Summary:

- PepsiCo’s core EPS payout ratio is positioned to remain in the mid-60% range in 2023.

- Led by legendary brands, the consumer staple conglomerate’s net revenue and core EPS surged higher by double digits through the first half of this year.

- The company’s profits can service its debt effortlessly.

- My inputs into the discounted cash flows model and dividend discount model show PepsiCo to be trading about 4% below fair value.

- PepsiCo’s 2.8% dividend yield and 8.5% annual core EPS growth forecast make it an appealing buy for dividend growth investors.

Money raining down on a businessman. Prostock-Studio

Aside from death and taxes, another certainty in life is that as long as you keep breathing, there will always be bills that must be paid. This is what makes it so important for us as investors to build up portfolios that can generate lasting and growing passive income.

This is where companies with 50-plus years of dividend growth (i.e., Dividend Kings) can come in handy. That is because these businesses have had to withstand recessions, wars, pandemics, and so forth. It isn’t a guarantee that any one Dividend King will remain such in the decades to come. But I believe a well-diversified portfolio of such businesses is the closest thing we have to a guarantee in the world of dividend growth investing.

Having hiked its quarterly dividend per share for 51 consecutive years with its most recent 10% boost announced in May, PepsiCo (NASDAQ:PEP) is among the most revered Dividend Kings. Let’s explore why it should be a smart buy for investors seeking dividend growth.

Dividends Don’t Get Any Safer Than PepsiCo’s

To be sure, no dividend is fool-proof in that it will last forever. But if I had to hitch my wagon to any one company with the objective of steady and growing dividend income, PepsiCo would be at the top of my list. Why is that?

For starters, the company’s dividend has compounded at 8.1% annually over the last 10 years. For a business that is as established in its dividend growth streak as PepsiCo, this is a solid dividend growth rate. And if the most recent 10% raise is any guide, healthy dividend growth isn’t going to be subsiding anytime soon.

PepsiCo’s dividend is also well-protected against any short-term underperformance in its business. The company generated $6.79 in core EPS in 2022. Compared to the $4.45 in dividends per share that it paid during the year, this comes out to a 65.5% core EPS payout ratio.

And even after its generous dividend increase, dividend coverage is improving: PepsiCo’s dividends per share paid in 2023 ($4.83) are set to be 8.5% higher than in 2022. But because core EPS is set to rise by 10% over last year to $7.47, the company’s core EPS payout ratio is set to decrease to 64.7% in 2023.

Analysts anticipate that PepsiCo’s core EPS will grow by 8.5% annually for the next five years. Coupled with a payout ratio that should allow for dividend growth to match earnings growth, this is why I believe a 7.25% annual dividend growth rate over the long haul is realistic.

A Brand Portfolio That Can Satisfy (Almost) Any Craving

Operating in over 200 countries and territories, PepsiCo and its brands are known and loved in every corner of the world. The iconic company’s brand portfolio features 500-plus brands, including the likes of Lay’s potato chips, the eponymous Pepsi cola, and Gatorade sports drinks. Simply put, PepsiCo is a beverage and snacking company whose brands are capable of appealing to everyone.

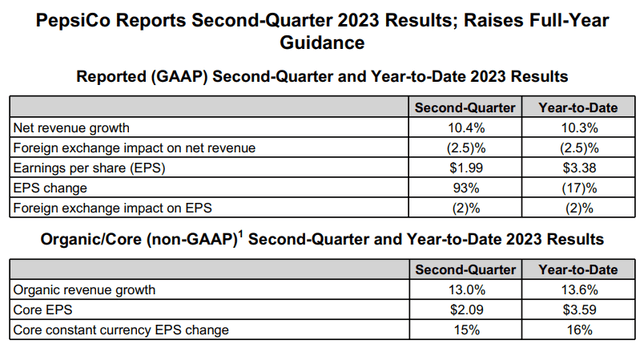

PepsiCo Q2 2023 Earnings Press Release

PepsiCo served up delicious operating results to its shareholders in the first half of 2023 concluded on June 17. The company’s net revenue surged 10.3% higher year over year to $40.2 billion during that period.

This topline growth was driven by the implementation of price hikes throughout the business, which contributed to a 16% growth in net revenue for the first half. Even with these sizable price hikes, PepsiCo’s organic volume held relatively steady – – down just 2%. That is because the company’s products have become deeply embedded into the routines of so many people around the world. This affords PepsiCo a remarkable amount of pricing power.

Due to the continued strength of the U.S. dollar relative to other foreign currencies, the company faced a 2.5% foreign currency translation headwind in the period. Along with small divestitures that hit the topline by 1%, these variables account for PepsiCo’s approximately 10% topline growth during the first half.

The snacking and beverage giant recorded $3.59 in core EPS for the first half, which was up 14% over the year-ago period. Thanks to slower growth in cost of sales and selling, general, and administrative expenses, PepsiCo’s profit margin expanded by over 30 basis points to 12.4% in the first half. This is how the company’s core EPS grew at a faster clip than net revenue during the half.

As if PepsiCo’s robust overall growth for the first half of 2023 wasn’t enough, it gets even better: The company’s profitability earns it the status of being a highly stable company financially. The consumer staple’s interest coverage ratio was 16 through the first half of the year. Put another way, PepsiCo covered its interest expenses from earnings before interest and taxes 16 times over. This demonstrates that the company can handle its current long-term debt load of $36 billion (all details in the previous five paragraphs sourced from PepsiCo Q2 2023 earnings press release).

Risks To Consider

PepsiCo is a fine business. However, it still carries risk with it.

Given that PepsiCo operates in a massive industry with decent growth potential, it shouldn’t be surprising to learn that the industry is also competitive. To this point, PepsiCo has been able to strengthen its product portfolio through new product launches and acquisitions. And moving forward, I’m confident that the company can keep up with changing consumer preferences. But if I am proven wrong and PepsiCo falls behind what consumers want, the business and its growth story could suffer.

The Valuation Is Within Reason

PepsiCo is a Dividend King that I believe belongs in every dividend growth portfolio. But as is the case with any business, purchases have to be made at the right entry point. In using some caution with two valuation models, I believe there is a modest margin of safety in buying shares of PepsiCo at the current $179.45 share price (as of September 18, 2023).

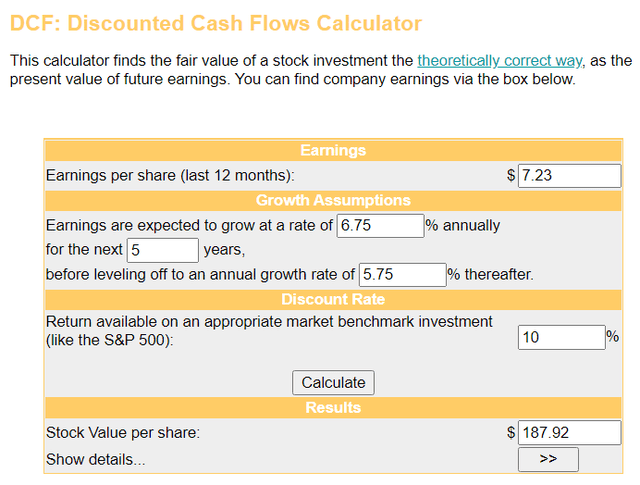

The first valuation model that I will use to value PepsiCo’s shares is the discounted cash flows or DCF model. This consists of three inputs.

The first input for the DCF model is the past four quarters of core EPS. PepsiCo has posted $7.23 in core EPS in the last 12 months.

The second input into the DCF model is growth projections. I will use a 6.75% annual core EPS growth rate for the first five years, which is well below the analyst consensus of 8.5%. Then, I’ll assume a slowdown to 5.75% in the years that follow.

The third input for the DCF model is the annual total return rate or the discount rate. My required annual total return rate is 10%.

Plugging these inputs into the DCF model, I get a fair value of $187.92 a share. This means that shares of PepsiCo are trading at a 4.5% discount to fair value and offer a 4.7% upside from the current share price.

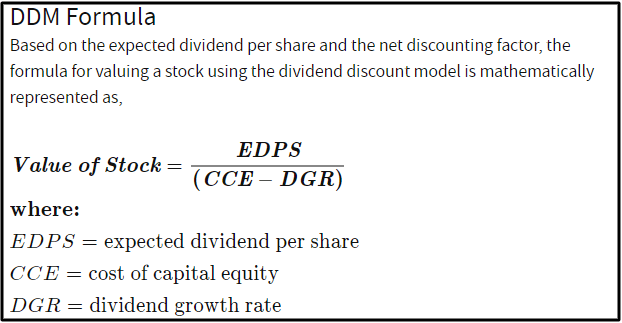

Investopedia

The second valuation model that I’ll employ to estimate the fair value of PepsiCo’s shares is the dividend discount model or DDM. Just like the DCF model, the DDM is made up of three inputs.

The first input in the DDM is the annualized dividend per share, which is also called the expected dividend per share. PepsiCo’s annualized dividend per share is currently $5.06.

The next input for the DDM is the cost of capital equity or annual total return rate. Again, I will use 10%.

The final input in the DDM is the annual dividend growth rate. As noted earlier, this will be 7.25% for PepsiCo.

These assumptions lead me to a fair value of $184 a share. That suggests that shares of PepsiCo are priced at 2.5% under fair value and could have 2.5% capital appreciation from the current share price.

Upon averaging these two fair values, I arrive at a fair value of $185.92 a share. This implies that PepsiCo’s shares are trading at a 3.5% discount to fair value and can provide a 3.6% upside from the current share price.

Summary: Satisfactory Starting Income And Moderate Growth At A Small Discount

PepsiCo’s 2.8% dividend yield isn’t remarkably high or likely to get your attention. But it’s fairly attractive compared to the measly 1.5% dividend yield of the S&P 500 index. Not to mention that PepsiCo’s sustainable payout ratio and ample growth prospects should translate into more dividend growth down the road.

While it is not a cheap stock, my inputs into the DCF model and DDM support the argument that PepsiCo is sensibly valued. This is why now isn’t a bad time to buy shares of the stock and a pullback would be an even better time to add to your position as a dividend growth investor.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.