Summary:

- Pfizer’s deep valuation and large dividend yield make it an attractive investment, despite potential distractions from activist investors.

- The focus should remain on existing cost realignment plans and pipeline investments to ensure positive financial returns for shareholders.

- The stock only trades at 10x forward EPS targets.

JHVEPhoto

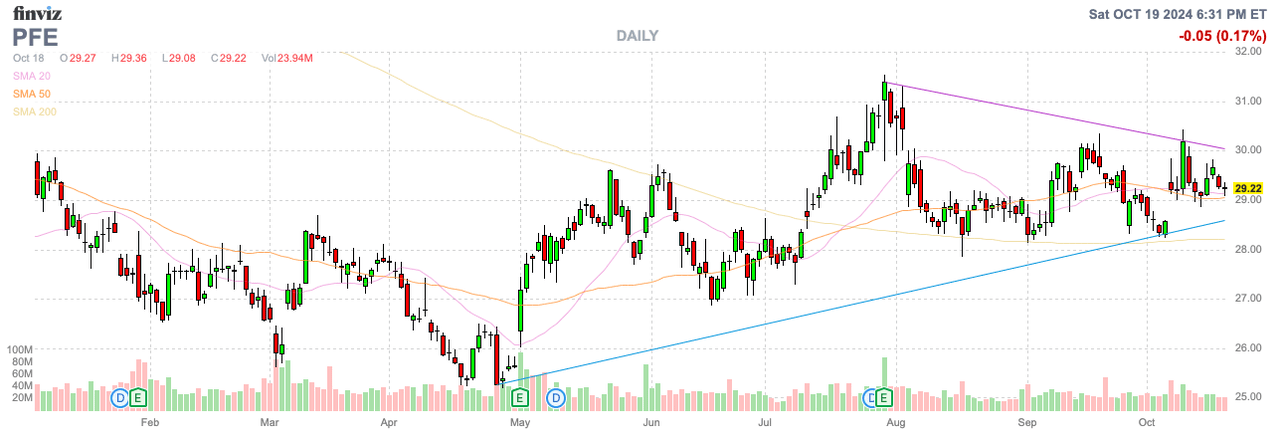

As 2024 comes to an end, Pfizer Inc. (NYSE:PFE) (NEOE:PFE:CA) was poised to return to growth. Oddly, activists are now swarming the biopharma for changes the company already appears to be implementing, clouding the story. My investment thesis remains ultra-Bullish on the stock due to the deep valuation and the large dividend yield, but a distracting activist battle could distract the management team.

Source: Finviz

Stay The Course

Pfizer recently reported Q2 non-covid sales grew by 14% YoY to reach $12.8 billion. Total sales beat analyst estimates, but revenues only grew 3% to reach $13.3 billion due to weak Covid sales.

The biopharma raised 2024 revenues estimates by $1.0 billion, yet activists are now pressuring Pfizer to make changes. The worst part is that former executives are in the middle of the pressure, with signs of ex-CEO Read and ex-CFO D’Amelio dropping out of the activist campaign due to pressure from the company.

Starboard Value LP has apparently invested $1.0 billion in Pfizer (not a large sum) and made the following accusations to the BoD regarding management pressuring the former executives to renege their activist push:

- Costly litigation against them

- Claw back prior compensation

- Cancel unvested performance stock units

Either way, Pfizer shareholders aren’t better off under this scenario. The activist is either distracting management and/or management is too focused on blocking activists than fixing the company.

Pfizer has a market cap of $165 billion, with Starboard only controlling a fraction of 1% of the company. The focus needs to return to finishing the plans already in place to streamline the business after the Covid drugs fizzled out.

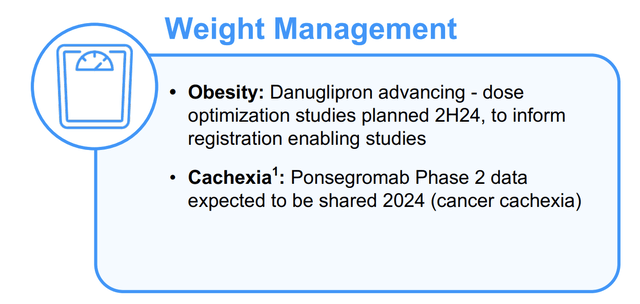

The biggest mistake Pfizer likely made was chasing the Covid vaccine prospects too much, and the biggest mistake now is likely chasing another drug franchise, such as in weight loss. The biopharma had a disappointing setback in this sector, with danuglipron development being halted last year after unacceptable side effects. The lead by Eli Lilly (LLY) and Novo Nordisk (NVO) would suggest a focus elsewhere is warranted, but Pfizer is still working on weight management drugs.

Source: Pfizer Q2’24 presentation

Moving Forward

Pfizer already implemented a cost realignment problem to remove $4 billion from the cost structure by this year, with another $1.5 billion targeted by 2027 via Phase 1 of the Manufacturing Optimization Program. The biopharma already bought Seagen to build the cancer business beyond Covid.

CEO Albert Bourla already appeared to be achieving results with the updated guidance after Q2. Seagen cost the company $43 billion and is expected to generate up to $5 billion of additional sales by 2026 with an original analyst target of hitting $9 billion by 2030.

The CEO needs to focus on driving sales for cancer therapies after the biopharma got distracted with Covid vaccines. Adcetris, Padcev, and Tukysa continue to progress well.

At the Morgan Stanley conference about a month ago, Pfizer CFO David Denton discussed the strong pipeline setup to surpass the large LOE losses towards the end of the decade:

So what we have is, I keep saying we have a little bit of an air pocket right now. Once we get to the back half of the decade, we have — our launches of about 18 or 19 products are beginning to — will begin to take hold more rapidly. We’ve made investments in Seagen as a good example and Biohaven and GBT, all of which have bigger growth aspirations in the ’25 to ’30 time frame.

And so, if you look at our LOEs during that time, we have, I know $17 billion roughly of LOEs in that timeframe. Our business development activity alone is, we modeled at $20 billion. So I think just the net of those two should imply a bit of growth in the back half of the decade. Then you couple on top of that just any performance coming out of our pipeline in our new product launches. And so I feel like the back half of the decade from a growth perspective, I can almost check the box.

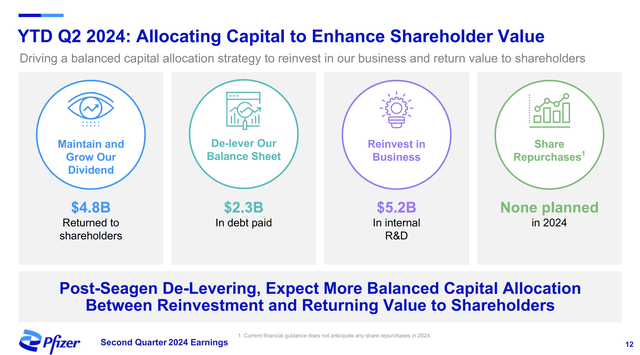

Pfizer has already stripped out $4 billion in costs, placing the company back on a path to a $3 EPS generating $17 billion in annual profits. The company is spending around $11 billion on R&D to invest in the future, while acquiring several drugs in the past few years.

Source: Pfizer Q2’24 presentation

One huge negative about the investment story is the massive $70 billion of debt accrued due to the acquisitions like Seagen and the current $9.6 billion dividend payout. Pfizer does have $7.1 billion in cash and short-term investments.

Hopefully, management will listen to any ideas from shareholders, including Starboard, but the goal should be to execute on existing plans. Pfizer has the pipeline and cost cuts already in place to drive positive financial returns for shareholders.

The stock already pays a nearly 6% dividend yield while offering enough extra cash flows to pay down debt. The only real negative to the investment story here is a potential management fight with activist and too much of a push to chase a sector already dominated by large biopharma competitors.

Takeaway

The key investor takeaway is that Pfizer remains cheap at 10x forward earnings while offering a very strong dividend yield. If the company focuses on the existing cost realignment programs while investing in the current drug pipeline, shareholders should be awarded. If the company gets distracted with an activist battle and loses focus, shareholders could see limited benefits.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start Q4, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.