Summary:

- PepsiCo has experienced strong net pricing growth over the past decade, driven by portfolio premiumization and innovative product offerings.

- Concerns about GLP-1 anti-obesity drugs potentially impacting PEP’s growth are overblown, as the drugs have potential side effects and high costs.

- The Company’s financials are strong, with respectable margins and healthy cash flow. Their long-term growth targets are in line with historical performance.

Fotoatelie

PepsiCo (NASDAQ:PEP) is the leading player in the global beverage and convenience food industry. Over the past decade, they have focused on portfolio premiumization and have experienced tremendous net pricing growth. Despite recent concerns about GLP-1 anti-obesity drugs potentially creating structural headwinds for PepsiCo’s future growth, I remain optimistic. The stock price recently decreased due to the GLP-1 news, presenting what I believe is a good opportunity for long-term investment. I give it a ‘Strong Buy’ rating.

Premiumization Leads Net Pricing Growth

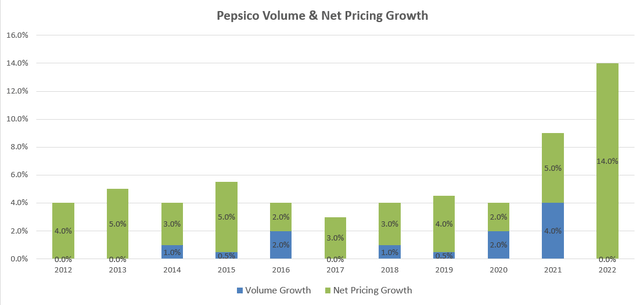

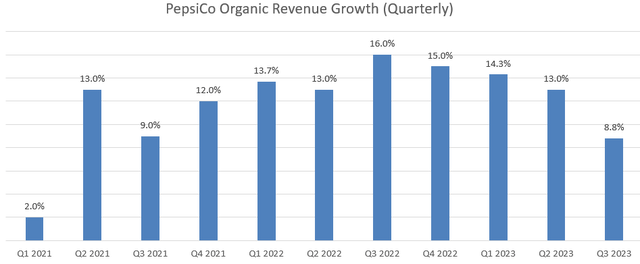

As illustrated in the chart below, PepsiCo has witnessed strong net pricing growth over the past decade. When inflation started to rise, PepsiCo raised its prices across its product categories, resulting in a 14% net pricing growth while keeping the volume flat in FY22. This indicates their tremendous pricing power over consumers.

I believe that PepsiCo’s net pricing growth can be attributed to the following factors. Firstly, PepsiCo has placed zero sugar at the center of its portfolio transformation in recent years, launching several non-sugar brands such as Lifewtr, Propel, and Bubly. These zero-sugar products broaden PepsiCo’s customer reach and cater to the demands of health-conscious consumers. Moreover, these new brands can generate higher margins for PepsiCo as they involve advanced technology.

Secondly, PepsiCo has extended its existing brands into new spaces. As indicated by their management in a recent conference, they are diversifying their offerings by combining coffee with cold brew and cola with nitro, among other innovations. Additionally, they are introducing brands like Gatorade into café or energy plus hydration segments. These extensions into new markets leverage PepsiCo’s existing manufacturing facilities, sales, and distribution channels, as well as marketing campaigns. I believe these innovative products have the potential to generate higher gross profits for PepsiCo.

Lastly, in their snack business, PepsiCo is expanding into small and multi-packs, as highlighted in the conference. For instance, they introduced Minis in November 2022, offering a variety of bite-sized snacks. These small multi-packs have the potential to significantly increase profit margins for PepsiCo.

Overall, I believe PepsiCo’s innovative approach and focus on premiumization have been effective, leading to substantial net pricing growth for the company.

Premiumization Impact on Growth

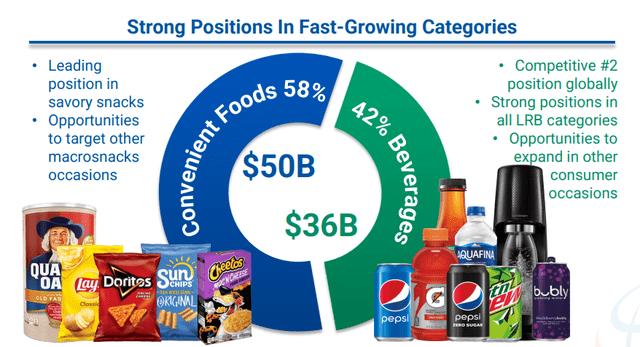

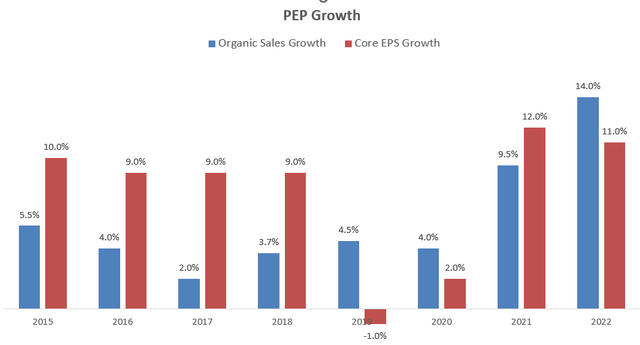

Due to the premiumization strategy, PepsiCo has experienced solid organic revenue and core EPS growth in the past few years. These new product categories and brands have enabled PepsiCo to broaden its target customers, leverage its distribution models, and improve operational efficiencies.

On one hand, they are extending their existing brands such as Doritos, Lay’s, Ruffles, and Cheetos, and on the other hand, they are building smaller portfolios like Smart Foods or PopCorners. In my opinion, these portfolio extensions and new small brands should have fewer incremental operating costs as they can leverage their existing infrastructure, including distribution channels, IT systems, as well as manufacturing capacities.

During their Q2 FY23 earnings call, their management team expressed that their innovations with Gatorade FIT and Gatorade are very important for their long-term growth. They believe that these subsegments will continue to develop along with G Zero, which continues to attract new consumers to the category, potentially bringing in substantial additional revenues for PepsiCo at lower costs.

GLP-1 Anti-Obesity Drugs

Novo Nordisk (NVO) launched Ozempic and Wegovy injectables, obesity drugs known as GLP-1s, associated with appetite regulation. PepsiCo and other diabetes-related stocks like DexCom (DXCM) experienced declines due to the anti-obesity drugs. According to media reports, in clinical trials, these medications led to substantial weight loss, averaging 21% of participants’ body weights.

The question remains: could these drugs create significant structural challenges for PepsiCo? In my opinion, in the near term, the answer is a clear “No,” as these drugs are still in the early stages. PepsiCo’s management also addressed this concern during their Q3 FY23 earnings call, stating there are no business impacts at the moment.

My analysis focuses more on the long-term impact, and I believe it is immaterial for PepsiCo. Firstly, according to Nature, clinical trials have already shown an association between GLP-1 drugs and gastrointestinal side effects, including nausea, constipation, and rare cases of pancreatitis. It’s worth noting that these drugs need to be injected once a week throughout patients’ lifespans. These side effects could pose significant challenges for patients, and it’s likely that only those with life-threatening obesity might be willing to undergo these treatments.

Secondly, GLP-1 drugs are expensive if insurance companies don’t cover them. According to HealthLine data, the manufacturer lists the price of Ozempic pens at $935. Some insurance companies might cover it for patients with Type-2 diabetes, but coverage policies vary. At such a high price, not all people with obesity can afford these drugs, in my opinion.

Lastly, PepsiCo has been working on a product premiumization strategy for years, including low-sugar and low-fat product categories. During the Q3 FY23 call, they mentioned their shift in product categories towards new cooking methods for their snacks, rather than solely focusing on low-sodium, low-fat, and low-sugar products.

In summary, I believe these GLP-1 drugs are creating unnecessary concerns for PepsiCo, and the overall impact is immaterial.

Financial Analysis and Outlook

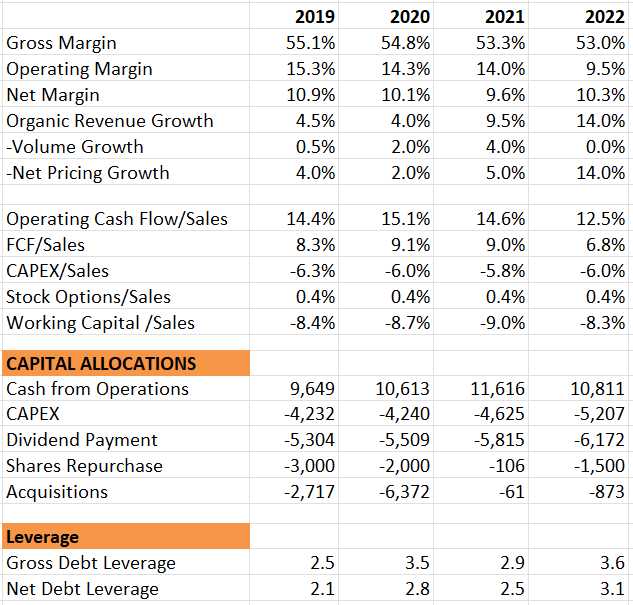

I believe PepsiCo is well-managed under its current leadership team. As illustrated in the table below, PepsiCo boasts respected gross margins and free cash flow margins. In terms of capital allocation, they pay decent dividends and repurchase their own stocks. Additionally, their balance sheet is exceptionally healthy, with gross debt leverage of 3.6x at the end of FY22, which I consider reasonable for a consumer staple company.

PEP 10Ks

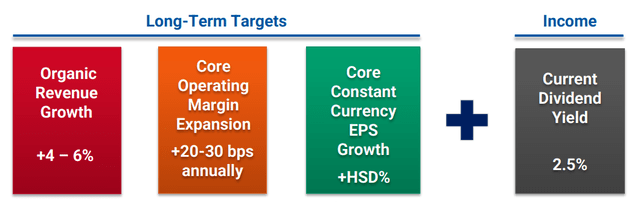

PepsiCo is targeting 4-6% of organic revenue growth over the long term, with 20-30bps annual margin expansion, which results in a high-single-digit EPS growth with the share repurchase.

Their long-term growth target is quite in line with their historical growth trajectory. With more product premiumization and extension into new spaces/categories, I think their growth rate should stay at the upper range of their long-term guidance with decent margin expansion driven by operating leverage and net pricing growth as discussed previously.

In Q3 FY23, PepsiCo delivered a quite decent quarterly result, with 8.8% organic revenue growth and 16% EPS growth.

The convenience foods volume declined 1.5% and beverage volume was flat in Q3, therefore the net pricing contributed all organic revenue growth. They expect the organic revenue growth to be 10% in FY23, and FY24 organic revenue and core constant currency EPS growth to be towards the upper end of their long-term targets. These preliminary FY24 guidance proves their management’s confidence for the near term, and I am quite encouraged by these guidance.

Key Risks

The sluggish consumer consumption could worsen over time, especially given the high-interest rates environment. If consumers need to tighten their day-to-day spending, they might cut back on snacks and beverages. Currently, PepsiCo can increase prices across product categories while maintaining relatively stable sales volume. However, there’s a risk that they might experience negative volume growth if their pricing becomes too high.

Additionally, PepsiCo has approximately 2% of revenue exposure in China and 11% in Latin American countries. These emerging markets could exhibit volatile consumption patterns and growth for PepsiCo. On a positive note, PepsiCo operates these businesses locally, involving local manufacturing and distribution.

Valuation

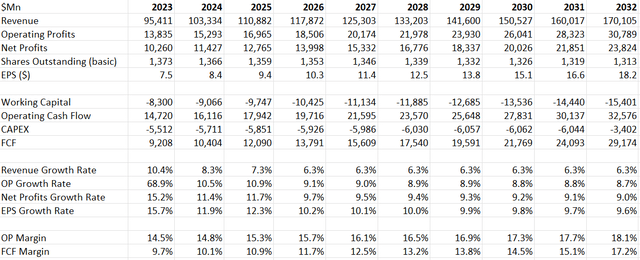

In my DCF model, I’ve assumed a 5% organic revenue growth rate, which is the midpoint of PepsiCo’s long-term guidance range of 4-6%. Additionally, considering PepsiCo’s history of consolidating small brands, I calculated that acquisitions could contribute approximately 1.3% to their top-line growth. This assumption aligns with their historical growth patterns.

Driven by operating leverage and net pricing growth, the company has the potential to increase its operating margin over time. With a 5% organic growth rate and an expense growth rate slightly above GDP levels at 3%, the margin is estimated to expand by 40 basis points annually.

PEP DCF – Author’s Calculation

The model deploys 10% discount rate, 4% terminal growth rate and 20% tax rate. After discounting all the free cash flow, the fair value of their stock price is calculated to be $190 per share in my model, and the stock price is undervalued.

Verdicts

I think PepsiCo is a well-managed global giant, and the current GLP-1 news is overreacting to PepsiCo’s stock price. It is an undervalued stock, and suitable for long-term investors. I assign a “Strong Buy” rating to PepsiCo.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.