Summary:

- PepsiCo offers stable dividends and a strong product portfolio, but its high price/book ratio makes it a pricey investment currently.

- The company has substantial long-term debt and a current ratio of 0.83, indicating a need to improve its cash position.

- PepsiCo faces significant competition domestically and internationally, necessitating heavy marketing investments and growth in emerging markets.

- Despite a solid dividend yield of over 3%, the high premium to book value suggests holding rather than buying for income investors.

Jonathan Knowles

When you’re an income investor, one of the key attractive features is dividend stability. It’s nice to have a company that has an iconic product, and steady income that will allow them to maintain a dividend payout at or above the current levels.

Today, I want to look at one of the extremely iconic companies on the market, PepsiCo (NASDAQ:PEP). They offer a hugely popular array of products, from the various Pepsi beverages to the Frito-Lay snack products and the ubiquitous Quaker Foods. We’ll be looking at what they offer to potential income investors, and how they are at producing a steady stream of income going forward.

Consolidated Balance Sheet

|

Cash and Equivalents |

$6.3 billion |

|

Total Current Assets |

$25.7 billion |

|

Total Assets |

$99.5 billion |

|

Total Current Liabilities |

$31.1 billion |

|

Long Term Debt |

$36.6 billion |

|

Total Liabilities |

$79.9 billion |

|

Total Shareholder Equity |

$19.4 billion |

(source: most recent 10-Q from SEC)

PepsiCo is a huge food and beverage company with a deep amount of infrastructure. As should be expected of a venerable company that’s been around so long, they have amassed a fair bit of long-term debt, though the company has a current ratio of 0.83, which is not exactly a strong position right now. I would like to see the company improve its cash position in the future, though they also don’t appear to be in any immediate danger.

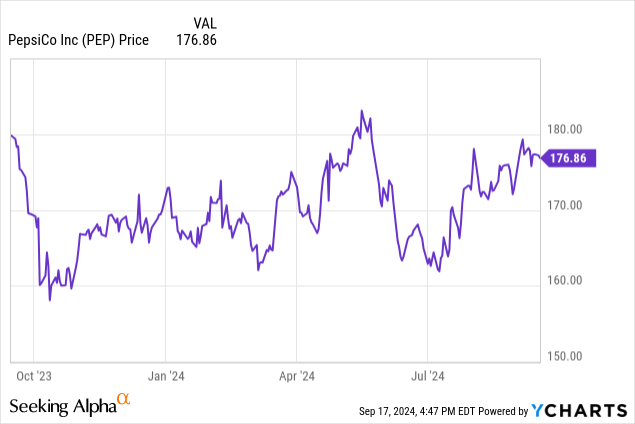

PepsiCo is trading at a price/book ratio of 12.51 right now, which is not surprising for a company so noteworthy. At the same time, this is vastly higher than the sector median of 2.60, which suggests to me that the company is not particularly cheap, and needs to offer a lot to justify such a premium.

The Risks

PepsiCo is an American institution at this point, but that doesn’t mean the company doesn’t have some substantial risks they have to face going forward. The most obvious risk is competition, as PepsiCo has been engaged in on-again, off-again Cola Wars with its rivals domestically and internationally for decades, forcing them to invest heavily in marketing to keep market up their share.

Obviously the big competitors are domestic ones, but PepsiCo also has to compete internationally against local and regional food and beverage companies.

To grow as a company worth 12.51 times its book value, PepsiCo has to grow a lot internationally, and that means improving their position in developing and emerging markets.

For a company that has such substantial debt, PepsiCo has to maintain a strong credit rating going forward, which would allow them to manage owing such an amount of money on a consistent basis while they ultimately pay it down.

Finally, PepsiCo relies a lot on third-party service providers all throughout their supply chain for various important products, and that means they can stumble upon some issues with providing products the world over that aren’t necessarily under their direct control.

Statement of Operations

|

2021 |

2022 |

2023 |

2024 (1H) |

|

|

Net Revenue |

$79 billion |

$86 billion |

$91 billion |

$41 billion |

|

Gross Profit |

$42 billion |

$46 billion |

$49 billion |

$23 billion |

|

Gross Margin |

53.2% |

53.5% |

53.8% |

55.3% |

|

Operating Income |

$11.1 billion |

$11.5 billion |

$12.0 billion |

$6.8 billion |

|

Operating Margin |

14.1% |

13.4% |

13.2% |

16.6% |

|

Net Income |

$7.6 billion |

$8.9 billion |

$9.1 billion |

$5.1 billion |

|

Diluted EPS |

$5.49 |

$6.42 |

$6.56 |

$3.71 |

(source: most recent 10-K and 10-Q from SEC)

PepsiCo’s business is in nice shape. They are growing, surely, but not exactly quickly, and are doing so while maintaining their strong margins. That’s important because it means steadily growing the bottom-line going forward.

Estimates are that PepsiCo is going to come in this year at $93.8 billion in revenue and earnings per share of $8.16, which is a P/E ratio of 21.73. Next year the expected revenue is $97.9 billion with earnings of $8.76 per share. That’s a forward P/E of 20.23.

Both P/Es are roughly in line with sector medians, and that’s a good situation to be in, much better than the high premium that the company commands to its book value right now.

The Dividends

PepsiCo also pays a somewhat better than ordinary dividends, at $1.355 quarterly, which is a yield of slightly over 3.0%. That’s a strong yield, and looks to be rock solid stable given the company’s expected earnings going forward.

I’m not sure that the company is going to be inclined to raise it much from here, and it probably would be best to pay down its debt somewhat as the growing earnings will allow them to.

Conclusion

PepsiCo is a great company, and I’d like to be able to recommend it for income investors. That said, the large premium to its book value right now suggests that the price is just a bit too rich for my blood, and I’m going to rate this a hold.

For those interested, I would keep a close eye on the current ratio of the company and how they are handling the ever-present risk of competition on their all important products. I can see where people would be willing to pay the high premium PepsiCo commands, but to me it is just awfully pricey to jump in right now.

In 10 or 20 or 30 years, PepsiCo will likely be in much the same position it is now, maybe a bit larger overall, but the premium to its multiples probably aren’t going to change. Just for income it may be a fair choice, but for overall returns there are doubtless better options to be had elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.