Summary:

- PepsiCo’s stock has a positive YTD return, outperforming Coca-Cola, but underperforms compared to the S&P 500.

- PepsiCo has a strong business model, adapting to changing consumer behavior and consistently increasing revenue and earnings.

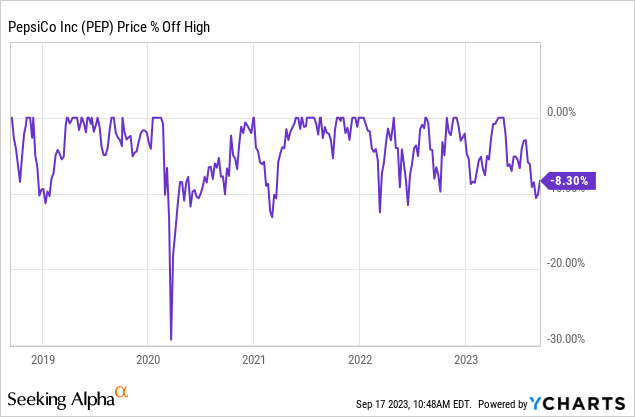

- In the last five years, only the exceptional crash of the Corona crisis saw a more significant share price decline than the current one.

- Overall, I rate the PepsiCo stock with a Buy rating. I would have preferred a more favorable valuation for a “Strong Buy” rating.

Fotoatelie

The PepsiCo stock (NASDAQ:PEP) has been in my broadly diversified dividend portfolio for a long time. The portfolio is there to finance a comfortable retirement for me one day. YTD, however, the stock only generates a positive return when dividends are considered, too.

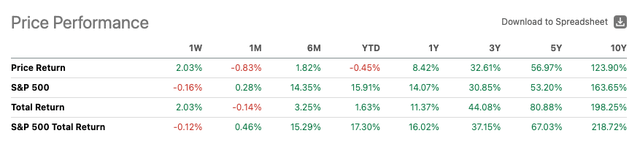

However, this is a much better performance than Coca-Cola (KO). Excluding dividends, Coca-Cola’s return is minus 9%. Nonetheless, PepsiCo takes a beating from the S&P 500, which is up nearly 16% YTD. To some bitter truth, however, PepsiCo has underperformed the S&P 500 in many time frames over the past ten years.

Price Performance PepsiCo vs. S&P 500 (Seeking Alpha)

However, as I showed in my last analysis, PepsiCo stock is particularly robust in crises and regularly outperforms the S&P 500. In addition, PepsiCo’s dividend yield is higher than that of the S&P 500. So overall, while PepsiCo is not a bargain with a dividend yield of 2.7% and the current valuation multiples, it is still a buy for long-term investors.

I love the business model

Investing in PepsiCo is investing in one of the world’s largest food and beverage companies. What I love about the business model is its ability to change and adapt to changing consumer behavior.

Like other food companies, PepsiCo can sell individual brands or buy new ones to maintain a portfolio that meets consumer tastes. PepsiCo has an excellent track record in this respect.

Since 2000, revenues have risen from $20 billion to $86 billion. Over the same period, earnings per share rose from $1.48 to $6.42. Further, the number of shares outstanding fell by 400,000 over the past 20 years, from 1.789 million to 1.387 million. During the same period, dividends per share increased from $0.56 to $4.53.

Today, the company has $50 billion in sales from Convenient Foods (58%) and $36 billion from Beverages (42%), with operating profits exceeding $12 billion in fiscal 2022. Its operating margin was 13.7%.

Good operating performance also in the previous quarter

In 2Q 2023, the company continued its good development. Sales grew by 10.4%. Organic sales growth was as high as 13%. EPS grew 15% adjusted for currency fluctuations. Net income even doubled due to one-time items in the prior-year quarter, when PepsiCo took a nearly $1.36 billion write-down on intangible assets.

I was particularly pleased with how PepsiCo passed on increased prices to end consumers:

And we’re seeing in the majority of the markets where we operate, we’re seeing better elasticities and that has continued to be during the first half of the year, even though we’re seeing lower income consumers strategizing around obviously optimizing their budgets, but we’re seeing the majority of consumers staying within our categories, staying within our brands. (Source: Earnings transcript)

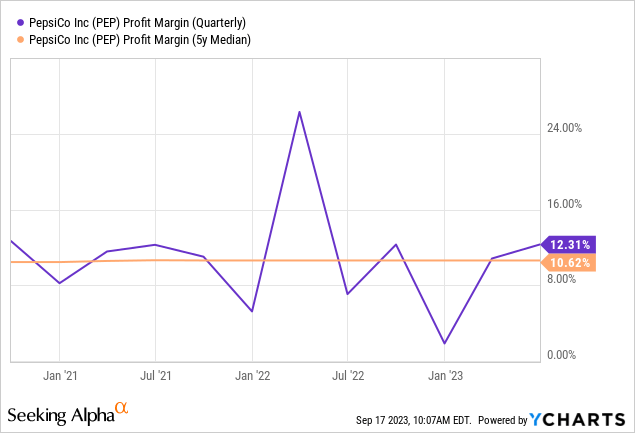

The profit margin has also increased somewhat and is now again above 12% and thus above the 5-year median.

As the cherry on top of the cake, the company has raised its forecast for the current fiscal year:

As a result, we now expect our full-year organic revenue to increase 10 percent (previously 8 percent) and our core constant currency EPS to increase 12 percent (previously 9 percent).

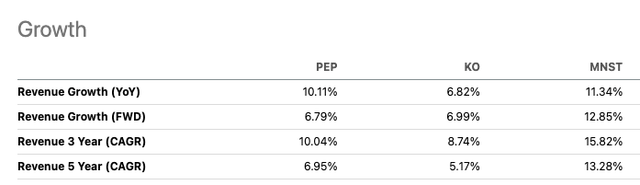

This puts PepsiCo in the solid middle range compared to its peer group. However, it is also clear that the company cannot keep up with the growth machine Monster Beverage (MNST).

Growth PepsiCo vs. Coca-Cola vs. Monster Beverage Corporation (Seeking Alpha)

A look into the future

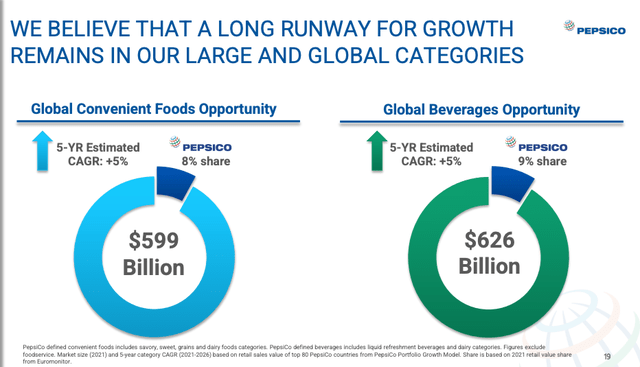

PepsiCo is excellently positioned to continue to grow in the future. In addition to the omnichannel strategy, which includes e-commerce and away-from-home, the aforementioned brand flexibility and the pep+ strategy are drivers for future growth. For example, 53% of beverages are reduced sugar. 66% of convenient foods have met sodium reduction targets. This is in line with the “zeitgeist” of consumers and could be a reason for brand loyalty.

In addition, Pepsi operates in markets that show very solid growth with a 5-year expected CAGR of 5% or more. In this context, PepsiCo is a strong market player, but the market shares of less than 10% still allow for further expansion.

PepsiCo Growth Potential (Investor Relations)

The analysts’ expectations are also very positive. In the following, I base my forecasts on analysts interviewed by FactSet Research. We first look at sales growth and then at adjusted EPS.

Analysts expect constant growth in sales. If we take the average of the forecast ranges, sales could grow by around a further 10% to $73 billion by 2025.

| Year | Number of analysts | Range |

| 2023 | 15 | $66.5 bn – $67.4 bn |

| 2024 | 15 | $69.28 bn – $71.47 bn |

| 2025 | 9 | $71.74 bn – $74.39 bn |

| 2026 | 2 | $74.16 bn – 75.77 bn |

The adjusted EPS estimates for the coming years are as follows.

| Year | Number of analysts | Range |

| 2023 | 9 | $6.82 – $7.67 |

| 2024 | 9 | $7.68 – $8.14 |

| 2025 | 4 | $8.41 – $8.82 |

| 2026 | 1 | $9.06 |

On average, adjusted earnings could, therefore, rise to $8.61 in 2022 from $6.42 last time. Compared to the 2022 calculated EPS, this is an increase of more than 34 percent.

A bit expensive but the price is justifiable and the share is never cheap

Now, let’s get to the somewhat sad topic, which is PepsiCo’s price tag. Over the last 15 years, Pepsi’s adjusted P/E ratio has been just under 20.5, which is quite a lot for a rather conservative growth business. Today, the valuation is even more expensive at almost 25. The same applies to the P/C ratio and the current dividend yield.

| Multiple | 15-Year Average | Today |

| P/E ratio | 22.3 | 31.5 |

| P/E ratio adj. | 20.4 | 24.9 |

| P/C | 15.7 | 22.7 |

| avg. Dividend Yield | 2.8% | 2.7% |

(Source: FactSet Research data)

The market is already pricing a lot of the future earnings into the stock. Thus, based on an adjusted EPS of $8.74 in 2025, the adjusted PE ratio would still be over 20. However, PepsiCo stock has never been cheap, and those hoping for major price pullbacks are probably waiting on the sidelines forever. In the last five years, only the exceptional crash of the Corona crisis saw a more significant share price decline than the current one.

In addition, investors should take a look at the dividend. With a payout ratio of 66% on earnings, investors can hope for a further increase in the dividend next May. I see room for further increases of between 7% and 10% over the next few years. Such a range would also align with the average increase of recent increases. Accordingly, investors could already have a yield on cost of more than 3% in two years, which would then grow annually like an avalanche.

Conclusion

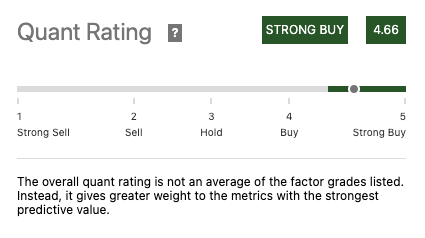

Overall, I rate the PepsiCo stock with a Buy rating. I would have preferred a more favorable valuation for a “Strong Buy” rating. I think the current multiples are a bit too high compared to the solid but not outstanding growth forecasts. By the way, the Seeking Alpha Quant Rating comes to a different conclusion. With 4.66 out of a possible 5 points, we see a Strong Buy here.

PepsiCo Quant Rating (Seeking Alpha)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.