Summary:

- PepsiCo is a safe haven stock.

- With attractive treasury yields, safe haven stocks lose some of their appeal.

- PepsiCo still trades at an elevated multiple and has a real risk of multiple compression.

Fotoatelie

Over the last year, global equity markets have been very volatile and many investors fled into Safe havens. Safe havens are investments expected to hold their value or even increase during economic uncertainty or market volatility. These types of investments are sought after by investors to protect their wealth and minimize potential losses. These investments may not offer the potential for high returns. Still, they can provide investors with a sense of stability and security, which we saw in action over the last year, where Consumer Staples outperformed and closed the year positive. While Staples underperformed the overall market due to the rally in risk-on assets this year, I believe many investors are still looking for safe investments in this uncertain time.

In this article, I’ll review if PepsiCo (NASDAQ:PEP), one of the most prominent Consumer staples, still provides investors a safe haven compared to US bonds.

US Bonds as a lucrative alternative?

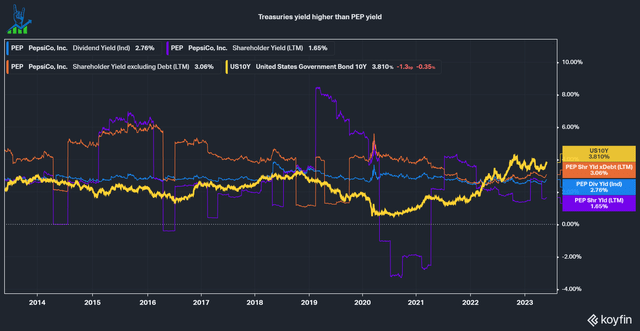

The classic example of a safe haven is the US 10-year treasury (US10Y), which has risen sharply in the last year, from just 0.56% in July 2020 to over 3.81% today. Until April of 2022, the decision was evident, with the low treasury yield, but after that, the treasuries have consistently stayed above PEP’s yield. This opens the question if it is still lucrative to hold PepsiCo shares as a safe haven or if it would be prudent to own treasuries instead. We’ll look at PEP’s business and growth prospects to find this out. After all, a treasury has a set yield once you buy it and can’t increase the yield as companies can with dividend raises. In the screenshot below, I used various yields for Pepsi. Besides the classic dividend yield, I also included the following:

- Shareholder yield = Dividend yield + Buyback yield + Debt paydown yield

- Shareholder yield xDebt = Dividend yield + Buyback yield

We can see that even factoring in other forms of capital returns, the treasuries had a superior yield over the last year.

10 year treasuries versus PepsiCo yield (Koyfin)

Revenue and Earnings Growth

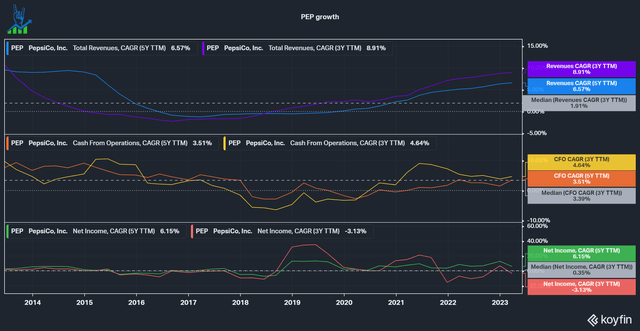

We can see that over the last decade, Pepsi’s growth has been lumpy and underwhelming, with a median growth of 2% in sales, 3.3% in operating cash flow and flat net income. We should positively note that PepsiCo has done an excellent job at showing its pricing power during this inflationary time and sales increased nicely over the last year.

Pepsi historical growth (Koyfin)

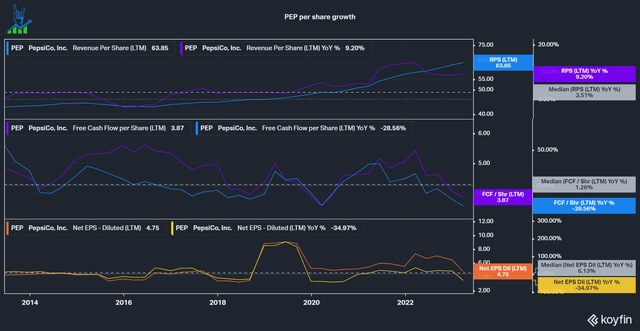

It gets slightly better if we look at the per-share growth rates instead. Pepsi managed to increase revenue per share by 2.5%, Free cash flow per share by 1.2% and EPS by 6% annually over the last decade. Over the same period, dividends per share increased by 7.9% annually. This has driven the EPS payout ratio from 50% in 2013 to 95% today, a worrying trend. The median buyback yield over the same period has been 1.3%, but the bulk of repurchases happened in the first half of the 2010s when PepsiCo traded at a much higher Free cash flow yield.

Pepsi per share growth (Koyfin)

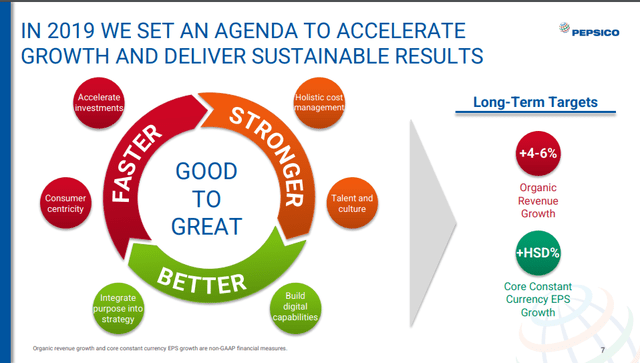

Analysts expect Pepsi to accelerate EPS growth to ~7.5% over the next five years. Revenue is expected to grow at 4-5% in the same period. This aligns with PepsiCo’s long-term target of 4-6% organic revenue growth and high single-digit EPS growth. I’d take these targets with a grain of salt because they haven’t achieved these numbers in the last decade and buybacks are tough to leverage at this valuation. To achieve this, PepsiCo announced its GOOD TO GREAT agenda in 2019. So far, results following the agenda indeed improved, but we can’t ignore that inflation helped PepsiCo out significantly. In a typical 2% inflationary environment, things might look different again. That being said, the company is executing its plans.

PepsiCo Good to great framework (Pepsi Investor Presentation)

Great business, pricey stock

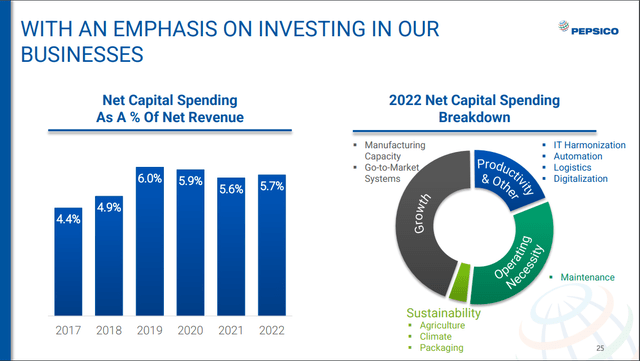

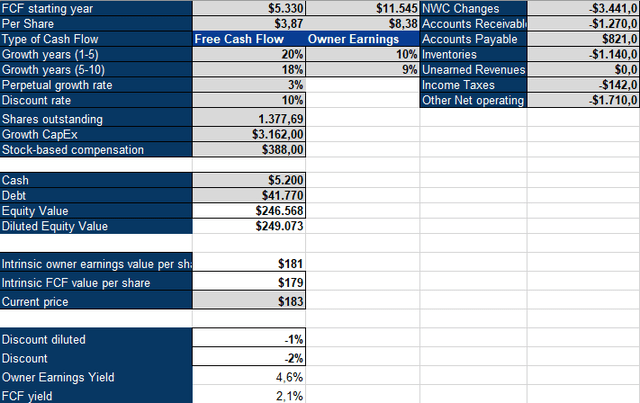

To value PepsiCo, I use an inverse DCF model. I use traditional FCF and Owner Earnings (FCF + Growth Capex – SBC +/- changes in NWC). PepsiCo breaks its capital expenditures down in its Investor Presentation. I’d consider growth (40%) and Productivity (20%) as growth capex, while sustainability and operating necessities represent maintenance capex.

Pepsi Growth Capex (Pepsi Investor Presentation)

Pepsi seems to be significantly overvalued at the current Free cash flow of $5.3 billion. We must consider that changes in Net working capital pushed FCF much lower than usual. We also can consider Pepsi’s considerable reinvestment into growth: If it weren’t invested for growth, it would flow back into traditional Free cash flow. Yet even after accounting for these adjustments, Pepsi still looks expensive and requires a 10% FCF growth rate to justify its valuation, much above its ten-year median and EPS growth guidance.

Pepsi Inverse DCF Model (Authors Model)

The dividend argument

While fundamentally expensive, there is an argument to make for PepsiCo as a bond proxy with a sole focus on the dividend income. At the current dividend yield of 2.76% and assuming a continued dividend growth in line with earnings (7%), it would take PepsiCo 5 years until the yield on cost would exceed the current 3.8% yield on the 10-year treasury. While this isn’t terrible, it also isn’t great, in my opinion. Meanwhile, PepsiCo has a real risk of multiple compression, which I wouldn’t ignore, even if one is just after the income. Over the last decade, safe haven dividend stocks were a no-brainer against low treasury yields, but this has changed. I rate PepsiCo a hold.

A few months ago I did a similar analysis with Pepsi’s peer Coca-Cola (KO) if you want to continue reading afterward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.