Pfizer And L3Harris: Two Recession-Resistant Companies Worth Considering

Summary:

- After the S&P rebounded nicely from its September/October low, it seems that solid value opportunities are no longer available – a closer look shows that this is not the case.

- With a recession looming, I think it is prudent to have at least part of the portfolio allocated in recession-resistant sectors, such as defense and healthcare.

- In this article, I will discuss L3Harris and Pfizer – two quite recession-resistant businesses that currently trade at compelling valuations and have solid long-term prospects.

- Both companies face challenges, risks and uncertainties, but I believe these are very manageable and appropriately reflected in the share prices.

- I own Pfizer in a diversified pharma portfolio and expect to open a position in L3Harris soon to compliment my other defense holdings – Lockheed Martin and Raytheon Technologies.

cokada

Introduction

Since the S&P 500 fell below 3,600 in late September 2022, the bulls have been back in charge, and several solid value opportunities are no longer available. Lucky are those who acted decisively during the selloff and aggressively added to their high-quality holdings. But what about those who prefer a dollar-cost averaging strategy and are uncomfortable going “all in” all at once? Are opportunities – once again – a thing of the past and is it a good idea to wait for the next leg down?

I do not think so – I believe that the stock market offers solid opportunities almost every day to investors who are willing to look closely. With a recession looming and a rather bleak economic outlook, I think it is important to have at least a portion of the portfolio allocated to recession-resistant sectors. I’m thinking of pharmaceutical companies and defense companies, but of course it’s important not to act procyclically. Stocks like Northrop Grumman (NOC) and Eli Lilly (LLY) appear considerably overvalued, but there are solid companies that currently trade at compelling valuations. In this article, I would like to draw your attention to Pfizer Inc (NYSE:PFE), the well-known large cap pharma company, and L3Harris Technologies Inc (NYSE:LHX), an underfollowed defense company.

Pfizer Inc (PFE)

Pfizer’s home run in its collaboration with German biotechnology company BioNTech (BNTX) is well known, and the associated earnings and cash flows are hard to overlook. The company also recently benefited from a handsome $4 billion dividend resulting from the spin-off of Haleon (HLN) from GSK plc (GSK).

As a long-term owner of PFE, I was naturally pleased to see the stock finally gain some appreciation from Wall Street beginning May 2021. However, as PFE tested the high $50s range, I concluded that the market was getting a bit ahead of itself, as the cash flows associated with Comirnaty sales would have to come down to earth at some point – keeping in mind, of course, that some base revenue was likely to remain and the technology employed offers huge future potential. I decided to sell roughly two-thirds of my position at the end of 2021 (something I rarely do). So naturally, I was pleased when the stock came back down to earth in 2022, and began buying back Pfizer shares in October. After the brief rebound to $55 – which admittedly caught me by surprise – I returned to adding to my position yesterday – here is why.

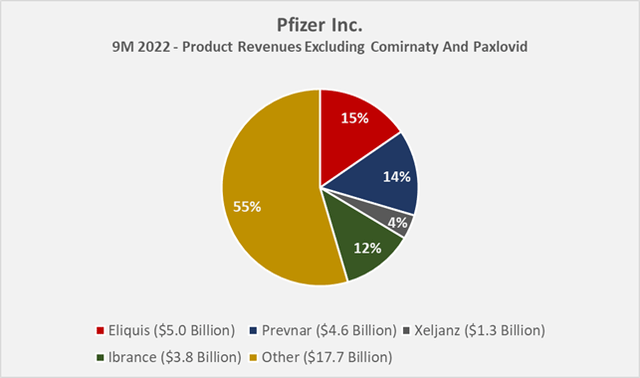

In the first nine months of 2022, Pfizer generated nearly 44% of its total revenue from Comirnaty and Paxlovid. Leaving those revenues aside, the company has what I would call concentration risk (Figure 1) in Eliquis (apixaban), its anticoagulant co-marketed with Bristol Myers Squibb (BMY), which I also own and am a big fan of. Prevnar, a tridecavalent vaccine containing thirteen serotypes of pneumococcus which are conjugated to diphtheria carrier protein, brought in $4.6 billion, and Ibrance (palbociclib), a CDK 4 and 6 inhibitor for the treatment of breast cancer, generated $3.8 billion in sales. Eliquis and Ibrance face their loss of exclusivity (LOE) in 2026 and 2027, respectively, and together with the immunology drug Xeljanz (tofacitinib, a Janus kinase inhibitor, LOE in 2025), 30% of Pfizer’s current non-COVID-19 revenue will need to be replaced sooner rather than later.

Figure 1: Pfizer’s product revenues for the first nine months of 2022, excluding its COVID-19 franchise (own work, based on the company’s 2022 10-Q3)

To that end, Pfizer has used a portion of its Comirnaty and Paxlovid proceeds to acquire Arena Pharmaceuticals in December 2021 and Biohaven in October 2022. Arena specializes in immune-inflammatory diseases and brings several development-stage candidates in dermatology, cardiology and gastroenterology. Etrasimod is the most promising candidate, used for example to treat ulcerative colitis (expected launch 2023, slide 5, 41st Annual J.P. Morgan Healthcare Conference presentation). Through Biohaven, Pfizer gets access to Nurtec/Vydura (rimegepant), a migraine drug that is already approved and works by blocking CGRP receptors, and commercially less interesting and yet to be approved nasal spray zavegepant (also for migraine). According to Morningstar, rimegepant could peak at over $4 billion in sales.

According to the company’s own projections (Figure 2), this and other efforts should help more than offset the expected $17 billion LOE-related revenue decline by 2030. One candidate in the pipeline that is not expected to launch until 2025 but has solid potential is the glucagon-like peptide-1 (GLP-1) receptor agonist danuglipron (link to the abstract of a phase 1 trial, article paywalled). GLP-1 is a key peptide hormone capable of lowering blood sugar levels in a glucose-dependent manner, i.e., danuglipron is a potential type 2 diabetes (T2D) treatment that also facilities body weight loss. The drug is currently being investigated in a phase 2 study against T2D and obesity (slide 7 of the pipeline update). Pfizer is currently also investigating another GLP-1 agonist as a T2D treatment (PF–07081532). Near-term pipeline candidates include a respiratory syncytial virus (RSV) vaccine and multiple myeloma treatment elranatamab, both of which are expected to be launched in 2023 (slide 5 of this presentation).

![Pfizer’s [PFE] revenue growth expectations for 2030](https://static.seekingalpha.com/uploads/2023/1/20/49694823-16742263172896528.png)

Figure 2: Pfizer’s [PFE] revenue growth expectations for 2030 (slide 9 of the Q3 2022 earnings presentation – seekingalpha.com/article/4551529-pfizer-inc-2022-q3-results-earnings-call-presentation)

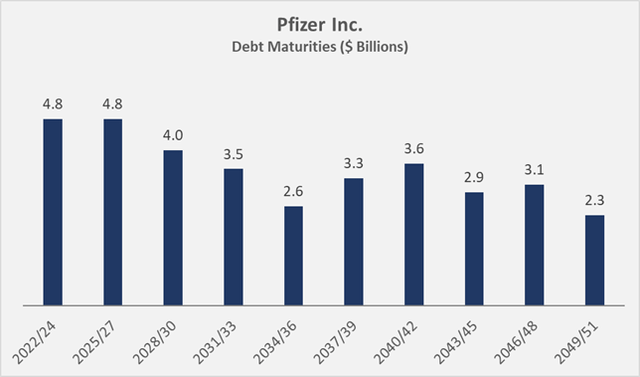

From a balance sheet perspective, there is not much to discuss. Clearly, Pfizer’s balance sheet is in great shape thanks to extraordinarily strong cash flows since 2021. Of course, this does not mean that Pfizer’s balance sheet was overly leveraged prior to the pandemic. At the end of the third quarter of 2022, the company had a theoretical net cash position of $3.5 billion, taking into account both short- and long-term investments. Of course, it would be foolish to expect Pfizer to pay down its debt with existing cash. Most likely, more acquisitions will follow, but if no promising acquisition targets show up, I would rather see management keep the cash on hand and take advantage of the improved interest rate environment. Of course, Pfizer could pay down some of its long-term debt at maturity (see maturity profile in Figure 3), but that is definitely not a necessity. As news coverage of COVID-19 eases, it does not seem unreasonable to expect further and potentially more pronounced share buybacks (management repurchased shares for $2 billion over the first nine months of 2022) and more significant dividend growth – balance sheet capacity and low volatility of baseline free cash flow definitely support a more generous return of cash to shareholders.

Figure 3: Pfizer’s debt maturity profile as of December 31, 2021; note that the maturities in 2028 and later years have been approximated based on the presentation of data in Pfizer’s 10-K (own work, based on the company’s 2021 10-K)

In terms of risks, in addition to the patent cliff mentioned above, there are changes in government policies to consider. Pfizer’s earnings will be affected by the Inflation Reduction Act (e.g., via expensive Eliquis and Ibrance), but these policies affect all major pharmaceutical and biotech companies at least to some degree. Litigation risk is also part of the “cost of doing business” when investing in pharma, so maintaining a diversified portfolio acquired at reasonable valuations is a good risk mitigation strategy in this context. Geographic concentration risk may also be mitigated by such a strategy, but with 63% of Pfizer’s total 2021 revenues coming from international operations (29% Europe, 19% China), I do not consider the company to be overly concentrated in any market.

Overall, Pfizer is on solid footing and has several current cash cows in addition to Comirnaty and Paxlovid. Granted, the patent cliff is substantial, but Comirnaty came along at just the right time, and the Biohaven acquisition in particular is encouraging, as is Pfizer’s early-stage data on GLP-1 agonist danuglipron. Even if management’s somewhat optimistic growth plan does not pan out as expected, I think the stock is still a good investment at $45. PFE is currently trading at a 2027 forward price-to-earnings ((P/E)) ratio of about 11. The free cash flow volatility of the current portfolio (again, leaving aside the COVID-19 franchise) is low and the balance sheet is very strong, two arguments qualifying PFE as a solid investment from a dividend perspective. The current yield of 3.6% is in line with the five-year average. Such a yield is very reasonable in comparison to the peer group and also to long-term government bonds, which obviously do not come with the added benefit of potential growth (but are, of course, de facto risk-free). Speaking of which, dividend growth is rather muted at the moment. The second increase of less than 3% incr was announced in December, likely due to management’s understandable wish to avoid negative press coverage. However, in the longer term, I believe dividend growth can be expected to mean-revert to the mid to high single digits, so investors can at least maintain the purchasing power of their dividend income. However, given Pfizer’s considerable balance sheet options, I will be keeping a close eye on management’s actions, particularly with regard to further M&A. It simply does not make sense to acquire other companies just for the sake of putting the money to work. The current interest rate environment is certainly helping to resist this temptation.

As mentioned above, I started buying back my previously partially sold position in October, but was admittedly surprised by the rebound to $55 towards the end of the year. I was pleased to see the stock decline in what can increasingly be described as a “risk-on” environment (bitcoin is up 35% since the November low, meme stocks seem to be back in vogue). As a result, I will be happy to add to my still fairly modest position as long as Pfizer trades at $45 or below, and bring it to a size similar to my other Big Pharma holdings – typically around 1% to 1.5% of total portfolio weight.

![FAST Graphs plot for Pfizer stock [PFE]](https://static.seekingalpha.com/uploads/2023/1/20/49694823-16742264096830654.png)

Figure 4: FAST Graphs plot for Pfizer stock [PFE] (obtained with permission from www.fastgraphs.com)

L3Harris Technologies Inc. (LHX)

L3Harris is one of the lesser known plays on the defense budgets of the Western world. It is not as easy to understand as, for example, Lockheed Martin (LMT), the manufacturer of the famous F-35 combat aircraft, but it operates in several niches and is the leading supplier of tactical communications equipment. With a current market cap of less than $40 billion, the company is a comparatively small but very interesting player.

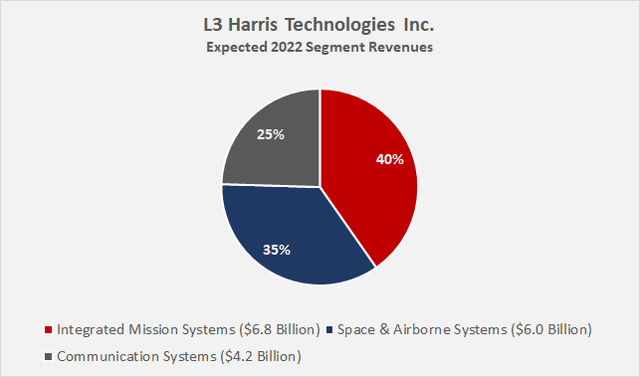

I like LHX primarily because of its diverse offerings and low capital intensity. Depreciation and amortization are about 2% of total revenues, similar to Lockheed but much lower than Raytheon Technologies (RTX). The capex ratio is about 15%, based on my somewhat conservative baseline free cash flow expectation of $2 billion annually. LHX does not rely on large capital-intensive platforms such as the F-35 and is therefore much more flexible, while supplying key components and thus indirectly benefiting from increasing demand. Similarly, the company benefits from the update cycles of such platforms, which can be viewed more or less as recurring revenues as airplanes, helicopters, ships and submarines are equipped with the latest technology. In addition, the company typically generates about 25% of its total revenue from outright service offerings. LHX operates in the following segments, and a breakdown of revenues is shown in Figure 5:

- In the Integrated Mission Systems segment, LHX manufactures and sells signaling, imaging, reconnaissance and surveillance equipment, and a variety of sensor systems. The segment is primarily focused on airborne platforms.

- Space & Airborne Systems offers satellite-based (e.g. tracking) and electronic warfare solutions but also contributes to the growing demand for cyber warfare.

- Through Communication Services, LHX provides radio and night vision systems and is well positioned to benefit from modernization cycles. It is the world’s leading provider of tactical communications equipment.

Figure 5: L3Harris Technologies’ expected 2022 segment revenues (own work, based on the company’s November 2022 investor presentation)

Anyone wishing to gain a deeper insight into the company’s business activities can take a look at the investor presentation from November 2022 (slides 4, 16 ff., 25 ff. and 33 ff.). In all three segments, most revenues are generated from U.S. and foreign government entities, with only a nearly insignificant portion from commercial customers. Therefore, L3Harris, like Lockheed Martin, for example, should be seen as an industrial company but is much less sensitive to economic cycles than entities with predominantly commercial customers. Conversely, it is highly dependent on the growth – or at least the maintenance – of defense budgets. Defense budget visibility is currently difficult in the U.S., but given the ongoing conflict in Ukraine and growing demand from Europe, I would not overstate this aspect. More important – but currently quite visible through declining profitability and rising working capital – are the ongoing supply chain issues that understandably impact a technology-intensive equipment provider like LHX disproportionately. However, the decline in demand in other sectors due to the likely recession should benefit LHX due to its rather non-cyclical demand profile.

Given the ongoing issues and the fact that LHX receives less attention on Wall Street than larger contractors such as LMT, Raytheon Technologies (RTX) or Northrop Grumman, the stock currently represents solid value. The recent announcement of the acquisition of Aerojet Rocketdyne (AJRD), a major supplier of missile, hypersonic, and electric propulsive systems, has put additional pressure on the stock. While AJRD is undeniably a top company in its field, I believe the lack of visibility on synergies (aside from cost synergies) made investors somewhat skeptical. Another reason for investor skepticism could be AJRD’s spotty profitability from a cash flow perspective, which is surprising given its customer profile. Of course, AJRD gives LHX access to several new markets, but seeing the acquirer as a pure holding company is indeed uninspiring, partly because its operating profitability will decline somewhat. Nevertheless, the expected consolidated EBTIDA margin of 20% is still solid. On the flipside, however, it is important to note that AJRD greatly balances LHX’s backlog structure and moves it more towards a long-cycle portfolio. In addition, the acquisition should help L3Harris bolster its long history as a merchant supplier. Finally, AJRD’s status as the premier launch propulsion provider for the U.S. Space Force fits the narrative of L3Harris capitalizing on space as the next generation warfighting domain; consider that Space & Airborne Systems is LHX’s second-largest segment, with $6 billion in annual revenues.

From a balance sheet perspective, LHX looks well managed. As of the end of Q3 2022, the company had net debt of $6.5 billion – a not insignificant amount, due in part to the fact that management has repurchased $4.6 billion of stock since the beginning of 2021 alone. However, putting the debt in relation to my conservative estimate of LHX’s baseline free cash flow of $2 billion, it looks very manageable indeed. However, the acquisitions of Aerojet ($4.7 billion, AJRD has de facto no net debt) and Viasat’s (VSAT) Tactical Data Links (TDL) product line for about $2 billion will significantly impact LHX’s ability to repurchase shares in the future. As a result of the debt that will be taken on to finance the acquisitions, rating agency Moody’s changed LHX’s rating outlook to negative, but affirmed its Baa2 (BBB S&P equivalent) senior unsecured rating in December. However, a look at LHX’s maturity profile (Figure 6) gives me confidence, as the company could theoretically repay its debt in most years with its baseline free cash flow, even after dividends, practically “on the go”. Of course, this does not make much sense from an economic point of view, as equity is always more expensive than debt, and a manageable combination of both sources of capital lowers the cost of capital.

![L3Harris Technologies’ [LHX] debt maturity profile as of December 31, 2021](https://static.seekingalpha.com/uploads/2023/1/20/49694823-16742265888866384.png)

Figure 6: L3Harris Technologies’ [LHX] debt maturity profile as of December 31, 2021 (own work, based on the company’s 2021 10-K)

All in all, L3Harris clearly has some issues at the moment, and the announcement of the AJRD acquisition has not exactly inspired confidence among investors. As a result, LHX’s share price remains under pressure and the stock is currently trading at a P/E ratio of around 15 (Figure 7). I believe that it is situations like this that can provide excellent long-term opportunities. As an income-oriented investor, I am pleased that the stock’s current dividend yield of 2.3% is well above the five-year average of 1.7%. Likewise, a free cash flow yield of 5.5% is not expensive at all, in part because I believe my own estimate for LHX’s baseline FCF of $2 billion is rather conservative and does not take into account contributions from AJRD and Viasat’s TDL product line.

Although the company will likely have to suspend its share repurchases to avoid running afoul of its debt covenants at some point, I do not think dividend growth is in jeopardy. In fact, I think LHX is a solid dividend growth investment (payout ratio of around 40% in terms of normalized baseline FCF), as I discussed in my comparative analysis with Boeing. L3Harris is a very shareholder-friendly company, highlighted by its compound annual dividend growth rate of over 13% over the past nine years. The last increase by 10% was also very meaningful in my opinion – in particular against the backdrop of ongoing operational challenges. This increase and the approval of another $3 billion share buyback in late October may suggest that management is overconfident and sacrificing balance sheet quality for near-term shareholder returns. However, I think it is worth noting that LHX management is very open and candid and is not in the category that puts lipstick on a pig. I think management’s Q3 2022 Investor Letter is a good example in this regard.

I own Lockheed Martin and Raytheon Technologies in my portfolio, the former because of its prime status as a defense contractor and the latter because of its balanced portfolio that also gives me exposure to commercial aerospace (see my comparative analysis). However, I believe LHX is a valuable addition due to its low capital intensity, agility, low Wall Street coverage and broad range of indispensable high-tech offerings. I view the company as a rather “silent beneficiary” in a world that is likely to increasingly focus on defense. At around $200, I think the stock offers a good opportunity, and with a starting yield of 2.3% and solid dividend growth, it won’t be too long before the position represents a significant yield on cost. Therefore, I plan to open a starting position in the next few days.

![FAST Graphs plot for L3Harris Technologies [LHX]](https://static.seekingalpha.com/uploads/2023/1/20/49694823-16742266232295218.png)

Figure 7: FAST Graphs plot for L3Harris Technologies [LHX] (obtained with permission from www.fastgraphs.com)

Thank you very much for taking the time to read my article. How did you like it, my style of presentation, the level of detail? If there is anything you’d like me to improve or expand upon in future articles, do let me know in the comments section below.

Disclosure: I/we have a beneficial long position in the shares of PFE, LMT, BMY, RTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Additional Disclosure:

I may initiate a beneficial Long position through a purchase of the stock in LHX over the next 72 hours.

The contents of this article and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice and I am in no way qualified to do so. I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any form of investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.