Summary:

- PepsiCo’s share price dropped due to near-term challenges related to volume growth, inflation, and stressed customers.

- Despite short-term challenges, PepsiCo has long-term competitive advantages in distribution, iconic brands, and scale.

- The stock is undervalued with a dividend yield of approximately 3.25% and a fair value estimate of $187.91, making it a long-term buy for dividend growth portfolios.

Stefonlinton/iStock Editorial via Getty Images

PepsiCo’s (NASDAQ:PEP) share price dropped from its recent high at the end of May 2024. In fact, the share price experienced continued losses over several straight days. Much of the decline is because of near-term challenges related to volume growth, inflation, and stressed customers. However, PepsiCo is a company with excellent long-term competitive advantages. It should weather the storm and continue to increase shareholder value. The equity is undervalued, and I expect the dividend growth streak to continue. I view PepsiCo as a long-term buy for a dividend growth portfolio.

Overview of PepsiCo

PepsiCo, Inc. is a leading global food and beverage corporation. It is the number one salty snacks company and the number two non-alcoholic beverage firm. It operates in over 200 countries, with 61% of its revenue coming from North America and 39% from the rest of the world. PepsiCo’s revenue is divided into about 59% salty snacks and food and 41% beverages.

The company operates in four business segments: PepsiCo Beverage North America, Frito-Lay North America, Quaker Foods North America, and International. It has a stable of well-known food and beverage brands, such as Doritos, Lays, Cheetos, Tostitos, Quaker, Gatorade, Pepsi, Mountain Dew, Aquafina, etc.

Total revenue was more than $91 billion in 2023 and the last twelve months (LTM)

Revenue and Earnings Growth

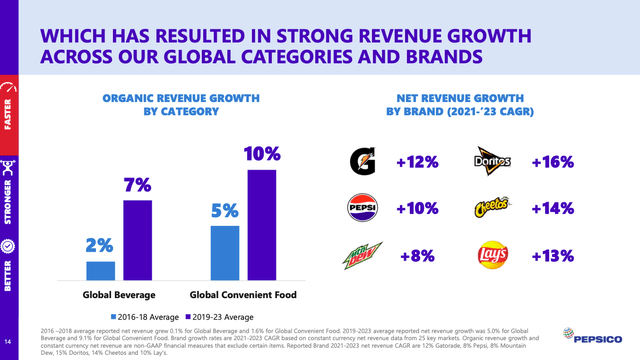

Dividend growth investors should be concerned about top and bottom-line growth. For dividends per share to rise over time, revenue and earnings per share must increase. In this regard, PepsiCo has done an admirable job in the past several years. Revenue has climbed from $67.6 billion at the end of 2019 to more than $91 billion at the end of 2023. Growth is being driven by both the beverage and convenient food categories and across brands. Data shows that organic growth has accelerated from the 2016 – 2018 period.

PepsiCo Investor Relations

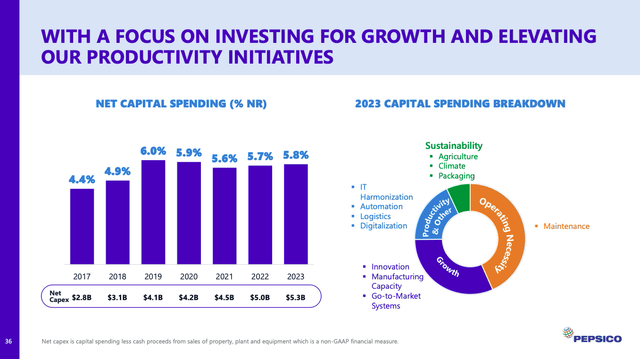

Most of this growth is being driven organically rather than by acquisition. The firm boosted capital expenditures from $3.1 billion in 2018 to $5.3 billion in 2023, a 69% increase. In 2017 – 2018, capital spending was 4.4% – 4.9% of net revenue. However, it has been much higher, at 5.6% – 6.0%, since 2019. The focus has been on operational needs, productivity, growth, and agriculture. For instance, PepsiCo has automated its plants and warehouses, advanced digitization, and improved routing. These efforts have driven organic revenue and EPS growth above long-term targets of 4% to 6% and high-single digits, respectively. From 2021 to 2023, organic revenue growth was even better than the above chart illustrates at 11%, while EPS climbed 12%

PepsiCo Investor Relations

Near-Term Challenges

Despite the seeming success, some Seeking Alpha authors have recently highlighted near-term challenges, indicating that volumes are declining because of price increases and foreign exchange effect is negative. They point to first quarter results showing volume declined 2% for Frito-Lay North America, 22% for Quaker Foods North America, and 5% for PepsiCo Beverage North America. Obviously, sustained volume drops are a net negative.

However, the declines are somewhat transitory. At the end of 2023, Quaker Foods was hit by product recalls affecting granola bars and cereals. The effect should fade as 2024 progresses.

Volume declines for Frito-Lay, and PepsiCo Beverages could be due to price increases. The consumer is clearly stressed, with rising prices outstripping income growth. Higher prices tend to result in lower volumes as consumers switch to other brands. The effect may be enhanced during inflationary times, with lower-income people reducing purchases. Also, customers may think twice before making an impulse buy. However, grocery inflation is now 1% or less, unemployment is 4%, and incomes are still rising, suggesting future trends may improve.

Moreover, PepsiCo is facing market share losses to its main beverage competitor, The Coca-Cola Company (KO). To add insult to injury, the Pepsi beverage lost its number two ranking to Dr. Pepper. However, PepsiCo is still the number two non-alcoholic beverage company due to growth from other brands and market segments. For instance, PepsiCo has a partnership with Celsius, expanding its presence in energy drinks.

Despite the short-term challenges, management still expects at least 4% organic revenue growth and an 8% increase in constant currency EPS.

Competitive Advantages

PepsiCo has several long-term competitive advantages that should allow its top and bottom lines, and thus the dividend, to grow over time.

First, PepsiCo has an extensive distribution network for both salty snacks and non-alcoholic beverages. Neither is easy to replicate. In salty snacks, no other company competes at the same global scale. Similarly, only Coca-Cola and Keurig Dr Pepper (KDP) have similar beverage distribution networks. The advantage is evident in that new entrants, e.g., Celsius, often need to partner with PepsiCo to gain distribution scale.

Next, PepsiCo has a stable of well-known iconic brands. We list some above. The firm continues to invest in brands by marketing and advertising. At the same time, it was increasing Capex; PepsiCo increased advertising and marketing from $4.23 billion in 2018 to $5.7 billion in 2023. In a competitive world, keeping the company’s brands at the forefront and maintaining customer loyalty is essential. The salty snack and beverage businesses have low private-label penetration because customers repeatedly buy the same brand. Advertising and marketing are crucial to maintain this behavior.

Lastly, PepsiCo possesses scale. This fact offers some primary benefits. It often leads to lower costs because PepsiCo can buy bulk commodities like sugar, corn syrup, coffee, packaging, grains, etc., cheaply. In addition, having a brand and product scale allows for better placement in retailers. The firm can also reach more stores via its extensive distribution network.

Dividend Analysis

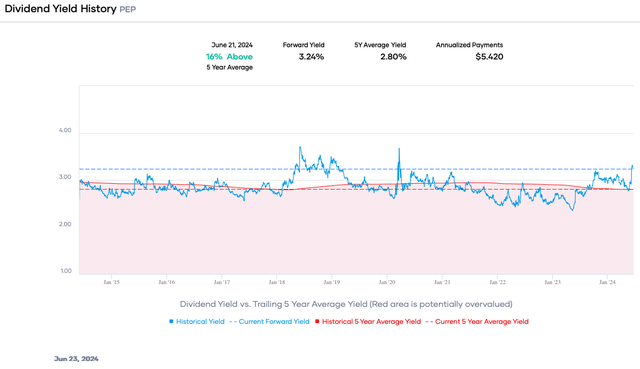

Because of the abovementioned challenges, the share price is flat this year and down about 10% in the LTM. Consequently, the dividend yield has risen to approximately 3.25%. PepsiCo usually yields less than 3%; for perspective, the 5-year average is roughly 2.8%.

Portfolio Insight

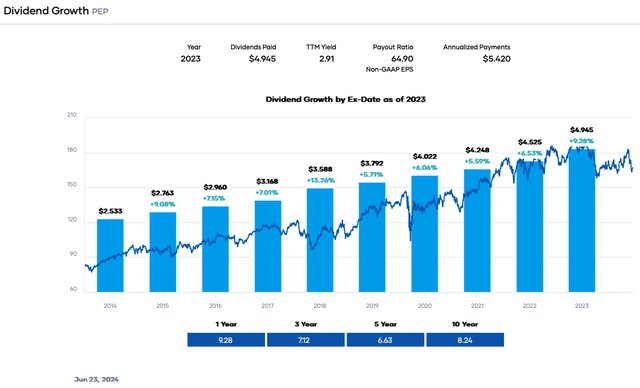

Furthermore, PepsiCo is a Dividend King with a 52-year streak of increases, the last one on April 30th. The quarterly dividend was raised 7.1% to $1.355 from $1.265 per share. The dividend growth rate has been about 6.6% in the trailing five years and 8.2% in the past decade.

Portfolio Insight

The annual dividend is supported by excellent safety. The earnings payout ratio is approximately 65%, precisely our target value. Free cash flow (FCF) of $7,242 million supports the dividend requirement of $6,841 million. However, the dividend-to-FCF ratio is less than ideal at 94%. Our criterion is 70%. This is a warning flag because companies sometimes experience FCF fluctuations. In PepsiCo’s case, rising capital expenditures and negatively impact FCF. That said, operating cash flow (OCF) increased from $9,649 million in 2019 to $13,442 million in 2023. If capex declines, FCF should rise. Also, as revenue and operating income climb, OCF and FCF should increase over time.

PepsiCo’s remaining safety metrics are solid. Net debt on the balance sheet has been fairly constant since 2020. It is currently at $37,518 million with a leverage ratio of ~2.1X and interest coverage of ~15.4X. These values are reasonable, and debt does not place the dividend at risk. The credit rating agencies give an A+/A1 upper-medium investment grade rating.

PepsiCo has done an excellent job expanding its business, growing the dividend, and repurchasing shares without adding excessive leverage. We expect dividend growth to continue. It is management’s second priority after investing in the business and ahead of bolt-on M&A, partnerships, and share repurchases.

Valuation

The share price has declined about 1.5% year-to-date and about 9.8% in the past year. Concurrently, the price-to-earnings (P/E) ratio has fallen to 20.5X, below the trailing five- and ten-year ranges. The valuation drop is primarily because of near-term challenges related to volume and inflation affecting consumers.

The consensus analyst estimate for earnings per share in 2024 is $8.17. We will use 23X as the fair value multiple near the midpoint of the 10-year range, accounting for near-term struggles. Hence, our fair value estimate is $187.91. The present share price is ~$167.28, indicating PepsiCo is undervalued.

Applying a sensitivity calculation using P/E ratios between 22X and 24X, we obtain a fair value range from $179.74 to $196.08. Hence, the stock price is approximately 85% to 93% of the fair value estimate.

Estimated Current Valuation Based On P/E Ratio

|

P/E Ratio |

|||

|

22 |

23 |

24 |

|

|

Estimated Value |

$179.74 |

$187.91 |

$196.08 |

|

% of Estimated Value at Current Stock Price |

93% |

89% |

85% |

Source: Dividend Power Calculations

How does this calculation compare to other valuation models? Portfolio Insight’s blended fair value model combining the P/E ratio and dividend yield gives a fair value estimate of $197.33 per share. The Gordon Growth Model [GGM] provides a fair value of $180.67, assuming a discount rate of 9% and a conservative annual dividend growth rate of 6%.

The three-model average is ~$188.64, indicating that PepsiCo is undervalued at the current price.

Final Thoughts

PepsiCo’s stock usually yields less than 3%, and its 5-year average is around 2.8%. However, the yield rises above 3% when the firm faces difficulties. This has proven an excellent time to add to existing positions. Moreover, the forward P/E ratio is ~20.5X, below the 5-year and 10-year ranges. The combination of undervaluation, dividend growth, dividend safety, and competitive advantages is attractive. I view PepsiCo as a long-term buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP, KO, KDP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.