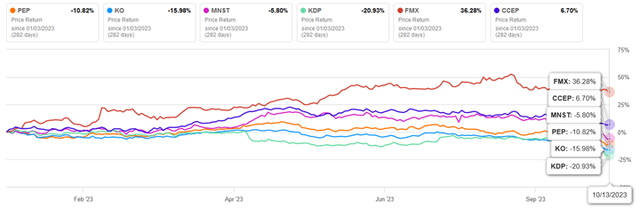

Despite the company’s operating income growing year over year, the company’s share price has declined by more than 10% since the beginning of this year. However, it continues to outperform its key competitors in the sector such as Coca-Cola (KO).

Author’s elaboration, based on Seeking Alpha

One of the key reasons for the decline in PepsiCo’s share price in recent weeks is concerns among financial market participants about the impact of the sales of Ozempic and Mounjaro on its financial position. However, the growing demand for these medicines does not significantly impact the company’s revenue growth rate.

Moreover, revenue in most of the company’s divisions continues to grow year over year, with the exception of the AMESA division, whose sales decreased by 6.4% compared to the third quarter of 2022. On the other hand, given the technical analysis, we believe that the price level at which the risk/reward profile will be attractive is $155-$156 per share.

We initiate our coverage of PepsiCo with a “hold” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only and does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.