Summary:

- PepsiCo has weathered the economic storm, but the company is still seeing sales volume decline in key divisions of the business in multiple regions.

- PepsiCo’s brands are mature, and the company isn’t likely to be able to drive more than mid-single-digit growth moving forward in most markets.

- Valuation still leaves little room for upside.

Derek White/Getty Images Entertainment

PepsiCo (NASDAQ:PEP) weathered the recent economic storm reasonably well. The company obviously has strong brands, and management was able to raise prices to more than offset labor shortage and supply chain issues over the last several years. PepsiCo performed well in 2022.

Still, while PepsiCo was able to offset rising costs and falling demand with price increases over the last year, this company isn’t going to be able to drive real and sustainable growth long-term without increasing sales volume and taking market share.

PepsiCo’s recent third quarter earnings were solid, but the report also showed several warning signs. PepsiCo recently reported earnings of $1.97 a share and revenue of $21.97 billion. Analyst expectations were for earnings per share of $1.84 and revenues of $20.84 billion. Management also raised their expectations for 2022 and 2023 earnings. PepsiCo discussed how they expected 2022 revenue to grow at 12% for the full year, versus previous expectations of 10%. The company also discussed how they expected full year earnings per share growth to be 10% in constant currency, up from 8%. Revenues were also up 9% on a quarter-to-quarter basis.

The main reason PepsiCo’s third quarter and full year earnings were so strong is because of the company’s pricing power. Management was able to significantly raise prices in several key markets to offset volume declines and rising prices.

Most of PepsiCo’s earnings growth in 2022 came in North America where the company’s price increases in the food division more than offset falling volumes and increasing costs. PepsiCo reported a 20% rise in revenues in North American Frito-Lays sells despite the product volume being lower. Quaker Food North America also saw revenues rise significantly despite sales being lower, with this division’s revenues being up 15%. The company’s North American beverage unit did report revenues increasing 4% on slightly higher sales volume, but clearly the company’s revenue growth in this region was driven primarily by prices increases in the food divisions, not increasing sales volume.

Management was also not able to raise prices as much outside of North America to offset rising costs. In Europe the company reported revenues rose just 1% and sales volume was down. In Africa, the Middle East, and Southeast Asia, revenues rose by just 4%, and sales volume in the food division was also down in these regions. The company saw a slight increase in beverage sales in these markets. China was the only region where PepsiCo saw revenues rise on increasing sales volume, and in the world’s second largest economy revenues still rose just 3%.

Almost all of PepsiCo’s revenue growth was driven by unsustainable price increases within North America in the company’s food divisions. PepsiCo obviously has some very strong brands in the food division, such as Frito-Lays and the Quaker Foods Brand, but falling volumes show that consumers are already trading down in some cases, and management can’t keep increasing prices at a double-digit rate. PepsiCo’s inability to offset rising costs as successfully in Europe and most emerging markets as the company did in North America also shows the limits of management’s pricing power. Costs continue to rise, and forex challenges remain, PepsiCo isn’t going to be able to drive consistent revenue growth by simply raising prices if sales volumes continue to decline in the company’s most important divisions.

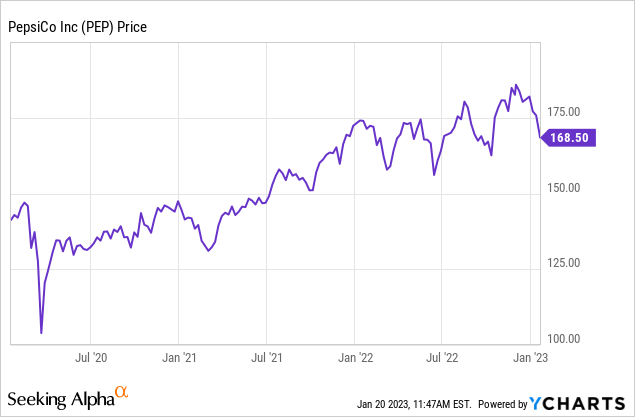

This is also why the current valuation of the company is unrealistic. PepsiCo currently trades at 24x forward earnings expectations, 3.27x likely forward sales, and 18.45x likely forward EBITDA expectations. The sector median valuation is 19x forward earnings, 1.76x forward sales, and 11.64x forward EBITDA expectations. PepsiCo also trades at a significant premium to the company’s average 5-year valuation. The company has historically traded at 23.92x forward earnings and 16.24x forward EBITDA. PepsiCo is trading at nearly 15% premium to the company’s average 5-year valuation. Analysts are also expecting PepsiCo to grow the company’s earnings by 4-7% over the next 3-5 years, which means the company’s price to earnings growth rate is 3.39, which is high.

PepsiCo is not likely going to be able to drive more than mid-single digit earnings growth moving forward, and the company’s strong earnings in 2022 was the primary result of price increases in the North American Food Division, and management can’t raise prices by double-digits every year without seeing market share losses. This company is seeing sales volume decline in the company’s most important division, the food division, in both North America and abroad, and raising prices while sales volume continues to fall is not a sustainable strategy. PepsiCo obviously has a number of strong products, but the company’s brands are also mature ones that likely will be hard to grow in established markets such as North America and Europe. While PepsiCo performed well in 2022, earnings growth for this company will likely be limited moving forward, and valuation levels remain unrealistic.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.