Summary:

- PepsiCo has underperformed the S&P 500 in the last 5 years, struggling with declining sales volume and unsustainable price increases.

- The company’s second-quarter earnings showed significant volume decreases and reliance on price increases for revenue growth, leading to a strong sell rating.

- PepsiCo’s debt levels are at a near 10-year high, limiting its ability to borrow for share buybacks and dividend increases, while facing overvaluation concerns.

Jonathan Knowles

Famous companies don’t always make good investments. While iconic brands often are enticing to investors, sometimes more mature brands can’t sustain substantive growth rates.

There are few labels more famous than that of PepsiCo (NASDAQ:PEP). The food and beverage company has the second most valuable soda brand in the world after Coke, in addition to having several well-known brands such as Frito-Lay, Quaker Oats, Fritos, Doritos, and Gatorade.

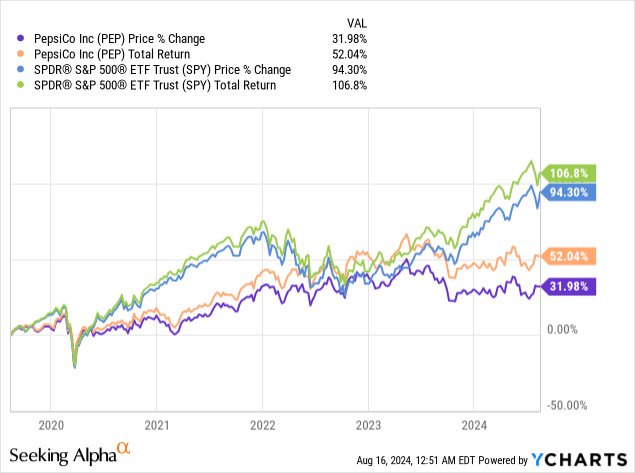

PepsiCo. has consistently and significantly underperformed the S&P 500 over the last 5 years in addition to struggling in the inflationary environment we’ve seen since early 2021. The iconic company has offered investors total returns of 52.04% since 2019, while the S&P 500 has offered investors total returns of 106.8% during the same timeframe.

Today, I am downgrading PepsiCo. to a strong sell. I last wrote about the well-known retailer in May of this year, and I rated the company a sell. I am downgrading the company to a strong sell today. PepsiCo. has been relying on unsustainable price increases to drive revenue growth, the company continues to see accelerating declines in volume in the core business with consumers now increasingly trading down as the economy deteriorates. The company’s Quaker Oats brand has also still not recovered from the product recall earlier this year, and the stock looks overvalued using several metrics.

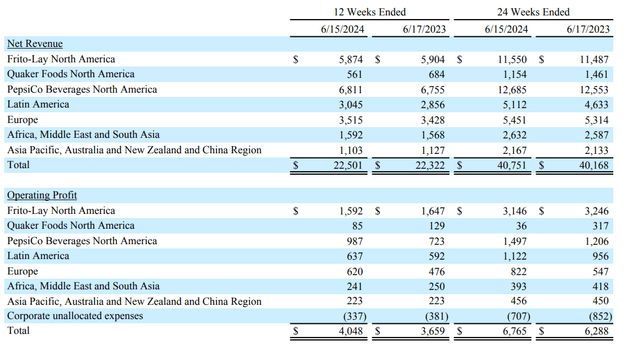

PepsiCo’s last quarter showed notable volume decreases across many of the company’s most important brands. The food and beverage company has seen slowing sales volume for some time, but management has no longer been able to raise prices to offset market share losses. The company raised prices by 11% between July and September of last year, and sales volume only dropped 2.5%.

For the second quarter management stated that sales volume fell by 4% in the core food unit on a year-to-year basis in the Frito-Lay North America segment, more than offsetting the company’s 3% price increase in this division. Target (TGT), Walmart (WMT), and even McDonald’s (MCD), have all reported that consumers are trading down, and PepsiCo. stated that the company saw this trend as well. Management’s attempt to continue to drive revenue growth with price increases backfired in the critically important North American food division. The company has seen revenues grow by 1% since September 2023.

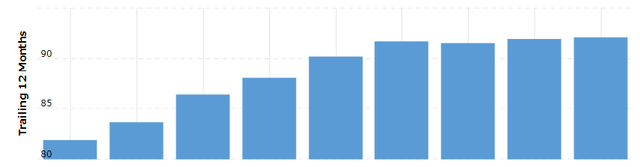

PepsiCo’s Annual Revenue (stockanalysis.com)

The company also saw a 3.5% decline in sales volume in Pepsi sales in North America on a year-to-year basis that was barely offset by a 5% increase in beverage prices in this region. Management also reported that sales volume in the Quaker Oats division, still impacted by the product recall, fell by 17%. The company also reported anemic organic sales growth overseas as well in addition to lowering guidance from at least 4% organic revenue growth to just 4% for the full year. The food and beverage retailer expects 7% earnings per share growth this year.

A Graphic of PepsiCo’s Earnings (PepsiCo)

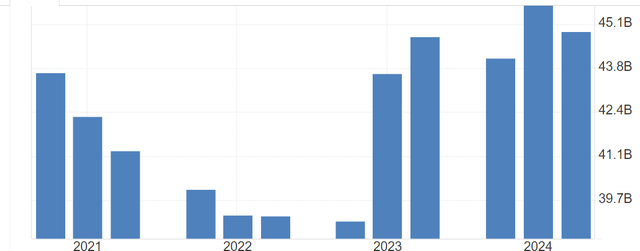

PepsiCo’s second-quarter earnings clearly showed that consumers are tapped out and management can no longer rely on price increases to drive revenue growth in the US or abroad. The food and beverage also continue to be negatively impacted by forex moves, with currency headwinds lowering the company’s organic growth by 1%. The company’s debt is also now at $44.9 billion, and while $36.38 billion of those obligations are longer-term, the company’s debt levels are still at a near to 10-year high, which should limit the food and beverage company’s ability to borrow for share buybacks and dividend increases with interest rates at elevated levels. PepsiCo’s debt levels are not significantly higher than the levels seen at competitor Coke (KO), which has long-term debt of $39.50 billion, but Coke also has a notable larger market cap of $295.55 billion.

A Chart of PepsiCo’s debt (Tradingeconomics)

This is why PepsiCo looks overvalued using several metrics right now. While the food and beverage company trades at 22.10x expected forward GAAP earnings estimates and 18.76x forecasted forward cash flow, below the 5-year average of 24.38x predicted forward GAAP earnings and 19.23x projected forward cash flow, the economic environment is deteriorating. PepsiCo is seeing declining sales volume growth and flat revenue growth. Credit card debt is also at record highs of $1.14 trillion, and consumer spending levels are beginning to slow significantly, as multiple larger retail companies have reported. Analysts are only projecting PepsiCo to grow revenues by 4-5% over the next 4 years, and to grow earnings per share by 6-7%. These estimates are also likely too high, since the economy continues to slow, and the food and beverage retailer has already been forced to lower guidance for this year.

Companies such as PepsiCo relied heavily on price increases to drive earnings growth over the last several years, and the normal recession-resistant business models of food and beverage companies with strong brands are more susceptible to business cycles because of how high the prices of many of these corporation’s products are right now. With the economy slowing and consumers increasingly being forced to trade down, PepsiCo is facing a growing number of headwinds.

gra

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.