Summary:

- RFK Jr.’s likely focus on processed foods presents a midterm risk for PepsiCo, but its shift toward healthier products could mitigate this over time.

- PepsiCo has experienced volume declines since mid-2022 due to price hikes, but its long-term growth remains solid, supported by a diversified portfolio that should weather short-term risks.

- PepsiCo has historically delivered 7% to 8% annual returns, with dividends contributing about one-third, and its current valuation suggests potential for similar or higher future returns.

- With a near-record dividend yield of 3.4% and a 51-year streak of increasing dividends, PEP remains a strong choice for income-focused investors, though the payout ratio is stretched.

jetcityimage

PepsiCo (NASDAQ:PEP) stock has taken some significant hits recently, dropping 10% in a month and now standing 20% below its all-time high. Over these past weeks, I have added to my existing Pepsi position on several occasions. This article will outline my investment case for Pepsi, adopting a fundamental long-term perspective rather than overemphasizing short-term events.

The Elephant In The Room

One of these is potentially more of a midterm concern. While the pressure on vaccine manufacturers and the broader pharmaceutical sector due to Robert F. Kennedy Jr.’s nomination for Health Secretary in the future Trump administration is evident, snacking giants like PepsiCo have also taken a significant hit in the stock market. It seems that increased uncertainty has been priced in, reflecting expectations that RFK Jr.’s focus may extend to obesity, the underlying food system, and processed foods. While this is likely a short- to midterm risk, I believe companies are adaptable enough to adjust their product offerings toward healthier alternatives. A similar risk was already anticipated with the rise of weight-loss drugs, which were expected to negatively impact consumer behavior. While the underlying cause is now diametrically opposed, the risk remains the same – and so does my conclusion. PepsiCo itself emphasizes “the company’s focus on evolving the portfolio toward more health and wellness.” This is likely not a quick process, though business as usual in the consumer goods sector – which is why taking this short- to midterm risk could pay off in the long run.

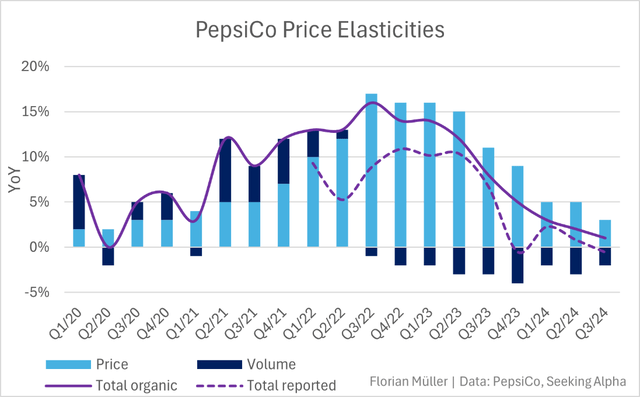

Limits Of The Price Elasticity Game

Until mid-2022, PepsiCo strongly capitalized on the inflation narrative, as most consumer companies did, driving ever-increasing top-line growth rates. Things took a turn in Q3 2022, however, as PepsiCo has since experienced steadily declining volumes amid price increases – albeit only in the single-digit range. Through its pricing, the company has still managed to achieve satisfactory overall growth. However, it is the direction of these trends that concerns analysts. The price elasticity game is beginning to falter, with overall growth stagnating – or worse. General Mills, for instance, has already suffered declines in both volume and pricing.

But is this really a cause for concern, or just business as usual? I argue the latter and base this on my previous analyses of consumer staples companies. Their revenues tend to correlate with inflation but benefit disproportionately during periods of high inflation. On the contrary, as inflation recedes, these companies face disproportionate headwinds. Beyond the short-term price fluctuations of their products – which tend to exceed inflation – PepsiCo’s revenue growth appears to be inflation-proof over the long run, even if there might be some “discounting pain” on snack shelves ahead to regain value-seeking customers and potentially recover volumes.

Author | Data: PepsiCo, Seeking Alpha

At the beginning of the year, PepsiCo’s Quaker Foods division made headlines due to a major product recall over suspected salmonella contamination. Such risks are always a factor for food companies. In the first nine months, the division’s revenue dropped by 18 percent. However, by the end of 2023, this segment accounted for only 3.4 percent of total revenue. This demonstrates just how large a conglomerate PepsiCo is and the kinds of incidents it can absorb. Therefore, I prefer to focus on the long-term prospects of this dividend machine. PepsiCo does not seem to be the kind of company to worry about short-term headwinds.

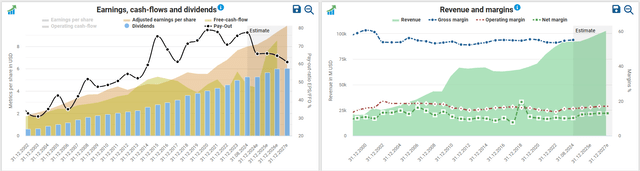

Here For The Long-Term

The long-term growth target set by management is around five percent annually for revenue and in the high single digits for EPS. PepsiCo shows long-term stable per-share adjusted earnings growth, but dividends have been increased even more, which makes the payout ratio seem increasingly stretched. The company’s margins are highly stable over the long term, with a net margin of around ten percent, though it is lower than Coca-Cola’s. This is because PepsiCo is more vertically integrated than Coca-Cola, which has increasingly outsourced its bottling business. This also explains PepsiCo’s relatively higher investment requirements.

dividendstocks.cash

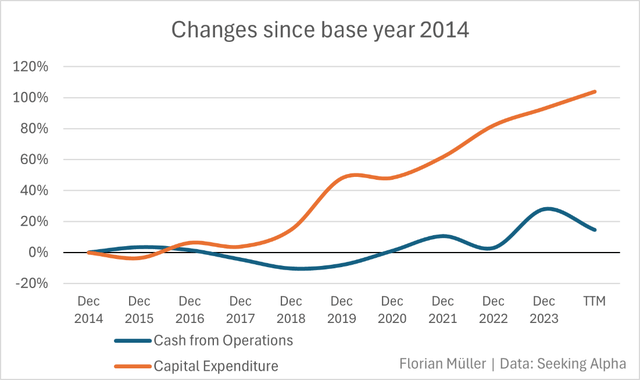

What stands out with PepsiCo is that, since around 2018, free cash flow has been increasingly under pressure. The company has significantly ramped up its capital investments, especially since 2018, in proportion to its operating cash flow, in order to ensure long-term growth. Over the past ten years, operating cash flow has increased by 15%, while capital expenditures have doubled.

Author | Data: Seeking Alpha

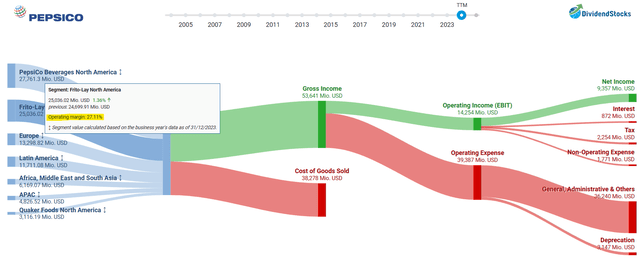

The majority of PepsiCo’s revenue comes from food, primarily snacks such as Lays chips or Doritos. The rest consists mainly of beverages like Pepsi Cola or Gatorade. In the energy drinks segment, PepsiCo serves as a distribution partner for Celsius and is also on board as an investor. The recent drop in Celsius’ stock price led a Piper Sandler analyst to speculate that the company might now be an attractive target for a full acquisition by PepsiCo. Notably, while Frito-Lay accounts for 27% of revenue, this segment contributes 48% to operating profit, thanks to its highest operating margin of 27%.

Since 61% of PepsiCo’s sales are still generated in North America, international expansion remains a key growth driver. In the first nine months, for example, PepsiCo grew more strongly in markets outside of North America. However, these markets are subject to exchange rate fluctuations, which can have either a positive or negative impact on profits.

dividendstocks.cash

Record Dividend Yield At Record Payout Ratios

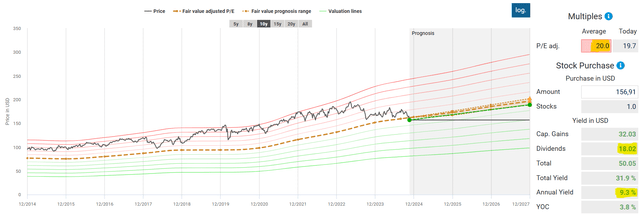

PepsiCo has historically delivered typical and adequate low-beta-consumer-staples total returns of around 7% to 8% annually, as follows:

- 7.1% over 10 years

- 8.3% over 15 years

- 7.4% over 20 years

- 7.4% over almost 25 years

Consistently, around one third of these total returns was attributed to dividends.

These returns are roughly in line with the cost of equity, which I currently estimate for PepsiCo at 8%. This places us at the upper end of historical total returns, which explains the current valuation being slightly below the historical average and suggests the potential for higher returns in the future.

Over the past 10 years, PepsiCo has been valued at an average of 22x its adjusted TTM earnings, while it is currently trading at 20x. This aligns with its 20-year valuation average. A 20x adjusted P/E corresponds to an adjusted earnings yield of 5%. To match the 8% cost of equity, a terminal growth rate of 3% from this point onward would be necessary. This seems realistic, as the majority of this growth could come from its inflation protection, requiring only minimal real growth at today’s valuation.

Using the most pessimistic estimate for adjusted earnings in 2027 and applying a 20x adjusted P/E results in an expected annual return of 9%, and consistent with PepsiCo’s historical return composition, dividends would have contributed roughly one-third of total returns.

The narrow forecast range, based on estimates from 4 to 19 analysts, highlights the high reliability of PepsiCo’s business model and aligns with the stock’s low beta.

dividendstocks.cash

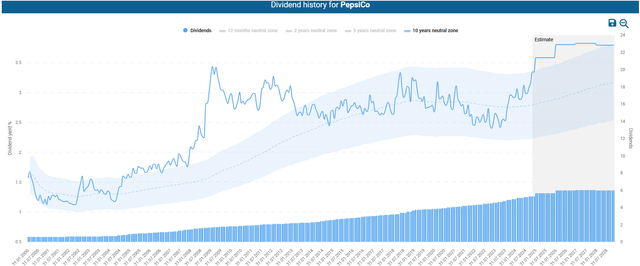

PepsiCo’s current dividend yield of 3.4% is just shy of the highest level in decades. The company boasts an impressive 51-year streak of ever-increasing dividends. However, history is no guarantee of future success, which is why some question whether PepsiCo can continue this streak. Given the recently elevated payout ratio, which exceeds free cash flow, these concerns appear to be well-founded.

dividendstocks.cash

This Ship Is Likely To Weather Rough Seas

PepsiCo remains a strong choice for long-term, income-focused investors. Despite short-term challenges, including volume declines, an elevated payout ratio, and potential scrutiny under RFK Jr.’s possibly upcoming policies, the company’s robust fundamentals over the long-term support its resilience.

At a below-average valuation of 20x adjusted TTM earnings and a near-record dividend yield of 3.4%, PepsiCo offers an attractive entry point. This assumes trusting the conglomerate’s adaptability to shifting consumer trends. Stable margins make it a reliable, inflation-resistant investment for dividend-focused portfolios.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.