Summary:

- Big pharma is one of the laggards and now rotational targets headed into 2024.

- Pfizer is one of the worst performers of the group, but also one of the oldest and most mature of the peer group.

- If the revenue projections over the next 6 years hold water, this will be one of the better deals of the next decade.

- A strong balance sheet and diverse portfolio of products should help Pfizer pivot much easier than a concentrated Covid-19 vaccine producer like Moderna.

PixelsEffect

A logical pick cut in half

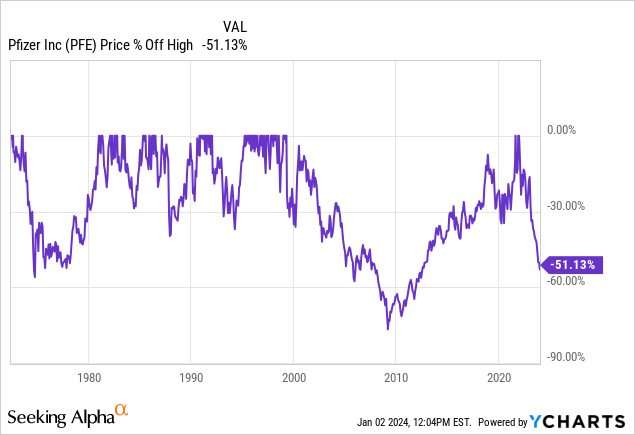

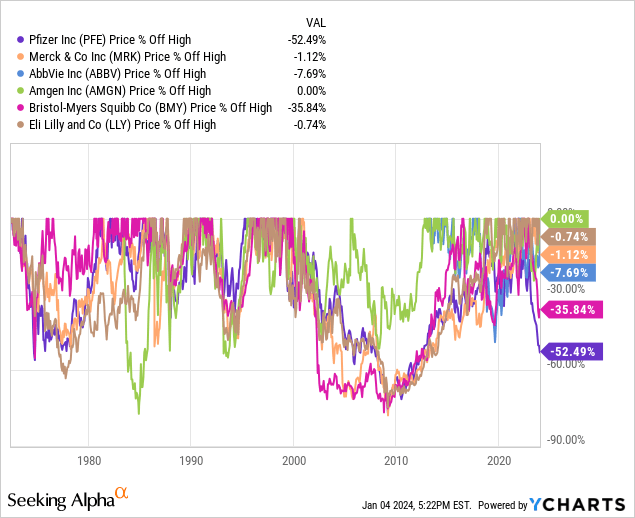

There haven’t been many, if any drawdowns of this caliber to grab Pfizer (NYSE:PFE) -50% off highs. The company is down for good reason, investment in the Covid Vaccine solutions has left the company behind from an R&D perspective. While products related to MRNA Covid vaccines continue to wane, pivoting into other areas such as weight loss drugs, with Zepbound, Mounjaro, Wegovy, and Ozempic are all the current rage in the market. If you don’t have a weight loss solution, then you’re behind.

Furthermore, it didn’t help that Pfizer’s twice daily oral weight loss trial run for danuglipron was unsuccessful. Lawsuits related to COVID-19 vaccine side effects may be a future worry. However, the company appears to be pivoting away from the MRNA vaccine development. The dividend not only remained intact after the last earnings call but was raised. With such a large yield in a possible rate-cut environment of 2024, this could be one of the better values out there.

A strong balance sheet and diverse portfolio of products should help Pfizer pivot much easier than a concentrated Covid-19 vaccine producer like Moderna (MRNA).

Problems and solutions

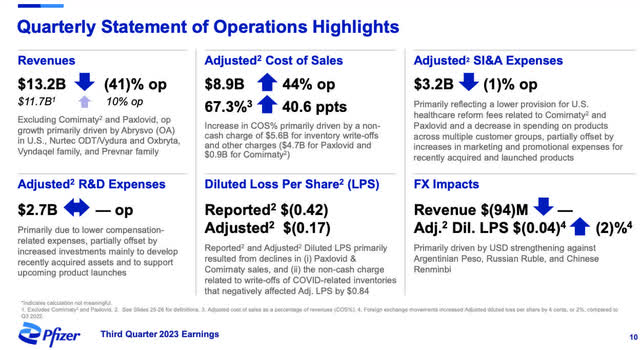

The adjusted cost of sales soaring was a major sore spot in the most recent earnings report primarily brought on by non-cash charges and inventory write-offs for Covid related drugs and vaccines.

- A non-cash charge of $5.6 Billion for inventory write-offs

- of the charges, $4.7 Billion is attributed to Paxlovid and $900 million for Comirnaty.

The primary growth drivers are now Abrysvo, Nurtec, and Oxbryta. For those unfamiliar with the drugs, here are their functions:

- Abrysvo: RSV vaccine for adults 60 and older and for pregnant women given at 32-36 weeks gestation to help protect their babies from severe RSV.

- Nurtec: Nurtec ODT, is a medication to treat migraine attacks and to prevent episodic migraine in adults.

- Oxbryta: OXBRYTA is a prescription medicine used for the treatment of sickle cell disease in adults and children 4 years of age and older.

Percent off high

Observing the 51% pull back, only the GFC of 2009 and the stagflation era of the mid to late 1970s presented pull backs this violent. Again, I’m not saying the pull back isn’t for good reason, but the stock recovered in each instance. These are exactly the charts I like to see.

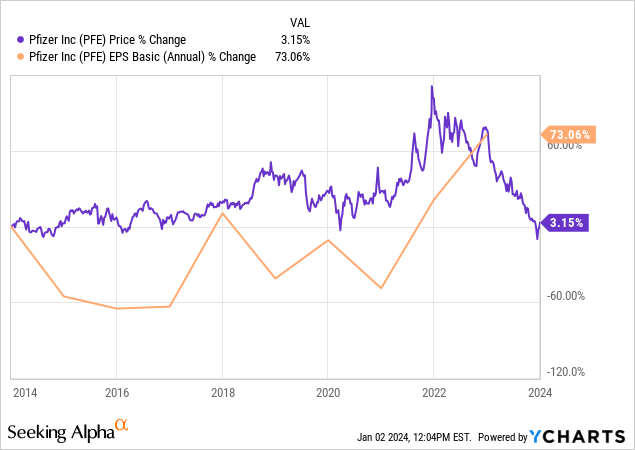

10 year growth in earnings to growth in price

Once again borrowing from the Peter Lynch ethos, comparing the 10-year growth in earnings to the price appreciation shows quite a divergence. This stock was generally beloved enough in the past decade to have price appreciation trending above earnings growth every year until 2023. The huge pullback now presents us with a company that has grown earnings 73% over the decade while price growth is only at 3.15%. This is indicative of value.

Once earnings recover and reattach themselves to the previous trajectory, the price has a lot of catching up to do from a normalized EPS multiple perspective.

Revenue sources

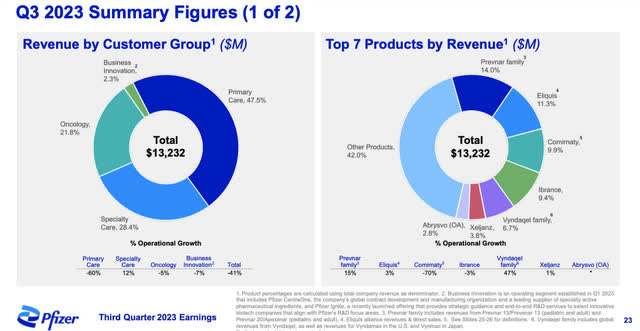

Pfizer had 52 reportable revenue-generating items in Q3 2023 amongst 4 segments. At times Pfizer gets lumped into Moderna comparisons because of the COVID-19 vaccine sales. The two companies couldn’t be more different from a revenue diversification standpoint.

All numbers in millions courtesy of Pfizer Q3 10 Q filing:

| PRODUCT FAMILY | Q3 REVENUE | PERCENTAGE |

| PRIMARY CARE | 6287 | 47.50% |

| SPECIALTY CARE | 3757 | 28.39% |

| ONCOLOGY | 2885 | 21.80% |

| BUSINESS INNOVATION+ ALLIANCE | 302 | 2.28% |

| TOTAL | 13231 |

2024 Valuation

Here i am using an “owner earnings” discount model to find the current 2024 value based on TTM numbers

All numbers in millions TTM courtesy of Seeking Alpha

- TTM net income: 10,482

- Plus TTM Depreciation and Amortization: 10,482+6,097=16,579

- Minus CAPEX:16,579-3,864=12,715

- Discounted at risk free rate [5.5%]=12,715/5.5%=

- Fair market cap:231,181

- Divided by shares outstanding: 231,181/5,646 shares outstanding=$40.94

- Trading at 70% of fair value.

My price target is on the higher end of Wall Street estimates. If there is an analyst 13.6% upside expected from this price level, it could outperform an overheated market, especially with the dividend included in the total return.

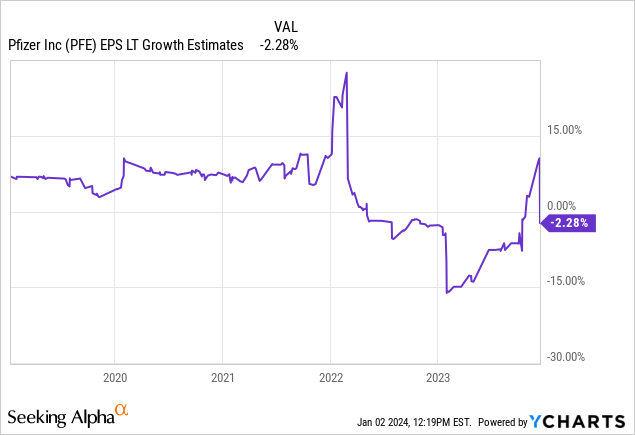

Long term EPS growth estimates

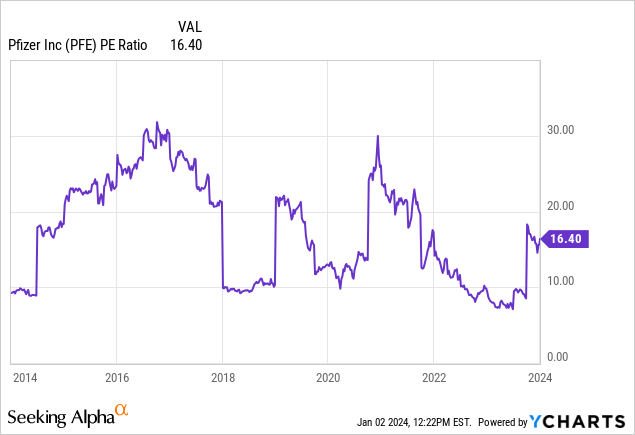

We can see that the analyst trend of EPS growth forecasts for Pfizer have been in the low teens year over year since 2019. With the issues Pfizer is facing, the earnings are expected to recede -2.28%.

With the company trading at the lower end [but not the absolute lowest] range of their P/E ratio, if the company returns to the low to mid-teens in EPS growth, then we have a near PEG 1 stock if we assume future growth rates return to normal. The multiple will also compress once earnings begin to grow again rather than just price action alone.

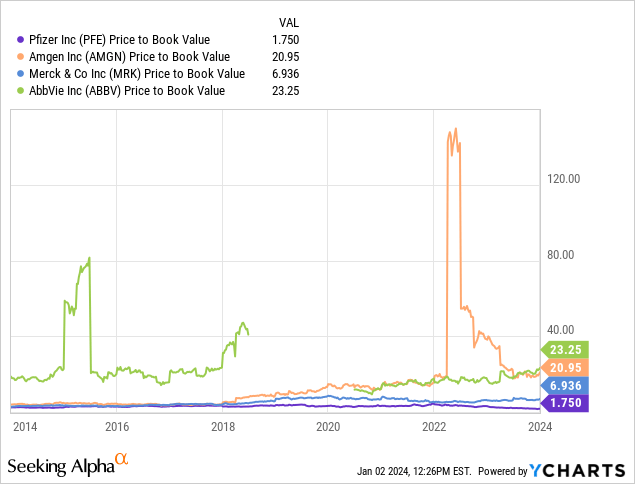

Price-to-book valuation

Comparing the price to book valuation amongst Pfizer’s peer group, this company is by far the cheapest of the pack. Amgen (AMGN), Merck (MRK), and AbbVie (ABBV) trade at multiples far over Pfizer based on this metric. The assets are underperforming, hence the discount. Once the product mix normalizes to compete with current pharma drug trends, this discount on assets will be likely to evaporate.

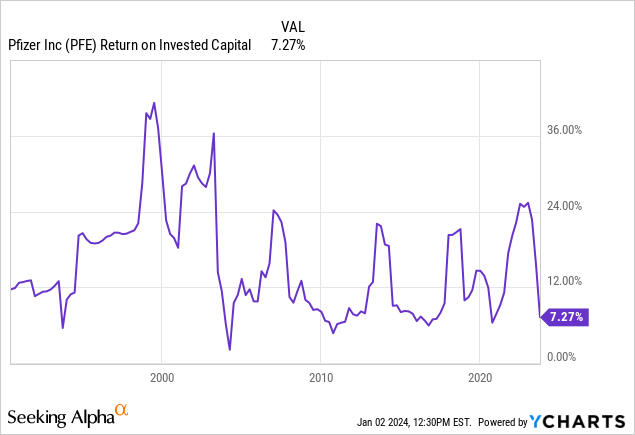

Return on invested capital [ROIC] is at the low end of Pfizer’s historical range. The cyclical R&D to production cycle is evident. There is probably going to be a further lag time in this cycle due to the focus on COVID-19 vaccines previously, but it does present a historical opportunity with the 50% haircut.

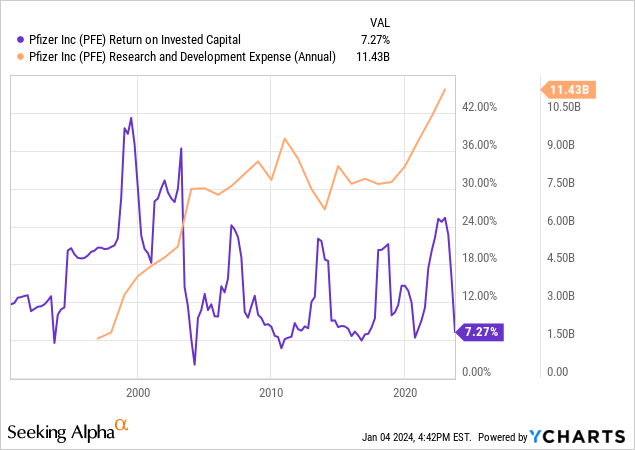

If we model R&D expense over return on invested capital, we can see when R&D spending spikes, ROIC retreats. We appear to be in another R&D spike and we can see the inverse relationship to ROIC.

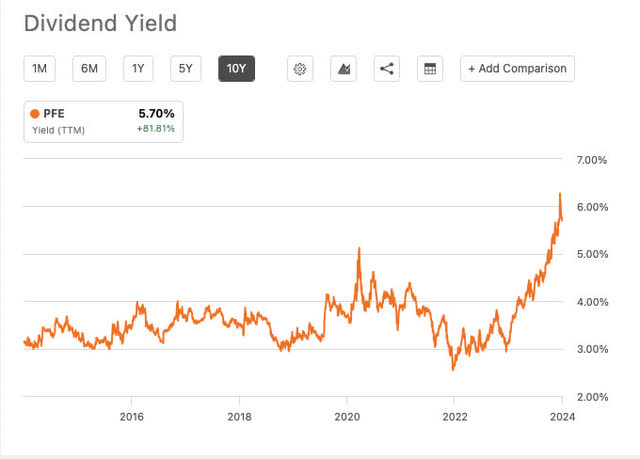

Dividend history

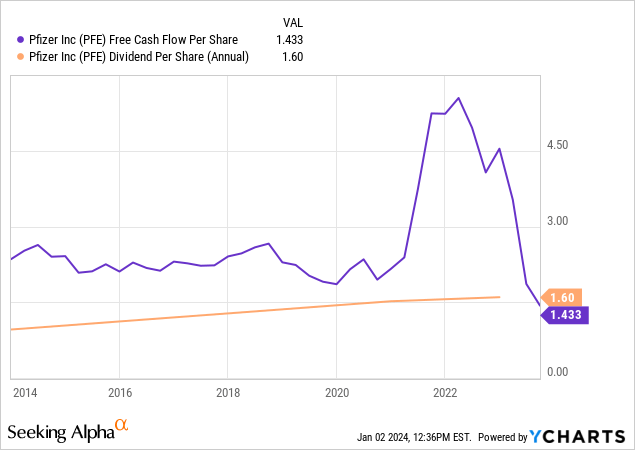

Buying Pfizer at this level will get you a decade-high dividend yield. The company recently continued to raise its dividend despite the free cash flow situation. This means Pfizer is willing to finance the dividend, at least for the time being, with existing balance sheet solutions until free cash flow recovers.

As we can see, the current dividend is not covered by free cash flow. However, Pfizer has had ample coverage in the past decade and most likely feels confident that this is a blip on the radar. If the company did have to cut because of a prolonged hit to free cash flow, a near 100% payout ratio would be in the neighborhood of $1.40/share, or a 4.8% yield on today’s price.

Yield on cost history

Even though Pfizer has not had the continuous dividend raises that would qualify it as a dividend aristocrat, the trajectory has been upward historically. Regardless if there is or isn’t a cut in the cards in between R&D cycles, this should still be a decade-high dividend entry point to improve your future yield on cost. If the dividend remains as is, even better.

Growth prospects

As we’ll see below, with the closure of the Seagen deal, Pfizer is putting a lot into M&A for growth purposes. With an expected $20 Billion in potential revenue growth for new molecular launches and $25 Billion from new Business Development deals by 2030, there is ample expected future growth in the pipeline. The above Q3 presentation was put out before the closure of the Seagen deal.

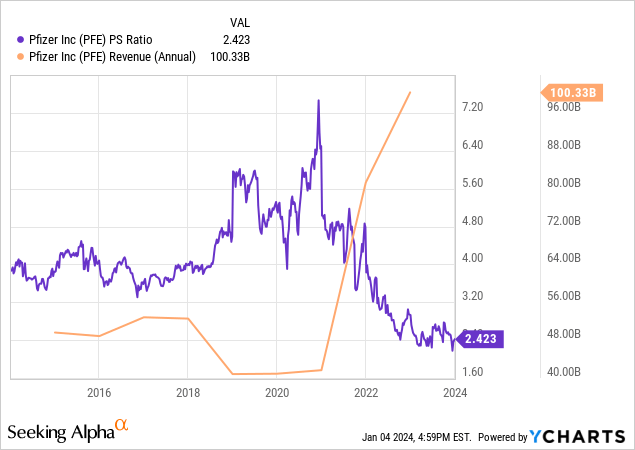

Future value

If we assume the price-to-sales ratio normalizes to 4 X, the median trend line on Pfizer, and an additional $50 Billion in revenue growth by 2030 with the mentioned new launches and business deals plus Seagen, $150 Billion X 4 would be equivalent to a $600 Billion market cap. If the share count is static, that would be a 2030 share price of $106/share.

Highlighting net margins, the average from 2016 to 2023 is 27%. A 27% margin on $150 Billion would be equivalent to $40.5 Billion in net income in 2030. Assuming no shares are repurchased or issued in this period would result in $7.08/ share in earnings. The ten-year average P/E ratio on Pfizer is 17.88 X. Assuming this to normalize could result in a 2030 price of $125 a share. Averaging out the normalized P/E ratio and P/S ratio averages against the above assumptions would result in a 2030 price target of $115/share. A possible $86 per share upside in the next 6 years.

Seagen acquisition

The completed acquisition of Seagen for $229 in cash per share, for a total enterprise value of approximately $43 billion shows where Pfizer is targeting it’s future growth story. More from the December 14th press release:

Seagen is a world-leader in ADC technology. With the addition of Seagen’s four in-line medicines, ADCETRIS® (brentuximab vedotin), PADCEV® (enfortumab vedotin), TIVDAK® (tisotumab vedotin) and TUKYSA® (tucatinib), Pfizer’s industry-leading Oncology portfolio now includes over 25 approved medicines and biosimilars across more than 40 indications, including nine medicines that are either blockbuster or have the potential to be blockbuster.

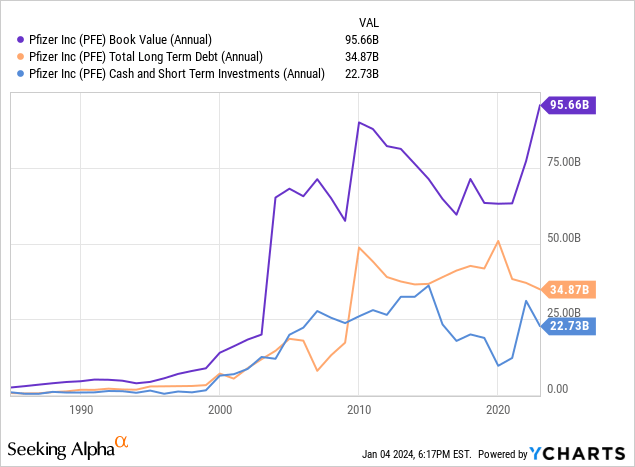

Balance sheet

Pfizer sports a very healthy balance sheet. With cash and short-term investments only $12 billion less than long-term debt and long-term debt only 35% of book equity value, the balance sheet doesn’t carry a lot of worries. Some stocks currently are cutting their dividends due to poor free cash flow coupled with a lack of cash and liquid investment resources. This problem doesn’t exist with Pfizer and they can manage the dividend how they like rather than being controlled by an inability to borrow further due to current interest rates to satisfy dividend shortfalls.

While this is not a dividend aristocrat and the company has had freezes, reductions, and return to growth on the dividend historically, it is largely a choice rather than a necessity. Being not of the dividend aristocrat breed is a plus when the trajectory over time is upwards. A cut or freeze should not have as deleterious an effect on Pfizer as it would have on others.

Risks

The risks to the company are varied. Pfizer may be too far behind in the R&D cycle to produce a viable weight loss drug. Weight loss drugs are akin to artificial intelligence as a keyword that investors are clinging to.

Weight loss also does not seem to be Pfizer’s future growth focus. Therefore if we are looking for a company to buy with hopes of a future weight loss solution, it’s best to look elsewhere. There could also be legal costs ahead related to Cominarty. Paxlovid is not as popular as Pfizer assumed.

The company could underperform financially for longer than expected due to a grouping of headwinds.

Summary

| STOCK | PERCENT OFF HIGH |

| (PFE) | -52.49% |

| (MRK) | -1.12% |

| (ABBV) | -7.69% |

| (AMGN) | 0% |

| (BMY) | -35.84% |

| (LLY) | -0.74% |

Big pharma is one of the laggards and now rotational targets headed into 2024. Pfizer is one of the worst performers of the group, but also one of the oldest and most mature of the peer group. Only Bristol-Myers Squibb Co. presents close to as good a deal amongst a peer group trading very closely to all-time highs. If the revenue projections over the next 6 years hold water, this will be one of the better deals of the next decade. Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE, AMGN, MRK, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information provided in this article is for general informational purposes only and should not be considered as financial advice. The author is not a licensed financial advisor, Certified Public Accountant (CPA), or any other financial professional. The content presented in this article is based on the author's personal opinions, research, and experiences, and it may not be suitable for your specific financial situation or needs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.