Summary:

- PepsiCo’s growth has stagnated post-pandemic, with flat shares since 2022.

- The company’s mature market presence limits growth avenues, relying heavily on price hikes, with innovation and new products struggling to make a significant impact.

- Acquisitions have been value-destructive for PepsiCo lately, and recent purchases like Siete Foods are unlikely to meaningfully boost overall growth.

- At 21x forward earnings, PepsiCo doesn’t have a probable path to market-beating returns.

lcva2

PepsiCo (NASDAQ:PEP) is one of many staple companies that are struggling to reignite growth following a pandemic boom and two years of significant price taking.

With no growth, there’s almost no path to market-beating returns.

So, where will growth come from? Let’s try to answer that question.

Recapping Two Years Of Post-Pandemic Stagnation

I’ve been covering PepsiCo on Seeking Alpha for over a year. Initially, I came out with a ‘Buy’ rating, but in my last article, I downgraded the stock to a ‘Hold’ as it became clear PepsiCo is losing market share, and volumes aren’t ticking up.

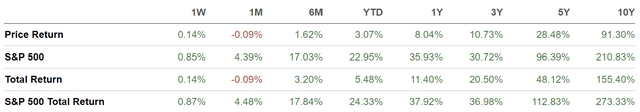

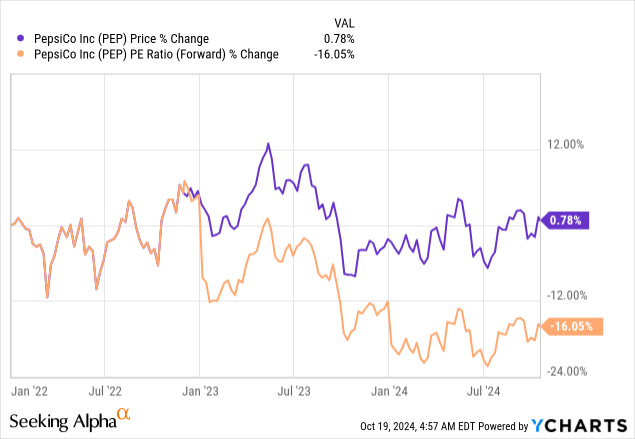

PepsiCo shares are flat since 2022, despite the EPS growing (albeit not by much), leading to a 16% contraction in the forward earnings multiple.

When a multiple contracts, there’s always a reason. It could be positive – like when a company delivers on high expectations (CC: Nvidia (NVDA)), but in most cases it’s a sign of negative developments, or at least a negative sentiment on developments.

In PepsiCo’s case, the former seems relevant. Over the past two years, revenue has grown by around 3% annually, below the low-end of company’s guidance, operating margins are essentially flat, and management had to cut guidance twice in the past year.

This disappointing performance is coming on the back of elevated demand during the pandemic, followed by two years of high inflation. The combination of those has resulted in lower demand in terms of volume, which led companies like PepsiCo to do significant price increases.

Obviously, there’s a point where the customer is no more willing to pay the new prices, even if they’re supposedly justified by higher costs. This has resulted in multiple consecutive quarters of volume declines for PepsiCo, which are ultimately the most important factor to observe the health of the business.

If the lack of growth is the reason for the underperformance, the only important question is, when and if, growth will return.

Struggling To Find Growth In An Ultra Mature Business

The best times to buy consumer staple empires like PepsiCo was several decades ago, when these companies were introducing products which today are as embedded in people’s lives as water.

Imagine a world where Pepsi sodas were only sold in a couple of states, and that’s it. This is a world where the company has a very clear and attractive growth trajectory, as it constantly enters new geographies, builds a worldwide distribution network, and has multiple innovation verticals across tastes, sugar-free products, and more.

Today, we’re at the other side of this world. PepsiCo products are sold in over 200 countries, it has a worldwide distribution network that’s second to none, and even if you’re in the most rural place somewhere in Africa, you’re highly likely to find a Pepsi in the convenient store.

In such world, PepsiCo doesn’t have clear growth avenues, and it has to rely on price increases and population growth with its legacy products. The only real way for meaningful growth is through innovation and introducing new products, but at PepsiCo’s scale, it’s very hard to develop a product that can move the scale.

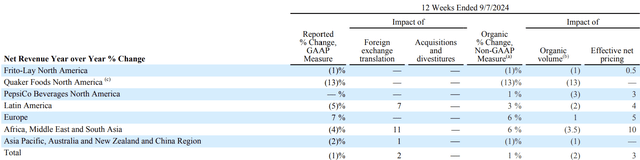

PepsiCo Q3’24 Earnings Release

It is then no surprise that we’re seeing results like those above. Negative volumes everywhere except from Europe with a miserable 1%, and even somewhat aggressive pricing barely offsets the volume declines.

So, Where Can Growth Come From?

If I had a perfect answer I’d probably be PepsiCo’s CEO and not an analyst, but from my view, the only path for growth is through acquisitions, and that’s usually not a path that’s good for shareholders.

PepsiCo has a history of bad acquisitions, the primary example being SodaStream, which it acquired for $11 billion and had to take a write-off on. There’s also names like Rockstar, Muscle Milk, and several others which were arguably value-destructive as well.

Just recently, PepsiCo announced the acquisition of Siete Foods, seeking to expand the dry foods portfolio with Mexican snacks. It’s a fast growing brand, but it was targeting $250 million in sales back in 2022. Even if it doubled sales since, this is still a drop in the bucket of PepsiCo’s portfolio.

In addition, these acquired brands tend to not perform as well when acquired by conglomerates that don’t have the same grit and velocity of a focused brand.

Besides acquisitions, it’s possible that getting rid of underperforming businesses and cutting certain product lines could help support consolidated growth, but it doesn’t seem like the company is looking to pursue that aggressively enough.

This leaves us with a recovery in demand for core product lines, but that will need some kind of marketing magic that’s hard to predict and doesn’t seem likely in the near future.

All in all, I have to say I’m quite bearish on PepsiCo’s growth trajectory.

Valuation & The “Long-Term Investor” Argument Regarding Long-time Winners

A very common phenomenon I’m witnessing from investors is that they’re automatically assuming that if a long-time winner like PepsiCo is underperforming, it means it’s a good buy “for long-term investors”.

At today’s price, PepsiCo is underperforming the S&P 500 on every time-period over the past decade:

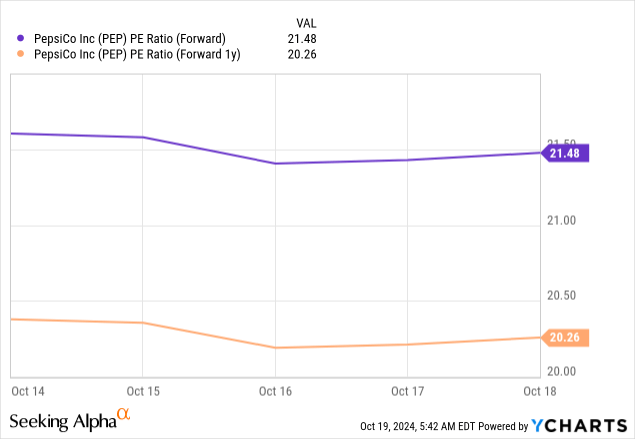

And, at 21 times forward earnings, shares are trading around 12% below historical valuation:

With the current growth trajectory, I view an 18x multiple as an attractive entry point. However, at these levels, I don’t see a reason to invest in PepsiCo over the S&P 500, which for me, deems it a ‘Hold’.

Conclusion

PepsiCo has been a great investment in the past, and the company is highly likely to be one of the largest staple businesses for decades to come.

Neither of those points contradict the fact that the path to market-beating performance is unclear and tough to envision.

If you grow slower than the market average, and you trade at a market-average valuation, underperformance is the inevitable outcome.

Therefore, I reiterate PepsiCo at a ‘Hold’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.