Summary:

- As a world-class dividend growth stock, PepsiCo occupies a core position within my portfolio.

- The consumer staple fell short of the analyst consensus for net revenue but topped expectations for core EPS in Q3.

- PepsiCo continues to boast a strong enough financial position to earn an A+ credit rating from S&P on a stable outlook.

- Shares could be trading at a 12% discount to fair value.

- PepsiCo could realistically post a 30% cumulative upside by the end of 2026.

A Pepsi truck drives on a road. Tamer Soliman/iStock Editorial via Getty Images

For me, the objective of dividend growth investing is to buy and hold businesses that I believe can withstand the test of time. This is admittedly a tall task and things can and do evolve with investments. The best bet in my view is to buy businesses that have consistently grown their profits and dividends and look to be in a position to continue doing so. From there, it’s just about occasionally monitoring these investments to make sure that things are holding up.

In terms of income generation and growth, PepsiCo (NASDAQ:PEP) has been well-respected for many years. When I last covered PepsiCo with a buy rating in May, I liked its track record as a Dividend King. I also liked the company’s growth prospects in a trillion-dollar global industry. PepsiCo’s A-rated balance sheet also stood out to me. Finally, the valuation appeared to be attractive at the time.

Today, I’m reiterating my buy rating for PepsiCo following its third-quarter earnings. The company has made recent acquisitions that I think will be a plus over the long haul. PepsiCo remains a financial fortress. Best of all, shares look to offer solid value right now and price in the risks facing the business.

PepsiCo Should Have Decent Growth Ahead

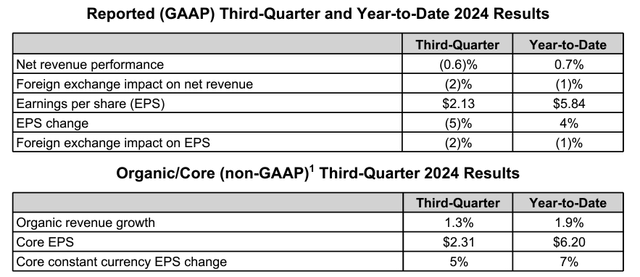

PepsiCo Q3 2024 Earnings Press Release

On October 8th, PepsiCo shared its third-quarter earnings results. The company’s net revenue decreased by 0.6% year-over-year to $23.3 billion during the quarter. For perspective, that was $460 million below Seeking Alpha’s analyst consensus for the quarter.

The company’s boost to the topline via a 3% effective net pricing increase was mostly offset by a 2% decline in organic volume in the period. PepsiCo’s global presence in an unfavorable foreign currency translation environment had an impact of approximately 2% during the quarter. Adjusting for foreign currency, organic revenue rose by 1.3% for the quarter.

PepsiCo’s core EPS increased by 2.7% over the year-ago period to $2.31 in the third quarter. This came in $0.02 better than Seeking Alpha’s analyst consensus during the quarter. Carefully managing expenses helped the company’s non-GAAP net profit margin expand by 40 basis points to 13.7% for the quarter. This is how PepsiCo’s core EPS rose as net revenue fell in the quarter.

Looking forward, the outlook for PepsiCo remains decent. As I have outlined in previous articles, PepsiCo operates in an at-home global beverage and convenient food industry that’s $1.2 trillion and still growing. The company is also making strategic moves that could position it to do well in the future.

Chairman and CEO Ramon Laguarta had positive things to say during the Q3 2024 Earnings Call. Mr. Laguarta highlighted platforms that are expected to get the company back on track. This is because, after the significant gains in its portfolio from consumer trends during the COVID-19 pandemic and coming out of it, PepsiCo has been focused on productivity and cost transformation.

As far as the supply chain is concerned, the company is making investments in further automation of warehouses, manufacturing, and distribution centers. This is expected to generate growth and productivity. Investments in Global Capability Centers a couple of years ago are now at a maturity level that they can be used more to optimize labor. That bodes well for 2025 and beyond.

Additionally, PepsiCo has been busy on the M&A front in recent months. In October, the company announced a $1.2 billion deal for the grain-free and dairy-free Mexican-American foods brand, Siete. The company is among the fastest-growing Latino food brands in the U.S. The deal, which is expected to close in the first half of 2025, represents an expansion of PepsiCo’s Mexican-American and better-for-you food portfolios.

Aside from the rapid growth of this brand, another potential reason for this deal is what I picked up from an insightful comment from the link above. A user (VoiceofSanitySometimes) pointed out that Siete’s grain-free and dairy-free operations are specialized. The assets acquired free PepsiCo from having to construct such assets or alter its existing facilities for such a purpose.

Bolt-on M&A like Siete and cost efficiency programs are expected to help drive core EPS 6.1% higher in 2025 to $8.65 per the FAST Graphs analyst consensus. Another 7% rise in core EPS to $9.26 is currently being projected for 2026. These growth rates come on top of the 7% growth in core EPS to $8.15 that’s being predicted in 2024.

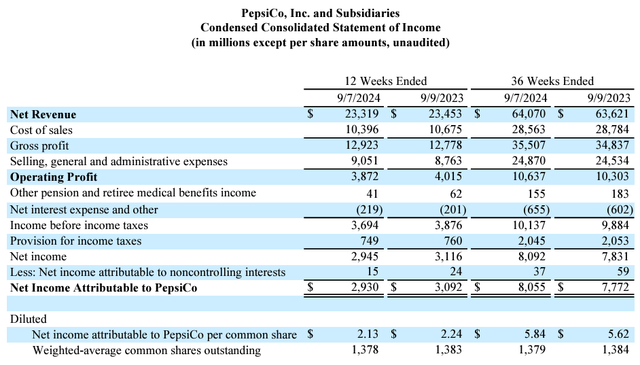

PepsiCo Q3 2024 Earnings Press Release

Financially, PepsiCo has the chops to continue being active with M&A to juice growth. That’s because the company’s interest coverage ratio through the first three quarters of 2024 was 16.5. This is high enough that PepsiCo has no problems servicing its debt from earnings. That’s why the company enjoys an A+ credit rating from S&P on a stable outlook (unless otherwise sourced, all details in this subhead were according to PepsiCo’s Q3 2024 Earnings Press Release).

Moderate Upside To Fair Value

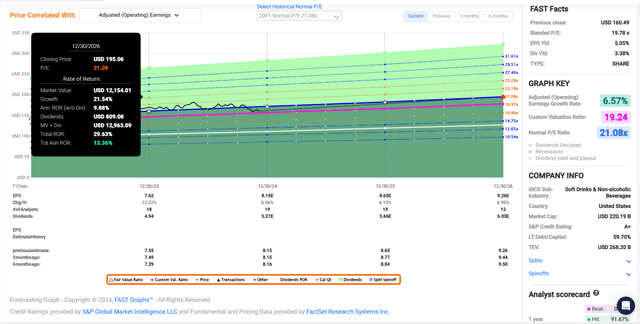

FAST Graphs, FactSet

Since my previous article, PepsiCo’s shares have posted -10% total returns as the S&P 500 index (SP500) has returned 15%. This can mostly be attributed to the growth concerns (e.g., volume headwinds) that the market has toward consumer staples right now.

That has brought PepsiCo’s shares to their lowest levels since the COVID-18 pandemic. Shares are currently trading hands for a forward P/E ratio of 18.4, which is materially below the 20-year normal P/E ratio of 21.1 per FAST Graphs.

This is despite an annual forward core EPS growth outlook of 6.6%, which is in line with the 20-year average of 6.8%. Growth is also comparable to the rate of the past decade when the P/E ratio was around 23. I now believe my previous fair value P/E ratio of 23 was too optimistic, though. This has to do with my revised expectation that interest rates will remain elevated beyond recent historical norms for the foreseeable future.

As it stands, the current calendar year 2024 is about 93% complete. That means another 7% of 2024 and 93% of 2025 lie ahead in the next 12 months. This is how I get a forward 12-month core EPS input of $8.62.

Applying my fair value multiple of 21.1, I computed a fair value of $182 a share. This represents a 12% discount to fair value. If PepsiCo can meet growth expectations and return to my revised fair value P/E ratio, it could produce 30% cumulative total returns through 2026.

Expect More Of The Same Dividend Growth

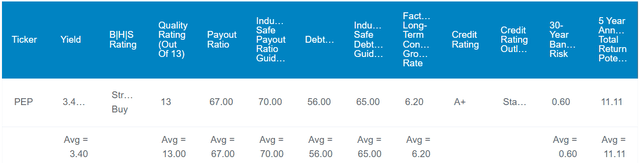

The Dividend Kings’ Zen Research Terminal

PepsiCo’s 3.4% forward dividend yield registers a bit higher than the 3.1% forward dividend yield median of the consumer staples sector. That’s why Seeking Alpha’s Quant System awards respective B and C grades for forward dividend yield and overall dividend yield.

The appeal to PepsiCo doesn’t stop at its superior starting income, either. The company’s core EPS payout ratio is expected to be in the mid-60% range for 2025. That’s better than the 70% payout ratio that rating agencies desire from the food and beverage industry. This gives the company flexibility to further grow the dividend in the years ahead. That’s what earns an A- grade from the Quant System for overall dividend safety.

This dividend growth is also set to be solid. The Quant System anticipates 7.5% annual forward dividend growth, which would be meaningfully above the sector median of 4.2%. This is sufficient for the Quant System to hand out an A+ grade for overall dividend growth. This dividend growth estimate is a bit more optimistic than my estimate of around 7%, but not by that much. I believe that dividend growth could come in right around core EPS growth for the foreseeable future, if not slightly better.

For these reasons, I believe it’s highly likely that PepsiCo will extend its 52-year dividend growth streak in the coming years. For context, that is already much greater than the sector median of 2 years. This is enough for the A+ grade from the Quant System for overall dividend consistency.

Risks To Consider

Predictably, PepsiCo’s business model as a food and beverage company is relatively low risk. It’s mostly not vulnerable to technological obsolescence. After all, people need to eat and drink to survive. Even so, there are risks with every investment and PepsiCo is no different.

On the subject of technological obsolescence, I can say with absolute confidence that nobody is going to innovate a food and beverage substitute. As I alluded to in a recent Coca-Cola article (KO), however, I am paying attention to how the GLP-1 drug class could impact food and beverage consumption in the future. Studies thus far have shown at least some reduction of food intake levels in patients in the treatment group. As GLP-1 penetration rates rise, it will be worth monitoring volume trends for consumer staples to see whether real-world results jive with the studies.

Another potential risk to PepsiCo is President-elect Donald Trump’s nomination of Robert F. Kennedy Jr. to become the next Secretary of Health and Human Services. However, Former U.S. House Representative and Democrat Tim Ryan has expressed his views that Democrats should work with RFK Jr. on food system reform. That could be emblematic of moderate Democrats being on board with collaborating to effect significant change in America’s food system. At any rate, this is another development that I’ll be paying attention to in the coming months.

One last risk to PepsiCo is that its growth depends on its continued ability to meet the shifting preferences of consumers. If the company fails to do so, industry peers could seize market share. That could weigh on PepsiCo’s growth profile.

Summary: PepsiCo Is A Quality Dividend Grower On Sale

PepsiCo is my portfolio’s 19th-biggest position, accounting for a 1.7% weight. The company’s status as a leader in a growing industry supports this overweight position. As does the firmly investment-grade balance sheet. PepsiCo’s valuation also looks compelling enough here to generate 13% annual total returns through 2026. That’s why I’m standing by my buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.