Summary:

- Pfizer’s sales doubled due to COVID-19 vaccine contracts, but revenues are returning to normal as the virus becomes less hazardous.

- After a year-to-date selloff, Pfizer offers a 4.5% forward dividend yield with substantial upside potential.

- Pfizer is focusing on improving its leadership in oncology and has potential moonshots under research and development.

sonja lekovic/iStock Editorial via Getty Images

Investment thesis

Pfizer (NYSE:PFE) was one of the primary beneficiaries of the COVID-19 pandemic. The company’s sales more than doubled in recent years due to the large governmental contracts for medicine to prevent and cure COVID-19. The company’s revenues are returning to normal as the virus mutated to less hazardous forms and the contagion pace significantly eased. That said, Pfizer’s stock price declined significantly year to date, and year-to-date weakness provides a compelling investment opportunity. The stock offers a 4.5% forward dividend yield with substantial upside potential. Pfizer is taking steps to improve its leadership in oncology and has potential moonshots under research and development. That said, I assign the stock a “Strong Buy” rating.

Company information

Pfizer is a leading global pharmaceutical and biotech company with a history of over 170 years. The company’s diversified product portfolio focuses on oncology, immunology, rare diseases, and vaccines.

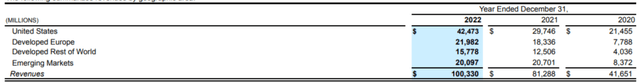

Pfizer’s fiscal year ends on December 31. According to the latest 10-K report, the company generated about 58% of its revenue outside the U.S.

Pfizer’s latest 10-K report

Financials

Pfizer is apparently not a growth company that enjoys its peak profitability stage. The company has the highest possible “A+” profitability grade from Seeking Alpha Quant.

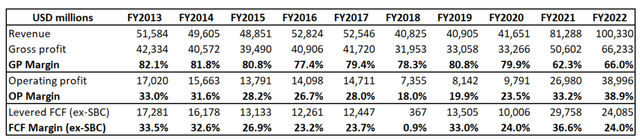

Author’s calculations

As you can see, profitability metrics are impressive, with the operating margin slightly below the immense 40% level. The company consistently demonstrates above 20% levered free cash flow [FCF] margin, which I usually call “printing” money. FY 2021 and FY 2022 revenues were abnormal due to the spike in vaccine sales used to protect people from COVID-19. COVID-19 prevention and medication revenues comprised $56.7 billion in FY 2022. That said, the top line is poised to return to normal in the next couple of years because I hope that a pandemic will not happen again in the foreseeable future.

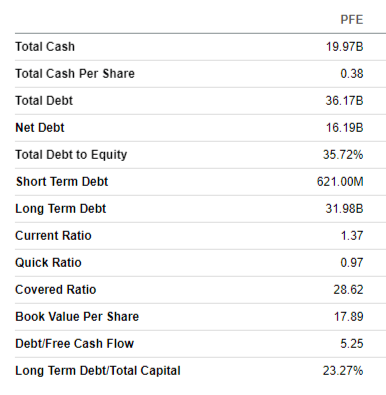

The company’s capital allocation approach is very shareholder-friendly. Pfizer pays out about $9 billion in dividends annually. Before the spike in the stock price due to the vaccination, the company returned massive amounts to shareholders via stock buybacks. The balance sheet is sound, with prudent leverage and liquidity ratios. The net debt position of more than $16 billion might look substantial, but the covered ratio is very comfortable at about 29. To add more context, Pfizer’s levered FCF in the last fiscal year was 50% higher than the net debt position. Therefore, I do not see any problems in a $16 billion net debt position.

Seeking Alpha

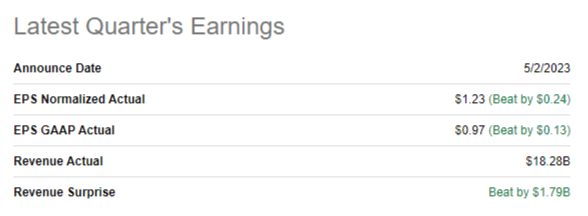

The latest quarterly earnings were announced on May 5, when the company smashed consensus estimates by a wide gap.

Seeking Alpha

Revenue decreased about 29% YoY due to comparatives containing extraordinary sales from anti-COVID vaccines. The bottom line followed with adjusted EPS shrinking from $1.62 to $1.23. Still, revenue was much higher in the first quarters before the pandemic started. The EPS was also consistently below $1 before Pfizer started selling anti-COVID vaccines via government contracts. In Q1 FY 2023, the gross and operating margins were stellar at 74% and 37%, respectively.

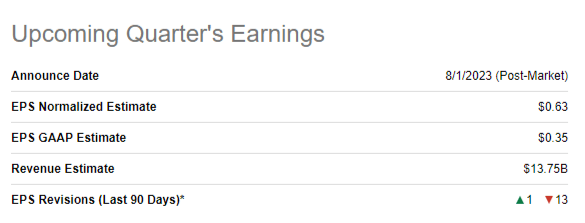

The upcoming quarter’s earnings are expected to be announced on August 1. Consensus estimates forecast a $13.75 billion Q2 revenue, indicating a 50% YoY decline. The massive drop is explained by the last year’s spike in revenue related to the prevention and medication of COVID-19. The adjusted EPS will follow the topline with a contraction from $2.04 to $0.63.

Seeking Alpha

The management expects non-COVID revenue to grow faster in the second half of FY 2023. According to the CEO, Dr. Albert Bourla, the company is expected to launch up to 19 new products and indications. From the long-term perspective, I think the future is bright for Pfizer because the company is investing heavily in a potential moonshot area related to the battle against cancer. This year, the company announced a significant acquisition of Seagen. This combination is aimed to enhance Pfizer’s position as a leading Oncology company. The management expects that the Seagen acquisition has the potential to contribute more than $10 billion in FY 2030 revenues which is significant relative to the company’s scale.

I think that substantial cash flows generated with the help of COVID-related products give the company an excellent opportunity to continue improving the pipeline through internal science and acquisitions. Pfizer’s excellent track record of success gives me the high conviction that the available cash will be allocated efficiently in building up the pipeline.

Valuation

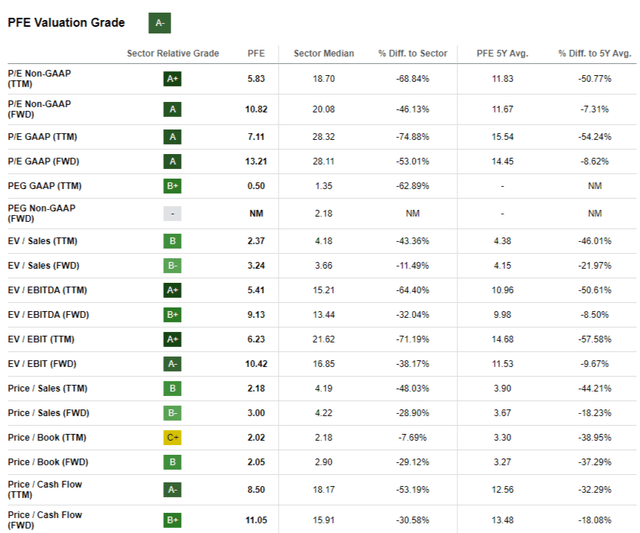

The stock’s price declined almost 30% year-to-date, meaning the stock significantly outperformed the broader market. PFE also underperformed the Healthcare sector (XLV), demonstrating a 3% YTD decline. Pfizer has a very high “A-” valuation grade from Seeking Alpha Quant. High valuation grade is explained by significantly lower valuation multiples than both the sector median and the company’s 5-year averages.

Seeking Alpha

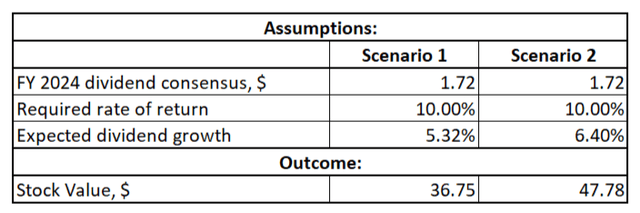

From the valuation ratios perspective, the stock is significantly undervalued. But I want to get more evidence to have a higher level of conviction. The dividend discount model [DDM] is the best choice for valuation analysis due to the company’s stellar dividend history with 33 consecutive years of dividend payouts. Valueinvesting.io suggests that Pfizer’s WACC is close to 10%, which I consider fair. I have dividend consensus estimates forecasting a $1.72 dividend for FY 2024. The dividend growth rate is usually tricky to predict because it depends on multiple factors. Therefore I would prefer to simulate two scenarios with dividend growth rates based on Pfizer’s history of payouts depending on the time horizon analyzed. For example, the five-year dividend CAGR equals 5.32%, while the ten-year CAGR is higher at 6.40%.

Author’s calculations

As you can see, the stock is slightly undervalued, even under more conservative dividend growth assumptions. And if the ten-year dividend CAGR is implemented, the DDM suggests the stock is more than 30% undervalued. Now let me underline a couple of reasons why dividend growth is safe, in my opinion. First of all, the payout ratio is relatively low at 26%. Second, the company has a solid record of dividend growth, with 12 consecutive hikes. Lastly, the consensus earnings estimates forecast that revenue and EPS will be almost flat over the next decade, indicating that the company is highly likely to sustain its profitability and FCF metrics. Overall, I am highly convinced that PFE is attractively valued at current levels.

Risks to consider

While offering attractive dividend yield and valuation, investing in PFE has risks.

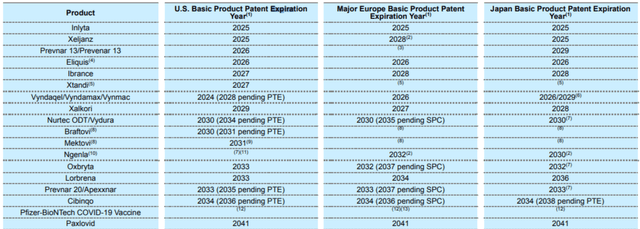

As a pharmaceutical company, Pfizer faces the significant risk of patent expirations for critical products, which can result in a deteriorated market share. This, in turn, will lead to a decrease in sales and earnings. According to the expiration schedule provided by the company, several patents are expiring by the end of this decade.

Pfizer’s latest 10-K report

The company invests vast resources to develop new products. Pfizer invested a staggering amount of above $80 billion in R&D over the past decade. But product development cycles are lengthy. Besides the long research and development phase, the regulatory approval processes for new drugs are complex and costly. Delays or failures to get regulatory approvals mean high uncertainty about the company’s future earnings after patents expire.

Pfizer operates in a highly regulated industry, posing significant risks for investors. Changes in government regulations or pricing controls might significantly undermine the company’s pricing power and market share.

Bottom line

Overall, I think that the upside potential, together with a 4.5% forward dividend yield, indicates that PFE is a compelling investment opportunity. Investing in pharmaceutical companies is inherently risky due to uncertainties related to new product development. On the other hand, Pfizer has a long-term story of success and high profits. To conclude, I assign PFE a “Strong Buy” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.